Property Tax Idaho

Welcome to a comprehensive guide on the intricacies of property tax in the state of Idaho. This article aims to provide an in-depth understanding of how property taxes work in Idaho, shedding light on the unique aspects of the state's tax system and offering practical insights for homeowners and prospective buyers.

Understanding Property Tax in Idaho

Idaho, much like other states in the US, relies on property taxes as a significant source of revenue for local governments. These taxes fund vital services such as schools, fire protection, roads, and more. The property tax system in Idaho is designed to be fair and equitable, ensuring that homeowners contribute to the community’s development and maintenance.

The state's property tax system is governed by the Idaho State Tax Commission, which sets guidelines and provides oversight to ensure consistency across counties. However, each county has a degree of autonomy in implementing these guidelines, leading to some variations in tax rates and assessment methods.

The Property Tax Assessment Process

In Idaho, the property tax assessment process is an annual affair. Here’s a step-by-step breakdown of how it works:

-

Property Valuation: The first step is to determine the value of the property. In Idaho, this is typically done by the county assessor's office. They assess the property's value based on its market value, taking into account factors like location, size, improvements, and recent sales of similar properties.

-

Taxable Value Calculation: After the property's value is determined, it undergoes a process called "trending" to calculate the taxable value. Trending adjusts the assessed value to account for changes in property values over time. This ensures that properties are taxed at a fair rate relative to each other, even if their assessed values differ significantly.

-

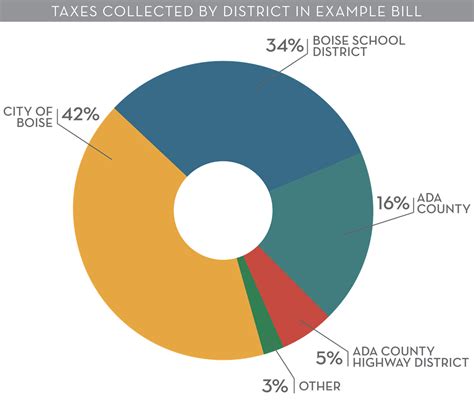

Applying Tax Rates: Once the taxable value is established, the county assessor applies the appropriate tax rate. Tax rates vary by county and can change annually. These rates are set by local governing bodies and are typically a combination of rates for various services like schools, county government, fire protection, and more.

-

Tax Bill Generation: With the taxable value and tax rates determined, the county assessor's office generates a tax bill for the property owner. This bill outlines the total tax due, the tax rate, and the assessment value. It also provides information on payment due dates and any applicable penalties for late payments.

It's important to note that Idaho offers several exemptions and credits to reduce the tax burden for certain property owners. These include homestead exemptions, veterans' exemptions, and property tax reductions for senior citizens.

Property Tax Rates and Variations

Idaho’s property tax rates can vary significantly across counties. As of the latest data, the effective property tax rate (the rate applied to the assessed value of the property) ranges from 0.66% to 1.72% across the state. This variation is influenced by factors such as the cost of living, local budgets, and the demand for public services.

| County | Effective Tax Rate (%) |

|---|---|

| Ada County | 1.09 |

| Bannock County | 1.15 |

| Bingham County | 0.99 |

| Blaine County | 0.83 |

| ... (Remaining counties) | ... |

Property Tax Calculation: A Real-World Example

Let’s walk through a hypothetical scenario to illustrate how property taxes are calculated in Idaho.

The Johnson Family’s Property

Imagine the Johnson family owns a residential property in Ada County, Idaho. Their home has a market value of $350,000. Here’s how their property tax would be calculated:

-

Property Valuation: The Ada County assessor's office determines that the Johnson family's property has a market value of $350,000 based on recent sales of similar homes in the area.

-

Taxable Value Calculation: Using the trending method, the taxable value of the property is calculated to be $280,000. This takes into account the average annual increase in property values in Ada County.

-

Applying Tax Rates: The current tax rate in Ada County is 1.09%. By multiplying the taxable value ($280,000) by the tax rate (0.0109), we get a total tax amount of $3,052.

-

Exemptions and Credits: The Johnson family is eligible for a homestead exemption, which reduces their taxable value by $100,000. This brings their taxable value down to $180,000. Additionally, they qualify for a veterans' exemption, reducing their tax bill by $500.

-

Final Tax Bill: After applying the exemptions, the Johnson family's final tax bill amounts to $1,852. This amount is due annually and is typically split into two payments, with the first installment due in October and the second in March.

Strategies for Managing Property Taxes

While property taxes are a necessary part of homeownership, there are strategies homeowners can employ to manage their tax burden effectively.

Claim Exemptions and Credits

Idaho offers several exemptions and credits to reduce property taxes for eligible homeowners. These include:

- Homestead Exemption: This reduces the taxable value of a primary residence by up to $100,000.

- Veterans' Exemption: Qualifying veterans can receive a reduction in their property taxes.

- Senior Citizen Exemption: Property tax reductions are available for homeowners aged 65 and above.

- Disabled Veterans' Exemption: Certain disabled veterans may be eligible for an exemption.

Appealing Property Assessments

If a homeowner believes their property’s assessed value is too high, they have the right to appeal. This process involves providing evidence to the county assessor’s office to demonstrate that the assessed value is inaccurate. Successful appeals can lead to a reduction in taxable value, resulting in lower property taxes.

Investing in Property Improvements

While it may seem counterintuitive, investing in certain property improvements can actually reduce property taxes. For instance, energy-efficient upgrades or improvements that increase the property’s value but do not increase its size or footprint can often result in a lower assessed value.

The Future of Property Taxes in Idaho

As Idaho continues to grow and develop, the property tax landscape is likely to evolve as well. Here are some key factors to consider for the future:

Population Growth and Development

Idaho’s population is projected to grow significantly in the coming years. This growth will put pressure on local governments to expand services and infrastructure, potentially leading to increased property tax rates to fund these developments.

Changing Tax Policies

Tax policies in Idaho, like in any state, are subject to change. While the current system provides a fair and equitable framework, future legislative changes could impact how property taxes are calculated and collected. Staying informed about these changes is crucial for homeowners.

Technological Advancements

Advancements in technology, such as digital assessment tools and online tax payment systems, are likely to improve the efficiency and accuracy of the property tax system. These innovations can lead to quicker processing times and more transparent tax calculations.

Conclusion

Property taxes are an essential part of Idaho’s fiscal landscape, playing a critical role in funding vital community services. Understanding the intricacies of the property tax system empowers homeowners to make informed decisions and effectively manage their tax obligations. By staying informed and utilizing available strategies, homeowners can ensure they’re contributing fairly to their community while also protecting their financial interests.

How often are property taxes assessed in Idaho?

+Property taxes in Idaho are assessed annually. This means that the value of your property is reviewed each year, and your tax bill is calculated based on the most recent assessment.

Are there any online tools to estimate property taxes in Idaho?

+Yes, several online tools and property tax estimators are available. These tools can provide a rough estimate of your property taxes based on your location and property details. However, it’s important to note that these estimates may not be entirely accurate and should be used as a guide only.

Can I appeal my property tax assessment if I think it’s too high?

+Absolutely! If you believe your property’s assessed value is inaccurate or too high, you have the right to appeal. The process typically involves submitting an appeal to your county assessor’s office and providing evidence to support your claim. It’s advisable to consult a tax professional or seek legal advice for a successful appeal.