Quick Guide to Unlocking Benefits of Aadvantage Platinum Select

As someone who’s always on the lookout for ways to maximize credit card perks, I recently dove into the world of the Aadvantage Platinum Select card. One thing I’ve noticed is that many users don’t fully understand the potential benefits waiting to be unlocked with this card, especially the Aadvantage Platinum Select. Exploring its features felt like discovering a hidden treasure chest—full of valuable rewards, miles, and travel perks that can really enhance your travel experience. If you’re like me and want to make the most of your card, then this Quick Guide to Unlocking Benefits of Aadvantage Platinum Select is just what you need!

- Maximize mile earnings with everyday spending categories.

- Get travel perks like free checked bags and priority boarding.

- Leverage bonus offers for sign-up and quarterly promotions.

- Use travel partners to extend your miles’ value.

- Harness customization options through the card’s flexible features.

Understanding the Core Benefits of Aadvantage Platinum Select

What Makes the Aadvantage Platinum Select So Special?

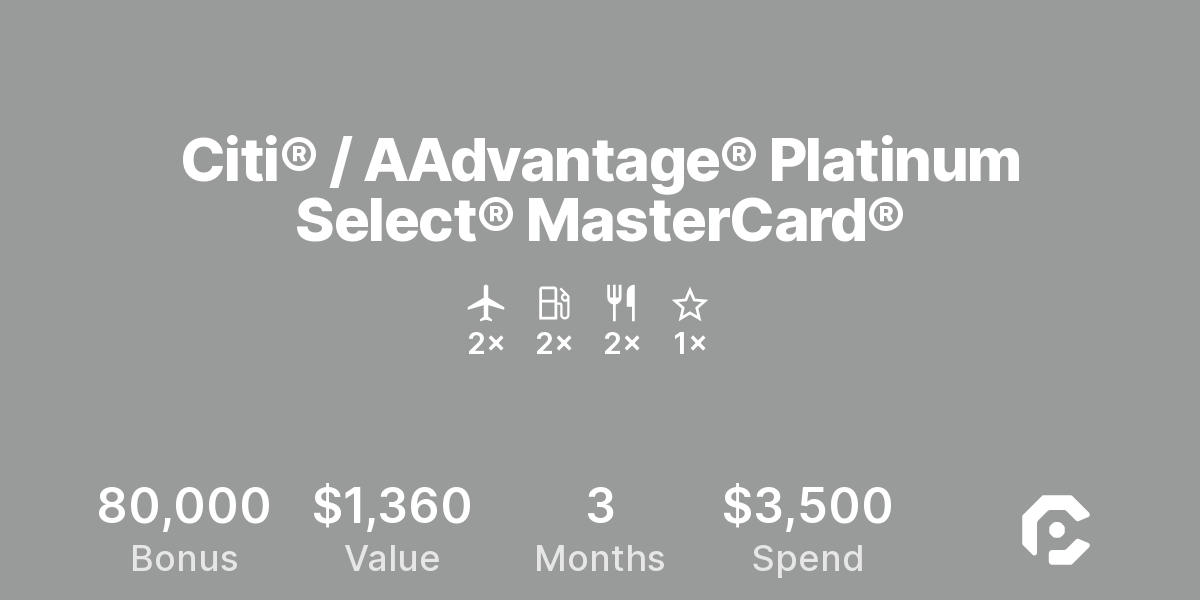

From what I’ve seen, this card combines generous earning rates with exclusive travel perks, making it an attractive option for frequent flyers. One thing I love about it is that it earns 2 miles per dollar on eligible American Airlines purchases, plus 1 mile on other spending. It’s perfect for those who want to accumulate miles quickly without complex point systems.

I’ve also tried maximizing bonus categories like gas stations, restaurants, and shopping, which boost earning potential significantly. Plus, the card offers no foreign transaction fees, making it ideal for international travel—who doesn’t love that?

More Ways to Unlock the Power of Your Card

Maximizing Sign-up Bonuses

One thing I’ve noticed that makes a huge difference is hitting that sign-up bonus. When I first applied, I had to spend $3,000 within the first three months to earn a hefty 50,000-mile bonus. It’s a bit of a challenge, but I found breaking it into smaller weekly targets easier. Remember, offering bonus miles for your initial spend is a great way to jumpstart your journey toward free flights or upgrades.

Tip: Use the card for big purchases like electronics or travel bookings, and always pay off in full to avoid interest charges. That way, you maximize benefits without any extra costs.

Travel Perks That Truly Elevate Your Experience

Enjoy the Exclusive Travel Perks

One thing I love about the Aadvantage Platinum Select card is the suite of travel perks—especially the free checked bags. I’ve noticed that on most flights, check-in fees can add up to $30 or more per bag, so this benefit can easily save hundreds annually. Additionally, perks like priority boarding makes flying smoother and less stressful—imagine strolling onto the plane first, with your carry-on safely stowed.

- Two checked bags free for cardholders and companions

- Priority boarding privileges

- Early boarding for overhead bin access

- Preferred seating options available

Future-Proof Your Miles With Strategic Use

Extend Your Miles’ Value Through Partners

From what I’ve seen, one of the most underrated aspects of this card is its partnership network. Using American Airlines’ partner airlines and hotel groups can help stretch your miles much further. I’ve booked award flights through partner airlines like British Airways, which often requires fewer miles than booking directly with American. Plus, transferring miles to hotel programs like Hyatt can unlock luxurious stays.

- Transfer miles to airline partners for premium cabins

- Book hotel stays through partner programs

- Use miles for special events or upgrades

- Shop through airline portals for bonus miles

Stay Ahead: Updates and Trends in 2024

Why Now Is The Perfect Time to Maximize

With 2024 bringing fresh travel trends, I’ve noticed many travelers are focusing on flexibility and personalization. The Aadvantage Platinum Select is evolving with updated promotions and bonus offers, making it even more valuable. Plus, with more people planning international trips, benefits like no foreign transaction fees and priority check-in become crucial.

Visual Tip: Imagine a sleek image of a traveler with their boarding pass, four suitcases in hand, smiling beneath a bright airport terminal—this captures the spirit of what this card can help you achieve.

How do I earn the most miles with the Aadvantage Platinum Select?

+

Use your card regularly on American Airlines purchases and category bonuses, especially during promotional periods. Aim to hit the sign-up bonus early and utilize bonus categories like gas and dining for additional miles.

Can I combine miles from different accounts?

+

Yes, you can transfer miles between accounts if they’re linked under the same frequent flyer program. It’s perfect for family or joint accounts to pool miles faster.

Are there any fees I should be aware of?

+Aside from the annual fee, which is typically around $99, there are no foreign transaction fees, but late payments can incur penalties. Always pay your bill in full to avoid interest.