Pa Income Tax Filing

Welcome to this comprehensive guide on Pennsylvania's Income Tax Filing, a critical aspect of financial responsibility for residents of the Keystone State. In this expert-level journal article, we'll delve into the intricacies of the process, offering a detailed breakdown of the steps, requirements, and considerations. Whether you're a seasoned taxpayer or new to the world of tax filings, this article aims to provide you with the knowledge and insights needed to navigate the process efficiently and effectively.

Understanding Pennsylvania’s Income Tax System

Pennsylvania’s income tax system is a fundamental component of the state’s fiscal framework, contributing significantly to its economic health and public services. The Pennsylvania Department of Revenue is the governing body responsible for the administration and enforcement of the state’s income tax laws, ensuring compliance and fair taxation across all income levels.

The Pennsylvania Income Tax is a flat-rate tax, currently set at 3.07% for the tax year 2023. This means that, regardless of your income bracket, the tax rate remains the same, making it a straightforward and transparent system for taxpayers. However, it's important to note that this rate is subject to periodic adjustments, so it's essential to stay updated with the latest information.

Key Dates and Deadlines

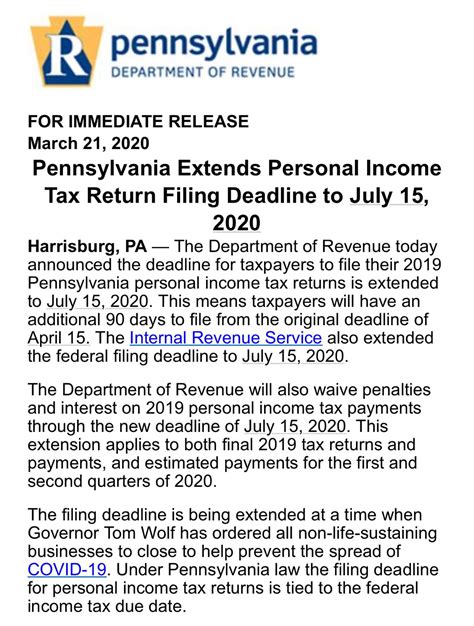

Understanding the crucial dates and deadlines is vital for a smooth tax filing process. The Pennsylvania Income Tax Return is due on April 15th each year, aligning with the federal tax deadline. However, it’s important to be aware of any potential changes due to holidays or other circumstances. For instance, if April 15th falls on a weekend or a public holiday, the deadline may be extended to the following business day.

Additionally, the Pennsylvania Department of Revenue offers an automatic six-month extension for filing income tax returns. This means you have until October 15th to file your return, providing a significant leeway for those who need more time. However, it's crucial to note that this extension is for filing the return, not for paying any taxes owed. Interest and penalties may still apply if you haven't paid your taxes by the original deadline.

| Tax Year | Return Due Date | Extension Deadline |

|---|---|---|

| 2023 | April 15th, 2024 | October 15th, 2024 |

| 2022 | April 18th, 2023 | October 17th, 2023 |

Eligibility and Requirements

Determining your eligibility for filing a Pennsylvania Income Tax Return is the first step in the process. In general, if you are a Pennsylvania resident and have income earned or received from any source within the state, you are required to file a tax return. This includes wages, salaries, tips, bonuses, commissions, interest, dividends, and other forms of income.

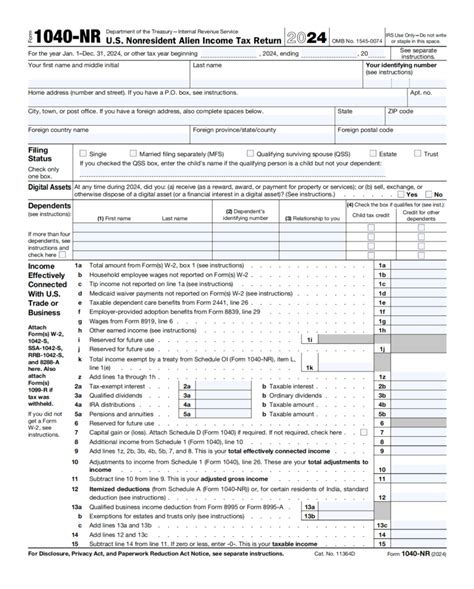

Non-residents who have income from Pennsylvania sources are also required to file a Pennsylvania Income Tax Return. This includes individuals who work in Pennsylvania but reside in another state, or those who own rental properties or businesses in the state. The specific rules and requirements for non-residents can be more complex, so it's advisable to consult the Pennsylvania Tax Guide for Individuals or seek professional advice.

Tax Forms and Documents

To file your Pennsylvania Income Tax Return, you’ll need the appropriate tax forms and documents. The primary form is the PA-40, which is the Pennsylvania Resident Income Tax Return. This form is used to report your income, deductions, and credits. You can obtain this form from the Pennsylvania official forms website or through the Pennsylvania Department of Revenue’s filing resources.

Along with the PA-40, you may also need additional forms and schedules depending on your specific circumstances. For instance, if you have business income or losses, you may need to use the PA-40B (Pennsylvania Partnership Return) or the PA-40X (Pennsylvania Fiduciary Income Tax Return). If you're claiming deductions or credits, you may require forms such as the PA-40-SP (Schedule of Itemized Deductions) or the PA-40-CR (Pennsylvania Tax Credit Claim Form).

| Form Name | Description |

|---|---|

| PA-40 | Pennsylvania Resident Income Tax Return |

| PA-40B | Pennsylvania Partnership Return |

| PA-40X | Pennsylvania Fiduciary Income Tax Return |

| PA-40-SP | Schedule of Itemized Deductions |

| PA-40-CR | Pennsylvania Tax Credit Claim Form |

Preparing Your Tax Return

The process of preparing your Pennsylvania Income Tax Return can be simplified by following a systematic approach. Here’s a step-by-step guide to help you through the process:

- Gather Your Documents: Collect all relevant tax documents, including W-2s, 1099s, interest and dividend statements, and any other income statements. Ensure you have all the necessary information for each source of income.

- Determine Your Filing Status: Decide whether you're filing as a single, married filing jointly, married filing separately, head of household, or qualifying widow(er). This status will impact your tax calculations and potential deductions.

- Calculate Your Income: Total your income from all sources, including wages, salaries, business income, rental income, and any other taxable income. Ensure you understand the difference between gross income and adjusted gross income, as the latter is used for calculating your tax liability.

- Claim Your Deductions and Credits: Review the various deductions and credits you may be eligible for, such as the standard deduction, itemized deductions, personal exemptions, and tax credits. Calculate these amounts and apply them to your tax return to reduce your taxable income and potential tax liability.

- Complete Your Tax Return: Using the PA-40 form and any additional schedules or forms required, fill in all the necessary information. Double-check your calculations and ensure all figures are accurate.

- Review and Sign Your Return: Carefully review your completed tax return for any errors or omissions. Once satisfied, sign and date your return. If you're filing jointly with a spouse, both of you must sign the return.

Filing Options

Pennsylvania offers several methods for filing your income tax return, catering to different preferences and levels of technical expertise. The most common methods include:

- Paper Filing: This traditional method involves completing the paper forms and mailing them to the Pennsylvania Department of Revenue. While this method may be simpler for those who prefer a manual process, it can be time-consuming and may increase the risk of errors.

- e-Filing: The Pennsylvania Department of Revenue encourages taxpayers to file their returns electronically, offering a faster and more secure process. e-Filing is available through various tax preparation software or directly through the Pennsylvania Department of Revenue's website. This method is often preferred for its convenience and potential for faster refunds.

- Professional Tax Preparation: For those who prefer a more hands-off approach or have complex tax situations, engaging a professional tax preparer or accountant can be beneficial. These professionals can guide you through the process, ensure accuracy, and maximize your potential deductions and credits.

Payment Options and Refunds

Understanding your payment options and potential refunds is an important aspect of the tax filing process. Here’s what you need to know:

Making Your Tax Payment

If you owe taxes, you have several options for making your payment to the Pennsylvania Department of Revenue. These include:

- Electronic Payment: You can make an electronic payment through the Pennsylvania Department of Revenue's website or by using a third-party payment service provider. This method is secure, convenient, and often the fastest way to ensure your payment is received.

- Check or Money Order: You can mail a check or money order, made payable to the Commonwealth of Pennsylvania, to the address provided on your tax return or on the Department of Revenue's website. Ensure you include your name, address, and Social Security Number on your payment to facilitate processing.

- Credit Card or Debit Card: Some third-party payment service providers offer the option to pay your taxes using a credit or debit card. However, be aware that these services may charge a convenience fee.

Obtaining Your Refund

If you are due a refund, the Pennsylvania Department of Revenue will process and issue it based on the information provided in your tax return. The method of refund depends on how you filed your return:

- e-Filing with Direct Deposit: If you filed your return electronically and provided your bank account details for direct deposit, your refund will be deposited directly into your account. This is the fastest way to receive your refund, typically taking around 10 to 14 days from the date of filing.

- Paper Filing or e-Filing without Direct Deposit: If you filed a paper return or did not provide direct deposit information, your refund will be sent as a check in the mail. This process can take longer, often around 4 to 6 weeks from the date of filing.

Common Mistakes and Pitfalls

Awareness of common mistakes and pitfalls can help you avoid potential issues during the tax filing process. Here are some of the most frequent errors taxpayers make:

- Inaccurate Income Reporting: One of the most common mistakes is failing to report all sources of income. Ensure you have all your income statements and double-check your calculations to ensure accuracy.

- Incorrect Filing Status: Selecting the wrong filing status can impact your tax liability and potential deductions. Review the criteria for each status and choose the one that best fits your situation.

- Overlooking Deductions and Credits: Taxpayers often miss out on valuable deductions and credits that could reduce their tax burden. Take the time to review all potential deductions and credits, and ensure you claim those for which you're eligible.

- Filing Late or Not Filing at All: Failing to file your tax return by the deadline can result in penalties and interest. Even if you can't pay your taxes in full, it's important to file your return to avoid additional charges.

Future Implications and Changes

Staying informed about potential changes and future implications is crucial for effective tax planning. Here are some key considerations:

Tax Law Updates

Tax laws and regulations can change frequently, often with little notice. It’s essential to stay updated with the latest information to ensure compliance and take advantage of any new benefits or incentives. The Pennsylvania Department of Revenue provides updates and notifications on its website, so it’s a good idea to check regularly.

Economic and Legislative Factors

Economic conditions and legislative decisions can impact tax rates and policies. For instance, during periods of economic downturn, tax rates may be adjusted to stimulate the economy. Conversely, in times of prosperity, tax rates may be increased to generate more revenue. Staying informed about these factors can help you anticipate and plan for potential changes.

Tax Planning and Strategies

Effective tax planning can help you minimize your tax liability and maximize your refunds. This involves understanding the tax code, identifying potential deductions and credits, and making strategic decisions about your income and expenses. Consulting a tax professional or utilizing tax planning software can be beneficial in this regard.

How can I check the status of my Pennsylvania Income Tax Refund?

+You can check the status of your Pennsylvania Income Tax Refund by using the Refund Status Lookup Tool on the Pennsylvania Department of Revenue’s website. You’ll need to provide your Social Security Number, date of birth, and refund amount to access the information.

Are there any tax benefits for homeowners in Pennsylvania?

+Yes, Pennsylvania offers several tax benefits for homeowners, including the Homeowners’ Exclusion and the Homeowners’ Property Tax Relief Program. These programs can reduce your property taxes based on certain criteria. For more information, visit the Pennsylvania Property Tax website.

What if I can’t pay my Pennsylvania Income Taxes by the due date?

+If you’re unable to pay your Pennsylvania Income Taxes by the due date, you should contact the Pennsylvania Department of Revenue as soon as possible to discuss your options. You may be eligible for a payment plan or other relief measures.