Tennessee Inheritance Tax

Tennessee's inheritance tax is an important aspect of the state's estate planning and taxation landscape. Understanding the intricacies of this tax is crucial for individuals seeking to navigate their financial obligations and maximize the value of their estates for their beneficiaries. This comprehensive guide aims to delve into the specifics of Tennessee's inheritance tax, offering a detailed analysis of its structure, implications, and strategic considerations.

Understanding Tennessee’s Inheritance Tax

Tennessee imposes an inheritance tax, which is distinct from federal estate taxes and state income taxes. This tax is levied on the beneficiaries who inherit property from a deceased individual, making it a recipient-based tax rather than an estate-based tax. The state’s inheritance tax is governed by Tennessee Code Annotated § 67-8-301 et seq., which outlines the specific rules and regulations governing the tax.

Tax Rates and Exemptions

The tax rates for Tennessee’s inheritance tax vary depending on the relationship between the beneficiary and the deceased individual. The closest relatives, including spouses, children, parents, and grandparents, are exempt from the inheritance tax. However, more distant relatives and non-relatives are subject to different tax rates, which are outlined in the following table:

| Relationship | Tax Rate |

|---|---|

| Spouse, Child, Parent, Grandparent | 0% |

| Siblings, Nieces, Nephews | 5.5% |

| Other Relatives, Non-Relatives | 6.0% |

It's important to note that Tennessee's inheritance tax is a progressive tax, meaning the tax rate increases as the value of the inheritance rises. The state's tax system is designed to ensure a fair distribution of tax obligations among beneficiaries.

Taxable Property and Exemptions

Tennessee’s inheritance tax applies to various types of property, including real estate, personal property, and intangible assets. However, certain assets are exempt from the tax. These exemptions include life insurance proceeds, qualified retirement accounts, and certain types of annuities. Additionally, charitable bequests are exempt from inheritance tax.

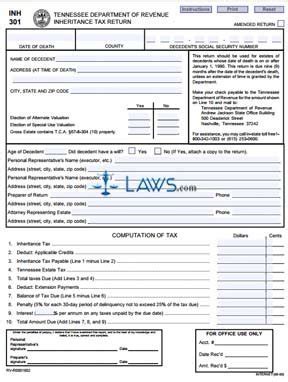

Filing and Payment Requirements

The executor or personal representative of the estate is responsible for filing the inheritance tax return and paying the associated taxes. Tennessee requires that the inheritance tax return be filed within nine months of the decedent’s death. The tax is due and payable at the time of filing. It’s important to note that interest and penalties may accrue for late filings or payments.

Strategies for Minimizing Inheritance Tax

While Tennessee’s inheritance tax is a significant consideration for estate planning, there are several strategies that individuals can employ to minimize their tax obligations and maximize the value of their estates for their beneficiaries.

Gift Giving and Estate Planning

One effective strategy for reducing inheritance tax is to make strategic gifts during one’s lifetime. Tennessee allows individuals to gift a certain amount of property annually without triggering gift taxes. By making thoughtful gifts to beneficiaries, individuals can reduce the value of their estates and, consequently, the potential inheritance tax burden. Additionally, estate planning tools such as trusts can be utilized to further minimize tax obligations and ensure the efficient distribution of assets.

Charitable Giving and Exemptions

Charitable giving is another powerful tool for minimizing inheritance tax. Tennessee, like many other states, exempts charitable bequests from inheritance tax. By including charitable organizations in one’s estate plan, individuals can not only support causes they care about but also reduce the overall value of their estates for tax purposes. This strategy allows individuals to leave a lasting legacy while also benefiting from tax advantages.

Estate Planning with Life Insurance

Life insurance is a valuable asset in estate planning, particularly for minimizing inheritance tax. Life insurance proceeds are typically exempt from inheritance tax in Tennessee. By purchasing life insurance policies and naming beneficiaries who are exempt from the tax (such as spouses or children), individuals can ensure that a substantial portion of their estate passes tax-free to their loved ones. This strategy provides a significant tax advantage and allows for more efficient estate planning.

The Role of Professional Guidance

Navigating Tennessee’s inheritance tax landscape can be complex, and the strategic considerations outlined above may vary depending on individual circumstances. It is crucial for individuals to seek professional guidance from experienced estate planning attorneys and tax advisors. These professionals can provide tailored advice based on an individual’s unique situation, ensuring that their estate plan aligns with their goals and minimizes tax obligations.

Personalized Estate Planning Strategies

Every individual’s estate planning needs are unique, and a one-size-fits-all approach is rarely effective. Professional advisors can conduct a thorough analysis of an individual’s assets, family dynamics, and financial goals to develop a comprehensive estate plan. This plan may involve a combination of strategies, including gift giving, trust establishment, and charitable giving, to optimize the distribution of assets and minimize tax liabilities.

Future Implications and Considerations

Tennessee’s inheritance tax landscape is subject to change, and individuals should stay informed about potential modifications to the tax system. While the state currently imposes an inheritance tax, there have been ongoing discussions and proposals to abolish or reform the tax. Staying abreast of these developments is crucial for effective estate planning.

Potential Changes and Reforms

In recent years, there have been legislative efforts in Tennessee to eliminate the inheritance tax altogether. These proposals argue that the tax is burdensome for heirs and may hinder economic growth. While these efforts have not yet been successful, they highlight the potential for future changes to the tax system. It is essential for individuals to monitor these developments and adjust their estate plans accordingly.

Alternative Taxation Strategies

In anticipation of potential changes to Tennessee’s inheritance tax, individuals may consider exploring alternative taxation strategies. This could involve shifting assets to other states with more favorable tax systems or utilizing trust structures that minimize tax obligations. However, it is crucial to consult with professional advisors before implementing such strategies, as they may have complex implications and require careful consideration of individual circumstances.

Conclusion: A Comprehensive Approach to Estate Planning

Tennessee’s inheritance tax is a critical consideration for individuals engaged in estate planning. By understanding the intricacies of the tax system, individuals can make informed decisions to minimize tax obligations and maximize the value of their estates for their beneficiaries. Strategic gift giving, charitable giving, and life insurance planning are just a few of the tools available to achieve these goals.

Working with experienced professionals is essential to ensure a comprehensive and tailored estate plan. These advisors can guide individuals through the complex process, helping them navigate the legal and tax landscape to protect their legacy. With a well-designed estate plan, individuals can rest assured that their assets will be distributed efficiently and in accordance with their wishes.

How does Tennessee’s inheritance tax compare to other states?

+Tennessee is one of a handful of states that impose an inheritance tax. While the tax rates and exemptions vary across states, Tennessee’s tax system is generally considered more favorable for beneficiaries who are immediate family members. However, for more distant relatives and non-relatives, the tax rates can be higher compared to some other states.

Are there any exemptions for small estates in Tennessee’s inheritance tax?

+Yes, Tennessee does provide exemptions for small estates. If the total value of the estate is less than $50,000, the inheritance tax is waived. This exemption is designed to reduce the administrative burden for small estates and ensure that the tax system does not disproportionately impact individuals with limited assets.

Can I transfer my assets to avoid inheritance tax in Tennessee?

+Transferring assets to avoid inheritance tax is a complex matter and may have significant legal and tax implications. It is essential to consult with a qualified attorney and tax advisor before attempting any asset transfers. They can provide guidance on the potential risks and benefits of such strategies, ensuring that you comply with all relevant laws and regulations.