Broward Sales Tax

Sales tax is an integral part of the retail landscape, and Broward County, Florida, is no exception. Understanding the intricacies of sales tax regulations is crucial for both consumers and businesses operating in this vibrant region. This comprehensive guide aims to shed light on the specifics of Broward's sales tax, its implications, and its role in shaping the local economy.

Navigating Broward’s Sales Tax Landscape

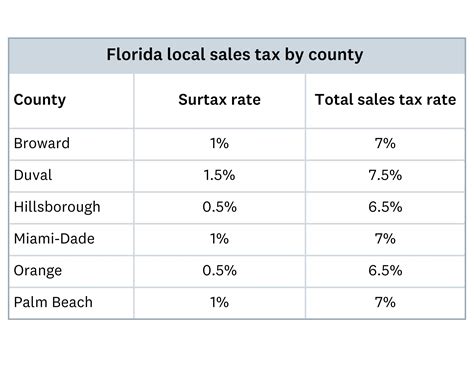

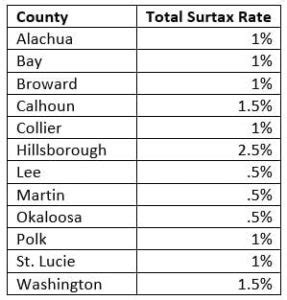

The sales tax in Broward County is a complex system that combines state, county, and municipal taxes, creating a unique tax environment for businesses and consumers alike. The current sales tax rate in Broward County is 6%, which is the standard Florida state sales tax rate. However, this rate can vary depending on the specific location within the county, as some municipalities opt to impose additional taxes.

For instance, the city of Fort Lauderdale, a bustling hub within Broward, levies an additional 1.5% sales tax, bringing the total sales tax rate to 7.5%. Similarly, Hollywood, another prominent city, applies an extra 0.5% tax, resulting in a 6.5% sales tax rate for residents and businesses.

This variation in sales tax rates across Broward County can have significant implications for businesses, especially those with multiple locations or those considering expansion. It also impacts consumers, who may find themselves paying different tax rates depending on where they choose to shop.

Understanding the Breakdowns

The sales tax breakdown in Broward County can be further analyzed as follows:

| Tax Jurisdiction | Tax Rate |

|---|---|

| Florida State Sales Tax | 6.0% |

| Broward County Sales Tax | 0.0% |

| Fort Lauderdale City Sales Tax | 1.5% |

| Hollywood City Sales Tax | 0.5% |

| Other Municipal Taxes (Vary by Location) | Varies |

It's worth noting that while Broward County itself does not impose an additional sales tax, there are other municipalities within the county that do, such as Pompano Beach and Coral Springs, each with their own unique tax rates.

Sales Tax Impact on Local Businesses

The sales tax environment in Broward County significantly influences the operational strategies of local businesses. For instance, a retail store located in Fort Lauderdale might need to adjust its pricing strategy to account for the higher sales tax rate, especially when competing with online retailers or stores in neighboring cities with lower tax rates.

Similarly, a restaurant in Hollywood might need to consider the impact of the sales tax on its menu pricing, potentially affecting its competitiveness in the market. The sales tax can also influence the cost of doing business for service-based companies, as they may need to factor in the tax when quoting for projects or services.

Compliance and Reporting

Ensuring compliance with Broward’s sales tax regulations is a critical aspect of doing business in the county. Businesses must accurately collect, report, and remit sales tax to the appropriate tax authorities, which can be a complex process given the varying tax rates across the county.

The Florida Department of Revenue provides resources and guidelines to help businesses navigate these complexities, offering tools for tax registration, filing, and payment. It's essential for businesses to stay updated with any changes in sales tax regulations to avoid penalties and maintain compliance.

Consumer Perspectives and Awareness

For consumers, understanding the sales tax landscape in Broward County is crucial for making informed purchasing decisions. While the sales tax rate may not directly influence the decision to buy a product or service, it can impact the overall cost of living, especially for residents who frequently make local purchases.

Educating consumers about sales tax rates can empower them to make more strategic choices. For instance, a consumer might choose to shop in a city with a lower sales tax rate to save money, especially for big-ticket items. Alternatively, they might opt for online shopping to avoid sales tax altogether, although this strategy may not support local businesses.

Sales Tax and Tourism

Broward County’s vibrant tourism industry is also affected by sales tax rates. Visitors to the county, whether for leisure or business, are subject to the local sales tax rates. This can impact their spending behavior and overall experience, especially if they are accustomed to lower tax rates in their home regions.

Tourism businesses, therefore, need to consider the sales tax rates when setting their pricing strategies. For instance, a hotel might need to adjust its room rates to remain competitive while still collecting the appropriate sales tax. Similarly, tour operators and attractions may need to factor in sales tax when quoting for their services.

Future Implications and Considerations

Looking ahead, the sales tax landscape in Broward County is likely to continue evolving, influenced by various economic and political factors. While it’s challenging to predict specific changes, certain trends and considerations are worth noting.

Firstly, there may be proposals for tax reforms at the state or county level, which could potentially impact the sales tax rates and regulations. These reforms could be driven by economic needs, political agendas, or a desire to streamline tax systems.

Secondly, the ongoing digital transformation of the retail sector may lead to further discussions around online sales tax collection. With more consumers shopping online, there could be pressure to ensure that online retailers are collecting and remitting sales tax, which could impact businesses and consumers alike.

Lastly, the economic recovery post-pandemic may influence sales tax rates. As the economy rebounds, there could be discussions around adjusting tax rates to support recovery efforts or fund specific initiatives. These considerations highlight the dynamic nature of sales tax regulations and the need for ongoing awareness and adaptability.

Conclusion

In conclusion, Broward County’s sales tax system is a complex yet vital component of its economic landscape. Understanding and navigating this system is crucial for both businesses and consumers, impacting pricing strategies, compliance, and overall purchasing decisions. As the county continues to evolve, staying informed about sales tax regulations will remain essential for all stakeholders.

FAQ

What is the current sales tax rate in Broward County, Florida?

+

The current sales tax rate in Broward County is 6%, which is the standard Florida state sales tax rate. However, this rate can vary depending on the specific location within the county, as some municipalities opt to impose additional taxes.

Do all cities in Broward County have the same sales tax rate?

+

No, sales tax rates can vary across different cities in Broward County. For example, Fort Lauderdale has a higher sales tax rate of 7.5%, while Hollywood has a rate of 6.5%. Other municipalities may have different rates, so it’s important to check the specific tax rate for each location.

How do sales tax rates impact businesses in Broward County?

+

Sales tax rates can significantly influence a business’s pricing strategy, competitiveness, and cost of doing business. Businesses need to consider these rates when setting prices and quoting for services to remain profitable and compliant with tax regulations.

Are there any resources available to help businesses understand and manage sales tax in Broward County?

+

Yes, the Florida Department of Revenue provides extensive resources, guidelines, and tools to assist businesses in navigating sales tax regulations. These resources cover tax registration, filing, payment, and compliance, ensuring businesses have the support they need to manage sales tax effectively.

How can consumers stay informed about sales tax rates in Broward County?

+

Consumers can stay informed by checking the official websites of the Florida Department of Revenue and the specific cities or municipalities they are interested in. These websites often provide detailed information about sales tax rates and any recent changes or updates.