Nm Tax Rate

Welcome to an in-depth exploration of the New Mexico tax rate, a crucial aspect of understanding the financial landscape of the Land of Enchantment. This article aims to provide a comprehensive guide to the various taxes levied in New Mexico, shedding light on their rates, implications, and how they compare to other states.

Understanding the New Mexico Tax Structure

The tax system in New Mexico is multifaceted, encompassing a range of taxes designed to fund public services and infrastructure. From income taxes to sales taxes and property taxes, each component plays a vital role in the state’s fiscal health.

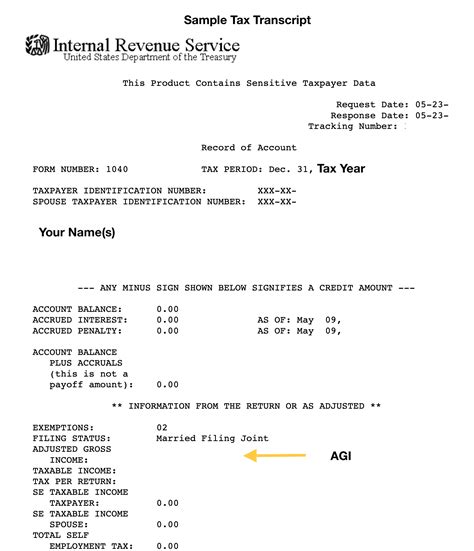

Income Tax Rates in New Mexico

One of the key revenue streams for the state is the individual income tax. New Mexico employs a progressive tax system, which means the tax rate increases as income rises. This approach ensures that those with higher earnings contribute a larger share to the state’s revenue.

| Income Bracket | Tax Rate |

|---|---|

| 0 - $5,600 | 1.7% |

| $5,601 - $9,400 | 3.2% |

| $9,401 - $15,000 | 4.7% |

| $15,001 - $22,000 | 4.9% |

| $22,001 and above | 5.9% |

These rates are applicable to both single filers and married couples filing jointly. However, for married individuals filing separately, the income limits and rates are halved.

New Mexico also offers various tax credits and deductions to ease the tax burden on residents. For instance, the state provides a standard deduction and allows itemized deductions for expenses such as medical costs, charitable contributions, and certain tax-exempt interest.

Sales and Use Taxes

New Mexico levies a gross receipts tax, which is essentially a sales tax on the sale of goods and services within the state. This tax is imposed on the seller, who then passes the burden to the consumer in the form of higher prices. The base rate for this tax is 5.125%, but it can vary depending on local ordinances.

Additionally, New Mexico has a compensating tax, which is applied to the use, storage, or consumption of goods purchased outside the state but brought into New Mexico. This tax is designed to ensure that out-of-state purchases do not provide an unfair advantage over in-state businesses.

| Tax Type | Base Rate |

|---|---|

| Gross Receipts Tax | 5.125% |

| Compensating Tax | 5.125% |

Certain goods and services are exempt from these taxes, including most groceries, prescription drugs, and certain medical devices. Additionally, there are specific exemptions for Native American tribes and their enterprises.

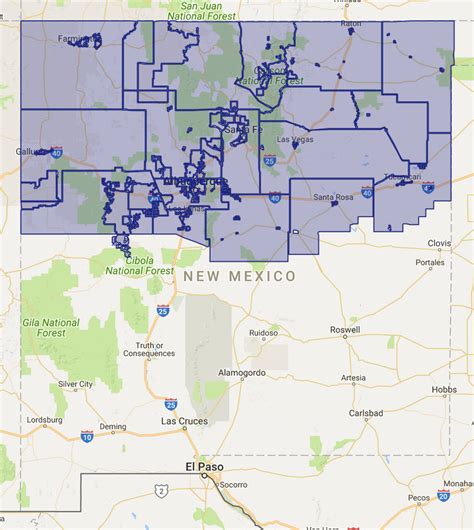

Property Taxes in New Mexico

Property taxes are a significant source of revenue for local governments in New Mexico. These taxes are levied on both real estate and personal property, such as vehicles and business equipment.

The tax rate for real property varies widely across the state, with each county setting its own mill levy rate. A mill is one-tenth of one percent, so a mill levy of 30 mills would equate to a tax rate of 3%. These rates are applied to the assessed value of the property, which is typically a percentage of the fair market value.

For instance, if a home is valued at $200,000 and the county's mill levy is 30 mills, the annual property tax would be calculated as follows:

$200,000 (assessed value) x 0.03 (tax rate) = $6,000 in annual property taxes.

New Mexico offers various exemptions and credits to reduce the tax burden on property owners. These include homestead exemptions, which reduce the taxable value of a primary residence, and veterans' exemptions, which provide relief to those who have served in the military.

Comparative Analysis: How New Mexico’s Tax Rates Stack Up

When compared to other states, New Mexico’s tax rates often fall in the middle of the pack. While it has relatively low income tax rates, especially for lower income brackets, its sales and property taxes can be higher than some neighboring states.

Income Tax Comparison

New Mexico’s progressive income tax system is similar to many other states, but its rates are generally lower. For instance, neighboring Colorado has a flat income tax rate of 4.55%, while Texas has no income tax at all.

Sales Tax Comparison

New Mexico’s gross receipts tax is slightly higher than the national average. For instance, Arizona’s transaction privilege tax (their equivalent of a sales tax) is 5.6%, while California’s sales tax can range from 7.25% to over 10% depending on the locality.

Property Tax Rates Across States

Property tax rates vary significantly across the country, and New Mexico’s rates are generally on the lower end. States like New Hampshire and Vermont have some of the highest property tax rates, while Alabama and Hawaii have some of the lowest.

Conclusion: Navigating the New Mexico Tax Landscape

Understanding the tax landscape in New Mexico is crucial for individuals and businesses alike. The state’s tax system, while progressive and relatively moderate, can present unique challenges and opportunities. From income taxes to sales and property taxes, each component plays a role in shaping the state’s economy and the lives of its residents.

As with any tax system, it's essential to stay informed about the latest changes and developments. Tax rates and laws can evolve, and keeping abreast of these changes can help individuals and businesses make informed financial decisions.

What is the current state income tax rate in New Mexico for 2023?

+The income tax rates for 2023 remain the same as previous years, ranging from 1.7% to 5.9% depending on income brackets. These rates are subject to change in future tax years.

Are there any plans to increase or decrease tax rates in New Mexico in the near future?

+There are no specific plans to make significant changes to the tax rates in the immediate future. However, tax laws are subject to change, and proposals can arise at any time, so it’s important to stay updated.

How do New Mexico’s tax rates compare to those of neighboring states like Texas and Arizona?

+New Mexico’s income tax rates are generally lower than Arizona’s, which has a flat rate of 4.55%. Texas, on the other hand, has no income tax, making it an attractive option for individuals seeking to minimize their tax liabilities.

Are there any tax incentives or credits available for certain industries or individuals in New Mexico?

+Yes, New Mexico offers a range of tax incentives and credits to encourage economic growth and support specific industries. These include film production incentives, renewable energy tax credits, and job creation tax credits.