Minneapolis Sales Tax

In the bustling city of Minneapolis, Minnesota, sales tax is an important consideration for both residents and businesses alike. Understanding the sales tax landscape is crucial for making informed financial decisions and navigating the local economy. This article aims to delve into the intricacies of Minneapolis sales tax, shedding light on its structure, rates, exemptions, and impact on the community.

The Complex Web of Minneapolis Sales Tax

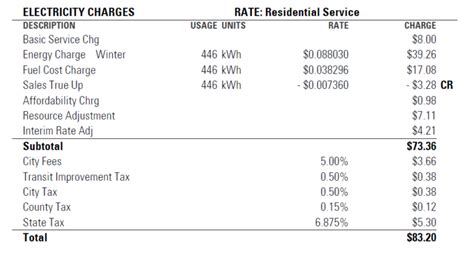

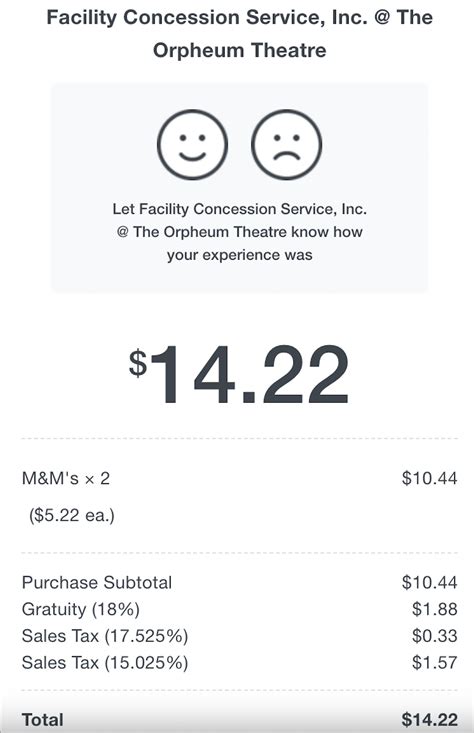

Minneapolis, like many other cities, has a unique sales tax system that involves a combination of state, county, and city taxes. This layered approach adds complexity to the tax structure, making it essential for consumers and businesses to grasp the nuances.

The sales tax in Minneapolis is primarily governed by the state of Minnesota, which sets the baseline tax rate. However, the city and county of Minneapolis also impose additional taxes, resulting in a combined rate that can vary depending on the specific location within the city.

As of my last update in January 2023, the state sales tax rate in Minnesota is 6.875%. This rate is applicable to most retail sales, including tangible personal property and certain services. However, it's important to note that the state tax rate is subject to change, and periodic updates should be monitored for accuracy.

City and County Taxes: Adding to the Mix

On top of the state sales tax, Minneapolis imposes a city sales tax of 0.5%. This additional tax is specifically allocated to fund city services and initiatives. Hennepin County, where Minneapolis is located, also applies a county sales tax of 0.25%. These local taxes contribute to the overall sales tax burden in the city.

When shopping in Minneapolis, consumers can expect to pay a total sales tax rate that combines the state, city, and county taxes. As of my knowledge cutoff, the combined rate stands at 7.625%, creating a significant impact on the prices of goods and services.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 6.875% |

| City Sales Tax (Minneapolis) | 0.5% |

| County Sales Tax (Hennepin) | 0.25% |

| Total Sales Tax | 7.625% |

It's important to note that sales tax rates can vary across different cities and counties within Minnesota. For instance, neighboring cities like St. Paul may have slightly different tax structures. Therefore, it is advisable to consult local resources or tax authorities for the most accurate and up-to-date information regarding sales tax rates.

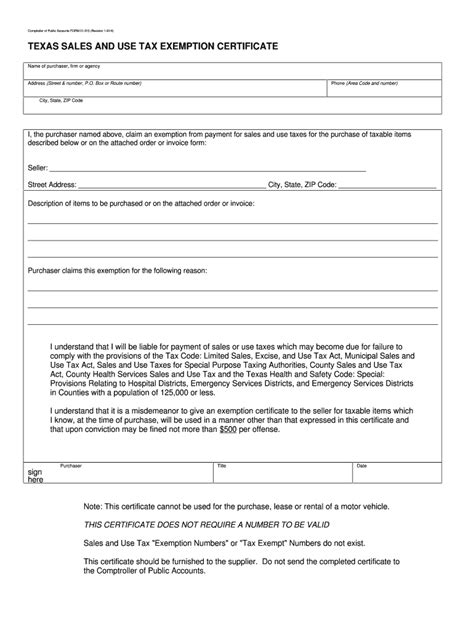

Sales Tax Exemptions: Navigating the Fine Print

While sales tax is a common burden for most goods and services, there are certain categories that are exempt from taxation in Minneapolis. These exemptions are designed to alleviate the tax burden on specific industries, promote economic growth, or provide relief to certain sectors of the population.

Groceries and Food Exemptions

One notable exemption in Minneapolis is the exclusion of certain food items from sales tax. Groceries, including staple foods like bread, milk, and eggs, are generally exempt from sales tax. This exemption aims to ensure that essential food items remain affordable for all residents.

However, it's crucial to understand the fine print when it comes to food exemptions. Prepared foods, such as meals from restaurants or takeout services, are typically subject to sales tax. Additionally, certain food items that are considered non-essential or luxury items may also be taxed.

Clothing and Footwear Exemptions

Another exemption that benefits Minneapolis residents is the exclusion of clothing and footwear from sales tax. Items of apparel, including shoes, are exempt from sales tax up to a certain threshold. This exemption is especially beneficial for families and individuals who rely on affordable clothing options.

The threshold for clothing and footwear exemptions can vary based on state and local regulations. In Minnesota, as of my knowledge cutoff, clothing and footwear items under $130 are exempt from sales tax. Items exceeding this threshold may be subject to taxation.

Other Exemptions and Special Cases

Beyond groceries and clothing, there are various other sales tax exemptions in Minneapolis. These include exemptions for prescription medications, medical devices, educational materials, and certain agricultural products. These exemptions aim to support specific industries and provide financial relief to targeted sectors.

It's essential to stay informed about the specific exemptions and their applicability. Local tax authorities and government websites often provide detailed guidelines and resources to help businesses and consumers understand their rights and obligations regarding sales tax exemptions.

The Impact of Sales Tax on the Minneapolis Economy

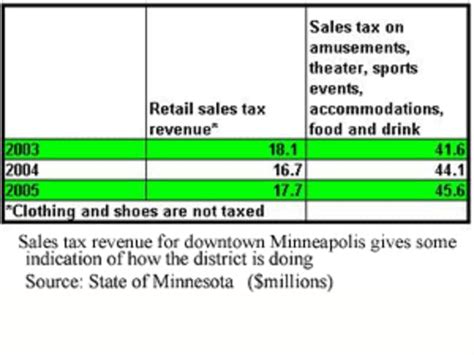

Sales tax plays a significant role in shaping the economic landscape of Minneapolis. The revenue generated from sales tax contributes to funding various city projects, infrastructure development, and public services. It also influences consumer behavior and business strategies.

Revenue Generation and City Development

The sales tax collected in Minneapolis is a substantial source of revenue for the city. This revenue is allocated to support a wide range of public services and initiatives, including education, public safety, transportation, and cultural programs. It ensures the continued development and improvement of the city’s infrastructure and amenities.

For instance, the sales tax revenue may be utilized to fund road repairs, upgrade public transportation systems, enhance public parks, or support local arts and cultural organizations. It contributes to the overall well-being and livability of the city, making it an attractive place to live, work, and visit.

Consumer Behavior and Business Strategies

The sales tax rate can significantly impact consumer behavior and business operations in Minneapolis. A higher sales tax rate may encourage consumers to make purchasing decisions based on tax considerations, potentially influencing their choice of shopping destinations.

Businesses, on the other hand, may need to strategize their pricing and marketing approaches to account for the sales tax. They may need to absorb a portion of the tax to remain competitive or pass it on to consumers through slightly higher prices. Additionally, businesses may explore tax-free weekends or promotions to attract customers and boost sales.

The sales tax landscape also influences the development of e-commerce and online shopping in Minneapolis. With the rise of online retail, businesses must navigate the complexities of sales tax compliance, ensuring they collect and remit taxes appropriately.

Looking Ahead: Future Trends and Implications

As the economy and technology continue to evolve, the sales tax landscape in Minneapolis is likely to undergo changes and adaptations. Staying informed about these trends is crucial for businesses and consumers to navigate the future effectively.

The Rise of E-Commerce and Remote Sales

The growth of e-commerce and remote sales platforms has presented new challenges and opportunities for sales tax collection. As more consumers opt for online shopping, businesses must ensure compliance with sales tax regulations, regardless of the sales channel.

Minneapolis, like many other cities, may need to adapt its sales tax policies to accommodate the changing retail landscape. This could involve exploring innovative approaches to tax collection, such as implementing a streamlined sales tax system or enhancing collaboration between online platforms and local tax authorities.

Potential Tax Reform and Simplification

The complex web of sales tax rates and exemptions in Minneapolis has sparked discussions about tax reform and simplification. Simplifying the tax structure could provide clarity and ease the tax compliance burden for businesses, especially small and medium-sized enterprises.

While tax reform is a complex and multifaceted process, it offers the potential to create a more transparent and efficient tax system. This could involve standardizing tax rates across different jurisdictions, streamlining exemption processes, or adopting modern tax collection technologies.

Impact on Local Businesses and Economic Growth

The future of sales tax in Minneapolis will have a direct impact on the city’s business community and overall economic growth. A well-designed and fair sales tax system can foster a conducive business environment, attracting investments and promoting entrepreneurship.

On the other hand, excessive or burdensome sales taxes could hinder economic growth and make it challenging for businesses to thrive. Finding the right balance between revenue generation and business competitiveness is crucial for the long-term prosperity of the city.

Stay Informed and Adapt to Change

In a rapidly changing economic landscape, staying informed about sales tax regulations and trends is essential for both businesses and consumers. Monitoring updates from local tax authorities, government websites, and industry resources can provide valuable insights into the evolving sales tax landscape.

Businesses should actively engage with tax professionals and consult relevant resources to ensure compliance and strategic decision-making. Consumers, on the other hand, can make more informed purchasing choices by understanding the sales tax implications and seeking out tax-free opportunities.

What is the current sales tax rate in Minneapolis, including all applicable taxes?

+As of my knowledge cutoff, the total sales tax rate in Minneapolis is 7.625%, including the state, city, and county taxes. However, it’s important to stay updated, as tax rates can change periodically.

Are there any sales tax holidays in Minneapolis, and what items are typically exempt during these periods?

+Yes, Minnesota, including Minneapolis, has sales tax holidays for specific items. These holidays usually exempt certain categories like clothing, school supplies, and energy-efficient appliances. Check the official state website for the latest information.

How can businesses stay compliant with sales tax regulations in Minneapolis?

+Businesses should register with the Minnesota Department of Revenue, collect and remit sales tax accurately, and stay updated on tax rate changes. Consulting tax professionals or using sales tax software can ensure compliance and reduce errors.

Are there any online resources for businesses to calculate sales tax accurately in Minneapolis?

+Yes, the Minnesota Department of Revenue provides a sales tax calculator on its website. This tool helps businesses and consumers estimate the sales tax on a purchase based on the item’s location.

What happens if a business fails to collect and remit sales tax in Minneapolis?

+Businesses that fail to comply with sales tax regulations may face penalties, interest charges, and legal consequences. It’s crucial for businesses to understand their obligations and seek guidance if needed.