How Long To Keep Tax Information

In the intricate world of personal finance and tax management, the question of how long to retain tax information is a crucial one. This article delves into the specifics, offering a comprehensive guide on tax documentation retention, including the legal requirements, practical considerations, and strategies to ensure compliance and efficient record-keeping.

Understanding the Legal Framework

The duration for which tax-related documents should be kept varies depending on the type of tax, jurisdiction, and specific circumstances. It is essential to understand these legal guidelines to avoid penalties and ensure compliance.

Income Tax Returns and Supporting Documents

For income tax returns, the general rule is to retain them for a minimum of three years from the due date or the date the return was filed, whichever is later. This applies to both federal and state income tax returns in the United States. However, this timeframe can extend to six years if your income tax return was substantially underreported, or indefinitely if you filed a fraudulent return or failed to file a return.

In addition to the tax returns themselves, it is crucial to keep supporting documents such as:

- W-2 Forms: Keep these for at least three years after filing your tax return. These forms provide essential information about your income and tax withholdings.

- 1099 Forms: These forms detail various types of income, such as interest, dividends, and self-employment income. The retention period is typically three years from the due date of the tax return, but check with your specific tax jurisdiction for any variations.

- Receipts and Invoices: These documents substantiate various expenses, including business expenses, charitable contributions, and medical expenses. It is advisable to keep them for at least three years from the date of filing your tax return.

Other Tax-Related Records

Beyond income tax returns, there are other tax-related documents that may require longer retention periods:

- Property Taxes: Records related to property taxes, such as assessment notices and payment receipts, should be kept for at least three years from the date of payment. However, if you plan to dispute the assessment or are considering an appeal, it is advisable to keep these records for a longer period.

- Estate and Gift Taxes: Records pertaining to estate and gift taxes should be retained indefinitely, as there is no statutory period for these taxes. This includes documents related to the value of assets, gift receipts, and estate planning documents.

- Sales and Use Taxes: The retention period for sales and use tax records varies by jurisdiction. In the United States, many states require businesses to keep these records for at least three to four years from the due date of the tax return. However, some states have longer retention periods, so it is essential to check the specific regulations in your state.

Practical Considerations and Best Practices

While the legal framework provides a baseline for tax document retention, there are practical considerations that individuals and businesses should keep in mind to ensure smooth operations and efficient record management.

Organizing and Storing Tax Records

Effective organization is key to managing tax records. Consider the following practices:

- Digital Storage: With the advancement of technology, many taxpayers opt for digital storage solutions. This can include scanning paper documents and storing them securely on cloud-based platforms or external hard drives. Ensure that these digital records are backed up regularly and kept in a secure location.

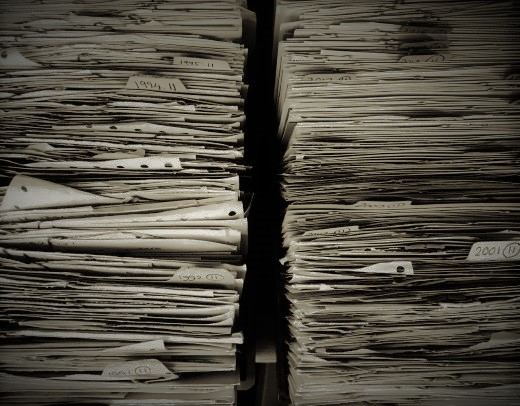

- Paper Storage: For those who prefer traditional paper records, consider using labeled file folders and storage boxes. Organize documents by year and type to facilitate easy retrieval when needed.

- Tax Software: Utilizing tax preparation software can simplify the process of organizing and storing tax records. These tools often provide built-in features for digital storage and easy access to past returns and supporting documents.

Document Retention Policies

Developing a comprehensive document retention policy can help individuals and businesses stay organized and compliant. Consider the following:

- Create a Schedule: Establish a schedule for reviewing and purging old tax records. This ensures that you are not keeping unnecessary documents indefinitely and helps maintain an organized system.

- Identify Critical Documents: Certain documents, such as tax returns, may need to be retained indefinitely, especially if they are related to significant financial transactions or legal matters.

- Consider Scanning and Destruction: Once you have confirmed that a tax document is no longer required, consider scanning it for digital storage and then securely destroying the original paper copy. This practice reduces physical storage needs and ensures a streamlined record-keeping process.

Record Retention for Audits

In the event of an audit, having well-organized and easily accessible tax records is crucial. The Internal Revenue Service (IRS) has the authority to audit tax returns for up to six years if there is a substantial understatement of income. During an audit, you may be required to provide detailed documentation to support your reported income and deductions.

It is therefore advisable to keep tax records for at least six years after filing your tax return. This ensures that you have the necessary documentation to support your tax position in the event of an audit.

Future Implications and Digital Trends

As technology continues to advance, the landscape of tax record-keeping is evolving. The shift towards digital tax records and the increasing use of cloud-based storage solutions are shaping the future of tax documentation retention.

Digital Record-Keeping

The use of digital records is becoming increasingly common due to its convenience and security. Digital tax records can be easily accessed, shared, and backed up, reducing the risk of loss or damage.

However, it is important to ensure that digital records are stored securely and that access is restricted to authorized individuals. This can be achieved through the use of encryption, two-factor authentication, and regular security audits.

Cloud Storage and Remote Access

Cloud-based storage solutions offer numerous advantages for tax record-keeping. They provide remote access to tax records, enabling individuals and businesses to access their tax information from anywhere with an internet connection.

Additionally, cloud storage providers often offer robust security features and automatic backup systems, ensuring that tax records are protected and easily recoverable in the event of data loss.

Blockchain Technology and Smart Contracts

The emergence of blockchain technology and smart contracts has the potential to revolutionize tax record-keeping. Blockchain offers a secure and transparent way to store and verify tax records, ensuring their integrity and authenticity.

Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate various tax processes, such as record-keeping, compliance, and even tax calculations. This technology has the potential to streamline tax administration and reduce the burden of manual record-keeping.

Conclusion

The duration for which tax information should be kept is a complex issue, influenced by various factors such as tax type, jurisdiction, and individual circumstances. While the legal framework provides a baseline, it is essential to consider practical considerations and future trends to ensure efficient and compliant tax record-keeping.

By understanding the legal requirements, implementing best practices, and embracing digital trends, individuals and businesses can navigate the complexities of tax record retention with confidence.

How long should I keep my income tax returns and supporting documents?

+It is generally recommended to keep income tax returns and supporting documents for at least three years from the due date or the date the return was filed. However, certain circumstances may require a longer retention period, such as underreporting of income or potential audit risks.

What if I need to keep records for a longer period due to an ongoing legal issue or potential audit?

+In such cases, it is advisable to retain tax records until the legal issue is resolved or the statute of limitations for an audit has passed. This ensures that you have the necessary documentation to support your tax position if needed.

Can I destroy tax records once the retention period is over?

+Yes, once the retention period is over and you are confident that there are no ongoing legal or audit risks, you can safely destroy tax records. However, ensure that you follow proper destruction methods, such as shredding or secure electronic deletion, to protect your personal information.