Property Tax Statement

The Property Tax Statement, a document that homeowners and property owners eagerly anticipate and often scrutinize, is a vital component of the real estate landscape. It provides an in-depth breakdown of the financial obligations tied to property ownership, shedding light on the intricate relationship between real estate and taxation. This article aims to delve into the complexities of the Property Tax Statement, exploring its various facets, and offering a comprehensive understanding of its role in the property ecosystem.

Understanding the Property Tax Statement: A Comprehensive Guide

The Property Tax Statement is an annual statement issued by local governments or tax authorities to property owners, detailing the assessed value of their property and the corresponding tax liability. It serves as a crucial communication tool, providing transparency and accountability in the property tax system. This guide aims to demystify the statement, breaking down its components and offering insights into its significance.

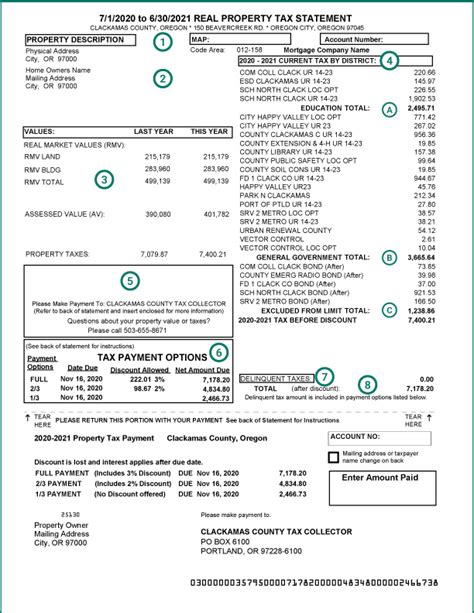

The Anatomy of a Property Tax Statement

A typical Property Tax Statement contains several key sections, each providing specific information crucial to property owners. These sections include:

- Property Information: This section provides details about the property, including its address, legal description, and unique identification number. It also specifies the type of property, such as residential, commercial, or agricultural.

- Assessment Details: Here, the assessed value of the property is outlined. This value is determined by the local tax assessor, taking into account various factors such as location, size, improvements, and market conditions. The assessment value forms the basis for calculating the property tax.

- Tax Rates and Calculations: This section breaks down the tax rates applicable to the property. It includes information on the various tax rates imposed by different taxing authorities, such as the city, county, school district, and special districts. The statement also details the calculation method used to determine the total tax liability.

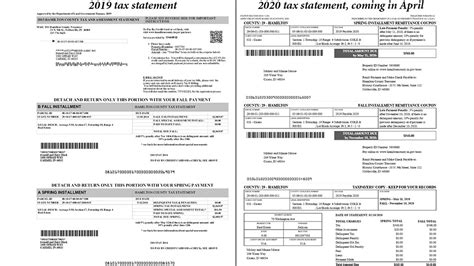

- Payment Information: Property owners will find crucial details about their tax payments in this section. It specifies the due dates for tax installments, late payment penalties, and any discounts or penalties for early payment. Additionally, it may provide information on payment methods and options available to property owners.

- Exemptions and Credits: Many jurisdictions offer property tax exemptions or credits to eligible property owners. This section details any applicable exemptions or credits, such as homestead exemptions, senior citizen discounts, or veterans' benefits. It provides information on the criteria for eligibility and the impact of these exemptions on the tax liability.

- Appeal Process: If a property owner disagrees with the assessed value or other aspects of the Property Tax Statement, this section outlines the appeal process. It provides information on the timeline, procedures, and requirements for filing an appeal. It may also include contact details for the relevant tax authority or assessment board.

| Section | Description |

|---|---|

| Property Information | Details about the property's address, type, and unique identification. |

| Assessment Details | Assessed value of the property and its determination. |

| Tax Rates and Calculations | Applicable tax rates and the calculation methodology. |

| Payment Information | Due dates, payment methods, and late payment penalties. |

| Exemptions and Credits | Information on applicable exemptions and credits, and their impact. |

| Appeal Process | Procedures and requirements for appealing the assessment. |

The Role of Property Tax Statements in the Real Estate Market

Property Tax Statements play a pivotal role in the real estate market, influencing property values, investor decisions, and the overall economic landscape of a region. Here’s how these statements impact the market:

Impact on Property Values

The assessed value on a Property Tax Statement is a key indicator of a property’s worth in the eyes of the tax authority. This value, when compared to recent sales prices of similar properties, can provide insights into the accuracy of the assessment. If the assessed value is significantly lower than market value, it may indicate an opportunity for property owners to appeal their assessment and potentially reduce their tax liability. Conversely, if the assessed value is higher, it could impact the property’s marketability and its appeal to potential buyers.

Influencing Investor Decisions

Investors in the real estate market pay close attention to Property Tax Statements when evaluating potential investment properties. High property taxes can significantly impact an investor’s cash flow and overall return on investment. Therefore, understanding the tax obligations associated with a property is crucial for investors to make informed decisions. Property Tax Statements provide transparency into these obligations, helping investors assess the financial viability of their investments.

Economic Impact on Communities

Property taxes are a significant source of revenue for local governments and taxing authorities. The revenue generated from these taxes funds essential services such as education, infrastructure development, and public safety. Therefore, Property Tax Statements play a critical role in ensuring the financial stability and sustainability of local communities. However, it’s important to strike a balance between generating revenue and maintaining affordable tax rates to support economic growth and development.

The Future of Property Tax Statements: Technology and Transparency

The world of property taxation is evolving, and technology is playing a pivotal role in enhancing transparency and efficiency. Here’s a glimpse into the future of Property Tax Statements:

Digital Transformation

Many tax authorities are embracing digital technologies to streamline the issuance and management of Property Tax Statements. Online platforms and mobile apps are being utilized to provide property owners with convenient access to their statements, allowing them to view and download their documents anytime, anywhere. These digital platforms also offer features such as secure payment gateways, real-time updates on tax balances, and interactive tools for appealing assessments.

Data Analytics and Predictive Modeling

Advanced data analytics and predictive modeling techniques are being leveraged to enhance the accuracy of property assessments. By analyzing vast datasets and historical trends, tax authorities can make more informed decisions about property values. This not only improves the fairness of the tax system but also reduces the need for frequent reassessments, providing stability for property owners.

Enhanced Communication Channels

The future of Property Tax Statements lies in establishing effective communication channels between tax authorities and property owners. This includes implementing robust customer service platforms, offering multilingual support, and providing clear and concise explanations of tax obligations. By fostering open communication, tax authorities can build trust and ensure that property owners understand their rights and responsibilities.

FAQs

How often are Property Tax Statements issued?

+Property Tax Statements are typically issued on an annual basis. However, the frequency can vary depending on the jurisdiction. Some areas may issue statements semi-annually or even quarterly. It’s important to check with your local tax authority for the specific schedule in your area.

Can I appeal my property’s assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeal process varies by jurisdiction, but generally involves submitting documentation and evidence to support your claim. It’s advisable to consult with a tax professional or attorney for guidance on the appeal process.

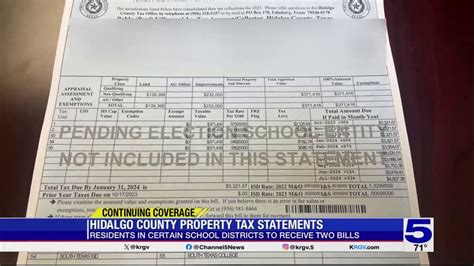

What happens if I don’t pay my property taxes on time?

+Late payment of property taxes can result in penalties and interest charges. In some cases, failure to pay taxes may lead to tax liens being placed on the property, which can impact its ownership and transfer. It’s crucial to stay informed about due dates and make timely payments to avoid these consequences.

Are there any exemptions or credits available for property owners?

+Yes, many jurisdictions offer exemptions and credits to certain property owners. These can include homestead exemptions for primary residences, senior citizen discounts, veterans’ benefits, and exemptions for historic properties. It’s essential to research and understand the specific exemptions available in your area to take advantage of any potential savings.

How can I stay informed about changes to my property tax obligations?

+Staying informed about changes to your property tax obligations is crucial. You can achieve this by subscribing to updates from your local tax authority or signing up for their newsletters. Additionally, regularly reviewing your Property Tax Statement and keeping an eye on local news and announcements can help you stay aware of any changes that may impact your tax liability.

The Property Tax Statement is a complex yet essential document in the realm of property ownership. By understanding its components, impact, and future trajectory, property owners can navigate the world of property taxation with confidence. As technology continues to advance, the future of Property Tax Statements promises increased transparency, efficiency, and accessibility, empowering property owners to make informed decisions and actively participate in the real estate market.