Austin Texas Property Tax Rate

Austin, Texas, is a vibrant city known for its diverse culture, thriving tech industry, and rapidly growing population. With its popularity, the real estate market has been a focal point for investors and homeowners alike. One crucial aspect that influences property ownership in Austin is the property tax rate. Understanding the intricacies of property taxes is essential for anyone considering investing in or owning property in this dynamic city.

Unraveling the Austin Property Tax Landscape

The property tax system in Austin, as in many other parts of the United States, is a complex mechanism that funds essential services and infrastructure development. Property taxes are a significant source of revenue for local governments, including school districts, cities, and counties. These taxes are determined based on the value of the property and are used to support a range of public services such as education, emergency services, transportation, and general government operations.

How Are Property Taxes Calculated in Austin, Texas?

Property taxes in Austin are calculated using a straightforward formula. The taxable value of a property is determined by multiplying its appraised value by the applicable tax rate. This tax rate, often referred to as the effective tax rate, is set by the local taxing authorities, which include the county, the city, and various special districts.

The appraised value of a property is established by the Travis Central Appraisal District (TCAD), which assesses the market value of properties annually. This value is then subject to certain exemptions and limitations, resulting in the taxable value. The effective tax rate is then applied to this taxable value to determine the final property tax amount.

| Component | Description |

|---|---|

| Appraised Value | The market value of the property as assessed by TCAD. |

| Taxable Value | The appraised value minus any applicable exemptions or limitations. |

| Effective Tax Rate | The rate set by local taxing authorities, typically a percentage of the taxable value. |

It's important to note that the effective tax rate can vary significantly across different parts of Austin due to the presence of various taxing entities. These entities, which include the city, county, and special districts, each have their own tax rates, which are combined to form the overall effective tax rate for a specific property.

Exploring the Components of Austin’s Effective Tax Rate

The effective tax rate in Austin is a composite of several individual tax rates from different taxing authorities. These authorities include the following:

- City of Austin: The city sets its own tax rate, which funds a range of municipal services and projects.

- Travis County: As the county seat, Austin is part of Travis County, which also levies a tax rate to support county-wide initiatives.

- Austin Independent School District (AISD): As one of the largest school districts in Texas, AISD plays a vital role in educating Austin's youth and requires a substantial portion of the tax revenue.

- Special Districts: There are various special districts in Austin, each serving a specific purpose, such as water supply, fire protection, or transportation. Each of these districts has its own tax rate.

The combination of these tax rates determines the overall effective tax rate for a property in Austin. It's important for property owners to understand the breakdown of these rates to have a comprehensive view of their tax obligations.

Analyzing Austin’s Property Tax Rates

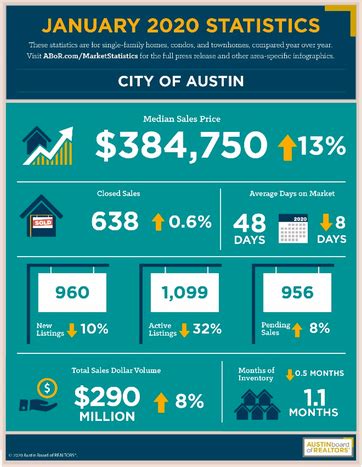

Austin’s property tax rates have been a topic of interest and concern for residents and investors alike. While the city boasts a thriving economy and a high quality of life, the property tax rates can significantly impact the cost of living and the feasibility of property ownership.

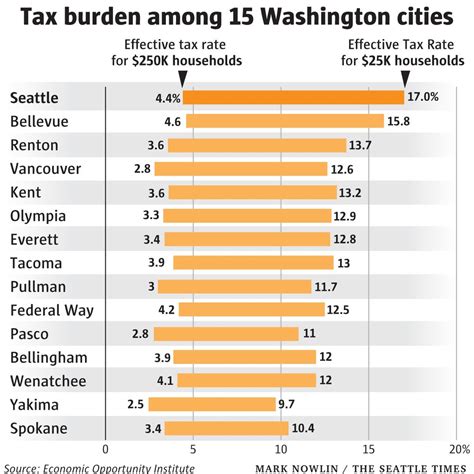

Comparative Analysis: Austin’s Property Tax Rates vs. Other Major Cities

When compared to other major cities in Texas and across the United States, Austin’s property tax rates are generally higher. This is due to a combination of factors, including the city’s rapid growth, the need to fund a robust public school system, and the presence of various special districts with their own tax requirements.

According to recent data, Austin's effective tax rate is approximately 2.16%, which is higher than the state average of 1.96%. This rate translates to an average property tax bill of around $6,000 for a home valued at $300,000. While this rate is lower than some major cities like New York or San Francisco, it is higher than many other cities in Texas, such as Houston or Dallas.

Trends and Projections: How Austin’s Property Tax Rates Have Evolved

Over the past decade, Austin’s property tax rates have been on a steady upward trajectory. This increase is primarily driven by the city’s rapid population growth, which has put a strain on infrastructure and public services. As a result, taxing authorities have had to raise rates to keep up with the increasing demand for services.

In recent years, there have been efforts by local governments to control property tax increases. These efforts include initiatives to streamline government operations, improve efficiency, and explore alternative funding sources. Despite these measures, property tax rates are expected to continue rising, albeit at a slower pace, as Austin continues to grow and develop.

Strategies for Managing Property Taxes in Austin

Given the relatively high property tax rates in Austin, it’s essential for property owners to employ strategies to manage their tax obligations effectively. Here are some approaches to consider:

Exemptions and Limitations: Maximizing Tax Relief

Austin, like many other cities, offers various exemptions and limitations that can reduce the taxable value of a property. These exemptions are designed to provide relief to specific groups of taxpayers, such as senior citizens, disabled individuals, and veterans. Understanding these exemptions and ensuring eligibility can significantly reduce property tax liabilities.

- Homestead Exemption: This exemption is available to homeowners who use their property as their primary residence. It can provide a substantial reduction in the taxable value of the property, resulting in lower property taxes.

- Over-65 Exemption: Residents who are 65 years or older and meet certain income requirements may be eligible for this exemption, which can significantly reduce their property taxes.

- Disability Exemption: Property owners with disabilities may qualify for this exemption, which can provide a reduction in taxable value.

It's crucial to research and understand the specific requirements and eligibility criteria for these exemptions to maximize tax savings.

Tax Appeals: Challenging Property Appraisals

If a property owner believes that the appraised value of their property is inaccurate or unfair, they have the right to appeal. The Travis Central Appraisal District provides a process for challenging appraisals, which can result in a reduction in the taxable value and, consequently, lower property taxes.

Property owners can gather evidence, such as recent sales data of comparable properties, to support their case. It's important to note that the success of a tax appeal depends on the strength of the evidence presented and the willingness of the appraisal district to reconsider its initial appraisal.

Investment Strategies: Maximizing Returns and Minimizing Taxes

For investors, managing property taxes is a critical aspect of ensuring the financial viability of their investments. Here are some strategies to consider:

- Diversification: Investing in properties across different parts of Austin, or even in different cities or states, can help spread the risk and potentially lower overall tax obligations. Different locations may have varying tax rates and property values, providing opportunities for strategic tax planning.

- Lease Options: Offering lease options to tenants can provide flexibility and potentially reduce tax liabilities. Lease options allow tenants to rent a property with the option to purchase it in the future. This strategy can help manage cash flow and tax obligations more effectively.

- Property Improvements: Making strategic improvements to a property can increase its value, which may result in a higher appraised value. However, certain improvements, such as energy-efficient upgrades or accessibility modifications, may be eligible for tax incentives or exemptions, offsetting some of the increased value.

It's important for investors to consult with tax professionals and financial advisors to develop a comprehensive tax strategy tailored to their specific investment goals and circumstances.

The Future of Property Taxes in Austin

As Austin continues to evolve and grow, the landscape of property taxes is likely to undergo changes as well. Local governments and taxing authorities will need to adapt to the city’s changing demographics and economic landscape to ensure the fair and sustainable funding of essential services.

Potential Reforms and Initiatives

There have been ongoing discussions and proposals for property tax reforms in Austin and across Texas. These initiatives aim to provide relief to taxpayers while ensuring the continued funding of critical public services. Some potential reforms include:

- Compression of Tax Rates: This approach involves reducing the effective tax rate by compressing the tax rates of various taxing authorities. By reducing the overall rate, taxpayers could see a decrease in their property tax bills.

- Revenue Caps: Implementing revenue caps for taxing authorities would limit their ability to raise property tax rates beyond a certain threshold. This measure aims to control tax increases and provide predictability for taxpayers.

- Enhanced Exemptions: Expanding and enhancing existing exemptions, as well as introducing new ones, could provide targeted relief to specific groups of taxpayers, such as low-income earners or first-time homebuyers.

While these reforms are still in the discussion phase, they highlight the ongoing efforts to address the concerns of Austin's residents and businesses regarding property taxes.

The Impact of Austin’s Growth and Development

Austin’s rapid growth and development have had a significant impact on property taxes. As the city attracts new residents and businesses, the demand for services and infrastructure increases, putting pressure on local governments to raise tax rates. However, this growth also presents opportunities for strategic investment and tax planning.

For investors, the influx of new residents and businesses can create a robust rental market and increase property values. This can lead to higher returns on investment but also potentially higher property taxes. Understanding the dynamics of Austin's growth and development can help investors make informed decisions about their real estate portfolios.

Conclusion: Navigating Austin’s Property Tax Landscape

Austin’s property tax system is a complex but essential aspect of owning or investing in property in the city. By understanding the components of the effective tax rate, exploring exemptions and limitations, and staying informed about potential reforms, property owners and investors can effectively manage their tax obligations.

While Austin's property tax rates are relatively high compared to some other cities, the city's vibrant economy, thriving culture, and high quality of life make it an attractive place to live and invest. By employing strategic tax planning and staying engaged with local government initiatives, individuals and businesses can thrive in Austin's dynamic real estate market.

How often are property taxes assessed in Austin, Texas?

+Property taxes in Austin are assessed annually. The Travis Central Appraisal District (TCAD) appraises the market value of properties each year, which forms the basis for calculating property taxes.

Can I appeal my property tax assessment in Austin?

+Yes, property owners in Austin have the right to appeal their property tax assessment if they believe it is inaccurate or unfair. The TCAD provides a process for challenging appraisals, and property owners can gather evidence to support their case.

Are there any tax incentives or exemptions available for energy-efficient properties in Austin?

+Yes, Austin offers various tax incentives and exemptions for energy-efficient properties. These incentives can provide a reduction in the taxable value of the property, resulting in lower property taxes. It’s important to research the specific requirements and eligibility criteria for these incentives.