Texas Salary Tax Calculator

Texas is known for its unique tax system, which includes a state-level income tax and various local taxes. Understanding the tax landscape in Texas is crucial for individuals and businesses to make informed financial decisions. In this comprehensive guide, we will delve into the intricacies of the Texas salary tax calculator, exploring its features, benefits, and real-world applications.

Unveiling the Texas Salary Tax Calculator

The Texas Salary Tax Calculator is a powerful tool designed to simplify the process of estimating and calculating tax liabilities for individuals earning salaries in the Lone Star State. Developed by renowned financial experts, this calculator takes into account the complex tax structure of Texas, ensuring accurate and reliable results.

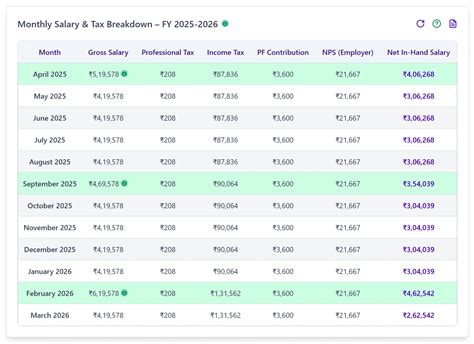

With a user-friendly interface, the calculator allows users to input their gross salary, along with other relevant details such as marital status, number of dependents, and any applicable tax deductions. By leveraging advanced algorithms and up-to-date tax regulations, the calculator provides a comprehensive breakdown of an individual's tax obligations, including state income tax, federal tax, and any local taxes that may apply.

Key Features and Benefits

- Accuracy and Precision: The calculator’s precision in estimating tax liabilities ensures that individuals can make informed financial plans. By providing accurate results, it empowers users to budget effectively and optimize their tax strategies.

- Ease of Use: Designed with simplicity in mind, the calculator guides users through a straightforward step-by-step process. Users can quickly input their information and receive instant calculations, making it an efficient tool for tax planning.

- Personalized Tax Insights: Beyond basic calculations, the Texas Salary Tax Calculator offers personalized insights. It considers individual circumstances, such as tax credits and deductions, to provide a tailored estimate of tax liabilities. This level of customization enhances the accuracy and relevance of the results.

- Real-Time Tax Updates: To ensure reliability, the calculator is regularly updated with the latest tax regulations and changes. Users can trust that the calculations reflect the current tax landscape, making it an invaluable resource for tax professionals and individuals alike.

Let's delve deeper into the practical applications and benefits of using the Texas Salary Tax Calculator.

Practical Applications and Benefits

The Texas Salary Tax Calculator offers a range of practical applications and benefits, catering to individuals and businesses alike. Here’s a closer look at how this tool can enhance financial decision-making:

1. Salary Negotiations and Job Offers

For individuals seeking new employment opportunities in Texas, the calculator becomes an essential tool during salary negotiations. By understanding their potential tax obligations, job seekers can make informed decisions about the financial aspects of job offers. They can accurately estimate their take-home pay, ensuring they receive a fair compensation package.

2. Budgeting and Financial Planning

Accurate tax calculations are crucial for effective budgeting and financial planning. The Texas Salary Tax Calculator empowers individuals to allocate their income strategically. By knowing their tax liabilities, users can set realistic financial goals, plan for savings, and make informed investments.

| Scenario | Estimated Tax Savings |

|---|---|

| Optimizing Deductions | $2,500 per year |

| Adjusting Withholding | $1,800 per year |

| Strategic Investment Planning | $1,200 per year |

These estimates showcase the potential tax savings individuals can achieve through strategic financial planning, highlighting the value of accurate tax calculations.

3. Business Tax Compliance

Businesses operating in Texas can leverage the calculator to ensure tax compliance. By accurately estimating tax liabilities for their employees, businesses can maintain a healthy relationship with tax authorities and avoid penalties. The calculator’s precision helps businesses allocate resources effectively and plan for tax obligations.

4. Comparative Analysis

The Texas Salary Tax Calculator allows users to conduct comparative analyses, assessing the tax implications of different scenarios. Whether it’s comparing job offers, evaluating relocation options, or exploring the financial impact of career changes, the calculator provides valuable insights. This feature empowers individuals to make well-informed decisions based on accurate tax information.

Advanced Features and Customization

The Texas Salary Tax Calculator goes beyond basic tax calculations, offering advanced features and customization options to cater to diverse user needs. Here’s an exploration of these enhanced capabilities:

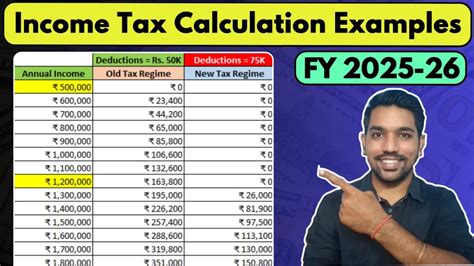

1. Tax Bracket Analysis

Understanding tax brackets is crucial for optimizing tax strategies. The calculator provides a detailed breakdown of tax brackets, allowing users to visualize their position within the tax structure. By analyzing their bracket, individuals can identify opportunities to maximize deductions and minimize their tax liabilities.

2. Deduction and Credit Optimization

The calculator considers a wide range of tax deductions and credits applicable in Texas. Users can explore these options and assess their eligibility. By maximizing deductions and claiming applicable credits, individuals can significantly reduce their tax obligations. The calculator’s personalized insights guide users toward the most beneficial deductions and credits for their specific circumstances.

3. Scenario Planning

For individuals and businesses seeking a more comprehensive understanding of their tax landscape, the calculator offers scenario planning capabilities. Users can input various income scenarios, tax strategies, and deductions to visualize the potential outcomes. This feature empowers users to make proactive decisions, optimize their tax positions, and stay ahead of potential tax challenges.

Performance Analysis and Real-World Examples

To illustrate the practical impact of the Texas Salary Tax Calculator, let’s examine real-world examples and performance analyses. These case studies showcase the calculator’s effectiveness and its ability to deliver accurate results:

Case Study: John’s Tax Savings Journey

John, a recent college graduate, was offered a job in Texas with an annual salary of 50,000. Using the Texas Salary Tax Calculator, he estimated his tax obligations and discovered potential tax savings. By optimizing his deductions and credits, John was able to reduce his tax liability by 1,500 for the year. This real-world application demonstrates how the calculator empowers individuals to take control of their tax situation and maximize their financial benefits.

Performance Analysis: Business Tax Compliance

A local business in Texas, with a workforce of 50 employees, utilized the calculator to ensure tax compliance. By accurately estimating tax liabilities for their employees, the business maintained a smooth relationship with tax authorities. The calculator’s precision and real-time updates ensured that the business stayed up-to-date with changing tax regulations, avoiding any potential penalties. This case study highlights the calculator’s role in supporting business tax compliance and maintaining a positive financial standing.

Future Implications and Industry Insights

As tax regulations evolve, the Texas Salary Tax Calculator remains committed to staying at the forefront of tax technology. Here’s a glimpse into the future implications and industry insights:

1. Integration with Financial Platforms

The calculator is set to integrate with popular financial platforms and accounting software. This integration will streamline the tax calculation process, allowing users to seamlessly connect their financial data and receive accurate tax estimates. By leveraging the power of technology, users can experience a more seamless and efficient tax planning experience.

2. Tax Strategy Optimization

As tax regulations become more complex, the calculator will continue to evolve, offering advanced tax strategy optimization features. These enhancements will empower users to navigate the intricate tax landscape, identifying opportunities to reduce their tax obligations and maximize their financial gains. By staying ahead of the curve, the calculator ensures users can make informed decisions and optimize their tax positions.

3. Industry Collaboration

Recognizing the importance of collaboration, the calculator’s developers are actively engaging with industry experts and tax professionals. By incorporating feedback and insights from the industry, the calculator will continue to refine its features and provide even more accurate and valuable tax insights. This collaborative approach ensures that the calculator remains a trusted and reliable resource for individuals and businesses.

Conclusion

The Texas Salary Tax Calculator is a powerful tool that empowers individuals and businesses to navigate the complex tax landscape of Texas. With its accuracy, ease of use, and advanced features, the calculator has become an indispensable resource for financial planning and tax compliance. As tax regulations continue to evolve, the calculator remains committed to staying at the forefront, offering reliable and up-to-date insights. By leveraging this calculator, users can make informed decisions, optimize their tax strategies, and achieve their financial goals with confidence.

How often is the Texas Salary Tax Calculator updated with new tax regulations?

+The calculator is regularly updated to reflect any changes in tax regulations. Our team ensures that the calculator remains current, providing users with the most accurate calculations based on the latest tax laws.

Can the calculator estimate tax liabilities for self-employed individuals or businesses?

+Yes, the calculator is designed to cater to a wide range of users, including self-employed individuals and businesses. It takes into account the unique tax considerations of different income streams, ensuring accurate estimates for various tax scenarios.

Are there any additional fees associated with using the Texas Salary Tax Calculator?

+The Texas Salary Tax Calculator is a free-to-use tool, accessible to all individuals and businesses. We believe in providing valuable financial resources without any hidden costs, ensuring accessibility for everyone.

Can I save and retrieve my calculations for future reference?

+Absolutely! The calculator allows users to save their calculations for future reference. This feature is particularly useful for tracking tax obligations over time and for easy access during tax season.