Low Income Housing Tax Credit Lihtc

The Low Income Housing Tax Credit (LIHTC), commonly known as the Housing Credit, is a powerful federal program in the United States that has been a cornerstone of affordable housing development for over three decades. Since its inception in 1986, the LIHTC program has played a vital role in creating and preserving millions of affordable housing units, addressing the critical need for decent and safe homes for low-income families, individuals, and vulnerable populations.

In this comprehensive guide, we will delve into the intricacies of the LIHTC program, exploring its history, mechanics, impact, and the vital role it plays in shaping the affordable housing landscape across the nation. By understanding the LIHTC, we can appreciate its significance and the transformative effect it has had on communities, while also identifying areas where further enhancements can be made to ensure an even brighter future for affordable housing.

The Evolution of LIHTC: A Historical Perspective

The roots of the Low Income Housing Tax Credit can be traced back to the late 1970s, a period marked by a severe affordable housing crisis in the United States. As the need for affordable housing grew, policymakers sought innovative solutions to address the widening gap between housing costs and the financial means of low-income households.

In 1986, the Tax Reform Act was passed, introducing the LIHTC program as a critical component of the nation's tax code. This landmark legislation aimed to stimulate private investment in affordable housing development by offering tax credits to incentivize the construction and rehabilitation of housing units for low-income individuals and families.

Since its inception, the LIHTC program has undergone various refinements and expansions. One of the most significant enhancements came with the passage of the Housing and Economic Recovery Act of 2008, which introduced the 4% credit rate and the 9% credit rate structure, providing developers with increased flexibility in designing affordable housing projects.

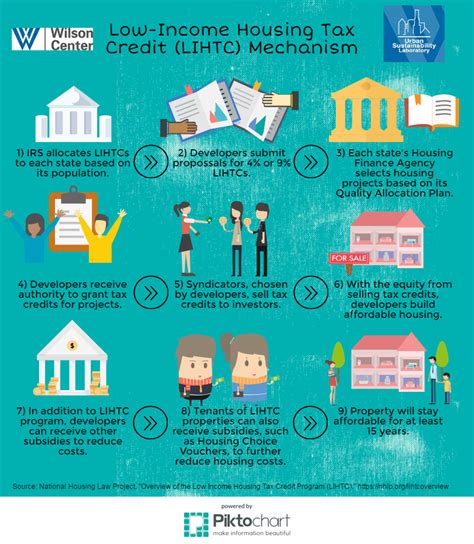

The Mechanics of LIHTC: How It Works

The LIHTC program operates through a complex yet effective mechanism, leveraging the power of the tax code to attract private investment into affordable housing. Here’s a simplified breakdown of how the program functions:

Allocating Tax Credits

The Internal Revenue Service (IRS) allocates a limited number of tax credits to each state annually, based on a formula that considers factors such as population and median income.

State Allocation Plans

States then develop allocation plans, determining how the credits will be distributed among qualified projects within their jurisdiction. State housing agencies typically oversee this process, ensuring a fair and transparent allocation system.

Qualifying for Tax Credits

Developers of affordable housing projects must meet specific criteria to qualify for tax credits. These criteria include compliance with income restrictions, rent limits, and a commitment to provide affordable housing for a minimum period, often 15 years or more.

Using Tax Credits

Once a project is approved and allocated tax credits, the developer can monetize these credits over a set period, typically 10 years. The tax credits can be sold or transferred to investors, who in turn receive tax benefits in exchange for their investment in affordable housing.

The Impact of LIHTC: Transforming Communities

The LIHTC program has had a profound impact on the affordable housing landscape, creating tangible benefits for low-income households and communities across the nation. Here are some key impacts of the program:

Creating Affordable Homes

Since its inception, the LIHTC program has financed the development and rehabilitation of over 3 million affordable housing units, providing homes to low-income families, seniors, and individuals with special needs. These units have become lifelines for those struggling to find affordable and safe housing options.

Stimulating Economic Growth

The LIHTC program has not only addressed the affordable housing crisis but has also been a catalyst for economic development. Each year, the program generates billions of dollars in economic activity, creating jobs and stimulating local economies. The construction and ongoing maintenance of affordable housing projects create employment opportunities and support local businesses.

Preserving Neighborhoods

In addition to creating new affordable housing, the LIHTC program has played a crucial role in preserving existing affordable housing stock. By incentivizing the rehabilitation of older properties, the program ensures that vulnerable communities can remain in their neighborhoods, maintaining social cohesion and preventing displacement.

Enhancing Quality of Life

Affordable housing developed through the LIHTC program often includes critical amenities and services, such as community centers, childcare facilities, and health clinics. These amenities not only enhance the quality of life for residents but also contribute to the overall well-being of the community.

The Future of LIHTC: Challenges and Opportunities

While the LIHTC program has been a remarkable success, it is not without its challenges. As the nation’s housing needs continue to evolve, the program must adapt to meet these changing demands. Here are some key considerations for the future of LIHTC:

Addressing the Growing Need

The affordable housing crisis persists, and the need for affordable units continues to outpace supply. The LIHTC program must explore ways to increase its impact, whether through expanded allocations or innovative financing mechanisms, to meet the growing demand.

Incorporating Green and Sustainable Practices

As the world embraces sustainable practices, the LIHTC program can play a pivotal role in promoting green and energy-efficient affordable housing. Incorporating sustainable design principles can not only reduce environmental impact but also lower operating costs for residents and property owners.

Promoting Equity and Inclusion

Ensuring that the benefits of the LIHTC program are equitably distributed is crucial. Developers and policymakers must prioritize projects that serve underserved communities and address historical disparities in access to affordable housing.

Adapting to Changing Demographics

The demographics of the United States are evolving, with an increasing number of households headed by single parents and a growing elderly population. The LIHTC program must adapt its strategies to meet the unique needs of these demographic shifts.

Leveraging Technology and Innovation

The affordable housing industry can benefit from technological advancements. From streamlined application processes to smart home technologies, innovation can enhance the efficiency and effectiveness of affordable housing development and management.

Conclusion: A Powerful Tool for Change

The Low Income Housing Tax Credit program has been a beacon of hope for millions of Americans seeking affordable housing. Its impact on communities is undeniable, and its potential for further transformation is immense. As we look to the future, it is essential to continue building upon the success of the LIHTC program, ensuring that it remains a vital tool in the pursuit of equitable and sustainable housing solutions.

By embracing innovation, promoting equity, and adapting to changing needs, the LIHTC program can continue to make a profound difference in the lives of low-income households, shaping a brighter and more inclusive future for communities across the nation.

How are LIHTC projects selected for funding?

+State housing agencies allocate LIHTC funds based on a competitive process, considering factors like community impact, developer experience, and compliance with income and rent restrictions.

What types of properties qualify for LIHTC funding?

+A wide range of properties, including new construction, substantial rehabilitation, and even historic preservation projects, can qualify for LIHTC funding, provided they meet the program’s criteria.

Can LIHTC benefits be combined with other housing programs?

+Yes, LIHTC projects often leverage multiple funding sources, including state and local programs, to maximize the impact of affordable housing development.

How long do LIHTC properties remain affordable?

+LIHTC properties are required to maintain affordability for a minimum of 15 years, with many projects opting for extended affordability periods of 30 years or more.