Dallas Sales Tax Rate

The sales tax landscape in Dallas, Texas, is an intricate and essential aspect of doing business in the region. The sales tax is a crucial revenue source for the state and local governments, and it impacts the financial decisions of businesses and consumers alike. This article will delve into the specifics of the Dallas sales tax rate, exploring its history, current rates, and the factors that influence it. We'll also examine the implications for businesses and residents and offer expert insights on navigating this complex tax environment.

Understanding the Dallas Sales Tax Structure

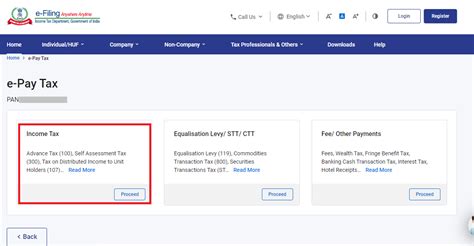

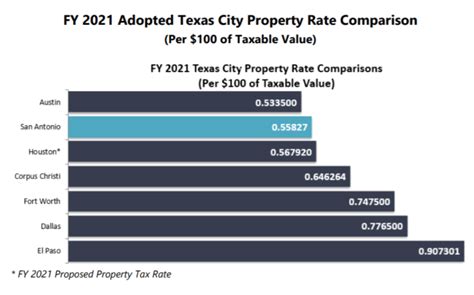

The sales tax in Dallas is a complex interplay of state, county, and municipal tax rates, each with its own rules and regulations. The Texas Comptroller of Public Accounts oversees the state’s sales and use tax, while local governments have the authority to impose additional sales taxes to fund specific projects or initiatives.

As of [current year], the sales tax in Dallas consists of several components. The state sales tax rate is [state tax rate]%, which applies uniformly across Texas. On top of this, Dallas County imposes a county sales tax of [county tax rate]%. The city of Dallas further adds its own municipal sales tax of [city tax rate]%, bringing the total sales tax rate in Dallas to approximately [total tax rate]%.

However, the sales tax rate isn't uniform across the entire city. Dallas is divided into various tax districts, each with its own unique tax rate. These districts are established based on geographical boundaries, and the additional sales tax rates within them are often used to fund specific local projects or initiatives. For instance, the Dallas Arts District, known for its cultural offerings, may have a slightly higher sales tax rate to support the arts scene.

| Tax Component | Tax Rate (%) |

|---|---|

| State Sales Tax | [state tax rate] |

| Dallas County Sales Tax | [county tax rate] |

| City of Dallas Sales Tax | [city tax rate] |

| Total Sales Tax in Dallas | [total tax rate] |

The Impact of Sales Tax on Businesses

For businesses operating in Dallas, understanding the sales tax landscape is crucial for effective financial planning and compliance. The sales tax rate directly affects the pricing strategies of businesses, as it impacts the final cost of goods and services for consumers. Companies must accurately calculate and collect sales tax, remit it to the appropriate authorities, and maintain detailed records to avoid penalties.

Businesses often utilize specialized software and tax consultants to ensure compliance with the complex sales tax regulations. They must also stay updated on any changes to the tax rates, as these can fluctuate based on political and economic factors. For instance, temporary increases in sales tax rates might be implemented to fund specific infrastructure projects or address budget shortfalls.

Sales Tax and Consumer Behavior

From a consumer perspective, the sales tax rate can significantly influence purchasing decisions. Higher sales tax rates can discourage impulse purchases and impact the affordability of goods and services, especially for lower-income households. Consumers may strategically plan their purchases to minimize the impact of sales tax, such as by timing their purchases to coincide with sales tax holidays or by shopping in neighboring counties with lower tax rates.

Retailers in Dallas often leverage sales tax rates as a competitive advantage, offering pricing strategies that account for the tax burden. For example, a retailer might advertise its prices as being "tax-included" to make its offerings appear more competitive. Alternatively, some businesses may absorb the sales tax to provide a more attractive price point, especially for high-value items.

Historical Perspective: Dallas Sales Tax Rate Evolution

The sales tax rate in Dallas has evolved significantly over the years, reflecting the changing economic landscape and the needs of local governments. Historically, the state sales tax rate has remained relatively stable, with occasional increases to address budget shortfalls or fund specific initiatives.

Dallas County and the city of Dallas have seen more frequent changes to their sales tax rates. These changes are often tied to specific projects or infrastructure developments. For instance, the construction of the Dallas Area Rapid Transit (DART) system was funded in part by a temporary increase in the sales tax rate. Similarly, investments in education, healthcare, and cultural initiatives have led to fluctuations in the local sales tax rates.

Recent Sales Tax Rate Adjustments

In recent years, Dallas has witnessed several notable adjustments to its sales tax rates. For instance, in [year], the city council approved an increase in the municipal sales tax rate to fund a multi-billion dollar infrastructure improvement plan. This plan included investments in roads, bridges, and public transportation, with the aim of improving the city’s overall livability and economic competitiveness.

Additionally, Dallas County has periodically adjusted its sales tax rate to support various initiatives. In [year], a temporary sales tax increase was implemented to fund the expansion of the Dallas County Hospital District, enhancing healthcare accessibility for residents. These adjustments demonstrate the dynamic nature of sales tax rates and their role in shaping the city's development.

Navigating the Dallas Sales Tax Environment

For businesses and consumers alike, navigating the Dallas sales tax environment requires a nuanced understanding of the local tax landscape. Here are some key considerations and strategies:

Compliance and Record-Keeping

Businesses must ensure they are compliant with all applicable sales tax regulations. This includes accurately calculating and collecting sales tax, as well as maintaining detailed records to substantiate their tax filings. Utilizing robust accounting software and seeking professional advice can help businesses stay on top of their tax obligations.

Strategic Pricing and Sales Tax

Businesses should carefully consider their pricing strategies in relation to the sales tax rate. Offering competitive pricing while accounting for the tax burden can be a delicate balance. Some companies choose to absorb the sales tax, while others pass it on to consumers. The choice depends on the business’s unique market position and customer base.

Sales Tax Exemptions and Incentives

Dallas, like many other cities, offers certain sales tax exemptions and incentives to attract and support specific industries. These incentives can provide significant cost savings for businesses, especially those in sectors such as manufacturing, technology, or renewable energy. Staying informed about these incentives and qualifying for them can be a strategic advantage for businesses.

Future Outlook: Sales Tax Projections

Looking ahead, the sales tax landscape in Dallas is likely to continue evolving. As the city grows and its economic needs change, we can expect further adjustments to the sales tax rates. These adjustments will be influenced by a range of factors, including economic conditions, infrastructure needs, and political decisions.

In the coming years, Dallas may see a continued focus on infrastructure development, with potential sales tax adjustments to fund these initiatives. Additionally, the city's ongoing efforts to attract and support innovative industries may lead to the introduction of targeted sales tax incentives. Businesses and consumers should stay informed about these developments to make informed financial decisions.

What is the difference between state, county, and city sales tax rates in Dallas?

+The state sales tax rate is set by the Texas government and applies uniformly across the state. County and city sales tax rates are additional taxes imposed by Dallas County and the city of Dallas respectively, to fund local initiatives and projects.

How often do sales tax rates change in Dallas?

+Sales tax rates in Dallas can change periodically, often tied to specific projects or economic needs. While the state sales tax rate is relatively stable, county and city sales tax rates may fluctuate more frequently.

Are there any sales tax holidays in Dallas?

+Yes, Dallas, like many other Texas cities, occasionally has sales tax holidays. These are specific periods when certain categories of goods, such as school supplies or energy-efficient appliances, are exempt from sales tax. These holidays are typically announced by the Texas Comptroller’s office and provide an opportunity for consumers to save on essential items.