Virginia Income Tax Refund Status

Are you eager to know the status of your Virginia income tax refund? As a taxpayer, understanding the process and timeline for receiving your refund is crucial. This article aims to provide an in-depth guide, offering insights into how the Virginia tax refund system works and what you can expect at each stage. We'll cover everything from the initial filing to the various methods for checking the status of your refund, ensuring you have all the information you need to stay informed.

The Virginia Income Tax Refund Process: An Overview

The Virginia Department of Taxation handles income tax refunds for residents and non-residents who have overpaid their taxes. The process begins with the filing of your tax return, which can be done online or through traditional mail methods. Once your return is received and processed, the Department of Taxation will calculate your refund amount, if applicable.

The timeline for receiving your refund can vary based on several factors, including the method of filing, payment processing, and the accuracy of your tax return. On average, taxpayers can expect their refund within 4-6 weeks from the date of filing. However, this timeline can be impacted by various factors, which we will explore further.

Factors Affecting Refund Processing Time

Several factors can influence the processing time of your Virginia income tax refund. These include:

- Filing Method: Electronic filing, especially when coupled with direct deposit, tends to result in faster refund processing compared to traditional mail filing.

- Payment Processing: If you owe taxes and are making a payment with your return, the processing time may be extended as the Department of Taxation first processes the payment and then calculates your refund.

- Return Accuracy: Inaccurate or incomplete returns may require additional review, leading to delays in processing.

- Peak Tax Season: During the peak tax season (typically February to April), the Department of Taxation receives a high volume of returns, which can lead to longer processing times.

Understanding these factors can help you manage your expectations regarding the timeline for your refund.

Checking the Status of Your Virginia Income Tax Refund

There are several methods you can use to check the status of your Virginia income tax refund. The most common and convenient method is to use the Department of Taxation’s online refund status tool.

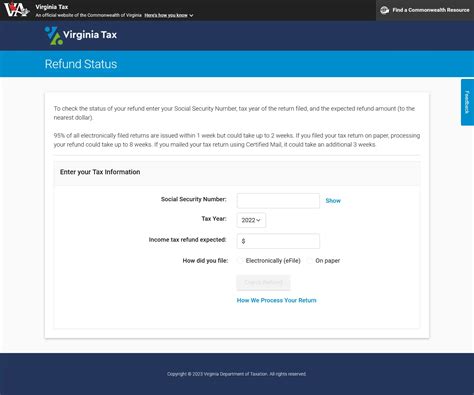

Online Refund Status Tool

The Department of Taxation provides an online tool that allows taxpayers to check the status of their refund. To use this tool, you’ll need to provide your Social Security Number or Individual Taxpayer Identification Number (ITIN), as well as the exact amount of your refund as stated on your return.

This tool will provide you with real-time information about the status of your refund, including whether it has been approved, processed, or is still pending.

Phone Inquiry

If you prefer to check your refund status over the phone, you can contact the Virginia Department of Taxation’s Refund Hotline. The hotline staff will be able to provide you with the same information as the online tool and can assist with any additional questions you may have.

Mail Inquiry

For those who prefer traditional methods, you can also check the status of your refund by mail. Simply send a written request to the Department of Taxation, including your name, address, Social Security Number or ITIN, and the exact amount of your refund. The Department will respond to your inquiry within 30 days.

Common Issues and Solutions

While the Virginia income tax refund process is generally straightforward, there may be instances where taxpayers encounter issues. Here are some common issues and their potential solutions:

Refund Delays

If your refund is taking longer than expected, there could be several reasons. First, check if you’ve provided the correct banking information for direct deposit. Incorrect or incomplete banking details can lead to delays or even errors in refund processing.

If your refund is still pending after several weeks, consider contacting the Department of Taxation. They can investigate the cause of the delay and provide you with an updated timeline for your refund.

Error Messages or Refunds Stopped

In some cases, you may encounter error messages when checking your refund status online, or you may receive a notice that your refund has been stopped. This could be due to several reasons, including:

- Missing or incorrect information on your tax return

- Discrepancies between your return and other tax documents

- Potential fraud or identity theft concerns

If you encounter such issues, it's crucial to contact the Department of Taxation immediately. They will guide you through the necessary steps to resolve the issue and ensure you receive your refund.

Amending Your Tax Return

If you discover an error on your tax return after it has been filed, you may need to amend your return. The process for amending a return can vary based on the nature of the error and the changes required. The Department of Taxation provides guidelines and forms for amending returns, which you can find on their website.

Staying Informed: A Year-Round Approach

While tax season is a critical time for understanding the status of your refund, staying informed year-round can help you manage your finances more effectively. Here are some tips to stay updated on your tax situation:

- Keep track of your tax documents and records. This will make it easier to file your taxes accurately and promptly.

- Consider using tax preparation software or hiring a professional tax preparer to ensure your return is filed correctly.

- Stay updated with the Virginia Department of Taxation's website and social media channels for any tax-related news or updates.

- Review your tax situation throughout the year, especially if you experience significant life changes (e.g., marriage, new job, etc.) that may impact your tax obligations.

Future Developments and Updates

The Virginia Department of Taxation continuously works to improve its services and systems. As a taxpayer, staying informed about these developments can help you navigate the tax landscape more effectively. Keep an eye out for announcements regarding new refund tracking tools, updated forms, and any changes to tax laws or regulations.

Conclusion

Understanding the Virginia income tax refund process and staying informed about your refund status is an essential part of being a responsible taxpayer. By utilizing the tools and resources provided by the Department of Taxation, you can efficiently track your refund and address any issues that may arise. Remember, timely and accurate filing, along with staying informed, can help ensure a smooth refund process.

How can I check the status of my Virginia income tax refund if I don’t have access to the internet or a phone?

+If you don’t have access to the internet or a phone, you can check the status of your Virginia income tax refund by sending a written request to the Virginia Department of Taxation. Include your name, address, Social Security Number or ITIN, and the exact amount of your refund. The Department will respond to your inquiry within 30 days.

What should I do if I haven’t received my refund after several weeks, and the online tool or hotline doesn’t provide any updates?

+If you haven’t received your refund and the online tool or hotline doesn’t provide any updates, it’s recommended to contact the Virginia Department of Taxation directly. They can investigate the status of your refund and provide you with an updated timeline or any necessary next steps.

Can I change my direct deposit information after filing my tax return?

+Changing your direct deposit information after filing your tax return can be a complex process. It’s best to contact the Virginia Department of Taxation to understand the steps involved and whether it’s still possible to make the change for the current refund.

How can I ensure my tax return is accurate to avoid delays or issues with my refund?

+To ensure your tax return is accurate, it’s recommended to use tax preparation software or hire a professional tax preparer. They can help you gather the necessary documents, calculate your deductions and credits correctly, and file your return accurately. This can help reduce the chances of errors and potential delays in processing your refund.