Yolo County Tax Collector

The Yolo County Tax Collector's Office plays a vital role in the financial ecosystem of Yolo County, California, by efficiently managing and collecting various forms of taxation to fund essential public services and infrastructure. This article delves into the functions, services, and impact of the Yolo County Tax Collector, shedding light on its operations and the benefits it brings to the community.

Understanding the Role of the Yolo County Tax Collector

The Yolo County Tax Collector’s Office is a crucial governmental entity responsible for the collection and administration of taxes within the county. This office acts as a financial intermediary between the residents and businesses of Yolo County and the local government, ensuring that the necessary funds are generated to support public projects and maintain the county’s infrastructure.

The primary mission of the Yolo County Tax Collector is to provide efficient, effective, and friendly service to taxpayers while ensuring compliance with state and local tax laws. This involves collecting various types of taxes, such as property taxes, vehicle registration fees, and other special assessments, and managing these funds in a transparent and accountable manner.

Key Responsibilities and Services

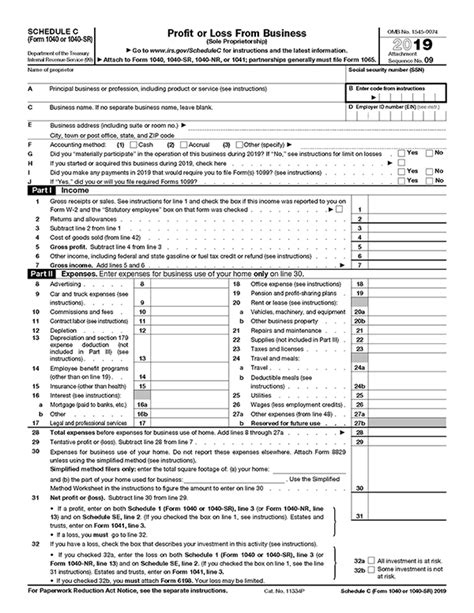

- Property Tax Collection: The tax collector’s office is responsible for assessing and collecting property taxes, which are a significant source of revenue for local governments. This involves sending out tax bills, receiving payments, and managing delinquencies.

- Vehicle Registration and Titling: Residents of Yolo County rely on the tax collector’s office for vehicle registration and titling services. This includes issuing vehicle registration stickers, processing title transfers, and handling related paperwork.

- Special Assessments and Fees: The office also collects various special assessments and fees, such as business license fees, hotel taxes, and other county-specific levies, ensuring that these funds are allocated appropriately.

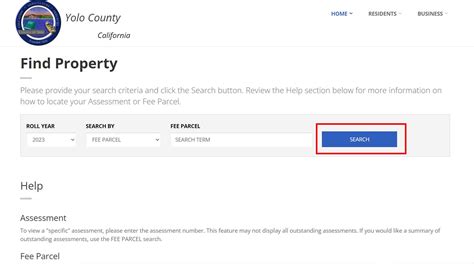

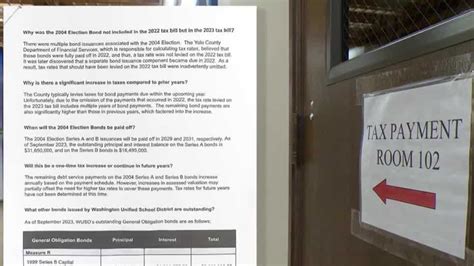

- Tax Payment Options: The tax collector’s office offers a range of payment methods to cater to different taxpayer needs, including online payments, in-person payments at the office, and payment by mail.

- Tax Assistance and Education: The office provides valuable resources and guidance to taxpayers, offering assistance with tax-related queries, explaining tax laws and regulations, and promoting compliance through educational initiatives.

A Comprehensive Overview of Services

The Yolo County Tax Collector’s Office provides a wide array of services to ensure that taxpayers can fulfill their obligations efficiently and conveniently. Here’s a detailed breakdown of these services:

Property Tax Administration

Property taxes are a cornerstone of local government funding, and the tax collector’s office plays a pivotal role in this process. Key aspects of property tax administration include:

- Assessment and Billing: The office assesses the value of properties within Yolo County and sends out tax bills to property owners. This process is intricate, involving the consideration of various factors such as property size, improvements, and market trends.

- Payment Options: Taxpayers have several payment options, including online payments through secure platforms, payment by mail, or in-person payments at the tax collector’s office. The office also offers flexible payment plans for those who require it.

- Appeals and Disputes: Property owners have the right to appeal their property assessments if they believe the valuation is inaccurate. The tax collector’s office provides guidance and support throughout this process, ensuring that property owners’ rights are respected.

- Delinquent Tax Collection: In cases where property taxes are not paid on time, the tax collector’s office initiates collection procedures, which may include penalties, interest charges, and, in extreme cases, tax sales.

Vehicle Registration and Titling

Vehicle registration and titling services are essential for maintaining road safety and ensuring that vehicles are properly documented. The tax collector’s office manages these services as follows:

- Registration Renewals: Residents can renew their vehicle registrations at the tax collector’s office or online. This process involves verifying the vehicle’s information, ensuring it meets safety standards, and collecting the appropriate fees.

- Title Transfers: When a vehicle is sold or gifted, the tax collector’s office facilitates the transfer of ownership by issuing new titles. This process ensures that the appropriate taxes and fees are paid and that the new owner receives a valid title certificate.

- Registration for New Residents: New residents to Yolo County can register their vehicles at the tax collector’s office. This process involves verifying the vehicle’s details, collecting the necessary fees, and issuing registration stickers and plates.

- Special Registration Types: The office also handles specialized vehicle registrations, such as for antique cars, classic cars, and vehicles used for commercial purposes.

Other Tax-Related Services

Beyond property and vehicle-related taxes, the Yolo County Tax Collector’s Office offers a range of additional services to cater to various taxpayer needs:

- Business Taxes: The office collects business license fees and other business-related taxes, ensuring that local businesses contribute to the county’s revenue stream.

- Hotel Taxes: Hotels and other lodging establishments pay a percentage of their revenue as a tax, which is collected and administered by the tax collector’s office.

- Special Assessments: Yolo County may impose special assessments for specific projects or services, such as flood control or infrastructure improvements. The tax collector’s office manages the collection and distribution of these funds.

- Taxpayer Assistance: The office provides comprehensive assistance to taxpayers, offering guidance on tax forms, payment methods, and tax laws. This service is particularly valuable for new residents or those facing complex tax situations.

The Impact on Yolo County’s Economy and Infrastructure

The work of the Yolo County Tax Collector’s Office has a profound impact on the county’s economic health and the development of its infrastructure. Here’s how:

Funding Essential Services

Tax revenues collected by the office fund a wide range of essential services and public projects. These include:

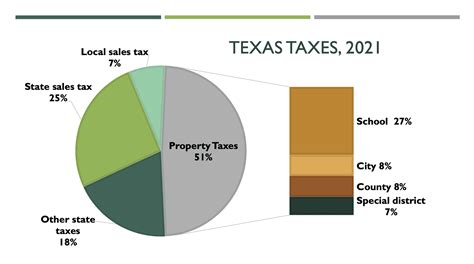

- Education: Property taxes contribute significantly to funding local schools, ensuring that students have access to quality education.

- Public Safety: Revenue from taxes supports the county’s police, fire, and emergency services, enhancing public safety and security.

- Infrastructure Maintenance: Funds collected are used to maintain and improve roads, bridges, and other critical infrastructure, ensuring the county’s transportation network remains efficient and safe.

- Social Services: Tax revenue helps finance social programs that support vulnerable populations, such as healthcare services, food assistance, and housing programs.

Economic Growth and Development

The efficient collection and administration of taxes by the Yolo County Tax Collector’s Office contribute to the county’s economic growth and development in several ways:

- Attracting Businesses: A well-run tax system that is transparent and efficient can be a significant factor in attracting businesses to the county. Businesses appreciate a streamlined tax process and fair tax rates, which can contribute to their bottom line.

- Stimulating Local Economy: The taxes collected are reinvested into the local economy, supporting local businesses and creating a thriving business environment. This, in turn, leads to job creation and economic growth.

- Encouraging Property Development: Effective tax collection and management can encourage property development and investment, as developers and homeowners are assured that their tax contributions are being utilized efficiently for the betterment of the community.

Community Engagement and Trust

The Yolo County Tax Collector’s Office plays a pivotal role in fostering community engagement and trust. Through its taxpayer assistance programs, educational initiatives, and transparent tax administration, the office:

- Builds Trust: By providing clear and accessible information, the office ensures that taxpayers understand their obligations and rights, leading to increased trust in the tax system.

- Engages the Community: Through outreach programs and community events, the office encourages taxpayers to participate in the tax process, fostering a sense of community and collective responsibility.

- Promotes Transparency: The office’s commitment to transparency in tax collection and management ensures that taxpayers can track where their tax dollars are being spent, enhancing trust in local government.

Conclusion: The Future of Taxation in Yolo County

The Yolo County Tax Collector’s Office is a cornerstone of the county’s financial and administrative landscape. Its commitment to efficiency, transparency, and taxpayer assistance ensures that the tax system remains fair and accessible to all. As Yolo County continues to grow and evolve, the tax collector’s office will play an increasingly vital role in funding public services and infrastructure, shaping the county’s future, and contributing to its economic prosperity.

Frequently Asked Questions

What are the office hours for the Yolo County Tax Collector’s Office?

+The office is typically open from 8:00 a.m. to 5:00 p.m., Monday through Friday. However, it’s always best to check the official website or call the office for the most up-to-date information, especially during holiday periods or for special circumstances.

How can I pay my property taxes in Yolo County?

+You have several options for paying your property taxes in Yolo County. You can pay online through the tax collector’s website, by mail using a check or money order, or in person at the tax collector’s office. Additionally, the office may offer payment plans for those who need more flexible options.

What happens if I miss the deadline to pay my property taxes?

+If you miss the deadline to pay your property taxes, you may be subject to penalties and interest charges. It’s essential to contact the Yolo County Tax Collector’s Office as soon as possible to discuss your options and avoid further consequences. The office may be able to offer a payment plan or other assistance.

How can I obtain a duplicate copy of my vehicle registration or title in Yolo County?

+If you need a duplicate copy of your vehicle registration or title, you can visit the Yolo County Tax Collector’s Office in person and complete the necessary paperwork. Alternatively, you may be able to request a duplicate online through the official website, depending on your specific situation and the requirements.

Are there any tax assistance programs available for low-income residents in Yolo County?

+Yes, Yolo County offers various tax assistance programs for low-income residents. These programs may provide reduced tax rates, waivers, or other forms of financial relief. To find out more about these programs and eligibility requirements, contact the Yolo County Tax Collector’s Office or visit their website for detailed information.