Pa Tax Return Status

The Pennsylvania Department of Revenue understands the importance of timely tax return processing and strives to provide accurate and up-to-date information to taxpayers. In this comprehensive guide, we will delve into the intricacies of the Pa Tax Return Status, exploring the various aspects of the process, from understanding the status updates to addressing common queries and providing valuable insights.

Understanding the Pa Tax Return Status

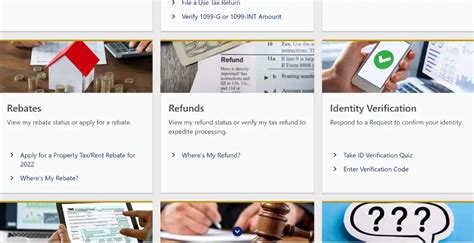

The Pa Tax Return Status is a vital tool for taxpayers to track the progress of their tax returns. It offers real-time updates, ensuring transparency and peace of mind during the tax filing season. The status updates provide crucial information about the current stage of processing, helping taxpayers anticipate potential delays and plan their financial strategies accordingly.

When accessing the Pa Tax Return Status, taxpayers are presented with a range of information, including:

- Receipt of Return: This status indicates that the Department of Revenue has successfully received the taxpayer's return. It serves as confirmation that the filing process has commenced.

- Processing: The "Processing" status signifies that the tax return is undergoing review and validation by the department. During this stage, the accuracy and completeness of the return are scrutinized.

- Accepted: Once the tax return has been thoroughly processed and found to be in order, the "Accepted" status is assigned. This signifies that the return has met all the necessary criteria and is considered complete.

- Rejected: In certain cases, a tax return may be flagged with the "Rejected" status. This indicates that the return has been deemed incomplete or contains errors that require correction. Taxpayers are typically provided with specific instructions to address these issues.

- Issued: The "Issued" status is a welcome indication for taxpayers. It signifies that the refund or payment associated with the tax return has been processed and is in the final stages of issuance.

- Paid: When the "Paid" status appears, it confirms that the taxpayer's refund or payment has been successfully delivered. This status provides closure to the tax filing process.

By closely monitoring the Pa Tax Return Status, taxpayers can stay informed and take appropriate actions. For instance, if a return is in the "Processing" stage for an extended period, taxpayers can reach out to the Department of Revenue for an update, ensuring that their return is not experiencing any unforeseen delays.

Common Queries and Their Solutions

Navigating the tax landscape often raises a multitude of questions. Here, we address some of the most frequently asked queries regarding the Pa Tax Return Status:

How long does it take to receive a refund after the “Issued” status?

The time frame for receiving a refund can vary depending on several factors. Generally, taxpayers can expect their refund to arrive within 10 to 14 business days after the “Issued” status. However, it’s important to note that this timeline may be influenced by factors such as the chosen refund delivery method, the volume of tax returns being processed, and any potential errors or discrepancies in the return.

What should I do if my tax return is flagged as “Rejected”?

A “Rejected” status can be disconcerting, but it’s essential to remain calm and take the necessary steps to resolve the issue. The Department of Revenue typically provides detailed explanations and instructions alongside the “Rejected” status. These instructions will guide taxpayers on the specific errors or omissions identified and the required actions to correct them. Taxpayers should carefully review these instructions and make the necessary amendments to their return. Once the corrections are made, they can resubmit their tax return, ensuring a smooth processing journey.

Can I check my tax return status if I e-filed?

Absolutely! Whether you chose to e-file or file your tax return manually, the Pa Tax Return Status is accessible to all taxpayers. By logging into your online account or contacting the Department of Revenue’s dedicated helpline, you can obtain real-time updates on the status of your e-filed return.

Are there any penalties for late tax return submissions?

Pennsylvania, like many other states, imposes penalties for late tax return submissions. These penalties can include interest charges and fines. It’s crucial to adhere to the filing deadlines to avoid any unnecessary financial burdens. However, in certain exceptional circumstances, the Department of Revenue may grant extensions or waive penalties. Taxpayers facing extenuating circumstances should reach out to the department for guidance and assistance.

Maximizing Efficiency: Tips for a Smooth Tax Return Process

To ensure a seamless tax return journey, taxpayers can employ the following strategies:

- Accurate Record-Keeping: Maintaining organized and up-to-date financial records is essential for a smooth tax return process. Taxpayers should gather all relevant documents, including income statements, deductions, and credits, to ensure an accurate and complete return.

- Utilize Online Filing: The Department of Revenue offers convenient online filing options, such as e-filing. By leveraging these digital tools, taxpayers can streamline the filing process, reduce errors, and receive status updates in real-time.

- Seek Professional Assistance: For complex tax situations or if taxpayers feel overwhelmed, seeking the expertise of a tax professional can be immensely beneficial. Tax advisors can provide guidance, ensure compliance, and help taxpayers navigate the intricacies of the tax system.

- Stay Informed: The tax landscape is subject to changes and updates. Taxpayers should stay informed about any legislative changes, new regulations, or tax incentives that may impact their return. Staying updated ensures that taxpayers can optimize their returns and take advantage of available opportunities.

Conclusion: Empowering Taxpayers with Knowledge

Understanding the intricacies of the Pa Tax Return Status empowers taxpayers to navigate the tax landscape with confidence. By staying informed, utilizing the available resources, and taking proactive measures, taxpayers can ensure a smooth and efficient tax return process. The Department of Revenue’s commitment to transparency and taxpayer assistance ensures that taxpayers receive the support they need to fulfill their tax obligations accurately and timely.

As taxpayers continue to embrace the digital age, the Pa Tax Return Status serves as a valuable tool, offering convenience, efficiency, and peace of mind. With this comprehensive guide, taxpayers can approach the tax filing season with clarity and preparedness, making the most of the resources provided by the Pennsylvania Department of Revenue.

Can I check my tax return status without an online account?

+Yes, you can check your tax return status without an online account. The Department of Revenue provides alternative methods, such as a dedicated helpline or a mail-in request process. These options ensure that all taxpayers have access to their return status updates.

What if I disagree with the Department’s assessment of my tax return?

+In the event of a disagreement with the Department’s assessment, taxpayers have the right to appeal. The Department of Revenue has a well-established appeals process, allowing taxpayers to present their case and seek a resolution. It’s important to follow the outlined procedures and provide supporting documentation to strengthen your appeal.

Are there any tax return status updates via text message or email?

+Currently, the Department of Revenue does not offer real-time status updates via text message or email. However, taxpayers can opt to receive notifications and updates through their online account or by subscribing to the Department’s newsletter, ensuring they stay informed about any significant developments.