Free Tax Courses Online

The world of taxation is a complex and ever-evolving field, and staying updated with the latest regulations and practices is crucial for both professionals and individuals alike. Fortunately, with the rise of online learning platforms, accessing free tax courses has become easier than ever. These courses offer a convenient way to enhance your knowledge, whether you're aiming to become a tax expert or simply want to understand the basics for personal financial management. This article explores some of the best free online tax courses, providing an in-depth analysis of their content, benefits, and how they can help you navigate the intricate world of taxation.

Introduction to Taxation: Understanding the Fundamentals

For those new to the realm of taxation, starting with a comprehensive introduction is essential. The Introduction to Taxation course offered by Tax Academy is an excellent choice. This online program covers a wide range of topics, including the history of taxation, the role of taxes in society, and the different types of taxes individuals and businesses encounter. With a focus on the US tax system, this course provides a solid foundation for further exploration into the intricacies of tax law.

Key Features and Benefits

- Comprehensive Curriculum: The course spans over 12 weeks, ensuring a thorough understanding of the subject. It covers tax terminology, tax calculation methods, and the impact of taxation on personal and business finances.

- Interactive Learning: Tax Academy utilizes multimedia elements, quizzes, and real-world examples to engage learners and enhance their understanding of tax concepts.

- Flexible Learning: With the option to study at your own pace, this course is ideal for busy professionals or students who want to fit their learning around other commitments.

- Expert Instructors: The course is taught by experienced tax professionals, ensuring that the content is up-to-date and aligned with the latest tax regulations.

Course Structure and Highlights

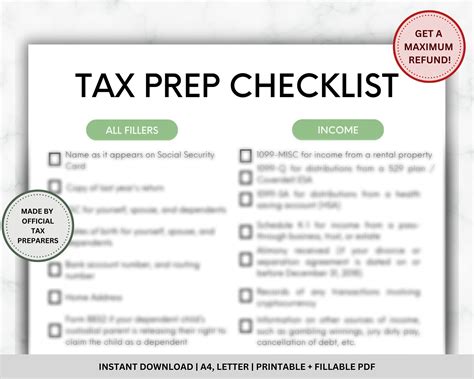

The Introduction to Taxation course is divided into several modules, each focusing on a specific aspect of taxation. Some of the key modules include:

- Taxation Basics: An overview of the tax system, including tax types, rates, and the role of the Internal Revenue Service (IRS)

- Income Tax: A deep dive into the US income tax system, covering tax brackets, deductions, and credits

- Business Taxes: Understanding the tax obligations of businesses, including corporation tax, payroll taxes, and sales tax

- International Taxation: An exploration of cross-border taxation, double taxation agreements, and the challenges of international tax planning

- Tax Planning and Strategy: Strategies for individuals and businesses to minimize tax liabilities and maximize deductions

Assessment and Certification

Upon completion of the course, learners can opt to take a final assessment. Those who pass the assessment will receive a certificate of completion, a valuable addition to their professional portfolio.

| Course Name | Provider | Duration |

|---|---|---|

| Introduction to Taxation | Tax Academy | 12 Weeks |

Advanced Tax Strategies: Mastering the Art of Tax Planning

For professionals and individuals looking to take their tax knowledge to the next level, Advanced Tax Strategies offered by Tax Institute is an excellent choice. This course delves into the intricate world of tax planning, providing learners with the tools and knowledge to navigate complex tax scenarios and optimize their tax positions.

Key Focus Areas

- Estate Planning: Understanding the tax implications of inheritance and strategies to minimize tax liabilities for beneficiaries.

- Business Tax Strategies: Exploring advanced tax planning for businesses, including tax-efficient structures and international tax considerations.

- Tax Research and Compliance: Developing skills in tax research and staying updated with the latest tax regulations and compliance requirements.

- Advanced Tax Forms and Filing: A deep dive into complex tax forms and the process of filing accurate tax returns for individuals and businesses.

Who Should Enroll

The Advanced Tax Strategies course is designed for experienced tax professionals, accountants, financial advisors, and business owners who want to enhance their tax expertise. It is also suitable for individuals who have completed introductory tax courses and are seeking to specialize in tax planning.

Course Modules and Content

- Advanced Tax Research: Learning how to navigate tax databases, research complex tax issues, and stay informed about the latest tax updates.

- Tax Planning for High-Net-Worth Individuals: Strategies for managing the tax obligations of wealthy individuals, including estate planning and trust taxation.

- International Tax Planning: A comprehensive look at cross-border tax issues, including transfer pricing, tax treaties, and the challenges of global tax compliance.

- Advanced Business Tax Strategies: Exploring tax-efficient business structures, international tax considerations, and tax planning for different business entities.

- Tax Audits and Disputes: Understanding the tax audit process, rights and responsibilities during an audit, and strategies for resolving tax disputes.

Benefits and Outcomes

Completing this advanced course will equip learners with the skills to provide expert tax advice, optimize tax positions for clients, and navigate complex tax scenarios with confidence. It is an excellent choice for professionals looking to expand their tax consulting services or individuals aiming to become tax specialists.

| Course Name | Provider | Duration |

|---|---|---|

| Advanced Tax Strategies | Tax Institute | 10 Weeks |

Taxation for Small Businesses: Navigating the Challenges

Running a small business comes with its unique set of tax challenges. Taxation for Small Businesses, a course offered by Small Business Academy, is designed specifically to address these challenges and provide entrepreneurs with the tax knowledge they need to succeed.

Key Course Highlights

- Startup Taxation: Understanding the tax obligations and incentives for new businesses, including tax breaks for startups and small businesses.

- Sales and Use Tax: A comprehensive guide to sales tax compliance, including registration, collection, and filing requirements.

- Payroll Taxes: Strategies for managing payroll taxes, including withholding, reporting, and compliance with employment tax laws.

- Business Tax Deductions: Exploring the various deductions available to small businesses and strategies for maximizing tax savings.

Why It’s Important

For small business owners, understanding the tax landscape is crucial for financial planning and growth. This course provides a practical guide to navigating the tax system, ensuring business owners can focus on their core operations while staying compliant with tax regulations.

Course Structure and Content

- Business Entity Taxation: An exploration of different business structures and their tax implications, including sole proprietorships, partnerships, and corporations.

- Taxes for Online Businesses: Understanding the unique tax challenges of e-commerce and online businesses, including sales tax for online sales and digital services.

- Tax Deductions and Credits: A deep dive into the various tax deductions and credits available to small businesses, including how to qualify and claim them.

- Recordkeeping and Reporting: Best practices for maintaining accurate financial records and reporting tax information to the IRS.

- Tax Planning for Business Growth: Strategies for scaling tax obligations as a business grows, including planning for expansion, hiring, and investment.

Additional Resources

The Small Business Academy provides a wealth of resources beyond the course, including tax calculators, tax guides for specific industries, and a tax blog with the latest updates and insights.

| Course Name | Provider | Duration |

|---|---|---|

| Taxation for Small Businesses | Small Business Academy | 8 Weeks |

International Taxation: A Global Perspective

With businesses expanding globally and individuals moving across borders, understanding international taxation is becoming increasingly important. The International Taxation course offered by Global Tax Academy provides a comprehensive overview of the complex world of cross-border taxation.

Course Overview

- Transfer Pricing: Understanding the principles of transfer pricing and its role in international tax planning.

- Tax Treaties and Agreements: An in-depth look at the network of tax treaties and how they impact cross-border transactions and investments.

- Expatriate Taxation: Tax considerations for individuals working or living abroad, including tax residency rules and foreign earned income exclusions.

- International Tax Compliance: Strategies for staying compliant with international tax regulations and avoiding double taxation.

Who Can Benefit

This course is ideal for tax professionals, accountants, and business advisors who work with international clients or companies with global operations. It is also beneficial for individuals who frequently travel or work abroad and want to understand their tax obligations in different countries.

Course Modules

- Introduction to International Taxation: An overview of the global tax landscape, including key concepts and terminology.

- Transfer Pricing and BEPS: Exploring the Base Erosion and Profit Shifting (BEPS) project and its impact on transfer pricing regulations.

- Tax Treaties and Double Taxation: A detailed analysis of tax treaties and their role in mitigating double taxation for individuals and businesses.

- International Tax Compliance and Reporting: Strategies for staying compliant with international tax reporting requirements, including Country-by-Country Reporting (CbCR) and Foreign Account Tax Compliance Act (FATCA) reporting.

- International Tax Planning: Advanced strategies for optimizing tax positions in a global context, including cross-border structuring and tax-efficient investment strategies.

Real-World Application

The course includes case studies and practical examples to help learners apply the concepts to real-world scenarios. It is an excellent resource for anyone looking to expand their international tax expertise and provide specialized tax services to global clients.

| Course Name | Provider | Duration |

|---|---|---|

| International Taxation | Global Tax Academy | 10 Weeks |

Conclusion: Expanding Your Tax Knowledge

The world of taxation is vast and dynamic, offering a wealth of opportunities for professionals and individuals alike. Whether you’re looking to start your tax journey, advance your career, or navigate the complexities of international taxation, the free online courses discussed above provide a solid foundation. By investing your time in these courses, you’ll not only enhance your understanding of taxation but also open doors to new career paths and opportunities.

Frequently Asked Questions

Are these courses accredited?

+

Yes, the courses mentioned are accredited by reputable tax organizations, ensuring that the content is of high quality and aligned with industry standards.

Can I earn college credits through these courses?

+

While these courses are not typically part of a formal degree program, some providers offer the option to transfer credits to certain institutions. It’s best to check with the course provider and your chosen college for more information.

Are there any prerequisites for these courses?

+

Prerequisites vary depending on the course. For introductory courses, no prior knowledge is typically required. However, advanced courses may assume a basic understanding of taxation or accounting principles.

How do I receive my course certificate?

+

Upon completion of a course, you will receive instructions on how to obtain your certificate. This usually involves passing a final assessment or project and then downloading or requesting a physical copy of the certificate.

Are these courses suitable for non-US residents?

+

Absolutely! While some courses focus on US tax laws, they provide a solid foundation for understanding taxation principles that can be applied globally. For courses specific to international taxation, the content is designed to be relevant to a worldwide audience.