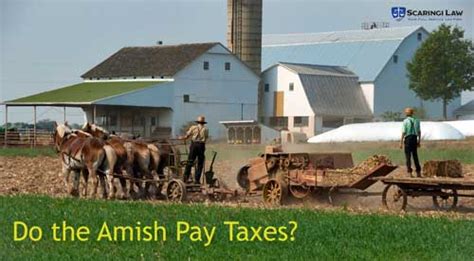

Do The Amish People Pay Taxes

The question of whether the Amish pay taxes is a fascinating one, as it delves into the unique lifestyle and beliefs of this distinct religious group. The Amish, known for their simple living, strong community bonds, and traditional values, have a complex relationship with the modern tax system. Let's explore this topic in depth, uncovering the facts and understanding the nuances of their approach to taxation.

Understanding the Amish Community

Before we delve into the specifics of their tax obligations, it’s essential to have a basic understanding of the Amish way of life. The Amish, originating from a Swiss Anabaptist tradition, are known for their adherence to a simple, faith-based lifestyle. They strive to live a life separate from the modern world, avoiding many technologies and conveniences that most of us take for granted. This includes a reluctance to use electricity, automobiles, and other modern amenities.

Their communities are tightly knit, often living in close proximity to each other and sharing a deep sense of mutual support and shared values. This sense of community is central to their identity and guides many of their decisions, including those related to finances and taxes.

The Amish and Taxation: A Complex Relationship

The relationship between the Amish and the tax system is a delicate one, shaped by a unique set of circumstances and beliefs. While the Amish do indeed pay taxes, their approach to taxation is nuanced and often differs from the broader population.

One of the key principles guiding the Amish community is their commitment to mutual aid and support within their own community. This means that they often rely on each other for assistance, rather than on external governmental programs or services. As a result, they may view certain taxes, particularly those that fund social programs, with a degree of skepticism or reluctance.

Additionally, the Amish have a long history of being exempted from certain military-related taxes and services, dating back to their origins as a peace-loving religious group. This exemption, while rooted in their pacifist beliefs, also extends to their general approach to taxation, where they may seek to minimize their obligations wherever possible.

Income Taxes: A Voluntary System

When it comes to income taxes, the Amish generally adhere to a voluntary system. They believe in honesty and integrity, and most Amish individuals and businesses will willingly pay their fair share of taxes. However, their interpretation of what constitutes a “fair share” may differ from the broader tax code.

For instance, many Amish businesses are small, family-run operations, often with minimal paperwork and record-keeping. This can make it challenging for them to comply with complex tax regulations, and they may require assistance from tax professionals to navigate the system. Despite these challenges, the Amish generally recognize the importance of contributing to the larger society through tax payments.

Social Security and Medicare: Opting Out

One of the most significant ways in which the Amish differ from the broader population when it comes to taxes is their approach to social safety net programs. The Amish, as a community, have traditionally opted out of programs like Social Security and Medicare. This is not due to a lack of need for these services, but rather a reflection of their belief in self-reliance and community support.

The Amish community has a strong network of mutual aid and assistance, with members contributing to a communal fund to support those in need. This fund is used to provide for the elderly, the sick, and those who have suffered losses, effectively replacing the need for government-run social safety net programs.

| Social Program | Amish Approach |

|---|---|

| Social Security | Opt out; rely on community funds and support. |

| Medicare | Opt out; community-based healthcare system. |

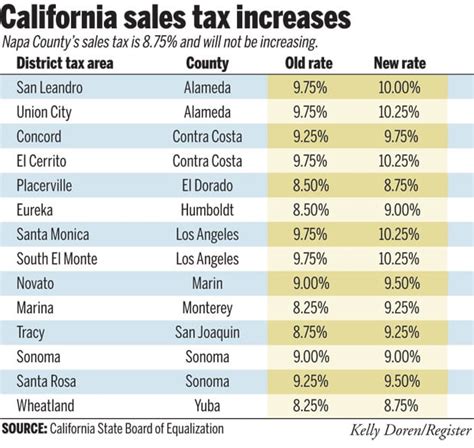

Sales and Property Taxes: A Mixed Approach

The Amish’s approach to sales and property taxes varies depending on the specific context and community. In some cases, they may pay these taxes like any other citizen. However, in certain situations, they may seek exemptions or adjustments based on their unique lifestyle and beliefs.

For instance, the Amish often operate small businesses, particularly in the agricultural sector. They may argue for reduced sales tax obligations, given the small scale and community-focused nature of their operations. Similarly, their traditional lifestyle, which often involves living in rural areas and using minimal resources, may lead to reduced property taxes in some jurisdictions.

The Impact of Modernization on Amish Tax Obligations

As the world becomes increasingly interconnected and the reach of the modern tax system expands, the Amish community is not immune to these changes. In recent years, there has been a growing trend of Amish businesses engaging in e-commerce and other online activities, which has led to a new set of tax challenges.

With the rise of online sales, the Amish are now faced with the need to navigate complex tax regulations related to internet sales and remote transactions. This has required many Amish businesses to adapt and seek professional guidance to ensure they are complying with the law while also managing their tax obligations in a way that aligns with their community's values.

Case Study: Amish Furniture Businesses

To illustrate this point, let’s consider the example of Amish furniture businesses, which have become increasingly popular for their high-quality, handcrafted products. These businesses, often run out of the homes of Amish craftsmen, have seen a boom in sales due to the growth of online marketplaces.

However, with this success comes the challenge of navigating complex sales tax regulations. Each state in the US has its own sales tax laws, and for an Amish business operating across state lines, this can be a daunting task. They must carefully calculate and remit sales taxes for each jurisdiction, a process that can be time-consuming and complex.

Additionally, these businesses must also consider the impact of online sales on their traditional, community-based way of life. As they engage more with the broader market, they must balance their commitment to their community with the need to comply with modern tax regulations. This delicate balancing act is a testament to the unique challenges faced by the Amish in today's world.

Conclusion: A Unique Approach to Taxation

In conclusion, the Amish community’s approach to taxation is a fascinating example of how cultural, religious, and traditional values can shape one’s relationship with the modern tax system. While they do pay taxes, their interpretation of these obligations is unique and often differs from the broader population.

From their voluntary approach to income taxes to their opt-out of social safety net programs, the Amish demonstrate a deep commitment to their community and a belief in self-reliance. As the world continues to evolve, the Amish's approach to taxation will undoubtedly continue to adapt, providing an ongoing example of how cultural values can influence our understanding of civic responsibilities.

Do all Amish people pay taxes in the same way?

+No, the Amish’s approach to taxation can vary between different communities and even within the same community. Factors such as location, business activities, and individual beliefs can influence how they navigate the tax system.

Are there any legal exemptions for the Amish when it comes to taxes?

+Yes, the Amish are legally exempt from certain military-related taxes and services, reflecting their pacifist beliefs. However, this exemption does not extend to all taxes, and they still have obligations to pay income and other types of taxes.

How do Amish businesses navigate the complexity of sales tax regulations?

+Amish businesses often seek professional guidance to navigate the complex world of sales tax regulations, particularly as they expand their operations and engage in e-commerce. This ensures they are compliant with the law while also managing their obligations in a way that aligns with their community’s values.