California Sales Tax 2025

As we look ahead to the year 2025, it's crucial to understand the landscape of sales tax regulations, especially in a dynamic state like California. With its diverse economy and a population known for its spending power, California's sales tax system plays a pivotal role in both state finances and business operations.

The Evolution of California Sales Tax

California’s sales and use tax is a combined state and local tax, making it one of the most complex tax systems in the United States. The state’s sales tax rate as of January 2024 stands at 7.25%, which is applied to the sale of tangible personal property and certain services. However, when we project into the future, specifically to the year 2025, we can anticipate some intriguing changes and challenges.

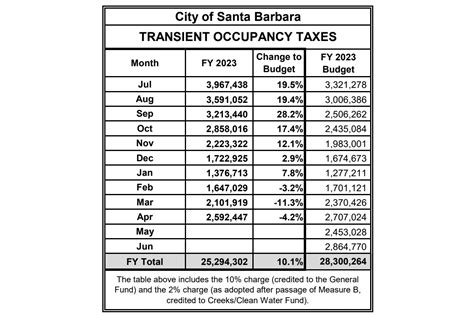

In recent years, California has witnessed a trend of increasing sales tax rates in various localities. For instance, in 2022, Los Angeles County implemented a temporary sales tax increase to fund critical public services, bringing the total sales tax rate in certain areas of the county to 10.25%. While this increase is set to expire in 2026, it highlights the dynamic nature of local sales tax rates.

Looking forward to 2025, we can expect to see a continued trend of localities exploring ways to increase revenue through sales tax measures. This could manifest as new tax initiatives, special assessments, or the extension of existing temporary tax increases. For businesses operating in California, staying abreast of these local variations in sales tax rates will be crucial to ensure compliance and effective tax planning.

Sales Tax Automation: A Necessity in 2025

The complexity of California’s sales tax system underscores the importance of tax automation. With varying rates across different localities, tax compliance can become a cumbersome task. Businesses operating in multiple jurisdictions within the state face the challenge of keeping up with these intricate tax regulations.

By 2025, we anticipate that sales tax automation will be an indispensable tool for businesses of all sizes. This technology streamlines the process of determining applicable tax rates, collecting sales tax, and filing tax returns. It ensures that businesses remain compliant, even as sales tax rates and regulations evolve.

Sales tax automation software provides businesses with the ability to automatically calculate and apply the correct sales tax rates based on the customer's shipping address, which is especially crucial for businesses with an online presence.

E-Commerce and Remote Sellers: Navigating the Landscape

The rise of e-commerce has brought about significant changes in the way sales tax is collected and remitted. With the growth of online sales, many businesses, particularly those classified as remote sellers, now have nexus in states where they have no physical presence. This has led to a surge in the number of businesses required to collect and remit sales tax in California.

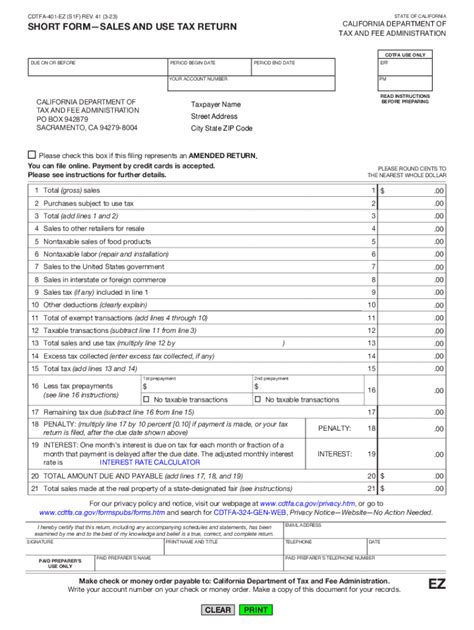

As we approach 2025, it's likely that California will continue to enforce economic nexus rules, requiring remote sellers to collect and remit sales tax based on their sales volume in the state. This means that businesses, even those located outside California, may need to register with the California Department of Tax and Fee Administration (CDTFA) and collect sales tax on transactions with California customers.

Navigating the intricacies of economic nexus can be challenging, but it's essential for remote sellers to understand their obligations. Failure to comply with these regulations can result in penalties and interest charges.

Sales Tax Audits: A Growing Concern

With the increasing complexity of sales tax regulations and the rise of e-commerce, sales tax audits have become a growing concern for businesses. California, like many other states, is ramping up its efforts to ensure tax compliance.

The CDTFA conducts sales tax audits to verify that businesses are accurately calculating, collecting, and remitting sales tax. These audits can be complex and time-consuming, often requiring businesses to provide extensive documentation and proof of compliance.

As we move into 2025, businesses should anticipate a heightened focus on sales tax audits. To mitigate the risk of audits and potential penalties, it's crucial for businesses to maintain meticulous records and ensure they have robust sales tax compliance systems in place.

California’s Sales Tax Future: Trends and Projections

Looking ahead, several trends and factors will shape the future of California’s sales tax landscape.

1. The Impact of Remote Work

The shift towards remote work, accelerated by the COVID-19 pandemic, has the potential to significantly impact sales tax collection. With employees working remotely, businesses may need to consider nexus based on the location of their remote employees. This could lead to increased sales tax obligations for businesses that were previously not required to collect sales tax in certain jurisdictions.

2. Online Sales Tax Fairness

The issue of online sales tax fairness is likely to remain a hot topic in 2025. As more and more transactions occur online, states are seeking to ensure that online sellers, particularly those with significant economic presence, contribute their fair share to state revenue. This may lead to further efforts to streamline sales tax collection and enforcement for online sellers.

3. Emerging Technologies and Tax Policy

The rapid advancement of technologies like blockchain and the Internet of Things (IoT) could have significant implications for sales tax. As these technologies become more integrated into our daily lives, policymakers will need to consider how they impact tax collection and compliance. This may lead to new regulations and policies to keep pace with technological advancements.

4. Simplification Efforts

While California’s sales tax system is known for its complexity, there have been efforts to streamline and simplify the process. These efforts may gain momentum in the coming years, with a focus on reducing the administrative burden on businesses and increasing compliance through simplified tax filing and collection processes.

Conclusion: Staying Ahead in a Dynamic Tax Landscape

As we project forward to 2025, it’s evident that California’s sales tax landscape will continue to evolve, presenting both challenges and opportunities for businesses. By staying informed about sales tax regulations, leveraging sales tax automation tools, and maintaining robust compliance practices, businesses can navigate this dynamic environment with confidence.

Whether it's understanding the nuances of local sales tax rates, adapting to changing economic nexus rules, or preparing for potential sales tax audits, a proactive approach to sales tax management is essential. By staying ahead of these trends and developments, businesses can ensure they remain compliant, minimize tax liabilities, and focus on their core operations.

What is the projected sales tax rate in California for 2025?

+While it’s difficult to predict the exact sales tax rate for 2025, we can anticipate that the state sales tax rate will remain at 7.25%. However, local sales tax rates may vary, and some localities may implement temporary or permanent tax increases. It’s crucial for businesses to stay updated on these local variations.

How can businesses prepare for potential sales tax audits in 2025?

+Businesses can prepare for sales tax audits by maintaining meticulous records, including sales invoices, customer shipping addresses, and sales tax calculations. It’s also beneficial to have a clear understanding of California’s sales tax regulations and to regularly review and update sales tax compliance processes.

What role will sales tax automation play in 2025 for businesses in California?

+Sales tax automation will be crucial in 2025 for businesses operating in California. With varying sales tax rates across different localities, automation tools can help businesses accurately calculate and apply the correct tax rates, ensuring compliance and reducing the risk of audits and penalties.