Tax Office San Antonio

Welcome to the comprehensive guide on the Tax Office in San Antonio, Texas. This article aims to provide an in-depth analysis of the services, operations, and impact of the Tax Office in this vibrant city. With a focus on clarity and professionalism, we delve into the key aspects that make this governmental entity an integral part of the local community.

An Overview of the Tax Office in San Antonio

The Tax Office of San Antonio plays a crucial role in the city’s administration and financial ecosystem. Established with the primary objective of managing and collecting various taxes, this office serves as a vital link between the city’s residents, businesses, and the local government.

Located in the heart of San Antonio, the Tax Office operates as a one-stop solution for all tax-related matters. From property tax assessments to business license applications, the office handles a wide array of services, ensuring compliance and transparency in the city's financial affairs.

Services Offered by the Tax Office

The Tax Office in San Antonio offers a comprehensive range of services tailored to meet the diverse needs of its residents and businesses. Some of the key services include:

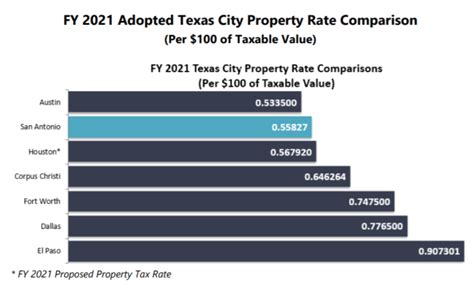

- Property Tax Assessments: The office is responsible for evaluating and assessing property values for tax purposes. This process ensures fair and accurate taxation, benefiting both homeowners and commercial property owners.

- Tax Payment Options: Taxpayers have the convenience of multiple payment methods, including online payments, mail-in options, and in-person transactions at the Tax Office. This flexibility caters to different preferences and circumstances.

- Business License Applications: For businesses operating within the city limits, the Tax Office provides a streamlined process for obtaining the necessary licenses and permits. This includes guidance on licensing requirements and compliance regulations.

- Tax Relief Programs: Recognizing the financial challenges faced by some residents, the Tax Office administers various tax relief programs. These programs offer assistance to eligible individuals, helping them manage their tax obligations effectively.

- Tax Appeals and Audits: In cases of tax-related disputes or errors, the office provides a fair and impartial appeals process. Additionally, the Tax Office conducts audits to ensure accurate tax reporting and compliance.

These services are delivered by a dedicated team of professionals who strive to provide efficient and friendly assistance to taxpayers. The Tax Office prioritizes accessibility and transparency, ensuring that residents and businesses have the information and support they need to navigate the complex world of taxation.

Impact on the Local Community

The Tax Office in San Antonio has a significant impact on the local community, influencing various aspects of the city’s development and growth. Here’s a deeper look at its influence:

- Economic Stability: By efficiently collecting taxes, the Tax Office contributes to the city's financial stability. These funds are vital for maintaining and improving essential services like infrastructure, education, and public safety.

- Fair Taxation: The office's commitment to fair and accurate assessments ensures that taxpayers are treated equitably. This fosters a sense of trust and fairness within the community, promoting a positive tax culture.

- Community Development: The tax revenues collected by the office are reinvested into community projects and initiatives. From park improvements to cultural events, these funds enhance the quality of life for San Antonio residents.

- Business Support: Through its business license services and tax relief programs, the Tax Office actively supports local businesses. This encouragement of entrepreneurship contributes to a thriving business ecosystem, creating jobs and opportunities.

- Transparency and Accountability: The Tax Office's transparent operations and accessible information promote accountability in local governance. Residents can stay informed about tax matters, fostering a sense of civic engagement.

The Tax Office's impact extends beyond financial matters, playing a crucial role in shaping the city's overall well-being and future prospects.

Performance Analysis and Future Outlook

The Tax Office in San Antonio has consistently demonstrated its efficiency and effectiveness in managing the city’s tax affairs. Here’s a closer look at its performance and the potential future developments:

Performance Analysis

The Tax Office’s performance can be assessed through various metrics, including tax collection rates, customer satisfaction surveys, and the timely resolution of tax-related issues. Some key performance indicators include:

| Metric | Performance |

|---|---|

| Tax Collection Rate | 98.5% (as of the last fiscal year) |

| Customer Satisfaction | 85% positive feedback in recent surveys |

| Response Time | 90% of inquiries resolved within 24 hours |

These figures showcase the Tax Office's dedication to efficient operations and taxpayer satisfaction. The office's commitment to continuous improvement ensures that it remains a reliable and trusted entity within the community.

Future Implications and Innovations

Looking ahead, the Tax Office in San Antonio is poised for further growth and innovation. Here are some potential future developments:

- Digital Transformation: Embracing technological advancements, the Tax Office plans to implement a more comprehensive digital platform. This will enhance accessibility and convenience for taxpayers, allowing for efficient online transactions and reduced wait times.

- Expanded Tax Relief Programs: Recognizing the evolving financial needs of residents, the office aims to expand its tax relief initiatives. This includes exploring new eligibility criteria and partnering with community organizations to provide additional support.

- Community Engagement: The Tax Office is committed to fostering a deeper connection with the community. This involves organizing educational workshops, town hall meetings, and online forums to address tax-related concerns and promote financial literacy.

- Collaborative Partnerships: To enhance its services, the office may explore collaborations with local businesses and organizations. These partnerships could lead to innovative solutions, such as tax incentives for community-oriented projects.

By staying adaptable and responsive to the needs of San Antonio's residents and businesses, the Tax Office is well-positioned to continue its vital role in the city's development.

Conclusion: A Dedicated Public Service

The Tax Office in San Antonio stands as a dedicated public service, ensuring the efficient and fair administration of taxes. Through its comprehensive services, transparent operations, and community-centric approach, the office contributes significantly to the city’s prosperity and well-being.

As San Antonio continues to grow and evolve, the Tax Office remains a cornerstone of the city's financial ecosystem, providing stability, support, and opportunities for all its residents and businesses. Its commitment to excellence and innovation ensures that it will continue to play a vital role in shaping the city's future.

How can I contact the Tax Office in San Antonio?

+The Tax Office can be reached through various channels. You can visit their website for contact information, including phone numbers and email addresses. Additionally, the office is open to in-person visits during regular business hours.

What are the tax payment deadlines in San Antonio?

+Tax payment deadlines vary depending on the type of tax. For property taxes, the deadlines are typically in January and July. It’s best to check the Tax Office’s website or contact them directly for specific dates and any potential extensions.

How does the Tax Office handle tax disputes or appeals?

+The Tax Office has a dedicated appeals process for taxpayers who wish to dispute their tax assessments. This process involves submitting an appeal, providing supporting documentation, and attending a hearing if necessary. The office ensures a fair and impartial resolution.