Tax Incidence And Tax Burden

The Complex Dynamics of Tax Incidence and Tax Burden: Unraveling the Impact on Society

The concepts of tax incidence and tax burden are fundamental to understanding the economic landscape and its impact on individuals, businesses, and the overall societal structure. In this comprehensive analysis, we delve into the intricacies of these concepts, exploring how taxes are allocated, who ultimately bears the burden, and the broader implications for economic policy and social welfare.

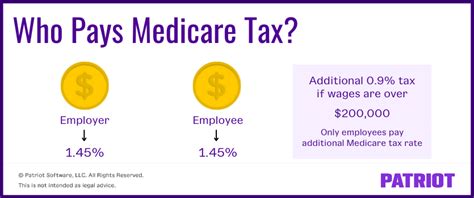

Tax incidence refers to the distribution of the economic burden of a tax among different entities, primarily between producers and consumers. It is a critical aspect of taxation, as it determines who pays what share of a tax and how it affects the equilibrium price and quantity in a market. The tax burden, on the other hand, encompasses the overall impact of taxation on an individual, business, or the economy as a whole, considering not only the direct costs but also the indirect effects on income, incentives, and resource allocation.

Understanding Tax Incidence: A Theoretical Perspective

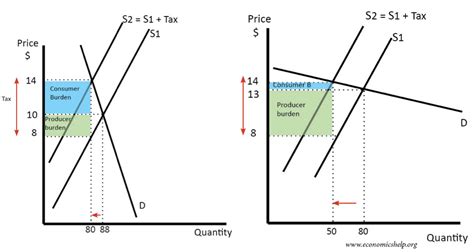

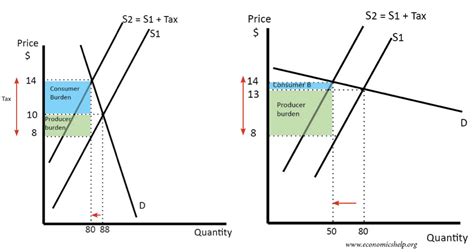

The theory of tax incidence provides a framework for analyzing how the economic burden of a tax is distributed. It considers the elasticity of supply and demand, which refers to the responsiveness of quantity supplied or demanded to changes in price. When a tax is imposed, it creates a wedge between the price paid by the buyer and the price received by the seller, leading to a shift in the equilibrium price and quantity.

The distribution of the tax burden depends on the relative elasticity of supply and demand. If demand is more elastic than supply, consumers bear a larger share of the tax burden, while producers bear a smaller share. Conversely, if supply is more elastic than demand, producers bear a larger share of the tax burden. In cases where both supply and demand are equally elastic, the tax burden is evenly distributed between producers and consumers.

Furthermore, the tax incidence can vary depending on the type of tax. For instance, in the case of a sales tax, which is typically imposed on goods and services, the incidence is often borne by the final consumer. On the other hand, a production tax, such as a tax on manufacturing, may be passed on to consumers through higher prices or absorbed by producers, leading to a reduction in profits.

The Practical Application: Tax Incidence in Real-World Scenarios

In practice, the determination of tax incidence is complex and influenced by various factors. Let's consider a real-world example: a government decides to impose a tax on soft drinks to address health concerns and generate revenue. The tax is expected to reduce consumption and improve public health outcomes.

Initially, the tax is expected to increase the price of soft drinks, as producers pass on a portion of the tax to consumers. However, the response of consumers and producers to this price change can vary. If consumers are highly price-sensitive (elastic demand), they may reduce their consumption of soft drinks, leading to a larger share of the tax burden falling on producers. Conversely, if producers have limited options for reducing costs (inelastic supply), they may absorb a significant portion of the tax, impacting their profitability.

Additionally, the tax incidence can be influenced by the availability of substitutes. If consumers have access to alternative beverages, they may switch to those options, reducing the demand for taxed soft drinks and shifting the burden towards producers. On the other hand, if substitutes are limited, consumers may have no choice but to pay the higher prices, bearing a larger share of the tax burden.

Tax Burden: Beyond Direct Costs

While tax incidence focuses on the distribution of the economic burden, the tax burden encompasses a broader range of effects. It considers not only the direct costs associated with paying taxes but also the indirect impacts on income, investment decisions, and overall economic welfare.

For individuals, the tax burden can affect disposable income, influencing their spending and saving patterns. Higher taxes may lead to a reduction in disposable income, impacting their ability to purchase goods and services, save for the future, or invest in education and training. This, in turn, can have ripple effects on the economy, affecting consumption, investment, and economic growth.

Businesses, too, face a tax burden that goes beyond the direct cost of taxes. Taxes can influence their decision-making processes, affecting investment, innovation, and expansion plans. High taxes may discourage businesses from investing in new projects or expanding their operations, leading to slower economic growth and reduced job creation. On the other hand, a well-designed tax system can provide incentives for businesses to invest, innovate, and create jobs, contributing to long-term economic prosperity.

The Role of Government and Policy Design

The design of tax policies plays a crucial role in determining the tax incidence and burden. Governments have the power to shape the distribution of taxes through various mechanisms, such as tax rates, exemptions, and deductions. By carefully crafting tax policies, governments can influence the allocation of resources, promote certain behaviors, and achieve specific economic and social goals.

For instance, progressive tax systems, where tax rates increase with income, aim to reduce income inequality and provide a more equitable distribution of resources. On the other hand, regressive tax systems, where lower-income individuals bear a relatively higher tax burden, can exacerbate income disparities. Governments must carefully consider the distributional effects of tax policies to ensure fairness and promote social welfare.

Additionally, the timing and structure of tax payments can influence the tax burden. Lump-sum taxes, where the tax amount is fixed and independent of income, can be less burdensome than proportional or progressive taxes. However, lump-sum taxes may be regressive, as they represent a larger share of the income for lower-income individuals. Governments must strike a balance between equity and efficiency when designing tax systems.

The Impact on Social Welfare and Economic Inequality

The tax incidence and burden have significant implications for social welfare and economic inequality. By redistributing income and resources, taxes can play a crucial role in reducing income disparities and promoting social equality. Progressive tax systems, for example, can help mitigate the concentration of wealth and provide opportunities for upward mobility.

However, the effectiveness of tax policies in reducing inequality depends on various factors, including the design of the tax system, enforcement mechanisms, and the overall economic context. In some cases, tax evasion and avoidance strategies can undermine the redistributive effects of taxation, leading to a less equitable distribution of resources.

Furthermore, the tax burden can disproportionately affect certain segments of society, such as low-income individuals or specific industries. Governments must carefully assess the potential impacts of tax policies on vulnerable populations and industries to ensure that the benefits of taxation are widely shared and that negative consequences are minimized.

The Future of Taxation: Trends and Innovations

As societies evolve and economic landscapes change, the world of taxation is also undergoing transformations. Technological advancements, globalization, and changing social values are shaping the future of taxation, presenting both challenges and opportunities.

One notable trend is the increasing focus on digital taxation. With the rise of e-commerce and digital platforms, governments are grappling with the challenge of taxing digital activities and ensuring a level playing field for traditional and digital businesses. The Organisation for Economic Co-operation and Development (OECD) is leading efforts to develop international standards for digital taxation, aiming to address tax avoidance and ensure a fair distribution of tax revenue.

Another emerging trend is the exploration of alternative tax systems, such as a universal basic income (UBI) or a wealth tax. These proposals aim to address income inequality and provide a safety net for individuals, particularly in an era of technological advancements and automation. While these ideas are still in the early stages of discussion and implementation, they offer a glimpse into the potential future of taxation and its role in shaping societal welfare.

Conclusion: Navigating the Complexities of Taxation

The concepts of tax incidence and tax burden are intricate and multifaceted, shaping the economic and social landscape in profound ways. Understanding these concepts is essential for policymakers, economists, and citizens alike, as they influence the distribution of resources, promote certain behaviors, and contribute to overall societal welfare.

As we navigate the complexities of taxation, it is crucial to recognize the dynamic nature of tax policies and their impacts. The distribution of the tax burden is not static but rather a continuous process influenced by market forces, technological advancements, and societal values. By staying informed and engaged, we can contribute to the development of fair, efficient, and equitable tax systems that support economic growth, reduce inequality, and promote social progress.

| Tax Type | Incidence | Burden |

|---|---|---|

| Sales Tax | Final Consumers | Reduced Disposable Income |

| Production Tax | Producers or Consumers | Profit Reduction or Higher Prices |

| Progressive Tax | Varies based on Elasticity | Redistribution of Wealth |

How does tax incidence differ from tax burden?

+Tax incidence refers to the distribution of the economic burden of a tax among different entities, primarily between producers and consumers. It focuses on the allocation of the tax burden based on the elasticity of supply and demand. Tax burden, on the other hand, encompasses the overall impact of taxation, considering not only the direct costs but also the indirect effects on income, incentives, and resource allocation.

Can tax incidence be predicted accurately?

+Predicting tax incidence accurately is challenging due to the complex nature of market dynamics. Factors such as elasticity, availability of substitutes, and producer behavior can influence the distribution of the tax burden. While economic theories provide a framework for analysis, real-world outcomes may deviate from theoretical predictions.

How do tax policies affect economic growth?

+Tax policies can have both positive and negative impacts on economic growth. Well-designed tax systems can provide incentives for investment, innovation, and job creation, contributing to long-term economic prosperity. However, high taxes or poorly designed policies may discourage investment, reduce business expansion, and hinder economic growth.

What is the role of government in tax incidence and burden?

+Governments play a crucial role in shaping tax incidence and burden through policy design. They have the power to influence the distribution of taxes, promote certain behaviors, and achieve specific economic and social goals. By carefully crafting tax policies, governments can address income inequality, promote fairness, and support economic growth.

How does tax evasion impact the tax burden?

+Tax evasion undermines the effectiveness of tax policies and can lead to an uneven distribution of the tax burden. When individuals or businesses evade taxes, the burden falls disproportionately on those who comply, potentially exacerbating income disparities and reducing the redistributive effects of taxation.