Property Tax Missouri

Welcome to a comprehensive guide on Property Tax in the state of Missouri. This article aims to provide an in-depth analysis, breaking down the intricacies of property taxation in this vibrant midwestern state. With a focus on clarity and detail, we will explore the various aspects of property taxes, from assessment processes to payment options, ensuring that you, the reader, gain a thorough understanding of this essential aspect of homeownership in Missouri.

Understanding Property Taxes in Missouri

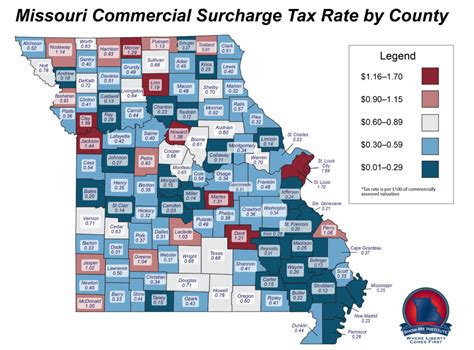

Property taxes in Missouri are a significant revenue source for local governments, including counties, cities, school districts, and other special purpose districts. These taxes contribute to the maintenance and development of essential public services and infrastructure, ensuring the smooth functioning and growth of communities across the state.

The property tax system in Missouri is locally administered and assessed, which means that the valuation and taxation processes can vary from one county to another. This localized approach ensures that property taxes are tailored to the specific needs and circumstances of each community.

Assessment Process

Property assessment in Missouri is a critical step in the property tax process. It involves the valuation of real estate properties, including land and improvements, to determine their taxable value. This value is then used as the basis for calculating property taxes.

Missouri follows a "fair cash value" approach to property assessment, which means that properties are valued at their market value. The assessed value is typically a percentage of the fair cash value, and this percentage can vary depending on the property type and location. For instance, residential properties are assessed at 19% of their fair cash value, while commercial and industrial properties are assessed at 32%.

The assessment process in Missouri is carried out by county assessors. These professionals are responsible for evaluating properties within their jurisdiction, ensuring accuracy and fairness in the valuation process. They consider various factors, such as location, size, condition, and recent sales data, to determine the fair cash value of each property.

| Property Type | Assessment Percentage |

|---|---|

| Residential | 19% |

| Commercial/Industrial | 32% |

Tax Rates and Calculation

Once the assessed value of a property is determined, the property tax rate is applied to calculate the tax liability. The tax rate, also known as the “levy rate,” is set by local taxing authorities, such as school districts, cities, and counties. These rates can vary significantly across the state, leading to different tax liabilities for similar properties in different locations.

The tax rate is expressed as a percentage and is typically divided into two components: the state-authorized rate and the local rate. The state-authorized rate is set by the Missouri State Legislature and is the same across the state. The local rate, on the other hand, is determined by local taxing authorities and can vary from one jurisdiction to another.

To calculate the property tax liability, the assessed value of the property is multiplied by the tax rate. For example, if a residential property has an assessed value of $100,000 and the tax rate is 2.5%, the property tax liability would be $2,500 ($100,000 x 0.025). This calculation provides a clear understanding of the tax obligation for property owners.

Payment Options and Due Dates

Property taxes in Missouri are typically due in two installments. The first installment is due on the first day of October each year, while the second installment is due on the first day of February. However, it’s important to note that the due dates can vary slightly depending on the county and the specific taxing authority.

Property owners have several options for paying their property taxes. The most common method is to pay online through the county treasurer's office website. This method is convenient and secure, allowing property owners to make payments from the comfort of their homes. Other payment options include mailing a check or money order to the county treasurer's office or paying in person at the treasurer's office or a designated payment location.

To ensure timely payment, property owners should keep track of the due dates and consider setting reminders. Late payments can result in penalties and interest, which can add up quickly. It's advisable to stay informed about the payment schedule and plan accordingly to avoid any unnecessary fees.

Payment Plans and Hardship Relief

Missouri recognizes that property owners may face financial difficulties and offers payment plans and hardship relief options to assist those in need. Property owners who are unable to pay their property taxes in full by the due date can apply for a payment plan, which allows them to pay their taxes in installments over a specified period.

Additionally, the state provides hardship relief for eligible property owners who are facing financial challenges. This relief can include a reduction in the property tax liability or a deferment of the tax payment. To qualify for hardship relief, property owners must meet certain criteria, such as low income, disability, or age. It's important to contact the local tax assessor's office or seek professional advice to understand the eligibility requirements and application process.

Appeals and Exemptions

Property owners in Missouri have the right to appeal their property assessments if they believe the assessed value is incorrect or unfair. The appeal process allows property owners to challenge the valuation and seek a more accurate assessment. It’s important to note that the appeal process can be complex and may require the assistance of a professional tax consultant or attorney.

To initiate an appeal, property owners must file a written notice with the county assessor's office within a specified timeframe, typically 30 days after the assessment notice is received. The assessor's office will then review the appeal and make a determination. If the property owner is not satisfied with the decision, they can further appeal to the county board of equalization or the state tax commission.

Property Tax Exemptions

Missouri offers various property tax exemptions to eligible property owners, reducing their tax liability. These exemptions are designed to provide relief to specific groups of individuals or properties that meet certain criteria.

- Homestead Exemption: This exemption is available to Missouri residents who own and occupy their home as their primary residence. It provides a reduction in the assessed value of the property, which results in a lower property tax liability. To qualify, property owners must meet certain income and residency requirements.

- Veterans' Exemption: Missouri offers property tax exemptions to honorably discharged veterans and their surviving spouses. This exemption can provide a significant reduction in property taxes, helping veterans and their families secure a more affordable homeownership experience.

- Senior Citizen Exemption: Eligible senior citizens in Missouri can benefit from a property tax exemption. This exemption is based on income and provides a reduction in the assessed value of the property, leading to lower property taxes. It's an essential relief measure for older adults who may be on a fixed income.

- Agricultural Land Exemption: Properties used for agricultural purposes can qualify for a partial or full exemption from property taxes. This exemption encourages and supports agricultural activities, ensuring that farmers and ranchers can continue their operations without facing excessive tax burdens.

Future Implications and Considerations

The property tax system in Missouri is dynamic and subject to ongoing developments and legislative changes. As the state’s economy and population continue to evolve, the property tax landscape may also shift to accommodate these changes.

One potential area of change is the reassessment process. While regular reassessments are already in place, there may be discussions and proposals to modify the frequency or methodology of assessments to ensure fairness and accuracy. Additionally, as property values fluctuate, especially in rapidly developing areas, the assessment process may need to adapt to reflect these changes accurately.

Another consideration is the potential impact of state and local budgets on property tax rates. In times of economic strain or when public services face funding challenges, local governments may need to adjust tax rates to maintain essential services. Property owners should stay informed about any proposed tax rate changes and their potential impact on their tax liabilities.

Furthermore, as Missouri continues to attract new residents and businesses, the demand for housing and commercial properties may increase. This could lead to rising property values, which would, in turn, impact property tax assessments. Property owners should be aware of these potential shifts and stay engaged with their local tax authorities to understand how these changes may affect their tax obligations.

How often are property assessments conducted in Missouri?

+Property assessments in Missouri are typically conducted every two to four years, depending on the county. These assessments ensure that property values remain up-to-date and accurate.

Can property owners appeal their property assessments?

+Yes, property owners in Missouri have the right to appeal their property assessments if they believe the valuation is incorrect. The appeal process involves filing a written notice and potentially presenting evidence to support the appeal.

What are the payment options for property taxes in Missouri?

+Property owners in Missouri have several payment options, including online payments through the county treasurer’s office website, mailing a check or money order, or paying in person at designated locations.

Are there any hardship relief options for property owners facing financial difficulties?

+Yes, Missouri offers hardship relief options, including payment plans and tax deferments, for property owners facing financial challenges. These programs aim to assist property owners in maintaining their homeownership during difficult times.

What property tax exemptions are available in Missouri?

+Missouri offers various property tax exemptions, including the homestead exemption for primary residences, veterans’ exemptions, senior citizen exemptions, and agricultural land exemptions. These exemptions provide relief to specific groups and encourage certain activities.