Seattle Income Tax Calculator

Welcome to our comprehensive guide on the Seattle Income Tax Calculator! As a resident or business owner in Seattle, understanding the city's income tax system is crucial for accurate financial planning and compliance. In this expert-level journal article, we will delve into the intricacies of Seattle's income tax structure, providing you with a thorough understanding of how to calculate your tax obligations and make informed financial decisions.

Understanding Seattle’s Income Tax System

Seattle, like many other cities, imposes a local income tax in addition to the state and federal income taxes. This local tax contributes to the city’s revenue and funds essential services and infrastructure. The Seattle income tax system is designed to ensure fairness and transparency, taking into account various factors such as income levels, deductions, and tax credits.

The city's income tax is administered by the Seattle Office of Finance and Administrative Services, which provides resources and guidance to help taxpayers navigate the process. Let's explore the key components of Seattle's income tax calculator and how it impacts individuals and businesses.

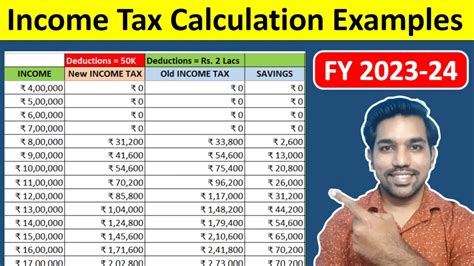

Income Tax Rates and Brackets

Seattle’s income tax is progressive, meaning that the tax rate increases as your income rises. The city utilizes a series of tax brackets to determine the applicable tax rate for different income levels. As of [current year], the income tax rates in Seattle are as follows:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $10,000 | 2.25% |

| $10,001 - $25,000 | 2.50% |

| $25,001 - $50,000 | 2.75% |

| $50,001 and above | 3.00% |

These tax brackets are subject to periodic adjustments to account for inflation and changes in the cost of living. It's important to refer to the official tax guidelines provided by the city for the most up-to-date information.

Taxable Income and Deductions

When calculating your taxable income in Seattle, certain deductions and exemptions can reduce the amount of income subject to taxation. These deductions are designed to provide relief to taxpayers and encourage specific behaviors, such as charitable contributions or retirement savings.

Here are some common deductions and exemptions available to Seattle taxpayers:

- Standard Deduction: Most taxpayers are eligible for a standard deduction, which reduces taxable income by a fixed amount. The standard deduction amount varies based on filing status and is adjusted annually.

- Itemized Deductions: Taxpayers can choose to itemize their deductions, listing specific expenses such as medical costs, charitable donations, and mortgage interest. Itemizing deductions may provide a larger reduction in taxable income for certain individuals.

- Retirement Plan Contributions: Contributions to qualified retirement plans, such as 401(k)s or IRAs, can be deducted from taxable income, encouraging individuals to save for their retirement.

- Education Expenses: Deductions or tax credits may be available for certain education-related expenses, including tuition and fees, to promote accessibility to higher education.

It's crucial to review the official guidelines and consult with a tax professional to determine which deductions and exemptions you may be eligible for.

Tax Credits and Incentives

Seattle offers various tax credits and incentives to support specific initiatives and promote economic development. These credits can significantly reduce the tax liability for eligible taxpayers.

Some notable tax credits and incentives in Seattle include:

- Research and Development Tax Credit: Businesses engaged in research and development activities may qualify for a tax credit, encouraging innovation and technological advancements.

- Energy Efficiency Tax Credit: Taxpayers who invest in energy-efficient improvements to their homes or businesses can benefit from this credit, promoting sustainability and reducing environmental impact.

- Low-Income Housing Tax Credit: Developers and investors who contribute to affordable housing initiatives can receive tax credits, supporting the city's efforts to address housing affordability issues.

- Workforce Training Tax Credit: Businesses that provide workforce training and development opportunities to their employees may be eligible for this credit, promoting skill enhancement and employee retention.

Stay informed about the available tax credits and incentives, as they can provide significant financial benefits and support your business or personal goals.

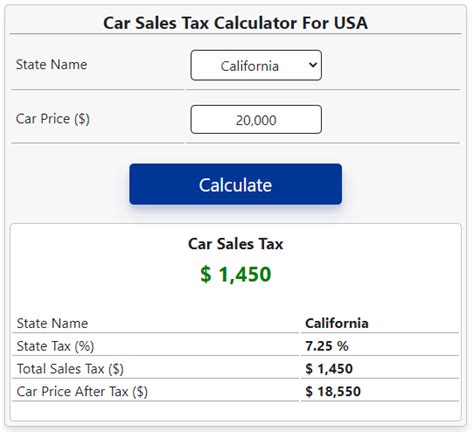

Calculating Your Seattle Income Tax

Now that we’ve covered the key components of Seattle’s income tax system, let’s walk through the process of calculating your income tax liability step by step.

Step 1: Determine Your Taxable Income

Start by calculating your total income from all sources, including wages, self-employment income, investments, and any other taxable income. Subtract any applicable deductions, such as the standard deduction or itemized deductions, to arrive at your taxable income.

Step 2: Apply the Tax Brackets

Using the income tax rates and brackets provided by the city, determine which tax bracket your taxable income falls into. Multiply the applicable tax rate by your taxable income to calculate the initial tax amount.

Step 3: Apply Tax Credits and Incentives

Evaluate your eligibility for any tax credits or incentives based on your specific circumstances. Subtract the value of the applicable tax credits from the initial tax amount calculated in Step 2 to arrive at your final income tax liability.

Step 4: Make Your Tax Payment

Once you have determined your income tax liability, ensure you make the payment by the due date to avoid penalties and interest. The city provides various payment options, including online payments, direct debit, and traditional mail-in payments.

Resources and Assistance

Navigating the income tax system can be complex, especially for those new to Seattle or unfamiliar with the city’s tax regulations. Fortunately, the Seattle Office of Finance and Administrative Services offers a range of resources and assistance to support taxpayers.

Here are some helpful resources to consider:

- Official Tax Guides: The city provides comprehensive tax guides and publications that explain the income tax system, deductions, and credits in detail. These guides are regularly updated and can be accessed online or at local tax offices.

- Tax Workshops and Seminars: The city organizes educational workshops and seminars throughout the year to help taxpayers understand their tax obligations. These events cover various topics, including income tax calculation, deductions, and filing requirements.

- Tax Assistance Programs: For those who need additional support, the city offers tax assistance programs, often in collaboration with community organizations. These programs provide free tax preparation services and guidance to eligible individuals and small businesses.

- Online Tax Calculators: To simplify the tax calculation process, the city provides online tax calculators and tools. These calculators allow you to input your income and deductions to estimate your tax liability accurately.

Utilizing these resources and seeking professional tax advice when needed can ensure a smooth and accurate tax filing process.

Future Implications and Updates

The Seattle income tax system is subject to ongoing review and potential changes to address evolving economic conditions and policy priorities. It’s essential to stay informed about any updates or proposed amendments to the tax code.

Key considerations for the future of Seattle's income tax include:

- Economic Growth and Development: As Seattle continues to experience economic growth and attract new businesses, the income tax system may be adjusted to support infrastructure development and address revenue needs.

- Equity and Social Justice: The city's commitment to equity and social justice may influence tax policy, with potential adjustments to ensure fairness and support vulnerable communities.

- Tax Reform Initiatives: There may be ongoing discussions and proposals for tax reform to simplify the tax code, improve efficiency, and provide additional relief to taxpayers.

- Inflation and Cost of Living: Tax brackets and rates may be adjusted periodically to account for inflation and ensure that taxpayers' purchasing power is protected.

Stay engaged with local news and official announcements to stay updated on any changes to the income tax system and their potential impact on your financial planning.

Conclusion

Understanding Seattle’s income tax calculator is a vital aspect of financial management for individuals and businesses in the city. By familiarizing yourself with the tax rates, brackets, deductions, and credits, you can make informed decisions and optimize your tax obligations.

Remember, the information provided in this article serves as a comprehensive guide, but it's always recommended to consult with tax professionals and refer to official sources for the most accurate and up-to-date tax information. Stay compliant, take advantage of available deductions and credits, and plan your finances effectively to make the most of your income in Seattle.

Can I claim deductions for charitable contributions in Seattle?

+Yes, Seattle allows taxpayers to claim deductions for charitable contributions made to qualified organizations. These deductions can reduce your taxable income, encouraging philanthropy and supporting community initiatives.

Are there any tax incentives for green energy initiatives in Seattle?

+Absolutely! Seattle offers tax incentives for homeowners and businesses that invest in energy-efficient upgrades and renewable energy systems. These incentives promote sustainability and reduce the tax burden for environmentally conscious initiatives.

What is the deadline for filing Seattle income taxes?

+The deadline for filing Seattle income taxes typically aligns with the federal and state tax filing deadlines. However, it’s crucial to check the official guidelines for any specific dates or extensions applicable to Seattle taxpayers.

Can I receive assistance with my tax calculations?

+Yes, the Seattle Office of Finance and Administrative Services provides various resources and assistance programs to help taxpayers with their tax calculations. You can access online tools, attend workshops, or seek support from community-based tax assistance programs.