Property Tax Reduction For Seniors

Property tax relief for seniors is a critical issue that impacts the financial well-being of older adults across the nation. As the population ages, the financial burden of property taxes becomes increasingly significant, often leading to economic hardships and even the displacement of seniors from their long-time homes. This article delves into the complexities of property tax relief for seniors, exploring the various strategies and programs available to alleviate this burden and provide a more secure financial future for our aging population.

Understanding Property Tax Challenges for Seniors

For many seniors, their home is their most significant asset, and the equity built over decades of ownership is often relied upon for retirement income. However, rising property taxes can quickly erode this equity, leading to difficult financial decisions. The challenge is twofold: first, the fixed incomes of seniors may struggle to keep up with increasing property tax bills, and second, the emotional and financial stress of potential foreclosure or displacement can be devastating.

Furthermore, the impact of property taxes is not limited to the individual. It can also affect the broader community. When seniors face financial hardships due to property taxes, they may be forced to reduce their spending on goods and services, leading to a decline in local economic activity. Additionally, the potential loss of long-time residents can disrupt the social fabric of a community, impacting everything from neighborhood stability to local volunteer efforts.

Strategies for Property Tax Relief

To address these challenges, various strategies and programs have been implemented at the local, state, and federal levels. These initiatives aim to provide seniors with much-needed financial relief, ensuring they can continue to live comfortably in their homes without the fear of tax-related financial burdens.

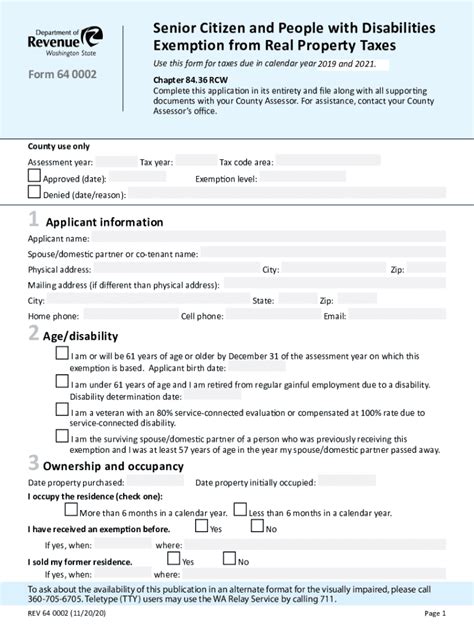

1. Senior Property Tax Exemptions

One of the most common forms of property tax relief for seniors is through exemptions. These exemptions can take various forms, including full or partial waivers of property taxes for qualifying seniors. For instance, in the state of California, the Senior Citizens Property Tax Exemption offers a reduction in property taxes for seniors aged 62 and above. The exemption reduces the assessed value of the property by $7,000, resulting in lower property taxes. Similarly, in Texas, the Over 65 Homestead Exemption allows seniors to exclude up to $25,000 of the home's value from taxation.

These exemptions not only provide immediate financial relief but also offer long-term benefits. By reducing the assessed value of the property, seniors can save money year after year, ensuring their retirement funds are not depleted by rising property taxes.

2. Deferred Property Tax Programs

Deferred property tax programs offer a different approach to providing tax relief. These programs allow seniors to defer (or delay) the payment of their property taxes until a later date, typically upon the sale of the property or the death of the homeowner. This strategy provides immediate relief, as seniors are not required to pay their taxes out of pocket, allowing them to maintain their financial stability.

For instance, the Property Tax Deferral Program in the state of Washington allows eligible seniors to defer their property taxes until they sell their home or pass away. This program ensures that seniors can continue to live in their homes without the worry of accumulating property tax debt.

3. Income-Based Property Tax Relief

Recognizing that property tax relief should be tailored to individual financial situations, some programs offer income-based relief. These initiatives provide varying levels of tax relief based on the senior's income, ensuring that those with lower incomes receive a greater reduction in their property taxes.

The Senior Citizen Property Tax Assistance program in Illinois is a great example. This program offers a rebate check to seniors based on their income and the amount of property taxes paid. For seniors with limited means, this program can provide a significant financial boost, helping them manage their property tax obligations.

4. Senior Citizen Discounts and Credits

In addition to the above strategies, many jurisdictions offer discounts and credits to seniors, reducing the overall cost of property taxes. These discounts can be applied to the base property tax rate, providing a direct reduction in the tax bill. For instance, the Senior Citizen Discount in New York City offers a 15% reduction in property taxes for qualifying seniors, helping them manage their financial obligations.

Performance Analysis and Future Implications

The implementation of these property tax relief programs has had a significant impact on the financial well-being of seniors across the nation. By reducing the tax burden, these initiatives have allowed seniors to maintain their standard of living and continue to contribute to their communities. Moreover, the long-term benefits of these programs, such as the accumulation of equity and the preservation of retirement funds, cannot be overstated.

Looking ahead, the future of property tax relief for seniors appears promising. As the population continues to age, the need for such programs will only grow. However, the success of these initiatives will depend on continued advocacy and policy support. It is crucial that policymakers and community leaders recognize the importance of these programs and work towards their expansion and improvement.

Furthermore, the ongoing evaluation and refinement of these programs are essential to ensure they remain effective and accessible. This includes regular reviews of eligibility criteria, tax assessment methods, and the overall impact of the programs on senior financial well-being. By staying responsive to the changing needs of the senior population, these initiatives can continue to provide much-needed relief and support.

| State | Senior Property Tax Relief Program | Relief Amount |

|---|---|---|

| California | Senior Citizens Property Tax Exemption | $7,000 reduction in assessed value |

| Texas | Over 65 Homestead Exemption | Up to $25,000 exemption |

| Washington | Property Tax Deferral Program | Taxes deferred until home sale or death |

| Illinois | Senior Citizen Property Tax Assistance | Rebate based on income and taxes paid |

| New York | Senior Citizen Discount | 15% reduction in property taxes |

Frequently Asked Questions

How do I qualify for senior property tax relief programs?

+

The eligibility criteria vary by program and location. Generally, you must be a certain age (typically 62 or older), own the property as your primary residence, and meet income requirements. It’s advisable to check with your local tax assessor’s office or consult a tax professional for specific details.

Can I still receive property tax relief if I’m a senior living on a fixed income?

+

Absolutely. Many programs are specifically designed to assist seniors with limited income. These programs offer reduced property taxes based on your income level, ensuring that those with lower incomes receive greater relief.

What happens if I don’t pay my property taxes due to a senior tax relief program?

+

The terms of each program vary, but generally, if you qualify for a deferred payment program, you are not required to pay your property taxes until a future date, such as when you sell your home or pass away. It’s important to understand the specific terms of your program to avoid any penalties or fees.

Are there any limitations to the amount of property tax relief I can receive as a senior?

+

Yes, the amount of relief provided varies by program and location. Some programs offer a flat reduction in property taxes, while others base the relief on income or the assessed value of your property. It’s crucial to review the specific details of the program in your area to understand the potential savings.

How do I apply for senior property tax relief programs?

+

The application process also varies by program and location. Generally, you’ll need to complete an application form and provide supporting documentation, such as proof of age, income, and residence. It’s advisable to contact your local tax assessor’s office or visit their website for specific instructions and forms.