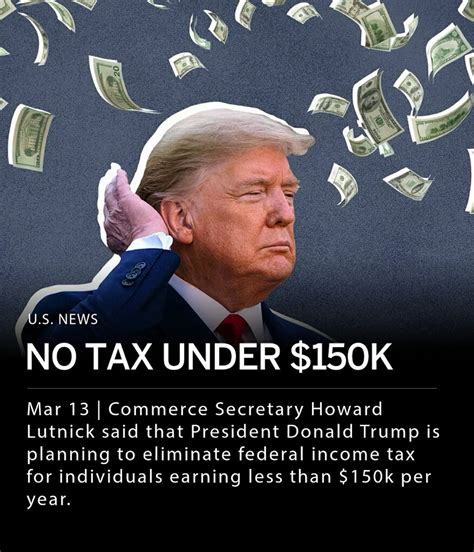

Trump No Taxes Under 150K

In the world of politics and public figures, tax returns have often been a topic of interest and scrutiny. The tax policies and practices of prominent individuals can provide valuable insights into their financial strategies and the broader implications for society. This article delves into the tax policy attributed to former U.S. President Donald Trump, specifically the claim that he proposed a tax exemption for Americans earning less than $150,000.

The Trump Tax Plan: A Closer Look

Donald Trump, during his presidential campaign and tenure, proposed various tax reforms aimed at simplifying the tax code and providing relief to certain segments of the population. One of the key aspects of his tax plan was the idea of offering a tax exemption to individuals earning below a certain threshold.

The Trump administration's tax proposal, often referred to as the Tax Cuts and Jobs Act, introduced significant changes to the U.S. tax system. One of the notable features was the expansion of the standard deduction, which effectively reduced the tax liability for many middle-class households. However, the specific claim that Trump aimed to exempt individuals earning less than $150,000 from paying taxes altogether requires a closer examination.

Understanding the Tax Exemption Claim

The claim that Trump proposed a tax exemption for Americans earning less than $150,000 is a simplified interpretation of his tax plan. While his administration did advocate for tax relief measures, the reality is more nuanced.

During his campaign, Trump suggested the idea of a massive tax cut for the middle class, which included raising the standard deduction to $24,000 for married couples and $12,000 for single individuals. This proposal aimed to simplify tax filing and provide a significant boost to the disposable income of many Americans.

However, it is essential to clarify that this proposal did not equate to a complete exemption from paying taxes. Instead, it aimed to reduce the tax burden for a substantial portion of the population by increasing the amount of income that would be tax-free.

| Tax Proposal | Details |

|---|---|

| Increased Standard Deduction | Proposed raising the standard deduction to $24,000 for married couples and $12,000 for singles. |

| Tax Brackets | The plan also included adjustments to tax brackets, with rates ranging from 0% to 35% for individuals and 15% to 35% for corporations. |

| Child Tax Credit | Trump's plan expanded the child tax credit, providing a credit of up to $1,600 per child, with a maximum of $2,000 per child for families earning less than $230,000. |

Impact and Criticisms

The Trump tax plan faced both praise and criticism from various quarters. Supporters argued that the tax cuts would stimulate economic growth and benefit the middle class. Critics, on the other hand, raised concerns about the potential impact on the federal deficit and the distribution of benefits, with some arguing that the plan primarily favored the wealthy.

The implementation of the Tax Cuts and Jobs Act resulted in a significant reduction in corporate tax rates, which was a central focus of the administration's economic agenda. However, the impact on individual taxpayers varied based on their income level and family situation.

While the increased standard deduction provided relief to many, it also led to a decrease in the number of taxpayers claiming itemized deductions, as the standard deduction became more advantageous for a larger portion of the population.

The Reality of Tax Exemptions

It is important to note that complete tax exemptions are rare and often limited to specific circumstances, such as certain government programs or initiatives aimed at promoting specific industries or social causes. In the context of the Trump tax plan, a blanket exemption for all individuals earning below $150,000 was not a realistic proposal.

Tax exemptions are typically designed to encourage specific behaviors or support targeted groups. For example, tax incentives are often offered to promote investments in renewable energy or to encourage businesses to locate in economically disadvantaged areas. These exemptions are carefully crafted to achieve specific policy goals and are not applied universally to all taxpayers.

Tax Policy and its Complexities

Tax policy is a complex and ever-evolving field, influenced by economic conditions, political ideologies, and societal needs. The Trump administration’s tax reforms were a significant departure from previous policies, and their impact continues to be analyzed and debated by economists and policymakers.

While the claim that Trump proposed a tax exemption for those earning less than $150,000 simplifies the reality, it highlights the importance of understanding the nuances of tax policies. Tax reforms can have far-reaching consequences, affecting not only individual taxpayers but also the overall economy and social welfare.

As we navigate the intricate world of tax policies, it is crucial to differentiate between proposed reforms and their practical implementation. The Trump tax plan, while ambitious, did not result in a complete tax exemption for a large portion of the population. Instead, it aimed to provide targeted relief and simplify the tax code, leaving a lasting impact on the U.S. tax landscape.

Did Trump’s tax plan benefit the middle class?

+Yes, the Trump tax plan aimed to provide significant tax relief to the middle class by increasing the standard deduction and expanding tax credits. This proposal sought to boost disposable income and simplify tax filing for many Americans.

What was the main criticism of the Trump tax plan?

+Critics argued that the Trump tax plan disproportionately benefited the wealthy and increased the federal deficit. They believed that the tax cuts for corporations and high-income individuals outweighed the benefits provided to the middle class.

How did the Trump tax plan impact the federal deficit?

+The Tax Cuts and Jobs Act led to a significant reduction in tax revenues, which contributed to an increase in the federal deficit. The decrease in tax income, coupled with other factors, resulted in a larger budget gap.