My Unique Tax Reference Number

Tax obligations are an essential part of financial management, and for businesses and individuals alike, understanding the intricacies of the tax system is crucial. One key element in this system is the Unique Tax Reference (UTR) number, a unique identifier assigned to each taxpayer by the relevant tax authorities. This number plays a vital role in the tax process, ensuring accurate and efficient administration. In this article, we delve into the world of UTR numbers, exploring their purpose, how they are obtained, and their significance in the broader context of tax compliance.

Understanding the Unique Tax Reference Number

The Unique Tax Reference number, often simply referred to as a UTR, is a sequence of ten characters that serves as a taxpayer’s personal identification in the eyes of the tax authorities. This number is a fundamental component of the tax system, facilitating the accurate processing of tax returns and ensuring each taxpayer’s data is securely linked to their specific account.

The UTR number is assigned to all taxpayers, whether they are individuals, businesses, or organizations. For individuals, the UTR is typically provided when they register for Self Assessment, the process through which individuals calculate and report their income tax to HM Revenue and Customs (HMRC) in the United Kingdom. For businesses, the UTR is issued upon registration with HMRC for taxes such as Income Tax, Corporation Tax, or Value Added Tax (VAT). The UTR number is a crucial identifier, ensuring that tax records are accurately maintained and accessible for both the taxpayer and the tax authorities.

UTR numbers are not static; they can change over time due to various reasons. For instance, when a business changes its legal structure or when an individual's personal circumstances alter significantly, a new UTR may be issued. This dynamic nature of UTR numbers ensures that the tax system can adapt to changing circumstances and maintain the integrity of tax records.

The Purpose of UTR Numbers

The primary purpose of UTR numbers is to provide a unique and secure identifier for each taxpayer. This identifier is used to link all tax-related activities and communications between the taxpayer and the tax authorities. When a taxpayer files a tax return, pays taxes, or receives correspondence from HMRC, the UTR number ensures that all actions and information are correctly attributed to the right taxpayer.

UTR numbers also play a crucial role in the security and privacy of taxpayer information. By using a unique identifier, the tax authorities can ensure that sensitive tax data is protected and that only authorized individuals have access to it. This level of security is particularly important given the sensitive nature of tax information, which often includes personal financial details and business operations.

Obtaining a Unique Tax Reference Number

The process of obtaining a UTR number varies depending on whether you are an individual or a business. For individuals, the UTR is typically provided automatically when they register for Self Assessment. This registration process usually occurs when an individual’s tax affairs become more complex, such as when they start a business, become a director of a company, or have income from self-employment or property rental.

When registering for Self Assessment, individuals will receive a Notice of Tax Return (form SA316) from HMRC. This notice will include the UTR number, which the individual should keep safe and use for all future tax communications. It's important to note that the UTR number is unique to each individual and should not be shared with others, even if they are family members or business partners.

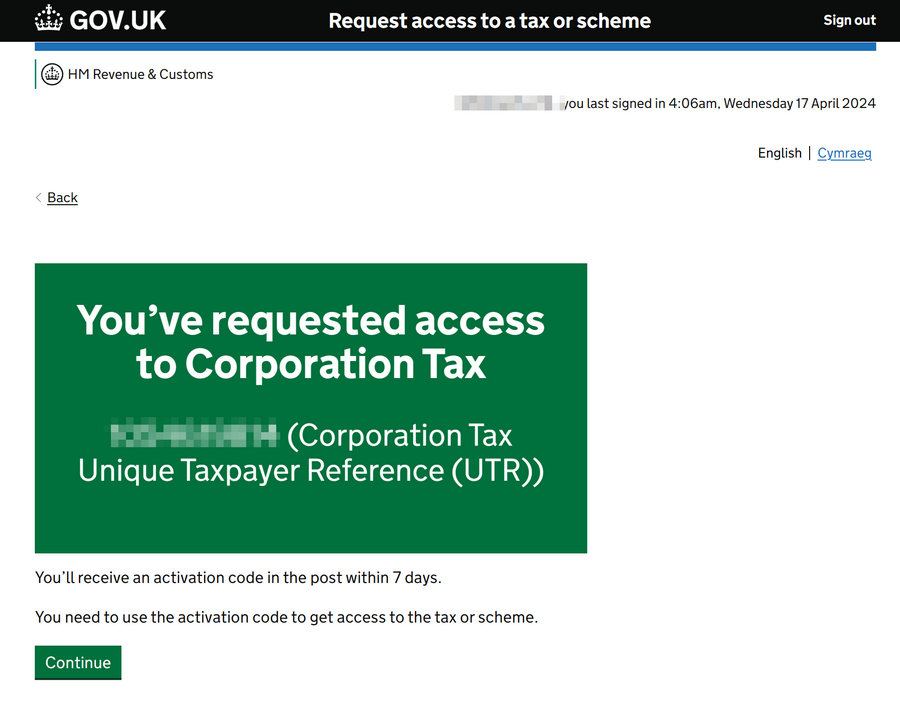

For businesses, the process of obtaining a UTR number is slightly different. When a business registers with HMRC for tax purposes, such as for Income Tax, Corporation Tax, or VAT, they will be issued a UTR number specific to that business. This number is usually provided immediately upon registration, and the business owner or tax representative should keep it secure for future use.

It's worth noting that in some cases, businesses may already have a UTR number if they are a subsidiary of a larger group or have previously registered for taxes. In such situations, the existing UTR number can usually be used for all tax communications, provided the business's tax affairs remain unchanged.

| Tax Type | UTR Number Obtained |

|---|---|

| Self Assessment (Individuals) | Upon Registration |

| Income Tax, Corporation Tax, VAT (Businesses) | Upon Registration with HMRC |

Using Your UTR Number

Once you have obtained your UTR number, it becomes a crucial part of your tax communications and records. Here are some key ways in which you will use your UTR number:

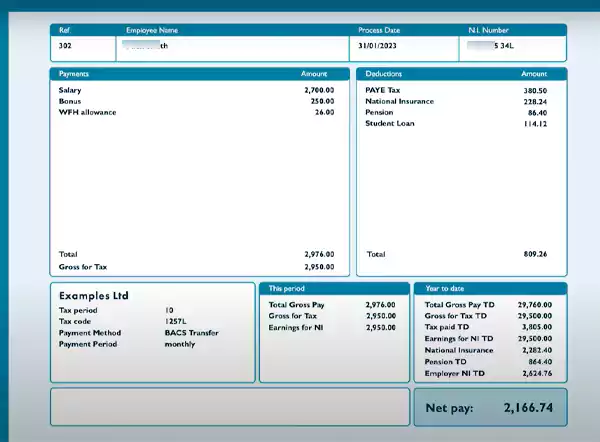

- Filing Tax Returns: When completing your tax return, whether online or on paper, you will need to enter your UTR number. This ensures that your return is correctly linked to your tax account.

- Making Tax Payments: When paying taxes, such as Income Tax or Corporation Tax, you will need to include your UTR number on your payment to ensure it is credited to your account accurately.

- Correspondence with HMRC: All official communications with HMRC, whether by post, email, or phone, should include your UTR number. This helps HMRC identify your account quickly and efficiently.

- Accessing Tax Records: Your UTR number is essential for accessing your tax records online. By logging into the HMRC online services using your UTR, you can view your tax account, check your balance, and manage your tax affairs.

It's important to keep your UTR number secure and confidential. Do not share it with anyone unless it is necessary for tax purposes, and always be cautious of potential scams or fraudulent activities. If you suspect any misuse of your UTR number, report it to HMRC immediately.

The Importance of UTR Numbers in Tax Compliance

UTR numbers are a critical component of tax compliance, providing a secure and efficient means of managing tax affairs. By ensuring each taxpayer has a unique identifier, the tax system can accurately process tax returns, payments, and communications. This not only simplifies the tax process for taxpayers but also helps tax authorities maintain a high level of integrity in the tax system.

UTR numbers also play a vital role in combating tax evasion and fraud. By linking all tax-related activities to a single, unique identifier, tax authorities can more easily identify suspicious activities and potential cases of non-compliance. This enhances the overall effectiveness of tax enforcement and helps ensure a fair and equitable tax system for all.

Future Implications and Developments

As technology advances and tax systems evolve, the role of UTR numbers is likely to become even more crucial. With the increasing shift towards digital tax systems, UTR numbers will play a central role in ensuring secure and efficient online tax management. The integration of UTR numbers with digital platforms will enhance the convenience and accessibility of tax services for taxpayers, while also maintaining the highest standards of security and data protection.

Furthermore, the use of UTR numbers may expand to cover a broader range of tax-related activities, such as payroll tax and benefits in kind. This expansion would ensure a more comprehensive and integrated tax system, further streamlining the tax process for both taxpayers and tax authorities.

In conclusion, the Unique Tax Reference number is a fundamental component of the tax system, providing a unique and secure identifier for each taxpayer. Its role in tax compliance, security, and efficiency is invaluable, and its importance is only set to grow as tax systems continue to evolve and adapt to new technologies.

How do I find my UTR number if I’ve lost it?

+

If you’ve misplaced your UTR number, you can retrieve it by contacting HMRC directly. They can provide your UTR number over the phone or by post once they verify your identity. It’s important to have your personal details ready, such as your full name, address, and date of birth, to expedite the process.

Can I have multiple UTR numbers for different tax purposes?

+

Generally, you should have one UTR number for all your tax affairs. However, in certain circumstances, such as when you have multiple businesses with distinct tax liabilities, you may be issued separate UTR numbers. It’s important to keep these numbers separate and use them for their designated tax purposes.

What happens if I provide the wrong UTR number when filing a tax return or making a payment?

+

Providing the wrong UTR number can lead to delays in processing your tax return or payment. It may also result in your payment being credited to the wrong account, which could cause additional complications. If you realize your mistake, it’s important to correct it as soon as possible by contacting HMRC and providing the correct UTR number.