Does Tn Have State Tax

When it comes to taxation, Tennessee, often referred to as the "Volunteer State," presents a unique landscape, particularly in comparison to many other states in the United States. The state's tax structure is designed to be relatively straightforward and has evolved over the years to accommodate the diverse economic activities within its borders. This article aims to provide an in-depth analysis of Tennessee's tax system, shedding light on its various components and how they impact individuals and businesses.

Understanding Tennessee’s Tax System

Tennessee’s tax system is governed by a range of laws and regulations, with the primary authority being the Tennessee Department of Revenue. This department is responsible for administering and enforcing the state’s tax laws, ensuring compliance, and collecting revenue to fund various state services and programs.

The Role of the Tennessee Department of Revenue

The Tennessee Department of Revenue plays a pivotal role in the state’s fiscal health. It is responsible for managing a wide array of taxes, including those on income, sales, and various business activities. The department’s comprehensive approach to taxation ensures that the state’s revenue streams are robust and sustainable.

| Tax Category | Description |

|---|---|

| Income Tax | Tennessee has a progressive income tax structure with six tax brackets ranging from 0% to 6%. |

| Sales and Use Tax | The state imposes a 7% sales tax on most goods and services, with some local jurisdictions adding an additional tax. |

| Excise Taxes | These taxes are levied on specific goods and activities, such as gasoline, tobacco, and alcohol. |

| Business Taxes | Tennessee has a franchise and excise tax for businesses, as well as various other taxes based on business type and activities. |

One of the most notable aspects of Tennessee's tax system is its lack of state income tax on wages. This unique feature has made Tennessee an attractive destination for businesses and individuals seeking to minimize their tax burden. However, it's important to note that Tennessee does levy an income tax on interest and dividend income, as well as certain types of business income.

Tax Exemptions and Credits

Tennessee offers a range of tax exemptions and credits to individuals and businesses. These incentives are designed to encourage economic growth, attract investment, and support specific industries. For instance, the state provides tax credits for research and development activities, job creation, and investment in renewable energy.

Taxation for Individuals and Families

Tennessee’s tax structure can have varying implications for individuals and families depending on their financial circumstances and lifestyle choices. Here’s a breakdown of how the state’s tax system impacts different aspects of personal finances.

Income Tax and Deductions

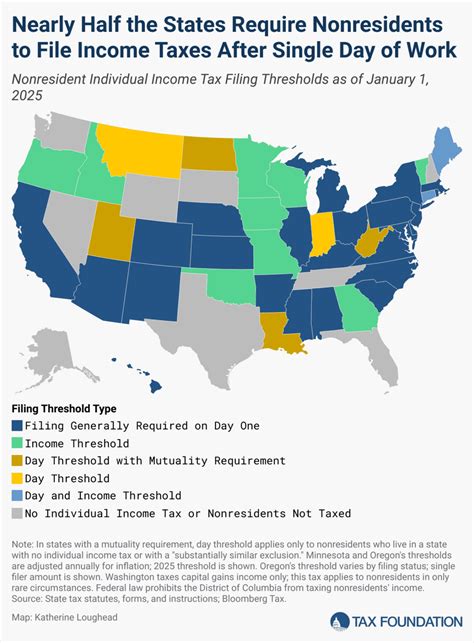

As mentioned earlier, Tennessee does not tax wage income. This means that individuals who earn their income primarily through wages or salaries can expect to keep a larger portion of their earnings compared to residents of many other states. However, Tennessee does impose taxes on other forms of income, such as interest, dividends, and certain types of business income.

Tennessee offers a standard deduction and personal exemptions to reduce the taxable income for individuals and families. These deductions are designed to provide relief to taxpayers, especially those with lower incomes. Additionally, the state allows taxpayers to itemize deductions, which can further reduce their tax liability.

Sales and Use Tax

Tennessee has a uniform sales tax rate of 7% on most goods and services. This rate is applied consistently across the state, with some local jurisdictions adding an additional tax, known as a local option sales tax, to fund specific projects or services.

The sales tax in Tennessee applies to a broad range of transactions, including the purchase of tangible personal property, certain services, and rental or lease agreements. However, there are some exemptions, such as food for home consumption, prescription drugs, and certain medical devices.

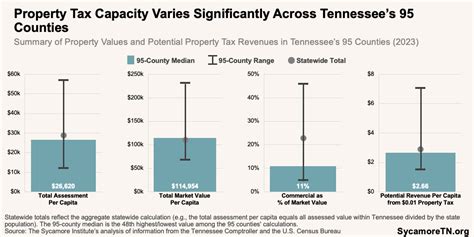

Property Tax

Property taxes in Tennessee are primarily assessed and collected at the local level, with rates varying widely across the state. These taxes are used to fund local services such as schools, emergency services, and infrastructure maintenance. The property tax rates are determined by the taxing authority, which can include cities, counties, and special districts.

Tennessee offers several property tax exemptions and relief programs, especially for low-income seniors and veterans. These programs aim to reduce the financial burden of property taxes on certain segments of the population.

Taxation for Businesses

Tennessee’s business-friendly tax environment is a significant factor in its economic growth and attractiveness to investors. The state’s tax structure for businesses is designed to be competitive and encourage economic development.

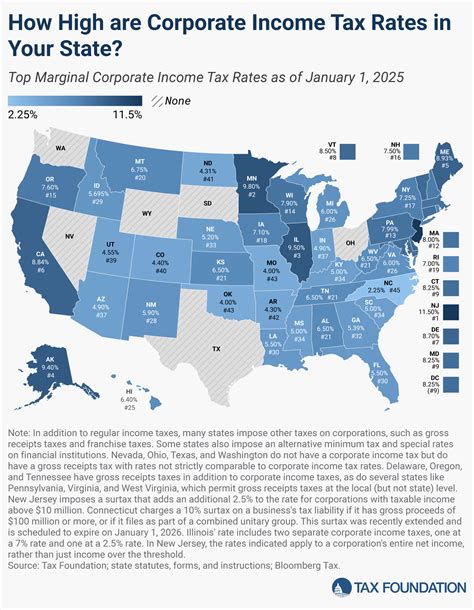

Business and Franchise Taxes

Tennessee imposes a franchise and excise tax on businesses, which is based on the net worth or capital stock of the company. This tax is a significant source of revenue for the state and helps fund various government services and programs.

The franchise and excise tax is applicable to a wide range of business entities, including corporations, limited liability companies (LLCs), and partnerships. The tax rate varies depending on the type of business and its structure.

Sales and Use Tax for Businesses

Businesses in Tennessee are responsible for collecting and remitting sales tax on their transactions. This includes both the state’s 7% sales tax and any applicable local option sales taxes. Failure to comply with sales tax regulations can result in penalties and interest.

To assist businesses in managing their sales tax obligations, Tennessee provides resources and tools, such as online filing and payment systems, tax guides, and educational materials. The state also offers tax incentives and credits for businesses that invest in certain sectors or create jobs.

Other Business Taxes and Incentives

Tennessee imposes various other taxes on businesses, including taxes on gasoline, diesel fuel, and other petroleum products. These taxes are often used to fund specific infrastructure projects or support environmental initiatives.

Additionally, Tennessee offers a range of tax incentives and credits to attract and retain businesses. These incentives can include tax credits for job creation, investment in research and development, and investment in certain industries such as film and entertainment.

Tennessee’s Tax Landscape: Future Implications

Tennessee’s tax system is continually evolving to meet the changing needs of its residents and businesses. As the state’s economy grows and diversifies, the tax structure will likely adapt to ensure it remains competitive and supportive of economic development.

Potential Tax Reforms

There have been ongoing discussions and proposals for tax reforms in Tennessee, particularly regarding the state’s lack of an income tax on wages. Some policymakers and economic experts argue that introducing a wage income tax could provide a more stable and predictable revenue stream, allowing for better planning and investment in critical services.

However, any potential tax reforms would need to carefully consider the impact on businesses and individuals, as well as the state's overall economic health. Tennessee's current tax structure has been a significant factor in its economic success, and any changes would need to maintain the state's competitive advantage.

Economic Growth and Development

Tennessee’s business-friendly tax environment has been a key driver of its economic growth. The state’s ability to attract and retain businesses has led to job creation, increased investment, and a thriving economy. As the state continues to prioritize economic development, its tax structure will play a crucial role in shaping its future prosperity.

The state's focus on providing tax incentives and credits for businesses, particularly in sectors such as technology, healthcare, and manufacturing, is likely to continue. These incentives encourage innovation, job growth, and investment, all of which contribute to Tennessee's long-term economic sustainability.

Conclusion

Tennessee’s tax system is a complex yet strategically designed framework that supports the state’s economic growth and development. From its unique approach to income taxation to its comprehensive business tax structure, Tennessee’s approach to taxation has made it an attractive destination for businesses and individuals alike.

As Tennessee continues to evolve and adapt to the changing economic landscape, its tax system will remain a critical component in shaping its future. The state's commitment to providing a competitive and supportive tax environment will be a key factor in its ongoing economic success.

Does Tennessee have a state income tax on wages?

+

No, Tennessee does not impose a state income tax on wage income. However, it does tax other forms of income, such as interest and dividends.

What is the sales tax rate in Tennessee?

+

The state sales tax rate in Tennessee is 7%, with some local jurisdictions adding an additional local option sales tax.

Are there any property tax exemptions in Tennessee?

+

Yes, Tennessee offers several property tax exemptions, including programs for low-income seniors and veterans.

What is the franchise and excise tax in Tennessee?

+

The franchise and excise tax is a tax levied on businesses based on their net worth or capital stock. It is a significant source of revenue for the state.

Does Tennessee offer any tax incentives for businesses?

+

Yes, Tennessee provides a range of tax incentives and credits to attract and retain businesses, particularly in sectors such as technology and healthcare.