Sales Tax Pennsylvania

Understanding the intricacies of sales tax in Pennsylvania is crucial for both businesses and consumers alike. With a unique set of rules and regulations, this state's sales tax system can be quite complex. In this comprehensive guide, we will delve into the specifics of Pennsylvania's sales tax, exploring its rates, applicability, exemptions, and the impact it has on various industries and transactions.

The Pennsylvania Sales Tax: A Comprehensive Overview

Pennsylvania, a vibrant state known for its diverse economy, imposes a sales tax on the sale of tangible personal property and certain services. This tax is an essential revenue source for the state, funding various public services and infrastructure projects. Let’s break down the key aspects of Pennsylvania’s sales tax to gain a thorough understanding.

Sales Tax Rates and Structure

The state of Pennsylvania applies a base sales tax rate of 6% to most taxable goods and services. However, it’s important to note that this base rate is not uniform across the state. Local municipalities have the authority to impose additional sales taxes, resulting in varying total sales tax rates depending on the specific location.

| Location | Additional Local Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Philadelphia | 2% | 8% |

| Allegheny County | 1% | 7% |

| Other Counties | Varies (up to 1%) | 6-7% |

These local tax rates can significantly impact the total sales tax burden for businesses and consumers, especially in densely populated areas like Philadelphia and Pittsburgh.

Taxable Items and Services

Pennsylvania’s sales tax applies to a wide range of goods and services, including but not limited to:

- Clothing and footwear

- Electronics and appliances

- Groceries (excluding food prepared for immediate consumption)

- Automotive parts and services

- Entertainment services (e.g., movie tickets, concerts)

- Lodging and accommodation

- Certain professional services (e.g., legal and accounting services)

It's important for businesses to stay updated on the latest regulations to ensure compliance and avoid penalties.

Exemptions and Special Considerations

While Pennsylvania’s sales tax covers a broad spectrum of items, there are certain categories that are exempt or subject to reduced rates. Understanding these exemptions is crucial for both businesses and consumers.

Food and Groceries

Prepared food and beverages intended for immediate consumption are subject to the full sales tax rate. However, groceries, including staple foods, are exempt from sales tax, providing some relief for consumers’ grocery bills.

Pharmaceuticals and Medical Supplies

Prescription drugs and certain medical devices are exempt from sales tax in Pennsylvania. This exemption aims to make essential healthcare items more accessible and affordable for residents.

Manufacturing and Industrial Machinery

Sales tax is not applicable to the purchase of machinery and equipment used directly in manufacturing or industrial processes. This exemption encourages investment in the state’s industrial sector and promotes economic growth.

Nonprofit Organizations

Certain nonprofit entities, such as charitable organizations and religious institutions, are exempt from sales tax on their purchases. This exemption supports the vital work of these organizations and helps keep their operational costs down.

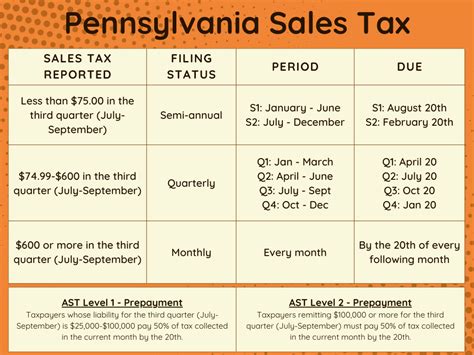

Registration and Compliance

Businesses operating in Pennsylvania are required to register for a sales tax permit with the Pennsylvania Department of Revenue. This permit allows them to collect and remit sales tax on behalf of the state. Failure to register and comply with sales tax regulations can result in penalties and legal consequences.

To ensure compliance, businesses should keep accurate records of taxable sales, file regular sales tax returns, and remit the collected taxes to the state on time. The Department of Revenue provides resources and guidelines to assist businesses in understanding their sales tax obligations.

Impact on Businesses and Consumers

Pennsylvania’s sales tax system has a significant impact on both businesses and consumers. For businesses, it represents a crucial revenue stream that contributes to the state’s economic development. However, it also adds administrative overhead and complexity to their operations, especially for those with multiple locations or online sales.

Consumers, on the other hand, bear the burden of sales tax when making purchases. The varying rates across the state can influence buying behavior and impact local economies. Understanding these rates and exemptions can help consumers make informed purchasing decisions and plan their budgets accordingly.

Navigating the Complexities: Expert Insights

Pennsylvania’s sales tax landscape can be intricate, especially for businesses operating across multiple locations or offering diverse products and services. Here are some expert insights to help navigate these complexities:

The Future of Sales Tax in Pennsylvania

As the economic landscape evolves, so does the sales tax system. Pennsylvania, like many other states, is exploring ways to modernize its tax policies and keep pace with changing consumer behaviors and technological advancements.

Online Sales and Remote Sellers

The rise of e-commerce has presented new challenges for sales tax collection. Pennsylvania, along with other states, has been implementing measures to ensure that online sellers collect and remit sales tax, even if they do not have a physical presence in the state. This shift aims to level the playing field between brick-and-mortar and online businesses.

Sales Tax Simplification Efforts

There have been ongoing discussions and initiatives to simplify Pennsylvania’s sales tax system, making it more straightforward and efficient for businesses and consumers. These efforts may include harmonizing tax rates across the state or introducing streamlined registration and filing processes.

Impact of Economic Changes

Economic shifts, such as the transition to a more service-based economy or changes in consumer spending patterns, can influence the structure and rates of sales tax. Pennsylvania’s policymakers will need to adapt and adjust the tax system to ensure it remains fair and sustainable.

Conclusion: A Comprehensive Guide to Pennsylvania Sales Tax

In this comprehensive guide, we’ve explored the intricacies of Pennsylvania’s sales tax system, from its rates and structure to its impact on businesses and consumers. Understanding these nuances is essential for anyone operating within the state’s economy.

As Pennsylvania continues to evolve and adapt to changing economic realities, staying informed about sales tax regulations and leveraging expert insights will be key to success. Whether you're a business owner, a consumer, or simply curious about the state's fiscal policies, this guide provides a solid foundation for navigating Pennsylvania's sales tax landscape.

How often do sales tax rates change in Pennsylvania?

+Sales tax rates in Pennsylvania can change periodically, typically as a result of legislative actions or local initiatives. It is important for businesses and consumers to stay updated on any changes, especially when operating in multiple locations.

Are there any sales tax holidays in Pennsylvania?

+Pennsylvania does not currently have sales tax holidays, which are temporary periods when certain items are exempt from sales tax. However, the state may consider implementing such holidays in the future to stimulate consumer spending.

How can businesses stay compliant with sales tax regulations in Pennsylvania?

+Businesses can ensure compliance by registering for a sales tax permit, accurately calculating and collecting sales tax on taxable items, maintaining proper records, and filing sales tax returns on time. Staying informed about changing regulations and utilizing tax management tools can also aid in compliance.