Dependent Care Tax Credit

In the intricate world of tax credits, the Dependent Care Tax Credit stands as a valuable relief for millions of taxpayers with childcare expenses. This credit, a cornerstone of the US tax system, offers a financial boost to families navigating the often daunting costs of childcare. It's not just a tax deduction; it's a recognition of the economic realities faced by working parents and caregivers, providing a tangible incentive to help manage these expenses.

Unraveling the Dependent Care Tax Credit

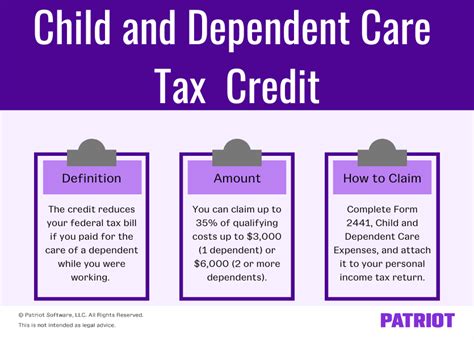

The Dependent Care Tax Credit is a federal tax credit available to taxpayers who incur expenses for the care of a qualifying individual while they work or look for work. This credit aims to ease the financial burden of childcare, recognizing the essential role of childcare in enabling parents to participate fully in the workforce.

The Internal Revenue Service (IRS) defines a qualifying individual as a dependent under the age of 13, a spouse or dependent who is physically or mentally incapable of self-care, or a dependent of any age who lives with the taxpayer for over half the tax year and who has earned income.

Eligibility and Qualifications

To be eligible for the Dependent Care Tax Credit, taxpayers must meet certain criteria. Firstly, they must have earned income from employment or a business during the tax year. This includes wages, salaries, tips, commissions, and net earnings from self-employment. The taxpayer’s spouse, if filing jointly, must also have earned income unless they are a student or physically or mentally unable to care for themselves.

Additionally, taxpayers must have paid for the care of a qualifying individual in order to work or look for work. This care must be provided by someone other than the taxpayer, their spouse, or any dependent of the taxpayer.

Credit Calculation and Benefits

The credit calculation is based on a percentage of the qualifying childcare expenses, up to a maximum dollar amount. The credit percentage and maximum amounts vary depending on the taxpayer’s adjusted gross income (AGI). For taxpayers with an AGI of 15,000 or less, the credit percentage is 35% of qualifying expenses, up to a maximum of 3,000 for one qualifying individual or 6,000 for two or more qualifying individuals. The credit percentage and maximum amounts gradually decrease as AGI increases, with a maximum credit percentage of 20% and maximum expenses of 3,000 for one individual and 6,000 for two or more individuals for taxpayers with an AGI of 43,000 or more.

For example, a taxpayer with an AGI of $20,000 who pays $5,000 in childcare expenses for one qualifying individual would be eligible for a credit of $1,750 (35% of $5,000). If the same taxpayer had two qualifying individuals and paid $8,000 in childcare expenses, the credit would be limited to $2,000 (25% of $8,000) due to the maximum expense limitation of $6,000 for two or more individuals.

The Dependent Care Tax Credit can be claimed on Form 2441, which is then carried over to Schedule 3 of Form 1040 to calculate the final credit amount.

Expenses and Care Providers

Qualifying expenses for the Dependent Care Tax Credit include payments made to a childcare center, nursery school, preschool, or similar facility. It also covers payments to an individual, such as a babysitter or nanny, for the care of a qualifying individual in the taxpayer’s home or the caregiver’s home. However, the taxpayer must provide the caregiver’s identifying information, such as name, address, and taxpayer identification number, on Form 2441 to claim the credit.

Expenses that are not considered qualifying include payments made to a camp if the child's primary activity is education or the recreation of a healthy child, payments for transportation to and from a care facility, and payments made to a spouse or dependent who lives with the taxpayer for more than half of the year, even if they are not claimed as a dependent on the tax return.

| Qualifying Expenses | Non-Qualifying Expenses |

|---|---|

| Childcare center | Camp fees for primarily educational or recreational activities |

| Nursery school | Transportation costs |

| Preschool | Payments to spouse or dependent living with taxpayer |

| Babysitter or nanny | Meals and incidentals |

It's important to note that the IRS may disallow the credit if the taxpayer does not provide sufficient information about the care provider, such as the caregiver's name, address, and taxpayer identification number. Taxpayers should also be aware that the credit is non-refundable, meaning it can only offset the taxpayer's income tax liability and any excess cannot be refunded.

Real-Life Impact and Benefits

The Dependent Care Tax Credit has a tangible impact on the lives of millions of American families. Consider the story of Sarah, a single mother working two jobs to support her family. With two young children, Sarah’s childcare expenses were a significant financial burden. However, by claiming the Dependent Care Tax Credit, she was able to offset a substantial portion of these costs, providing much-needed financial relief and enabling her to continue working and supporting her family.

Similarly, John and Emily, a married couple with dual incomes, found the credit to be a significant benefit. With both parents working full-time, their childcare expenses were considerable. By understanding the eligibility criteria and maximizing their credit, they were able to reclaim a significant portion of their childcare costs, making a meaningful difference in their financial planning and overall well-being.

Maximizing the Credit: Strategies and Tips

For taxpayers looking to maximize the Dependent Care Tax Credit, several strategies can be employed. Firstly, it’s crucial to understand the credit’s eligibility requirements and ensure that all necessary criteria are met. This includes having earned income, paying for qualifying childcare expenses, and providing sufficient information about the care provider.

Taxpayers should also be aware of the credit's income limits and how they affect the credit percentage and maximum expenses. By staying informed about these limits, taxpayers can plan their childcare expenses accordingly to maximize the credit.

Furthermore, taxpayers should keep detailed records of their childcare expenses, including payments made to care providers and any receipts or invoices. This documentation is essential for verifying the expenses when claiming the credit and can help in the event of an IRS audit.

Finally, taxpayers should explore all available childcare options and consider the potential tax benefits when making their choices. For example, while a traditional childcare center may offer convenience and a structured environment, employing a nanny or babysitter can provide more personalized care and may offer additional tax benefits through the Dependent Care Tax Credit.

Future Trends and Implications

As the landscape of work and family life continues to evolve, the Dependent Care Tax Credit remains a vital component of the US tax system. With more families relying on dual incomes and facing the challenges of rising childcare costs, the credit’s role in supporting working families becomes increasingly significant.

Looking ahead, there are several potential implications and trends to consider. Firstly, with the increasing prevalence of remote work and flexible work arrangements, the demand for childcare may shift, potentially impacting the types of care providers taxpayers rely on and the locations where care is provided. This could influence the types of expenses that qualify for the credit and the documentation required to support these expenses.

Secondly, as the cost of living continues to rise, particularly in urban areas, the financial burden of childcare may become even more significant. This could lead to calls for an increase in the maximum credit amount or a reevaluation of the credit's income limits to ensure it remains accessible to those who need it most.

Lastly, with an increasing focus on the economic empowerment of women and the recognition of the value of care work, there may be opportunities to expand the scope of the Dependent Care Tax Credit to include a broader range of care services, such as eldercare or support for family members with disabilities. This would align with the credit's underlying goal of supporting working families and promoting economic participation.

Conclusion

The Dependent Care Tax Credit is a vital tool for millions of taxpayers, offering a much-needed financial boost to offset the costs of childcare. By understanding the credit’s eligibility criteria, calculating the credit accurately, and employing strategic planning, taxpayers can maximize the benefit and ease the financial burden of childcare. As the landscape of work and family life continues to evolve, the credit’s role in supporting working families remains essential, and its future implications are poised to shape the economic realities of American families for years to come.

What is the Dependent Care Tax Credit?

+The Dependent Care Tax Credit is a federal tax credit available to taxpayers who incur expenses for the care of a qualifying individual while they work or look for work. It helps offset the costs of childcare, allowing parents and caregivers to manage their expenses more effectively.

Who is eligible for the Dependent Care Tax Credit?

+Taxpayers must have earned income from employment or a business and pay for the care of a qualifying individual. A qualifying individual can be a dependent under 13, a spouse or dependent who is physically or mentally incapable of self-care, or a dependent of any age who lives with the taxpayer for over half the tax year and has earned income.

How is the credit calculated and what are the benefits?

+The credit is based on a percentage of qualifying childcare expenses, up to a maximum dollar amount. The credit percentage and maximum amounts vary based on the taxpayer’s adjusted gross income (AGI). The credit can provide a substantial financial relief, offsetting a significant portion of childcare costs.

What are qualifying expenses for the credit?

+Qualifying expenses include payments to childcare centers, nursery schools, preschools, and similar facilities. It also includes payments to individuals, like babysitters or nannies, for care provided in the taxpayer’s home or the caregiver’s home. Expenses for camps, transportation, and payments to certain relatives are generally not qualifying.