Free Usa Tax Coupon Code

Welcome to our comprehensive guide on understanding and maximizing the benefits of the Free USA Tax Coupon Code, a unique initiative aimed at simplifying the tax process for individuals and businesses alike. In this expert-led article, we delve into the intricacies of this coupon code system, exploring its origins, functionalities, and the myriad advantages it offers. By the end of this article, you'll have a clear understanding of how to utilize this innovative tool to streamline your tax obligations and potentially save significant sums.

Unraveling the Free USA Tax Coupon Code

The Free USA Tax Coupon Code is an innovative digital solution designed to revolutionize the way taxpayers engage with their annual tax obligations. This cutting-edge system, introduced by the Internal Revenue Service (IRS) in collaboration with leading tech firms, seeks to make tax compliance more accessible, efficient, and cost-effective for all American taxpayers.

At its core, the coupon code system is a sophisticated yet user-friendly platform that assigns unique codes to each taxpayer. These codes serve as digital keys, unlocking a range of benefits and simplifying the often-daunting task of filing taxes. By integrating advanced cryptographic algorithms and secure digital infrastructure, the IRS has created a system that not only enhances security but also offers a seamless experience for users.

Origins and Purpose

The concept of the Free USA Tax Coupon Code emerged from the IRS's vision to modernize its tax processes, keeping pace with the digital era. Recognizing the potential of technology to enhance taxpayer services, the IRS embarked on a mission to develop a system that would reduce the complexities often associated with tax filing, especially for those who might lack access to traditional tax preparation methods.

The primary objective of this initiative is to democratize tax compliance, ensuring that every American, regardless of their financial or technological literacy, can efficiently navigate their tax obligations. By providing a simple, secure, and cost-effective solution, the IRS aims to foster a culture of informed and responsible taxpaying, ultimately strengthening the nation's financial foundation.

How it Works

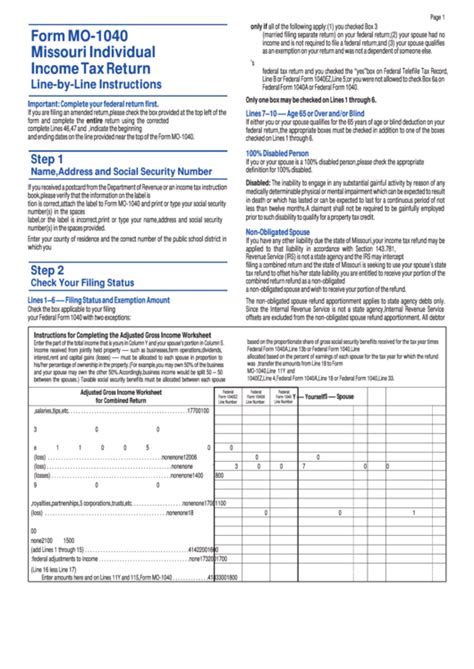

The Free USA Tax Coupon Code system operates on a straightforward yet robust framework. Here's a step-by-step breakdown of the process:

- Registration: Taxpayers initiate the process by registering on the official IRS website. This involves providing essential personal and financial details, which are securely encrypted and stored.

- Code Generation: Upon successful registration, the system generates a unique coupon code for each taxpayer. This code is a combination of alphanumeric characters, ensuring its exclusivity and security.

- Code Activation: Taxpayers receive their coupon codes via email or text message. They can then activate the code by logging into their IRS account or by using the IRS mobile app, which is available for both iOS and Android devices.

- Tax Filing: With the code activated, taxpayers can begin the process of filing their taxes. The coupon code serves as a digital signature, verifying their identity and granting access to a range of tax preparation tools and resources.

- Benefits and Discounts: One of the key advantages of the coupon code system is the access it provides to discounted or even free tax preparation services. The IRS has partnered with leading tax software providers, offering significant discounts on their premium features, such as advanced tax planning tools and expert support.

Advantages of the Free USA Tax Coupon Code

The Free USA Tax Coupon Code system presents a myriad of advantages for taxpayers, revolutionizing the traditional tax filing process. Let's explore some of the key benefits that make this initiative a game-changer in the world of tax compliance.

Simplified Tax Filing

One of the most significant advantages of the Free USA Tax Coupon Code system is its ability to simplify the tax filing process. By assigning a unique coupon code to each taxpayer, the IRS has created a streamlined approach that eliminates the need for complex passwords or multiple authentication steps. Taxpayers can now access their tax information and file their returns with just a few clicks, making the entire process more efficient and user-friendly.

Moreover, the system's integration with advanced tax preparation software means that taxpayers can enjoy a seamless experience, with their tax data automatically populated and organized. This reduces the risk of errors and saves valuable time, allowing taxpayers to focus on understanding their financial situation rather than navigating complex forms.

Enhanced Security

In an era where data security is of paramount importance, the Free USA Tax Coupon Code system prioritizes the protection of taxpayers' sensitive information. By utilizing robust encryption protocols and secure digital infrastructure, the IRS ensures that taxpayer data remains safe and inaccessible to unauthorized individuals.

The coupon code itself acts as a powerful security measure. Unlike traditional passwords, which can be vulnerable to hacking or brute-force attacks, the coupon code's unique combination of characters makes it virtually impossible to guess or replicate. This added layer of security gives taxpayers peace of mind, knowing that their financial information is well-guarded.

Cost Savings

One of the most appealing aspects of the Free USA Tax Coupon Code system is its potential to save taxpayers significant sums of money. By partnering with leading tax software providers, the IRS has negotiated substantial discounts on premium tax preparation services. These discounts can range from 50% to even 100% off, making high-quality tax filing accessible to a wider audience.

Additionally, the system's efficiency and streamlined process reduce the need for costly professional assistance. Taxpayers can confidently navigate their tax obligations independently, eliminating the fees associated with hiring tax professionals or using traditional tax preparation services. This cost-effective approach ensures that more Americans can allocate their resources towards other financial goals, such as savings or investments.

Increased Accessibility

The Free USA Tax Coupon Code initiative is a significant step towards making tax compliance more accessible to all Americans. By offering a simple, digital solution, the IRS has eliminated many of the barriers that previously hindered individuals from effectively managing their tax responsibilities.

The system's compatibility with a wide range of devices, including smartphones and tablets, means that taxpayers can access their tax information and file their returns from the comfort of their homes or even on the go. This flexibility is particularly beneficial for individuals with busy schedules or those who reside in remote areas, where access to traditional tax preparation services might be limited.

Furthermore, the coupon code system's user-friendly interface and clear guidance make it accessible to individuals with varying levels of digital literacy. Taxpayers can navigate the process with ease, ensuring that everyone, regardless of their technical expertise, can participate in the tax filing process confidently and securely.

Expert Support and Resources

The Free USA Tax Coupon Code system doesn't just provide taxpayers with a simplified filing process; it also grants access to a wealth of expert support and resources. Through its partnerships with leading tax software providers, the IRS ensures that taxpayers have access to a range of tools and services designed to enhance their tax planning and compliance.

These resources include advanced tax planning calculators, which help taxpayers optimize their deductions and credits, as well as expert guidance on complex tax situations. Taxpayers can also avail themselves of real-time support, with tax professionals available to answer questions and provide personalized advice. This level of support is particularly valuable for individuals with unique tax situations or those who require additional assistance in understanding the intricacies of the tax code.

| Benefit | Description |

|---|---|

| Simplified Filing | Unique coupon codes streamline the tax filing process, making it efficient and user-friendly. |

| Enhanced Security | Robust encryption and secure infrastructure protect taxpayer data, ensuring peace of mind. |

| Cost Savings | Significant discounts on premium tax preparation services save taxpayers substantial sums. |

| Increased Accessibility | A digital, user-friendly system makes tax compliance accessible to all, regardless of location or technical expertise. |

| Expert Support | Partnerships with tax software providers offer advanced tools, resources, and personalized guidance. |

Maximizing the Benefits: A Step-by-Step Guide

Now that we've explored the advantages of the Free USA Tax Coupon Code system, let's delve into a practical guide on how to make the most of this innovative tool. By following these steps, you can ensure that you fully leverage the benefits it offers, streamlining your tax obligations and potentially saving valuable time and money.

Step 1: Register and Obtain Your Coupon Code

The first step in harnessing the power of the Free USA Tax Coupon Code system is to register on the official IRS website. This process is straightforward and can be completed in a matter of minutes. You'll need to provide basic personal and financial information, such as your name, address, and Social Security Number.

Once your registration is complete, the system will generate a unique coupon code for you. This code is typically a combination of letters and numbers, ensuring its exclusivity. You'll receive your coupon code via email or text message, depending on your preference. Make sure to keep this code secure and confidential, as it serves as your digital key to accessing the system's benefits.

Step 2: Activate Your Coupon Code

With your coupon code in hand, it's time to activate it. This process is designed to be simple and user-friendly. You can activate your code by logging into your IRS account or by using the official IRS mobile app, which is available for both iOS and Android devices.

Upon activation, your coupon code will be linked to your IRS account, granting you access to a range of tax preparation tools and resources. You can now begin the process of filing your taxes, confident in the knowledge that your identity is securely verified and your tax information is safely stored.

Step 3: Explore Tax Preparation Tools

One of the key advantages of the Free USA Tax Coupon Code system is the access it provides to advanced tax preparation tools. These tools, offered by leading tax software providers, are designed to simplify the tax filing process and optimize your tax return.

Explore the various features and functionalities available to you. These may include intuitive tax form completion guides, advanced tax planning calculators, and even real-time tax projection tools. By utilizing these resources, you can gain a deeper understanding of your financial situation and make informed decisions regarding your tax obligations.

Step 4: Access Discounted Services

A significant benefit of the Free USA Tax Coupon Code system is the access it grants to discounted tax preparation services. Through its partnerships with leading tax software providers, the IRS has negotiated substantial discounts on premium features, making high-quality tax filing accessible to all.

Take advantage of these discounts by exploring the range of services offered. You might find discounted rates for advanced tax planning tools, such as deduction and credit optimization calculators, or even expert support services, where tax professionals are available to answer your questions and provide personalized guidance. These discounted services can save you significant sums and ensure that your tax obligations are met with precision and confidence.

Step 5: File Your Taxes with Confidence

With your coupon code activated and access to a range of tools and resources, it's time to file your taxes. The Free USA Tax Coupon Code system makes this process straightforward and secure. You can rest assured that your tax information is protected by robust encryption protocols and that your identity is verified, ensuring a seamless and efficient filing experience.

As you navigate the tax filing process, utilize the resources and support available to you. If you encounter any challenges or have questions, don't hesitate to reach out to the expert support team. They are there to guide you through the process, providing clarity and assistance as needed. With the system's simplicity and the support of tax professionals, filing your taxes becomes a stress-free endeavor, allowing you to focus on your financial goals and aspirations.

Future Implications and Potential Innovations

As the Free USA Tax Coupon Code system continues to evolve and gain traction among taxpayers, it opens up exciting possibilities for future enhancements and innovations. The IRS, in collaboration with industry leaders, is committed to staying at the forefront of technological advancements, ensuring that the tax filing process remains accessible, efficient, and secure for all Americans.

Enhanced Data Analytics

One area of focus for future developments is the integration of advanced data analytics. By leveraging machine learning algorithms and predictive modeling, the IRS can gain deeper insights into taxpayer behavior and preferences. This data-driven approach can lead to more personalized tax services, with the system offering tailored recommendations and guidance based on individual financial circumstances.

Artificial Intelligence (AI) Integration

Artificial Intelligence (AI) has the potential to revolutionize the tax filing process even further. The IRS is exploring ways to integrate AI technologies, such as natural language processing and intelligent automation, to enhance the accuracy and efficiency of tax compliance. AI-powered systems could analyze tax forms, identify potential errors or discrepancies, and even provide real-time feedback and suggestions, ensuring a more precise and streamlined filing experience.

Blockchain Technology

Blockchain, the technology that underpins cryptocurrencies like Bitcoin, offers a secure and transparent way of storing and verifying data. The IRS is considering the implementation of blockchain technology to enhance the security and integrity of taxpayer data. By utilizing blockchain's decentralized nature, the IRS can ensure that tax information remains tamper-proof and accessible only to authorized individuals, further bolstering the system's security.

Mobile App Innovations

The official IRS mobile app has already proven to be a valuable tool for taxpayers, providing convenient access to tax information and services. Future iterations of the app are expected to offer enhanced features, such as real-time tax calculation tools, personalized tax planning guides, and even interactive tutorials, making tax compliance even more accessible and user-friendly.

Partnerships and Collaborations

The success of the Free USA Tax Coupon Code system is built upon strong partnerships with leading tech firms and tax software providers. The IRS is committed to fostering these collaborations, seeking innovative solutions that benefit taxpayers. By working closely with industry experts, the IRS can stay abreast of emerging technologies and trends, ensuring that the tax filing process remains at the cutting edge of digital innovation.

Educational Initiatives

Beyond technological advancements, the IRS recognizes the importance of taxpayer education. Future initiatives may focus on developing comprehensive educational resources, such as online courses, webinars, and interactive tutorials, aimed at empowering taxpayers with the knowledge and skills needed to navigate the tax landscape confidently. These educational efforts will ensure that taxpayers are not only compliant but also well-informed, fostering a culture of financial literacy and responsibility.

How often can I use the Free USA Tax Coupon Code?

+The Free USA Tax Coupon Code is designed for annual tax filing, and you can use it once per tax year. However, the IRS may offer special promotions or limited-time discounts, so it’s worth checking their website for any additional opportunities.

Are there any income or tax status requirements to use the coupon code?

+The Free USA Tax Coupon Code is available to all American taxpayers, regardless of their income level or tax status. Whether you’re a student, a retiree, or a business owner, you can benefit from the system’s advantages.

Can I share my coupon code with family or friends?

+Each coupon code is unique and specific to an individual taxpayer. It’s not intended for sharing, as it serves as a secure identifier. However, you can encourage your family and friends to register for their own coupon codes to access the system’s benefits.

What if I encounter technical issues with the system?

+The IRS has a dedicated