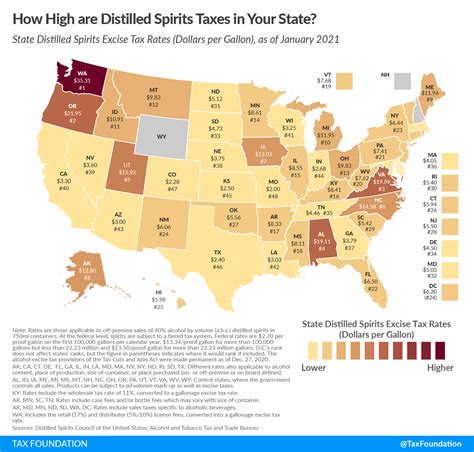

Washington Liquor Tax

The Washington Liquor Tax is an important revenue source for the state, playing a crucial role in funding various public services and programs. It is levied on the distribution and sale of distilled spirits, wine, and beer, with the tax rates varying depending on the type of alcoholic beverage. This tax system has evolved over the years, adapting to changing market dynamics and the state's fiscal needs. In this article, we delve into the intricacies of the Washington Liquor Tax, exploring its history, current structure, and its impact on the state's economy and consumers.

The Historical Perspective

The history of liquor taxation in Washington State dates back to the early 20th century. The Washington Liquor Control Board (LCB), established in 1934, initially had a dual role: to regulate the sale and distribution of liquor while also generating revenue through taxation. This marked a significant shift from the prohibition era, which ended in 1933 with the repeal of the Eighteenth Amendment.

In the decades that followed, the LCB underwent several reforms and restructurings. One of the most significant changes occurred in 2011 when the Initiative 1183 privatized the liquor distribution system. This initiative also introduced a new tax structure, replacing the previous excise tax system with a tax based on the wholesale price of liquor, wine, and beer.

Understanding the Current Tax Structure

The Washington Liquor Tax is primarily a wholesale tax, meaning it is levied on the distributors or suppliers who sell alcoholic beverages to retailers. The tax rates are determined based on the type of beverage and its alcohol content. As of my last update in January 2023, the tax rates are as follows:

| Beverage Type | Tax Rate |

|---|---|

| Distilled Spirits (over 20% alcohol) | 20.5% of wholesale price |

| Wine (between 13.5% and 20% alcohol) | 0.59 cents per liter |

| Beer (up to 13.5% alcohol) | 0.28 cents per liter |

It's important to note that these tax rates are subject to change, and it is advisable to refer to the Washington State Department of Revenue for the most current and accurate information.

Tax on Specialties and Hard-to-Find Spirits

In addition to the standard tax rates, Washington State also imposes a specialty spirits tax on certain distilled spirits that are considered unique or hard to find. This tax is applied to spirits with an alcohol content of 20% or more and is calculated as 10% of the wholesale price. This additional tax is aimed at capturing revenue from premium and limited-edition spirits, which often have higher profit margins.

Tax Collection and Distribution

The Washington Liquor Tax is collected by the Washington State Liquor and Cannabis Board (WSLCB), which is responsible for licensing and regulating the sale of liquor and cannabis in the state. The revenue generated from these taxes is then distributed to various state funds and programs. A significant portion of the tax revenue is allocated to the General Fund, which supports a wide range of public services, including education, healthcare, and infrastructure development.

Impact on the Economy and Consumers

The Washington Liquor Tax has a significant impact on both the state’s economy and its consumers. From an economic perspective, the tax generates substantial revenue for the state, contributing to its overall fiscal health. The funds generated are crucial for maintaining and improving public services, which in turn can attract businesses and talent, fostering economic growth.

Consumer Perspective

For consumers, the liquor tax is an additional cost that can influence purchasing decisions and overall alcohol consumption. The tax can make alcoholic beverages more expensive, especially for premium and specialty products. However, it’s worth noting that the tax structure in Washington is designed to be relatively competitive compared to other states, which can make it more appealing for consumers who frequently purchase alcohol.

Additionally, the tax revenue generated is often reinvested in programs that benefit the community, such as substance abuse prevention and treatment initiatives. This indirect benefit can positively impact public health and safety.

Future Implications and Potential Reforms

As with any tax system, the Washington Liquor Tax is subject to ongoing evaluation and potential reforms. One of the key considerations is the balance between revenue generation and the impact on consumers and businesses. The state may need to strike a delicate balance to ensure that the tax remains fair and sustainable while also supporting vital public services.

Potential Reforms and Initiatives

There have been discussions and proposals for reforming the liquor tax system in Washington. Some potential initiatives include:

- Adjusting Tax Rates: The state could consider revising the tax rates to reflect changes in the market and consumer preferences. This might involve adjusting the tax on beer and wine to account for their increasing popularity.

- Implementing a Volume-Based Tax: Shifting from a wholesale price-based tax to a volume-based tax could be another option. This approach would tax alcoholic beverages based on the quantity sold, which could simplify the tax system and make it more transparent.

- Expanding Tax Base: The state could explore expanding the tax base to include other alcohol-related activities, such as charging a fee for liquor licenses or imposing taxes on alcohol-related tourism activities.

However, any reforms or initiatives would need to be carefully considered to ensure they do not negatively impact the state's competitiveness or consumer affordability.

Frequently Asked Questions

How often are the liquor tax rates reviewed and adjusted in Washington State?

+The liquor tax rates are reviewed periodically, typically as part of the state’s budget process. Adjustments can be proposed by the Governor or legislators, and the rates are often revised to align with the state’s fiscal needs and market dynamics. However, significant changes require careful consideration and may not occur frequently.

What is the primary source of revenue for the state from liquor taxes?

+The primary source of revenue for the state from liquor taxes is the wholesale tax levied on distributors. This tax accounts for the majority of the revenue generated from liquor sales, with additional revenue coming from specialty spirits taxes and other related fees.

Are there any tax incentives or discounts for small businesses or local producers in Washington’s liquor tax system?

+Washington State does offer certain tax incentives and discounts for small businesses and local producers. For example, microbreweries and craft distilleries may be eligible for reduced license fees and tax rates. These incentives aim to support the growth of local alcohol producers and promote economic development.