Tax Attorney San Antonio

When it comes to navigating the complex world of taxes and ensuring compliance with the law, having a skilled tax attorney by your side can be invaluable, especially in a bustling city like San Antonio, Texas. With a population exceeding 1.5 million, San Antonio is a vibrant metropolis known for its rich history, diverse culture, and thriving business landscape. In this dynamic environment, individuals and businesses often find themselves in need of expert legal guidance to tackle tax-related challenges and optimize their financial strategies.

The Role of a Tax Attorney in San Antonio

A tax attorney in San Antonio plays a crucial role in helping clients navigate the intricate tax laws and regulations at both the federal and state levels. Whether you’re an individual taxpayer, a small business owner, or a corporate entity, tax attorneys provide specialized legal advice and representation to ensure you stay on the right side of the law.

In San Antonio, the need for tax attorneys arises from the city's diverse economic landscape. From the vibrant tourism industry centered around iconic landmarks like the Alamo and the River Walk, to the thriving military presence with bases like Fort Sam Houston, tax attorneys are essential in ensuring that businesses and individuals alike comply with tax regulations specific to these sectors.

Key Responsibilities and Services Offered

Tax attorneys in San Antonio offer a wide range of services tailored to meet the unique needs of their clients. Here are some of the key responsibilities and services you can expect from a tax attorney in this region:

- Tax Planning and Strategy: Tax attorneys assist clients in developing comprehensive tax planning strategies. This involves analyzing financial goals, assessing tax liabilities, and implementing legal strategies to minimize tax obligations while remaining compliant with the law. They can help individuals and businesses structure their finances in a way that optimizes tax efficiency.

- IRS and State Tax Disputes: If you find yourself in a dispute with the Internal Revenue Service (IRS) or the Texas Comptroller of Public Accounts, a tax attorney can provide invaluable assistance. They can represent you in audits, tax collection matters, and appeals, ensuring your rights are protected and your interests are advocated for effectively.

- Tax Compliance and Reporting: Tax attorneys guide clients through the complex process of tax compliance and reporting. This includes preparing and filing tax returns, ensuring accurate and timely submissions, and addressing any issues that may arise during the filing process.

- International Tax Matters: San Antonio’s growing global business community often requires specialized tax advice for international transactions and investments. Tax attorneys with expertise in international tax laws can assist businesses in navigating cross-border tax issues, ensuring compliance with both U.S. and foreign tax regulations.

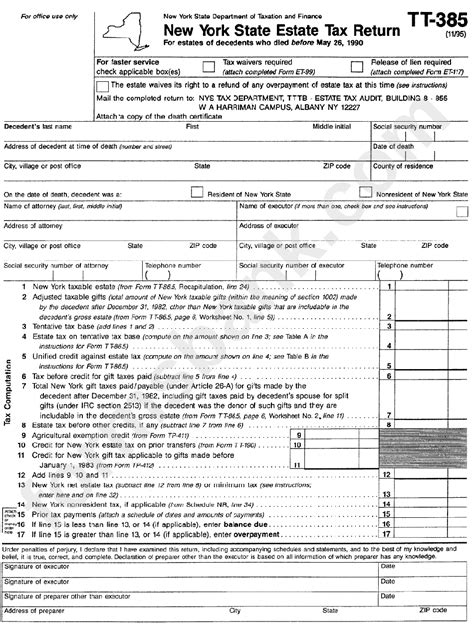

- Estate and Gift Tax Planning: For individuals and families in San Antonio, tax attorneys can provide essential guidance on estate and gift tax planning. They help structure estates to minimize tax liabilities, ensure smooth transfers of wealth, and protect the interests of heirs and beneficiaries.

Choosing the Right Tax Attorney in San Antonio

With the abundance of legal professionals in San Antonio, selecting the right tax attorney can be a daunting task. Here are some factors to consider when making your choice:

Experience and Expertise

Look for a tax attorney with extensive experience in handling cases similar to yours. Whether you’re an individual taxpayer or a business owner, ensure the attorney has a proven track record of success in your specific area of need. For instance, if you’re facing an IRS audit, prioritize attorneys with a history of successful audit representations.

Specialization and Credentials

Tax law is a specialized field, and not all attorneys are equally equipped to handle complex tax matters. Opt for a tax attorney who is licensed to practice law in Texas and has additional certifications or credentials in tax law. Some attorneys may have earned the Certified Tax Law Specialist designation from the Texas Board of Legal Specialization, indicating a high level of expertise and competence in this area.

Communication and Accessibility

Effective communication is key when working with a tax attorney. Choose an attorney who takes the time to thoroughly explain complex tax concepts and strategies in a way that you can understand. Additionally, consider their availability and responsiveness. Will they be readily accessible when you have questions or concerns? Can they provide timely updates on the progress of your case?

Reputation and Reviews

Research the reputation of potential tax attorneys by reading online reviews and testimonials from past clients. These firsthand accounts can offer valuable insights into the attorney’s work ethic, level of service, and overall satisfaction. Additionally, consider reaching out to local business organizations or industry peers for recommendations based on their own experiences.

The Impact of Tax Attorneys in San Antonio’s Business Landscape

The presence of skilled tax attorneys in San Antonio has a profound impact on the city’s business environment. By providing expert guidance and representation, tax attorneys help businesses navigate the complex web of tax regulations, allowing them to focus on their core operations and strategic growth. This legal support contributes to the overall economic health and stability of the city, fostering an environment conducive to business success.

Furthermore, tax attorneys play a crucial role in ensuring tax fairness and compliance. Their expertise helps prevent businesses and individuals from inadvertently falling into non-compliance, which can lead to costly penalties and legal repercussions. By promoting a culture of tax compliance, tax attorneys contribute to the overall integrity of San Antonio's tax system.

A Case Study: Small Business Tax Relief

Consider the case of Maria, a small business owner in San Antonio’s growing tech industry. Maria’s startup had experienced rapid growth, but she was concerned about the tax implications of her success. She engaged a tax attorney who specialized in small business tax strategies. The attorney helped Maria restructure her business entity to minimize tax liabilities, advised her on tax-efficient investment strategies, and provided ongoing support during tax season.

Through the attorney's guidance, Maria was able to navigate the complex tax landscape with confidence. The tax relief strategies implemented by the attorney not only saved Maria a significant amount of money but also provided her with the peace of mind to focus on growing her business without the burden of tax-related worries.

Conclusion: Empowering San Antonio’s Taxpayers

In the dynamic and diverse city of San Antonio, the role of a tax attorney is more crucial than ever. From assisting individuals with tax planning and compliance to guiding businesses through complex tax matters, tax attorneys provide invaluable legal expertise. By choosing the right tax attorney, San Antonio residents and businesses can ensure they are well-equipped to navigate the ever-changing tax landscape, protect their financial interests, and contribute to the city’s economic prosperity.

How do I find a reputable tax attorney in San Antonio?

+Finding a reputable tax attorney involves thorough research. Start by asking for recommendations from trusted sources such as friends, family, or business associates. You can also search online directories and review platforms to find attorneys with positive client feedback. Additionally, consider contacting local bar associations or legal aid organizations for referrals.

What should I expect during my initial consultation with a tax attorney?

+During your initial consultation, the tax attorney will gather information about your tax-related concerns and goals. They will assess your situation, provide an initial analysis, and discuss potential strategies and next steps. It’s essential to come prepared with relevant financial documents and be open and honest about your tax situation.

Are tax attorneys only for businesses, or can individuals also benefit from their services?

+Absolutely! Tax attorneys provide valuable services to both businesses and individuals. Whether you’re an individual taxpayer seeking tax planning advice or a business owner facing complex tax issues, a tax attorney can offer expert guidance tailored to your specific needs.