Pay Md State Taxes Online

Paying taxes online has become a convenient and efficient way for individuals and businesses to fulfill their tax obligations. Maryland, like many other states, offers various online platforms and services to facilitate the payment of state taxes. This article will guide you through the process of paying Maryland state taxes online, providing a comprehensive overview of the steps involved, the benefits, and the available options.

Understanding Maryland State Taxes

Maryland’s tax system encompasses a range of taxes, including income tax, sales and use tax, corporate income tax, and various other taxes specific to certain industries and activities. For individuals and businesses, income tax is a significant component, with rates varying based on income brackets and filing status. Maryland also imposes sales tax on most tangible personal property and certain services, with the rate varying by jurisdiction.

Staying compliant with Maryland's tax regulations is crucial to avoid penalties and interest charges. Fortunately, the state offers a user-friendly online platform, providing taxpayers with a secure and convenient way to manage their tax obligations.

Benefits of Paying Maryland State Taxes Online

Online tax payment offers numerous advantages over traditional methods. Here are some key benefits of paying Maryland state taxes online:

- Convenience: You can pay your taxes from the comfort of your home or office at any time, eliminating the need for in-person visits to tax offices.

- Time Efficiency: Online payment systems streamline the process, allowing you to complete your tax obligations quickly and efficiently.

- Security: Maryland's online tax payment platforms utilize secure protocols, ensuring the protection of your personal and financial information.

- Error Reduction: The online system reduces the risk of errors often associated with manual calculations and paperwork, minimizing the chances of penalties.

- Real-Time Updates: You can access real-time information about your tax payments, refunds, and any outstanding balances.

- Payment Flexibility: Online platforms typically offer multiple payment methods, including credit cards, debit cards, and electronic funds transfer, providing flexibility to choose the most convenient option.

Step-by-Step Guide: Paying Maryland State Taxes Online

Here is a detailed guide on how to pay your Maryland state taxes online:

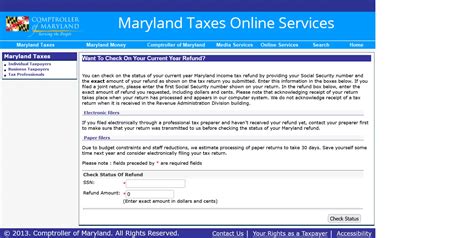

Step 1: Access the Maryland Taxpayer Access Point (MTAP)

To begin, visit the official website of the Maryland Comptroller’s Office and navigate to the Maryland Taxpayer Access Point (MTAP) platform. This is the primary online portal for managing your tax obligations in Maryland.

Step 2: Create an Account (if you don’t have one)

If you are a first-time user, you will need to create an account. Follow the on-screen instructions to register your account, providing your personal or business details as required.

Ensure you have the necessary information ready, such as your Social Security Number (for individuals) or Employer Identification Number (for businesses), along with other relevant details.

Step 3: Log in to Your MTAP Account

Once you have created an account, log in using your credentials. The login process is straightforward and secure, ensuring your privacy and confidentiality.

Step 4: Select the Appropriate Tax Type

On the MTAP dashboard, you will find various tax categories. Select the tax type you wish to pay, such as Income Tax, Sales and Use Tax, or Corporate Income Tax. Each tax type will have its own specific payment process.

Step 5: Enter Tax Information

Provide the necessary tax details, including your tax year, tax amount, and any relevant identifiers. Ensure the information is accurate to avoid delays or errors.

Step 6: Choose Your Payment Method

Maryland’s online tax payment system offers multiple payment options. Choose the method that suits your preference, such as credit card, debit card, electronic check, or electronic funds transfer.

Each payment method will have its own set of instructions and requirements. For instance, credit card payments may require you to provide card details and security codes, while electronic funds transfer will involve setting up a secure connection with your bank account.

Step 7: Review and Confirm Your Payment

Before finalizing your payment, carefully review the details, including the tax type, amount, and payment method. Ensure all the information is correct to avoid any discrepancies.

Step 8: Make the Payment

Once you have verified the details, proceed with the payment. Follow the instructions provided by the online system, and complete the transaction. The process may vary slightly depending on the payment method you choose.

Step 9: Receive Confirmation

After successfully making the payment, you will receive a confirmation message or email. This confirmation serves as a record of your tax payment and can be used for future reference.

Step 10: Track Your Payment Status

You can track the status of your payment within your MTAP account. The platform provides real-time updates, allowing you to monitor the progress of your tax payment and receive notifications regarding any changes or refunds.

Tips for a Smooth Online Tax Payment Experience

To ensure a seamless online tax payment process, consider the following tips:

- Have all the necessary tax information and documents ready before starting the process.

- Double-check your tax calculations to avoid errors.

- Familiarize yourself with the online platform and its features to navigate it efficiently.

- If you encounter any issues, contact the Maryland Comptroller's Office for assistance.

- Keep records of your online tax payments for future reference and audit purposes.

Maryland’s Online Tax Payment Platform: A Secure and Efficient Solution

Maryland’s online tax payment platform, MTAP, is designed to provide a secure and user-friendly experience. The platform offers a range of features, including:

- Real-Time Payment Tracking: You can monitor the status of your payments and refunds in real time.

- Electronic Filing: Certain tax types can be filed electronically, streamlining the process.

- Payment History: The platform maintains a record of your past payments, providing easy access to historical data.

- Secure Data Encryption: MTAP utilizes advanced encryption protocols to protect your personal and financial information.

- Helpful Resources: The platform provides access to tax forms, instructions, and guides to assist taxpayers.

By leveraging the features of the online platform, you can efficiently manage your tax obligations while ensuring compliance with Maryland's tax regulations.

Future of Online Tax Payment in Maryland

The trend towards online tax payment is expected to continue in Maryland, with the state investing in technology and infrastructure to enhance the online experience. Future developments may include:

- Mobile Optimization: Maryland may introduce mobile-friendly versions of the online tax payment platform, allowing taxpayers to pay their taxes using smartphones and tablets.

- Integration with Accounting Software: The state could collaborate with popular accounting software providers to integrate tax payment functionality, making it easier for businesses to manage their tax obligations.

- Enhanced Security Measures: As cybersecurity threats evolve, Maryland is likely to implement additional security measures to protect taxpayer data.

- Expansion of Online Services: The state may expand the range of tax types and services available online, providing a more comprehensive platform for taxpayers.

Stay tuned for future updates and improvements to Maryland's online tax payment system, ensuring a more efficient and secure tax payment experience.

Conclusion

Paying Maryland state taxes online is a convenient, secure, and efficient way to manage your tax obligations. With the guidance provided in this article and the user-friendly online platform offered by the state, you can navigate the process with ease. Remember to stay informed about tax deadlines and utilize the resources available to ensure compliance and minimize any potential penalties.

Frequently Asked Questions (FAQ)

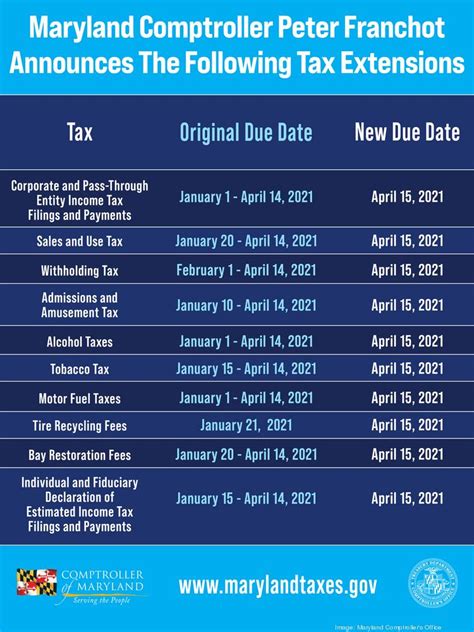

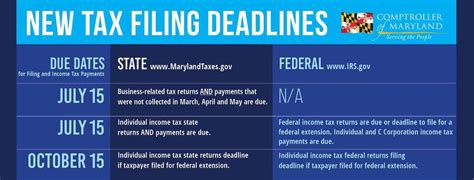

What is the deadline for paying Maryland state taxes online?

+

The deadline for paying Maryland state taxes online varies depending on the tax type. For income tax, the deadline is typically April 15th for the previous tax year. However, it’s crucial to check the official website of the Maryland Comptroller’s Office for any updates or changes to the deadlines.

Can I pay my Maryland state taxes in installments online?

+

Yes, Maryland offers an installment payment option for certain taxes. You can set up installment plans for taxes such as income tax and sales and use tax. Visit the Maryland Comptroller’s Office website for more information on eligibility and the application process.

Are there any fees associated with online tax payment in Maryland?

+

Maryland does not charge any fees for online tax payment. However, if you choose to pay your taxes using a credit card, you may incur processing fees imposed by the credit card company. These fees are typically a small percentage of the tax amount.

Can I pay my Maryland state taxes using a mobile device?

+

Yes, the Maryland Taxpayer Access Point (MTAP) platform is optimized for mobile devices, allowing you to pay your taxes using your smartphone or tablet. Simply access the platform through your device’s web browser and follow the same steps as you would on a desktop.

What should I do if I encounter technical issues while paying my taxes online?

+

If you experience any technical difficulties while using the online tax payment platform, contact the Maryland Comptroller’s Office for assistance. They have a dedicated support team to help resolve any issues you may encounter.