Kansas Auto Sales Tax

The Kansas Auto Sales Tax is a crucial aspect of the state's revenue generation and economic policy. It plays a significant role in shaping the automotive industry and influencing consumer behavior within the state. This article aims to provide an in-depth analysis of the Kansas Auto Sales Tax, its impact, and its implications for various stakeholders.

Understanding the Kansas Auto Sales Tax

The Kansas Auto Sales Tax is a consumption tax levied on the purchase of motor vehicles, including cars, trucks, motorcycles, and recreational vehicles. It is a vital component of the state’s revenue stream, contributing significantly to the overall tax revenue collected by the state government. The tax is imposed on both new and used vehicle sales, making it a comprehensive approach to generating funds for various public services and infrastructure development.

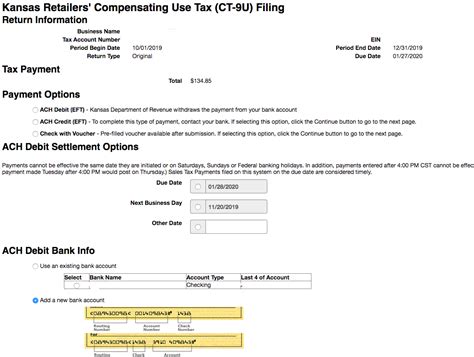

The Kansas Department of Revenue is responsible for administering and collecting the auto sales tax. This department ensures compliance with tax laws, provides guidance to taxpayers, and enforces regulations to maintain a fair and efficient tax system. The tax rate and its application are subject to change based on legislative decisions and economic considerations.

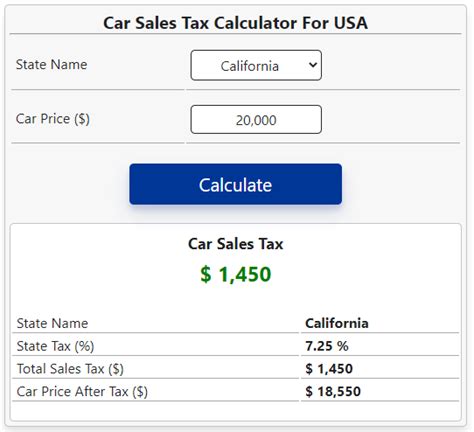

As of my last update in January 2023, the Kansas Auto Sales Tax rate stood at 6.5%, which is applicable to the purchase price of the vehicle. This rate is competitive compared to many other states in the region, making Kansas an attractive destination for vehicle purchases from both a consumer and business perspective.

How the Auto Sales Tax Works

The Kansas Auto Sales Tax is calculated based on the purchase price of the vehicle. This includes the base price, any additional options or accessories, and applicable sales tax. The tax is collected by the vehicle dealer at the time of purchase and is then remitted to the Kansas Department of Revenue.

For example, if a consumer purchases a new car with a base price of $30,000 and adds $2,000 worth of options, the total purchase price would be $32,000. The auto sales tax on this transaction would be calculated as follows:

| Purchase Price | Auto Sales Tax Rate | Tax Amount |

|---|---|---|

| $32,000 | 6.5% | $2,080 |

So, in this case, the consumer would pay a total of $2,080 in auto sales tax on top of the vehicle's purchase price.

Exemptions and Special Cases

While the Kansas Auto Sales Tax is applicable to most vehicle purchases, there are certain exemptions and special cases to consider. These include:

- Vehicles purchased for resale: Dealers purchasing vehicles for resale purposes are typically exempt from paying the auto sales tax at the time of purchase. However, they must pay the tax when the vehicle is sold to the end consumer.

- Trade-ins: When trading in an old vehicle as part of the purchase of a new one, the trade-in value is deducted from the purchase price of the new vehicle. The auto sales tax is then calculated based on the net purchase price, excluding the trade-in value.

- Leased vehicles: The auto sales tax is not applicable to leased vehicles as the ownership is retained by the leasing company. However, there may be other taxes or fees associated with leasing, such as a lease acquisition tax or a registration fee.

- Military personnel: Active-duty military personnel stationed in Kansas may be eligible for tax exemptions or reductions on vehicle purchases. These exemptions are subject to specific criteria and documentation requirements.

Impact on the Automotive Industry

The Kansas Auto Sales Tax has a significant impact on the automotive industry within the state. It influences the pricing strategies of dealerships, affects consumer demand, and shapes the overall market dynamics.

Dealer Operations and Pricing

Auto dealerships in Kansas play a crucial role in the state’s economy. They employ a significant number of individuals, contribute to local communities, and drive economic growth. The auto sales tax directly affects their operations and pricing strategies.

Dealers must factor in the auto sales tax when setting vehicle prices. They aim to offer competitive pricing while maintaining profitability. The tax rate influences the dealership's gross profit margin and its ability to offer discounts or incentives to customers. Additionally, dealers must ensure compliance with tax regulations to avoid penalties and maintain their reputation.

To illustrate, let's consider a hypothetical scenario. A dealership in Kansas has a popular sedan model with a base price of $25,000. With the 6.5% auto sales tax, the total purchase price would be $26,750. The dealership may choose to offer various incentives, such as cash rebates or special financing options, to make the vehicle more affordable for customers. These incentives can help stimulate sales and maintain market competitiveness.

Consumer Behavior and Demand

The auto sales tax also has a direct impact on consumer behavior and demand for vehicles in Kansas. The tax rate can influence a consumer’s decision to purchase a vehicle, the timing of their purchase, and their preferred vehicle type.

A higher tax rate may discourage consumers from making immediate vehicle purchases, especially if they perceive the tax as an additional financial burden. Conversely, a lower tax rate or tax incentives can stimulate demand and encourage consumers to consider purchasing new vehicles. This is particularly relevant during economic downturns or when consumers are price-sensitive.

Furthermore, the auto sales tax can impact the choice of vehicle type. Consumers may opt for more affordable options, such as used vehicles or smaller, fuel-efficient models, to mitigate the impact of the tax. Alternatively, they may choose to delay their purchase until a more favorable tax rate is in effect or until they can take advantage of tax incentives or promotions.

Economic Implications and Revenue Generation

The Kansas Auto Sales Tax has far-reaching economic implications and plays a vital role in revenue generation for the state. It contributes to the overall economic health and development of the region.

Revenue for Public Services

The auto sales tax is a significant source of revenue for the state government. The funds generated are allocated towards various public services and infrastructure projects. These include education, healthcare, public safety, transportation, and other essential areas that benefit the citizens of Kansas.

By collecting auto sales tax, the state can invest in critical infrastructure development, such as road maintenance, bridge repairs, and the expansion of public transportation systems. These investments not only improve the quality of life for residents but also enhance the state's overall economic competitiveness and attractiveness to businesses.

Economic Growth and Employment

The automotive industry is a key driver of economic growth in Kansas. The auto sales tax supports this industry by providing a stable revenue stream for the state. The funds generated contribute to the industry’s growth, enabling dealerships and related businesses to expand, invest in new technologies, and create job opportunities.

Additionally, the auto sales tax indirectly supports other sectors of the economy. For instance, the demand for vehicles stimulates the manufacturing and supply chain industries, leading to increased production and employment in these sectors. The automotive industry's economic impact extends beyond dealerships, impacting various support industries and contributing to the overall economic vitality of the state.

Frequently Asked Questions

What is the current auto sales tax rate in Kansas?

+

As of my last update, the auto sales tax rate in Kansas is 6.5%.

Are there any exemptions or special cases for the auto sales tax?

+

Yes, there are certain exemptions and special cases. These include vehicles purchased for resale, trade-ins, leased vehicles, and military personnel who may be eligible for tax exemptions or reductions.

How does the auto sales tax affect dealerships’ pricing strategies?

+

The auto sales tax influences dealerships’ gross profit margins and their ability to offer discounts or incentives. Dealers must consider the tax rate when setting vehicle prices to maintain competitiveness and profitability.

What impact does the auto sales tax have on consumer behavior and demand for vehicles in Kansas?

+

The tax rate can influence consumers’ purchase decisions, timing, and vehicle preferences. A higher tax rate may discourage immediate purchases, while a lower rate or tax incentives can stimulate demand.

How does the auto sales tax contribute to the state’s economic development and revenue generation?

+

The auto sales tax generates revenue for public services, infrastructure projects, and economic growth. It supports the automotive industry, creates job opportunities, and stimulates other sectors of the economy.