Sales Tax On A Car In Va

Understanding sales tax on a car purchase is crucial when buying a vehicle in the state of Virginia. The sales tax rate in Virginia varies depending on the locality, with a statewide minimum of 4.3% and additional local taxes that can push the rate higher. This variation in sales tax rates across the state can significantly impact the overall cost of your car purchase, so it's essential to have a clear understanding of how it works and how to calculate it accurately.

Sales Tax Rates and Locality-Based Differences

Virginia operates a unique sales tax system where the state sales tax is combined with a locality-specific tax rate, resulting in a total sales tax percentage that can vary from one city or county to another. This is in contrast to some other states where a uniform sales tax rate is applied statewide.

The state sales tax rate in Virginia is currently set at 4.3%. However, local jurisdictions are allowed to add their own sales taxes, which can range from 0% to 4.7%, depending on the specific locality. This additional local tax is often referred to as the locality tax rate or local tax rate. When purchasing a car, this locality-specific tax is added to the 4.3% state sales tax, resulting in a total sales tax rate that can be as high as 9% in certain areas.

| Locality | Local Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Arlington County | 1% | 5.3% |

| Fairfax County | 4.7% | 9% |

| Loudoun County | 1% | 5.3% |

| Prince William County | 4.2% | 8.5% |

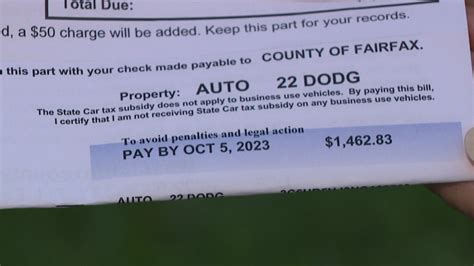

For instance, if you're buying a car in Fairfax County, you'd be subject to a total sales tax rate of 9%, comprising the state sales tax of 4.3% and the local tax rate of 4.7%. On the other hand, if you were purchasing in Arlington County, you'd pay a lower total sales tax rate of 5.3%, made up of the same state tax and a local tax rate of just 1%.

Calculating Sales Tax on a Car Purchase

Calculating the sales tax you’ll owe on your car purchase in Virginia involves a straightforward process. First, determine the total purchase price of your vehicle, including any applicable fees and charges. Then, apply the total sales tax rate for your locality to this purchase price to calculate the sales tax you’ll owe.

Step-by-Step Guide to Calculating Sales Tax

- Determine the Purchase Price: This is the full price of the vehicle, including any additional fees or charges, such as dealer preparation fees, delivery fees, or optional add-ons.

- Find the Local Sales Tax Rate: Look up the specific sales tax rate for the locality where you’re purchasing the vehicle. This information is typically available on the website of the Virginia Department of Taxation or the local government’s website.

- Calculate the Sales Tax: Multiply the purchase price by the sales tax rate. This will give you the amount of sales tax you owe.

- Add the Sales Tax to the Purchase Price: To find the total cost of the vehicle, add the sales tax to the purchase price.

For example, if you're buying a car with a purchase price of $25,000 in Fairfax County, where the total sales tax rate is 9%, you'd calculate the sales tax as follows:

- Sales Tax = Purchase Price x Sales Tax Rate

- Sales Tax = $25,000 x 0.09

- Sales Tax = $2,250

So, in this case, you'd owe $2,250 in sales tax on your car purchase.

Sales Tax Exemptions and Special Cases

While most car purchases in Virginia are subject to sales tax, there are certain situations where you might be exempt from paying sales tax or eligible for a reduced rate.

Exemptions for Certain Vehicle Types

Certain types of vehicles are exempt from sales tax in Virginia. These include:

- Motor vehicles purchased by or for the use of the U.S. government.

- Certain disabled veteran purchases.

- Vehicles used exclusively for farm purposes.

- Certain electric or hybrid vehicles.

Reduced Sales Tax for Certain Buyers

Some buyers in Virginia are eligible for a reduced sales tax rate. These include:

- Active-duty military personnel buying a vehicle in Virginia but stationed out of state. They are eligible for the reduced state sales tax rate of 3%.

- Virginia residents buying a vehicle out of state but bringing it back to Virginia. In this case, they are responsible for paying the Virginia sales tax rate, which includes both the state and locality tax rates.

Vehicle Trade-Ins

If you’re trading in your old vehicle as part of your new car purchase, the value of your trade-in can reduce the purchase price of your new vehicle, which in turn can reduce the amount of sales tax you owe. The exact reduction will depend on the value of your trade-in vehicle and the purchase price of your new vehicle.

Future Implications and Potential Changes

The sales tax landscape in Virginia is subject to change, and keeping up with these changes is essential for accurate financial planning when purchasing a vehicle. While the current system of locality-based sales tax rates provides a degree of flexibility, it also adds complexity for buyers. As such, there have been ongoing discussions and proposals to simplify the system, including suggestions for a uniform sales tax rate across the state or changes to the way local sales taxes are calculated and applied.

One potential future development could involve the state government implementing a new system where the sales tax rate is determined based on the buyer's residence rather than the location of the dealership. This would align more closely with how sales taxes are calculated in many other states. However, such a change would require significant legislative action and could face resistance from localities that currently benefit from higher sales tax rates.

Additionally, with the increasing popularity of online car-buying platforms, there is a growing need for clarity on how sales tax applies to these purchases. Currently, if you buy a car online from an out-of-state dealer and have it delivered to your home in Virginia, you are generally responsible for paying the Virginia sales tax rate. However, as online car sales continue to grow, there may be future discussions and potential legislative changes to address this specific scenario more explicitly.

In conclusion, understanding the sales tax landscape in Virginia is crucial for anyone purchasing a vehicle in the state. By staying informed about the current sales tax rates, potential future changes, and special cases or exemptions, you can make more informed financial decisions and avoid unexpected costs when buying a car.

What is the current state sales tax rate in Virginia for car purchases?

+The current state sales tax rate in Virginia for car purchases is 4.3%.

Are there any localities in Virginia with a 0% local tax rate?

+Yes, there are several localities in Virginia with a 0% local tax rate, which means the total sales tax rate in those areas is just the state rate of 4.3%.

How often are sales tax rates reviewed and updated in Virginia?

+Sales tax rates in Virginia are not updated on a regular schedule. Changes typically occur when a locality decides to adjust its tax rate, which can happen at any time. It’s always a good idea to check the latest rates before making a significant purchase.