County Of San Diego Tax Collector

Welcome to an in-depth exploration of the County of San Diego Tax Collector's office, a vital governmental entity responsible for collecting and managing various taxes and fees across the county. This comprehensive guide will delve into the functions, services, and significance of the Tax Collector's office, shedding light on its role in San Diego's economic and administrative landscape.

Introduction to the County of San Diego Tax Collector

The County of San Diego Tax Collector, an integral part of the county’s administrative framework, plays a pivotal role in ensuring the efficient and effective collection of taxes and fees. This department, led by the County Tax Collector, is responsible for a range of crucial financial transactions, contributing significantly to the county’s revenue stream and overall economic stability.

Located in the heart of San Diego County, the Tax Collector's office serves as a central hub for taxpayers, providing a comprehensive suite of services. From property tax assessments to business license fees, the department's remit covers a broad spectrum of financial obligations. Its operations are designed to streamline the tax payment process, making it as convenient and transparent as possible for the county's residents and businesses.

Key Responsibilities and Services

Property Tax Administration

One of the primary responsibilities of the County of San Diego Tax Collector is the management of property taxes. This involves the assessment, billing, and collection of taxes on real estate properties within the county. The department works closely with the San Diego County Assessor’s office to ensure accurate property valuations, which form the basis for tax calculations.

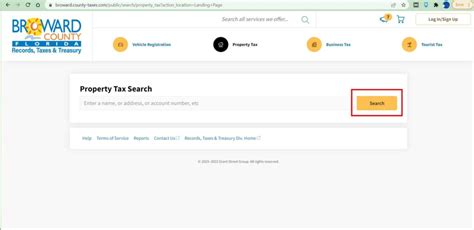

Taxpayers can access their property tax information online through the Tax Collector's website, where they can view their assessment details, pay taxes, and even sign up for convenient payment plans. The department also offers resources to assist taxpayers in understanding the property tax process, including explanations of assessment changes and tax relief programs.

Business Tax Services

The Tax Collector’s office also handles business taxes and licenses. This includes the issuance and renewal of business licenses, as well as the collection of taxes such as business property taxes and Transient Occupancy Taxes (TOT) for short-term rentals. The department provides a user-friendly online platform for businesses to register, manage their accounts, and make payments.

Additionally, the Tax Collector's office offers resources to help businesses understand their tax obligations. This includes guides on business tax rates, due dates, and filing requirements. The department also conducts outreach programs to educate new businesses about their tax responsibilities and to ensure compliance with local tax laws.

Vehicle Registration and Fees

Vehicle registration and related fees are another area of responsibility for the County of San Diego Tax Collector. The department handles the collection of Vehicle License Fees (VLF), which are an important source of revenue for the county. Taxpayers can renew their vehicle registrations and pay VLF online or at designated locations across the county.

The Tax Collector's office also provides information on vehicle registration requirements, including the documentation needed for new registrations, transfers, and title changes. The department's staff is trained to assist taxpayers with these processes, ensuring a smooth and efficient experience.

Other Tax Services

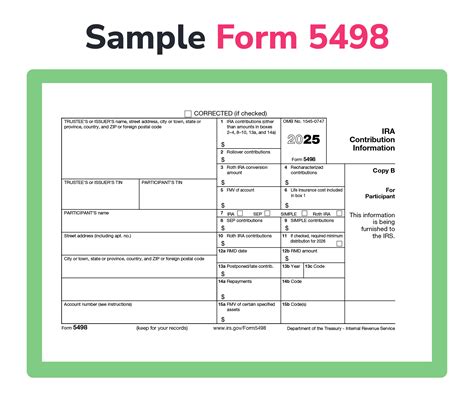

Beyond property, business, and vehicle taxes, the County of San Diego Tax Collector also administers a range of other taxes and fees. This includes special assessments for services such as flood control and water conservation, as well as taxes related to estates and gifts. The department’s website provides detailed information on each of these tax types, including due dates and payment options.

The Tax Collector's office also offers assistance to taxpayers who are facing financial difficulties or have questions about their tax obligations. This includes guidance on payment plans, penalty waivers, and tax relief programs. The department's goal is to ensure that all taxpayers have the resources they need to understand and meet their tax responsibilities.

Online Services and Payment Options

In an effort to enhance convenience and efficiency, the County of San Diego Tax Collector has developed a robust online platform. This platform allows taxpayers to access a wide range of services and information, including account management, payment options, and resources for understanding tax obligations.

Taxpayers can make payments online using a variety of methods, including credit and debit cards, e-checks, and electronic fund transfers. The online system also allows for the scheduling of future payments, providing a convenient way to ensure tax obligations are met on time. Additionally, the platform provides real-time account updates, allowing taxpayers to view their current balance and payment history.

| Payment Method | Description |

|---|---|

| Credit/Debit Cards | Visa, MasterCard, and Discover accepted with a convenience fee. |

| e-Check | Electronic check payment with no additional fees. |

| Electronic Fund Transfer | Direct transfer from a bank account with no additional fees. |

Mobile App and Text Alerts

To further improve accessibility, the Tax Collector’s office has developed a mobile app, available for both iOS and Android devices. The app provides many of the same features as the online platform, allowing taxpayers to manage their accounts, make payments, and receive important notifications on the go. Taxpayers can also opt-in for text alerts, which provide reminders about upcoming due dates and other important tax-related information.

Payment Locations

For taxpayers who prefer in-person interactions, the County of San Diego Tax Collector maintains several physical locations across the county. These locations provide a range of services, including payment processing, account assistance, and the issuance of vehicle registration stickers. Taxpayers can find the nearest location using the office’s online locator tool, which provides addresses, operating hours, and contact information.

Tax Relief Programs and Assistance

Recognizing that economic circumstances can vary, the County of San Diego Tax Collector offers several tax relief programs and assistance options. These programs are designed to help taxpayers who are facing financial hardships or have unique circumstances that impact their ability to pay taxes on time.

Hardship Exemptions

The Tax Collector’s office provides hardship exemptions for taxpayers who can demonstrate financial difficulty. This exemption allows eligible taxpayers to defer the payment of property taxes without incurring penalties or interest. To qualify, taxpayers must meet certain income and asset criteria and provide documentation supporting their financial hardship.

The hardship exemption is particularly beneficial for taxpayers who are facing temporary financial setbacks, such as unemployment or medical emergencies. It provides a measure of relief during difficult times, allowing taxpayers to focus on their immediate financial needs without the added burden of tax penalties.

Payment Plans

For taxpayers who are unable to pay their taxes in full but do not qualify for a hardship exemption, the Tax Collector’s office offers payment plans. These plans allow taxpayers to pay their taxes over an extended period, typically with a small setup fee. Payment plans can be tailored to the taxpayer’s financial situation, with flexible terms and payment schedules.

The payment plan option is particularly useful for taxpayers who are facing short-term financial challenges but expect their financial situation to improve in the near future. It provides a way to manage tax obligations while avoiding the stress and potential consequences of non-payment.

Senior Citizen Exemptions

The County of San Diego Tax Collector also offers exemptions for senior citizens. These exemptions reduce the property tax burden for homeowners who are at least 65 years old and meet certain income and residency requirements. The exemption applies to the taxpayer’s primary residence and can provide significant savings on property taxes.

The senior citizen exemption is an important tool for helping older residents maintain their financial stability and independence. By reducing the financial strain of property taxes, it allows seniors to continue living in their homes without the worry of rising tax obligations.

Taxpayer Assistance Programs

The Tax Collector’s office also provides general assistance to taxpayers who have questions or need help understanding their tax obligations. This includes offering guidance on tax forms, providing explanations of tax laws and regulations, and assisting with account issues. Taxpayers can access this assistance through the office’s website, by phone, or in person at one of the physical locations.

The taxpayer assistance programs are an integral part of the Tax Collector's commitment to transparency and fairness. By providing clear and accessible information, the office ensures that all taxpayers have the resources they need to navigate the tax system effectively and comply with their legal obligations.

Contact and Resources

The County of San Diego Tax Collector is dedicated to providing exceptional service and support to all taxpayers. If you have questions or need assistance with your tax obligations, the office’s team of professionals is ready to help. You can reach the Tax Collector’s office by phone, email, or in person at one of the physical locations.

For general inquiries, you can visit the Tax Collector's website, which provides a wealth of resources and information. The website includes detailed explanations of tax obligations, payment options, and relief programs. It also offers an online chat feature, allowing taxpayers to get quick answers to common questions.

The Tax Collector's office also maintains an active presence on social media platforms, including Facebook and Twitter. These channels provide a convenient way to stay updated on important tax-related announcements, due dates, and reminders. Additionally, the office often shares helpful tips and resources to assist taxpayers in managing their financial obligations.

Conclusion: A Vital Service for San Diego County

The County of San Diego Tax Collector plays a critical role in the economic and administrative landscape of the county. Through its efficient and comprehensive services, the Tax Collector’s office ensures that taxpayers can meet their financial obligations with ease and convenience. From property taxes to business licenses, the department’s suite of services provides a vital link between the county’s residents and its financial stability.

With a focus on accessibility and taxpayer support, the Tax Collector's office has developed innovative solutions, such as its online platform and mobile app, to make tax management as straightforward as possible. The office's commitment to fairness and transparency is evident in its range of tax relief programs and assistance options, ensuring that all taxpayers have the resources they need to navigate the tax system effectively.

As San Diego County continues to grow and evolve, the Tax Collector's office will remain a vital component of its administrative framework. By staying responsive to the needs of taxpayers and adapting to changing economic conditions, the department will continue to provide the efficient and effective services that are essential to the county's prosperity and well-being.

What are the office hours for the County of San Diego Tax Collector?

+The office hours for the County of San Diego Tax Collector vary depending on the location. Generally, the offices are open Monday through Friday, from 8:00 AM to 5:00 PM. However, some locations may have slightly different hours, so it’s best to check the specific office’s website or contact them directly for the most accurate information.

How can I pay my taxes to the County of San Diego Tax Collector?

+There are several ways to pay your taxes to the County of San Diego Tax Collector. You can pay online through their secure payment portal, by phone using a credit or debit card, or in person at one of their physical locations. Additionally, you can also set up automatic payments or enroll in a payment plan if you’re unable to pay your taxes in full.

What happens if I don’t pay my taxes on time to the County of San Diego Tax Collector?

+If you fail to pay your taxes to the County of San Diego Tax Collector by the due date, you may be subject to penalties and interest. The specific penalties and interest rates can vary depending on the type of tax and the amount owed. It’s important to stay informed about your tax obligations and contact the Tax Collector’s office if you’re unable to pay by the due date to discuss your options.

Can I get a tax exemption or relief from the County of San Diego Tax Collector?

+Yes, the County of San Diego Tax Collector offers various tax exemptions and relief programs. These programs are designed to assist taxpayers who are facing financial hardships or meet certain eligibility criteria. Some common exemptions include senior citizen exemptions, disabled veteran exemptions, and hardship exemptions. It’s recommended to check the Tax Collector’s website or contact their office for detailed information on eligibility and application processes.

How can I stay updated on important tax-related information from the County of San Diego Tax Collector?

+To stay informed about important tax-related information from the County of San Diego Tax Collector, you can subscribe to their email notifications or follow their social media accounts. They regularly post updates, reminders, and important announcements on their website, Facebook page, and Twitter account. Additionally, you can also sign up for text alerts to receive notifications directly to your mobile device.