Texas Tax Exempt Form Pdf

In the state of Texas, businesses and individuals may be eligible for tax exemptions under certain conditions. The Texas Comptroller of Public Accounts is responsible for administering tax laws and regulations, including the issuance of tax exemption certificates and forms. This article will delve into the specifics of the Texas Tax Exempt Form, providing an in-depth analysis of its purpose, requirements, and implications.

Understanding the Texas Tax Exempt Form

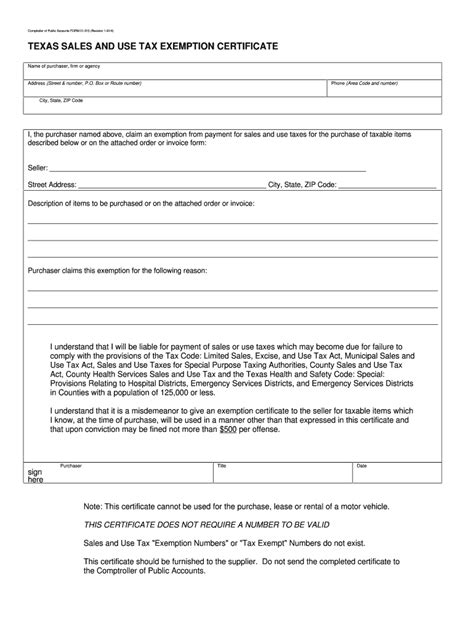

The Texas Tax Exempt Form, also known as Form 01-196, is a critical document for businesses and individuals seeking tax exemption status. This form serves as an official declaration of eligibility for specific tax exemptions, allowing qualified entities to avoid certain taxes or receive refunds for overpaid taxes.

The Texas Comptroller's office provides this form in PDF format, enabling taxpayers to download, complete, and submit it electronically or via traditional mail. The form's primary purpose is to facilitate the application process for tax exemptions and ensure compliance with Texas tax laws.

Eligibility Criteria

Eligibility for tax exemptions in Texas varies depending on the type of tax and the entity’s circumstances. Here are some common eligibility criteria:

- Sales and Use Tax Exemption: Entities may qualify for sales and use tax exemption if they are government agencies, certain nonprofit organizations, or businesses engaged in specific activities, such as manufacturing or agriculture.

- Property Tax Exemption: Property tax exemptions are available for homeowners, veterans, senior citizens, and individuals with disabilities. Eligibility often depends on factors like income, property value, and residency.

- Franchise Tax Exemption: Franchise tax exemptions are granted to certain nonprofit organizations, religious organizations, and governmental entities.

- Fuel Tax Exemption: Fuel tax exemptions are offered to government agencies, public transportation providers, and certain nonprofit organizations.

It's important to note that the eligibility criteria can be complex and may vary based on specific circumstances and tax laws. Taxpayers should carefully review the instructions provided with the tax exempt form and consult with tax professionals or the Texas Comptroller's office for clarification.

Form Requirements and Instructions

The Texas Tax Exempt Form requires detailed information about the taxpayer’s identity, type of exemption sought, and supporting documentation. Here’s a breakdown of the key requirements:

- Taxpayer Information: The form requests basic information about the taxpayer, including name, address, taxpayer identification number (TIN), and contact details.

- Exemption Type: Taxpayers must clearly indicate the type of tax exemption they are applying for, such as sales and use tax, property tax, or franchise tax.

- Reason for Exemption: The form requires a detailed explanation of why the taxpayer believes they qualify for the specific tax exemption. This section may involve describing the nature of the business, organization, or personal circumstances.

- Supporting Documentation: Depending on the exemption type, taxpayers may need to attach additional documents to support their claim. This could include copies of licenses, permits, organizational charters, or other relevant records.

- Signature and Certification: The form must be signed by an authorized representative of the taxpayer. By signing, the taxpayer certifies that the information provided is true and accurate to the best of their knowledge.

The Texas Comptroller's office provides comprehensive instructions alongside the tax exempt form, guiding taxpayers through the completion process. These instructions often include examples, tips, and clarifications to ensure accurate and complete submissions.

The Impact of Tax Exemptions

Tax exemptions can have significant financial implications for businesses and individuals. Here’s a closer look at the potential impact:

Financial Benefits

Tax exemptions offer taxpayers the opportunity to reduce their tax liabilities or receive refunds for overpaid taxes. For businesses, tax exemptions can improve cash flow, increase profitability, and provide a competitive advantage. Individuals may benefit from reduced tax burdens, allowing them to allocate more resources toward personal goals or investments.

For example, a qualified nonprofit organization may be exempt from sales and use tax on purchases made for their operations. This exemption can result in substantial savings, as nonprofit entities often rely on limited resources to carry out their missions.

Compliance and Record-Keeping

While tax exemptions provide financial benefits, they also come with certain responsibilities. Taxpayers must comply with the requirements outlined in the tax exempt form and maintain proper records to support their exemption status.

Businesses, in particular, may need to establish internal controls and procedures to ensure compliance with tax laws. This includes accurately tracking exempt and taxable transactions, maintaining proper documentation, and regularly reviewing their tax obligations.

Failure to comply with tax exemption requirements can result in penalties, interest charges, and revocation of the exemption status. Therefore, taxpayers should carefully review the instructions and seek professional advice if needed.

Economic Impact and Policy Considerations

Tax exemptions are a crucial tool for policymakers to influence economic activity and achieve specific goals. By offering tax incentives, the state of Texas can encourage economic growth, job creation, and support for targeted industries or communities.

For instance, sales and use tax exemptions for manufacturing businesses can stimulate investment in the sector, leading to increased production, job opportunities, and economic development. Similarly, property tax exemptions for homeowners can alleviate financial burdens, particularly for vulnerable populations, and promote homeownership.

However, tax exemptions also have implications for government revenue and budget allocations. Policymakers must carefully consider the trade-offs and potential impacts on state finances when designing and implementing tax exemption programs.

The Future of Tax Exemptions in Texas

Tax exemption policies are subject to change as economic conditions, political priorities, and tax laws evolve. The Texas Comptroller’s office periodically reviews and updates tax exemption guidelines to ensure compliance with state laws and reflect changes in the tax landscape.

As technology advances, the state of Texas may explore digital solutions to streamline the tax exemption process. Online platforms and electronic filing systems could enhance efficiency, reduce paperwork, and improve access to tax information and resources.

Additionally, the state may consider expanding or modifying existing tax exemption programs to address emerging economic challenges or support specific industries. This could involve targeting tax incentives toward green energy initiatives, small businesses, or sectors impacted by economic downturns.

Staying informed about tax exemption policies and engaging with the Texas Comptroller's office can help taxpayers understand their rights and responsibilities and ensure they maximize the benefits of tax exemptions.

Frequently Asked Questions

What happens if I submit an incomplete or incorrect tax exempt form?

+Submitting an incomplete or incorrect tax exempt form can result in delays in processing your application or even denial of your exemption request. It is essential to carefully review the form instructions and ensure that all required information is provided accurately. If you have any doubts or questions, it is advisable to seek guidance from a tax professional or contact the Texas Comptroller’s office for clarification.

Are there any penalties for claiming a tax exemption incorrectly?

+Yes, claiming a tax exemption incorrectly can lead to penalties and interest charges. It is crucial to understand the eligibility criteria and ensure that you meet the requirements before claiming any tax exemption. Falsely claiming an exemption can result in legal consequences and damage your reputation. If you are unsure about your eligibility, it is best to consult with a tax professional or seek guidance from the Texas Comptroller’s office.

How often do tax exemption policies change in Texas?

+Tax exemption policies in Texas can change periodically, typically in response to economic conditions, legislative changes, or administrative updates. It is essential to stay informed about any updates or modifications to tax exemption guidelines. The Texas Comptroller’s office regularly publishes updates and announcements regarding tax laws and regulations. By staying informed, taxpayers can ensure they are aware of any changes that may impact their tax obligations or exemption status.

In conclusion, the Texas Tax Exempt Form is a crucial tool for businesses and individuals seeking tax exemption status. By understanding the eligibility criteria, completing the form accurately, and staying informed about tax policies, taxpayers can maximize the benefits of tax exemptions and comply with Texas tax laws. Remember, tax exemptions offer financial advantages but also come with responsibilities, so careful consideration and professional guidance are essential.