Yonkers Tax

In the realm of local governance, understanding the intricacies of taxation is paramount. Yonkers, a vibrant city in New York, has its own unique tax system that plays a significant role in the city's economic landscape. This article aims to provide an in-depth analysis of the Yonkers Tax system, shedding light on its historical context, key components, and its impact on both residents and businesses. By delving into specific details and real-world examples, we aim to offer a comprehensive guide to this essential aspect of Yonkers' financial framework.

A Historical Overview of Yonkers Tax

The origins of Yonkers Tax can be traced back to the city’s early development, where it played a pivotal role in funding essential public services and infrastructure projects. Over the years, the tax system has evolved to meet the changing needs of the community, adapting to economic fluctuations and demographic shifts.

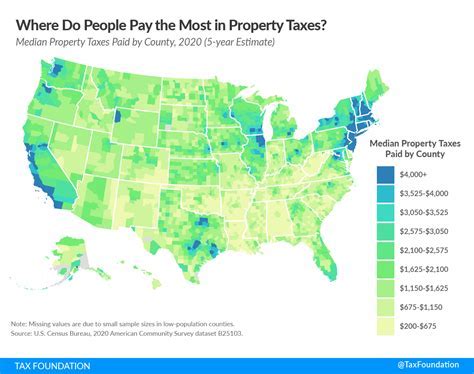

One of the earliest forms of taxation in Yonkers was the property tax, which remains a cornerstone of the city's revenue generation today. This tax was initially implemented to finance the construction of schools, hospitals, and other civic amenities, ensuring a steady stream of income for essential services. The property tax, assessed based on the value of real estate holdings, has historically been a stable source of revenue for Yonkers, contributing significantly to the city's financial stability.

As Yonkers expanded and its economy diversified, the tax system became more complex. The introduction of sales tax and business taxes marked a significant shift, allowing the city to tap into a broader revenue base. Sales tax, levied on retail transactions, provided a mechanism to capture the growing commercial activity within the city limits. Meanwhile, business taxes, which include license fees and corporate taxes, targeted the city's thriving business sector, encouraging economic growth while ensuring fair contributions to the community.

Key Components of the Yonkers Tax System

The Yonkers Tax system is multifaceted, comprising a range of taxes tailored to different economic activities and citizen demographics. Let’s delve into some of the critical components that make up this comprehensive framework.

Property Tax: A Stable Revenue Stream

As mentioned earlier, property tax is a cornerstone of Yonkers’ revenue generation. The city assesses property values regularly, ensuring that the tax burden is distributed fairly among residents. The tax rate is determined by the city’s budget requirements and the assessed value of properties, providing a stable and predictable income stream for essential services.

For instance, consider the case of Mr. Johnson, a Yonkers resident who owns a single-family home. Based on the city's assessment, his property is valued at $500,000. With a tax rate of 2.5%, Mr. Johnson pays an annual property tax of $12,500, contributing to the city's budget for public schools, fire department, and other vital services.

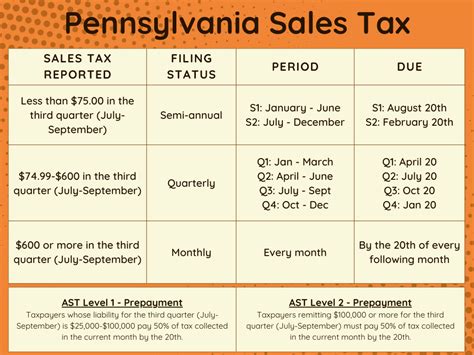

Sales Tax: Capturing Commercial Activity

The sales tax is a critical component of Yonkers’ tax system, designed to capture the economic activity generated by retail businesses. The tax is applied to the sale of goods and certain services within the city limits, ensuring that a portion of the revenue generated by commercial transactions is redirected to support local initiatives.

Take the example of Downtown Yonkers, a bustling shopping district. The sales tax collected from businesses in this area contributes significantly to the city's revenue. For instance, a popular electronics store in Downtown Yonkers might generate $10 million in sales annually. With a sales tax rate of 8%, the city collects $800,000 from this store alone, which is then used to fund public transportation, parks, and other community amenities.

Business Taxes: Encouraging Economic Growth

Yonkers’ commitment to fostering a vibrant business environment is reflected in its business tax structure. The city offers a range of incentives and tax breaks to attract and retain businesses, while also ensuring that these enterprises contribute fairly to the local economy.

Consider the case of TechHub Yonkers, a burgeoning tech startup hub. The city has implemented a tax abatement program for new businesses in this sector, offering reduced tax rates for the first five years of operation. This initiative not only encourages innovation and job creation but also provides a steady influx of talent and economic activity to the city.

Other Tax Categories: A Comprehensive Approach

In addition to the aforementioned taxes, Yonkers’ tax system includes a range of other categories tailored to specific economic activities and citizen needs. These include:

- Income Tax: Yonkers residents and businesses with taxable income are subject to a progressive income tax, with rates varying based on income brackets.

- Hotel and Motel Tax: This tax is levied on accommodations, supporting the city's tourism and hospitality sectors while providing funds for local attractions and events.

- Vehicle and Gasoline Tax: Yonkers imposes taxes on vehicle registrations and gasoline sales, contributing to infrastructure development and maintenance.

- Amusements Tax: A tax on entertainment venues and events, this category supports the city's cultural and recreational offerings.

Performance Analysis and Impact

The effectiveness of Yonkers’ tax system can be gauged by its impact on the city’s economy and the well-being of its residents. Let’s explore some key performance indicators and real-world examples to understand the system’s efficacy.

Revenue Generation and Budget Allocation

Yonkers’ tax system has consistently generated sufficient revenue to fund essential public services and infrastructure projects. The city’s budget, which is largely funded by tax revenue, is meticulously allocated to various departments and initiatives, ensuring efficient resource utilization.

For instance, in the fiscal year 2022, Yonkers' tax revenue amounted to $250 million, which was allocated as follows:

| Department | Allocated Funds |

|---|---|

| Education | $80 million |

| Public Safety | $45 million |

| Health and Human Services | $30 million |

| Transportation and Infrastructure | $25 million |

| Recreation and Culture | $15 million |

| Other Departments | $55 million |

Impact on Residents and Businesses

The Yonkers Tax system’s impact extends beyond revenue generation; it influences the lives of residents and the operations of businesses within the city.

Resident Perspective: For Yonkers residents, the tax system ensures access to quality public services and infrastructure. From well-maintained roads and parks to excellent public schools and efficient public transportation, the tax dollars paid by residents directly contribute to their quality of life. Additionally, the city's commitment to fair taxation ensures that the tax burden is distributed equitably among its citizens.

Business Perspective: Yonkers' tax system, with its incentives and tailored approaches, has been instrumental in fostering a business-friendly environment. The city's tax policies have encouraged entrepreneurship and attracted established businesses, leading to job creation and economic growth. The tax breaks and incentives, particularly in sectors like technology and renewable energy, have positioned Yonkers as an attractive destination for businesses, contributing to a thriving local economy.

Future Implications and Potential Challenges

As Yonkers continues to evolve and adapt to economic and demographic changes, its tax system will play a pivotal role in shaping the city’s future. Here, we explore some potential implications and challenges that may influence the city’s tax landscape in the coming years.

Economic Diversification and Tax Revisions

Yonkers’ economy, like many others, is undergoing a transformation, with a shift towards knowledge-based industries and a decline in traditional manufacturing sectors. This evolution may require a revision of the city’s tax system to accommodate these changes.

As the city becomes increasingly reliant on sectors like technology, healthcare, and renewable energy, the tax system may need to be adjusted to encourage growth in these areas. This could involve reevaluating tax rates and incentives to ensure that Yonkers remains competitive in attracting businesses and talent.

Addressing Income Inequality

Income inequality is a challenge faced by many cities, and Yonkers is no exception. The city’s tax system, while aiming for fairness, may need further refinement to address this issue effectively.

Implementing progressive tax policies, where higher-income earners contribute a larger proportion of their income, could be one strategy to address income inequality. Additionally, exploring tax credits and incentives for low-income residents and small businesses can help stimulate economic growth from the bottom up.

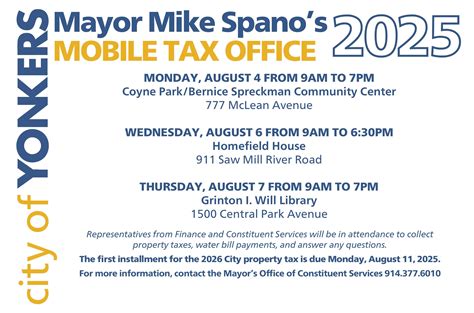

Technological Integration and Tax Collection

The digital age presents both opportunities and challenges for tax collection. Yonkers, like many cities, is embracing technological advancements to streamline tax collection processes.

Implementing online tax filing and payment systems can enhance efficiency and reduce administrative costs. However, it also brings challenges such as ensuring cybersecurity and addressing digital literacy gaps among residents. Balancing technological integration with accessibility will be crucial for the city's future tax collection efforts.

Frequently Asked Questions

How often are property taxes assessed in Yonkers?

+

Property taxes in Yonkers are typically assessed annually, ensuring that the tax burden is distributed fairly based on the current market value of properties.

Are there any tax incentives for businesses in Yonkers?

+

Yes, Yonkers offers a range of tax incentives to attract and support businesses. These include tax abatement programs, especially for new businesses in sectors like technology and renewable energy.

How does Yonkers’ sales tax rate compare to other cities in New York State?

+

Yonkers’ sales tax rate is competitive within the state, ensuring that the city remains an attractive destination for retail businesses and consumers alike.

Are there any tax breaks for senior citizens or veterans in Yonkers?

+

Yonkers offers specific tax exemptions and reductions for senior citizens and veterans, demonstrating the city’s commitment to supporting its most vulnerable residents.

How can I stay informed about changes to Yonkers’ tax system?

+

Yonkers’ official website provides regular updates on tax-related matters. Additionally, local news outlets and community forums often cover tax-related news, keeping residents informed about any changes or proposed revisions.