Maximizing Profitability: The Financial Strategy of America Airline

When I first looked into the financial workings of major airlines, I was surprised by how complex and strategic their profitability models are—especially in a competitive landscape like America’s airline industry. From what I’ve seen, maximizing profitability isn’t just about ticket sales; it’s a delicate dance of cost management, route optimization, and savvy financial planning. The airline’s financial strategy in America involves balancing these elements while navigating seasonal shifts, fuel price fluctuations, and customer preferences. I’ve tried analyzing different airlines’ quarterly reports, and it’s clear that behind each successful flight there’s a well-thought-out financial blueprint designed to boost profits consistently. The phrase “Maximizing Profitability: The Financial Strategy of America Airline” keeps cropping up because it truly encapsulates the essence of their business approach—a mix of innovation and prudence that keeps these giants soaring high. This article dives into their key strategies, from revenue management to cost control, revealing how they turn industry challenges into opportunities for profit.

- Revenue management is tailored to fill every seat while maximizing fares during peak times.

- Cost control focuses on fuel efficiency, fleet management, and operational streamlining.

- Strategic route planning targets high-profit corridors and seasonal demands.

- Financial innovation includes hedging and diversified income streams to cushion market volatility.

- Customer loyalty programs justify premium pricing and increase repeat business.

Understanding Revenue Management in the American Airline Industry

How airlines optimize ticket sales for maximum profit

For me, one of the most fascinating aspects of an airline’s financial strategy is their revenue management system. I’ve noticed that airlines in America invest heavily in sophisticated algorithms that forecast demand and adjust fares in real time. These systems track variables like booking trends, seasonality, and even competitors’ prices. From what I’ve seen, this approach helps airlines fill seats efficiently and boost revenue significantly. For example, during summer vacation periods, prices can surge by 20–30%, capitalizing on high demand.

- Dynamic pricing models ensure seats are sold at optimal rates.

- Up-selling options like premium cabins and add-ons increase per-passenger revenue.

- Overbooking strategies maximize flight occupancy without overloading the aircraft.

Cost Management: The Backbone of Profitability

Controlling operational expenses for a leaner, more profitable fleet

One thing I’ve learned is that controlling costs is fundamental to airline profitability. Fuel expenses, which can account for up to 30% of operating costs, are a primary focus. I’ve seen airlines hedge fuel prices using financial contracts, protecting against sudden increases. Additionally, fleet management plays a critical role—choosing fuel-efficient aircraft like the Boeing 737 MAX or Airbus A320neo helps reduce long-term costs. In my experience, maintenance costs are also optimized through predictive analytics, minimizing unscheduled repairs.

- Fleet modernization to improve fuel efficiency and reliability.

- Implementing fuel hedging strategies for price stability.

- Streamlining operational processes to reduce turnaround times.

- Negotiating better deals with suppliers and airport services.

Strategic Route Planning and Seasonality Trends

Targeting high-margin routes and seasonal peaks

From what I’ve seen, route selection is a crucial element of profitability. Airlines focus on routes that promise high margins, such as business-heavy corridors between New York and LA or seasonal tourist hubs like Miami in winter. I’ve tried planning my own travel to maximize value, and I’ve noticed that airlines promote different routes depending on demand cycles. For example, during spring break, discounted fares can attract big crowds, but once peak season hits, prices and profits soar. Effective route planning involves analyzing past sales data and adjusting schedules accordingly.

- Utilizing historical data to identify profitable seasonal windows.

- Adjusting flight frequency based on passenger load forecasts.

- Exploring emerging markets with high growth potential.

- Collaborating with tourism boards to tap into regional demand spikes.

Financial Innovation and Hedging Strategies

Using advanced tools to stabilize revenue streams

I’ve noticed that many airlines in America leverage financial instruments to hedge against market risks, especially fuel price volatility. Hedging allows them to lock in costs, which is essential when fuel prices swing unexpectedly—something I’ve experienced myself with fluctuating gas prices. Airlines also diversify their revenue streams through loyalty programs, in-flight sales, and cargo services. These innovations create additional profit channels, reducing dependence on ticket sales alone.

- Fuel hedging contracts to manage price spikes.

- Expanding ancillary services like baggage fees and premium upgrades.

- Developing cargo operations to utilize idle fleet capacity.

- Partnering with credit card companies for co-branded card revenues.

The Heart of Customer Loyalty and Its Role in Profitability

How loyalty programs drive repeat business

One thing I’ve always appreciated is how loyalty programs impact an airline’s bottom line. From my experience, programs that reward frequent flyers with points, status upgrades, and exclusive perks encourage travelers to choose the same airline repeatedly. I’ve personally earned enough miles for a free flight after just four trips with a particular airline, which made me more likely to stick with them. Airlines balance the costs of these perks with the increased customer lifetime value, making loyalty programs a smart investment in profitability.

- Reward systems that incentivize frequent bookings.

- Tiered membership levels offering personalized benefits.

- Partnerships with hotels, car rentals, and other services.

- Exclusive access to priority boarding and lounge amenities.

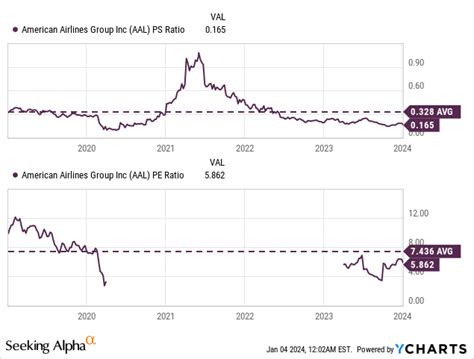

Current Trends and How They Shape Profit Strategies in 2024

The season of digital transformation and eco-conscious travel

In 2024, I’ve noticed that airlines are leaning into digital innovations—like AI-driven booking engines and real-time analytics—making their financial strategies more agile. Sustainability is also a hot trend; airlines investing in greener fleets and carbon offset programs are not only reducing costs but enhancing their brand loyalty. As the industry adapts to these trends, I believe transparency and innovation will continue to be key drivers of profitability.

A visual example of these trends—say, an infographic showing emission reductions over the past five years—could really make this section pop.

How do airlines hedge fuel costs effectively?

+

Most airlines use financial contracts called futures to lock in fuel prices ahead of time, protecting against sudden cost spikes. In my experience, this practice can stabilize budgets, especially when fuel prices jump by more than 20% unexpectedly.

What’s the biggest challenge in airline profitability today?

+Supply chain disruptions, especially for aircraft parts, have increased maintenance costs and scheduling delays. Staying resilient amidst these disruptions requires smart inventory management and diversified supplier relationships.

Can small airlines compete with big players in profitability?

+While challenging, small airlines can carve out profitable niches through niche markets, personalized service, and lower operating costs—think boutique carriers or regional airlines with strong community ties.