Texas Capital Gains Tax

Welcome to an in-depth exploration of the Texas capital gains tax landscape. In this comprehensive guide, we will navigate the intricacies of this vital tax topic, offering a detailed understanding of its implications and impact on individuals and businesses alike. The Lone Star State has a unique approach to taxation, and within this context, capital gains tax holds a significant position. As we delve into the specifics, we'll uncover the nuances of this tax, its calculation methods, and the strategies employed by Texans to optimize their financial outcomes.

Understanding Capital Gains Tax in Texas

Capital gains tax in Texas is a critical component of the state’s revenue system, yet its structure differs significantly from federal guidelines. Unlike many other states, Texas operates without an income tax, choosing instead to generate revenue through sales tax and other means. This unique approach has implications for how capital gains are taxed, creating a distinct landscape for investors and business owners.

At its core, capital gains tax is levied on the profit derived from the sale of a capital asset, such as stocks, bonds, real estate, or business interests. In Texas, the treatment of these gains varies based on the nature of the asset and the duration it was held. This distinction is crucial, as it forms the foundation for understanding the state's capital gains tax framework.

Long-Term vs. Short-Term Capital Gains

One of the pivotal aspects of capital gains tax is the classification of gains as either long-term or short-term. In Texas, assets held for a year or more are considered long-term, while those held for less than a year are deemed short-term. This classification is not merely academic; it has significant tax implications.

Long-term capital gains in Texas are subject to a lower tax rate compared to short-term gains. This incentive encourages investors to hold their assets for extended periods, fostering a more stable investment environment. The specific rates and thresholds for these classifications will be discussed in detail further in this article.

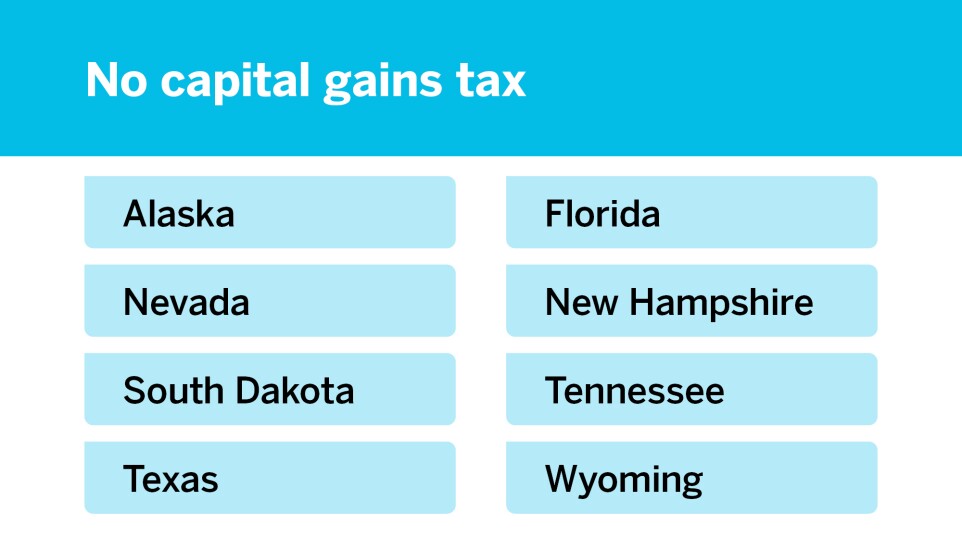

State vs. Federal Capital Gains Tax

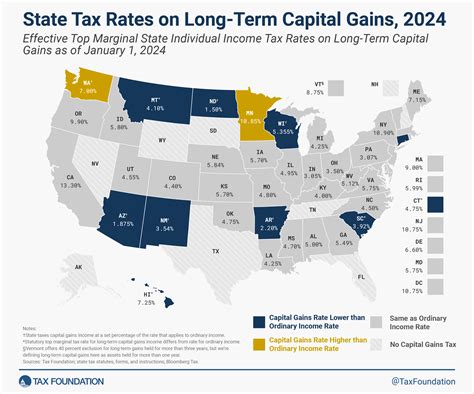

Texas’s unique tax system sets it apart from many other states, particularly in its approach to capital gains tax. While most states align their capital gains tax with federal guidelines, Texas stands out by not levying an income tax, including capital gains. This means that capital gains in Texas are taxed solely at the federal level, a factor that significantly influences investment strategies and financial planning in the state.

However, it's important to note that the absence of a state-level capital gains tax doesn't make Texas a tax haven for investors. The federal tax implications of capital gains are still applicable, and these can be substantial, especially for high-income earners. Understanding these federal tax rates and their interaction with Texas's tax-free status is crucial for effective financial planning.

| Asset Type | Tax Treatment |

|---|---|

| Stocks & Bonds | Federal capital gains tax applies; no state tax. |

| Real Estate | Gains subject to federal tax; no state income tax on sales. |

| Business Interests | Capital gains on business sales are taxed federally; no state income tax. |

Calculating Capital Gains Tax in Texas

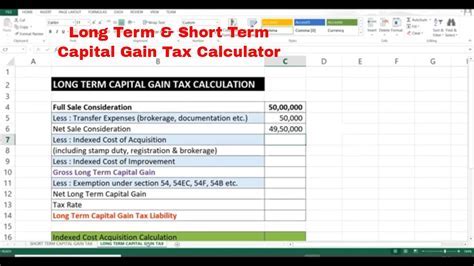

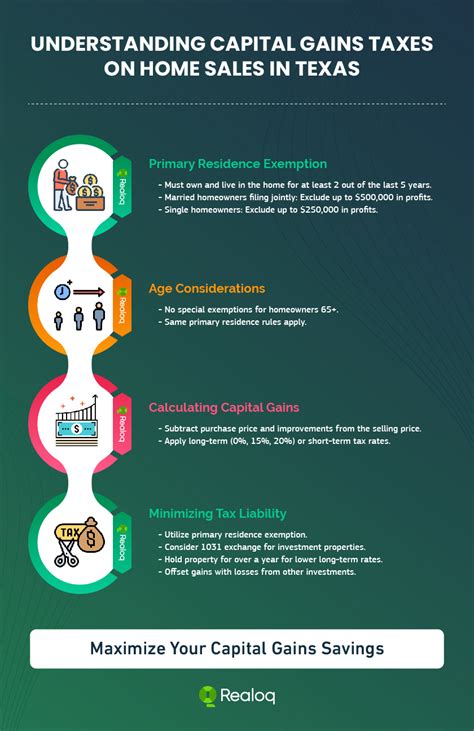

Calculating capital gains tax in Texas involves a series of steps that consider the asset’s nature, its holding period, and the applicable federal tax rates. This process ensures that investors and businesses accurately determine their tax liabilities, a crucial aspect of financial management.

Step-by-Step Guide to Calculating Capital Gains Tax

- Determine the Asset Type: Identify whether the asset is a stock, bond, real estate, or business interest. This classification guides the subsequent tax calculations.

- Establish the Holding Period: Calculate the duration the asset was held. Assets held for over a year are considered long-term, while those held for less are short-term.

- Calculate the Gain: Subtract the asset’s purchase price (basis) from its sale price to determine the capital gain. This gain is the amount subject to tax.

- Apply Federal Tax Rates: Use the appropriate federal tax rates based on the asset’s holding period and the individual’s income level. These rates can vary significantly and impact the final tax liability.

- Adjust for Deductions and Credits: Consider any applicable deductions or credits that can reduce the tax burden. These might include capital losses or tax credits for certain investments.

- Calculate the Tax: Apply the federal tax rates to the adjusted capital gain to determine the tax liability. This calculation provides the final amount owed to the federal government.

It's crucial to note that while Texas doesn't levy a state-level capital gains tax, the federal tax implications are substantial and must be carefully considered. Understanding these steps and the associated tax rates is essential for effective financial planning and compliance.

Example Calculation: Capital Gains on Stock Sales

Let’s illustrate the calculation process with an example of selling stocks in Texas.

Imagine an investor purchased 100 shares of ABC Corp. stock for $50 per share, totaling $5,000. After holding the stock for 18 months, they sell it for $70 per share, resulting in a total sale value of $7,000. The capital gain on this transaction is $2,000 ($7,000 - $5,000). Since the stock was held for over a year, it's considered a long-term capital gain.

The investor's income level plays a role in determining the applicable federal tax rate. Assuming they fall into the 22% tax bracket for long-term capital gains, their tax liability for this transaction would be $440 ($2,000 x 22%). This example demonstrates the importance of understanding tax rates and the impact they have on investment returns.

Strategies for Optimizing Capital Gains Tax in Texas

Given the unique tax landscape in Texas, investors and business owners have a range of strategies to optimize their capital gains tax liability. These strategies involve a careful consideration of investment timelines, asset types, and tax planning techniques to minimize tax burdens while maximizing returns.

Long-Term Holding Strategies

One of the most effective strategies in Texas is to hold assets for the long term. Assets held for over a year qualify for lower tax rates, known as long-term capital gains rates. This strategy not only reduces tax liability but also provides a more stable investment environment, as it encourages a long-term perspective.

For instance, an investor who holds onto stocks or real estate for multiple years can benefit from the reduced tax rates applicable to long-term capital gains. This approach can significantly impact the overall return on investment, making it a popular strategy among Texans.

Asset Type Selection and Diversification

The type of asset held can significantly impact capital gains tax. In Texas, certain assets like stocks and bonds are subject to federal capital gains tax but not state tax, making them attractive options for investors. On the other hand, real estate sales may have different tax implications, depending on the use of the property and the timing of the sale.

Diversifying one's investment portfolio can also be a strategic move. By spreading investments across different asset classes, investors can potentially reduce their overall tax burden. This strategy leverages the unique tax treatments of various assets to optimize financial outcomes.

Utilizing Tax-Advantaged Accounts

Tax-advantaged accounts, such as retirement accounts or 529 plans, offer a strategic way to minimize capital gains tax. Contributions to these accounts can grow tax-free, and withdrawals are often tax-free as well, providing a significant advantage for long-term investors.

For example, a Texas resident contributing to a Roth IRA can grow their investments tax-free, and qualified withdrawals are also tax-free. This strategy effectively reduces the impact of capital gains tax, making it a powerful tool for financial planning.

Tax Loss Harvesting

Tax loss harvesting is a strategy that involves selling investments at a loss to offset capital gains. This technique is particularly useful for balancing out gains and reducing overall tax liability. By strategically timing these losses, investors can minimize their tax burden while maintaining their investment portfolio.

For instance, an investor who has realized significant capital gains in a given year can offset these gains by selling other investments at a loss. This strategy not only reduces the tax burden but also allows the investor to maintain their overall portfolio value.

Future Implications and Considerations

The landscape of capital gains tax in Texas is dynamic, and future developments could significantly impact investors and businesses. As the state’s economy evolves and tax policies are reconsidered, the strategies and considerations outlined in this guide may need to be adjusted.

Potential Changes to Tax Policies

Texas’s unique tax system, free of an income tax, could face challenges or reconsiderations in the future. While this system has its advantages, it also limits the state’s revenue sources. Should the state decide to introduce an income tax or modify its tax policies, the implications for capital gains tax could be significant.

For instance, the introduction of an income tax could bring about a state-level capital gains tax, altering the current landscape. Investors and businesses would need to adapt their strategies to align with these new policies, potentially impacting their investment decisions and financial planning.

Economic Trends and Market Fluctuations

The Texas economy is dynamic, and its growth and fluctuations can impact capital gains tax. During economic booms, capital gains can increase, leading to higher tax liabilities. Conversely, economic downturns can reduce capital gains, impacting tax revenue and investment strategies.

Keeping abreast of these economic trends is crucial for investors and businesses. Understanding the market's direction can help inform investment decisions and tax planning, ensuring that strategies remain effective and relevant in a changing economic landscape.

Global Economic Factors

The global economy also plays a role in shaping Texas’s capital gains tax environment. Global economic events, such as recessions or financial crises, can impact Texas’s economy and, by extension, its tax policies. These events can influence investment decisions and the strategies outlined in this guide.

For example, a global economic downturn could impact the Texas economy, leading to reduced capital gains and potentially influencing the state's tax policies. Investors and businesses must stay informed about these global factors to make informed decisions and adapt their strategies accordingly.

Conclusion: Navigating the Texas Capital Gains Tax Landscape

Understanding and navigating the Texas capital gains tax landscape is a complex yet crucial task for investors and businesses. The state’s unique tax system, free of an income tax, offers a distinct environment for financial planning and investment strategies.

Throughout this guide, we've explored the intricacies of capital gains tax in Texas, from its calculation methods to the strategies employed to optimize tax outcomes. We've examined the differences between long-term and short-term capital gains, the state's unique approach to taxing these gains, and the impact of federal tax rates.

The strategies outlined, such as long-term holding, asset diversification, and tax-advantaged accounts, provide a roadmap for minimizing tax burdens and maximizing returns. However, the dynamic nature of the Texas economy and potential changes to tax policies underscore the need for ongoing vigilance and adaptability.

As we conclude, it's clear that effective financial planning in Texas requires a deep understanding of these tax intricacies and the willingness to adapt to changing circumstances. With this knowledge, investors and businesses can navigate the Texas capital gains tax landscape with confidence and success.

How does Texas’s absence of a state capital gains tax impact investors and businesses?

+Texas’s absence of a state capital gains tax offers a unique opportunity for investors and businesses to optimize their financial strategies. It simplifies tax calculations, as investors are only concerned with federal tax rates, and it encourages long-term investment strategies, as there’s no state-level tax on capital gains.

What are the federal tax rates for capital gains in Texas, and how do they impact financial planning?

+Federal tax rates for capital gains in Texas vary based on the asset’s holding period and the investor’s income level. These rates can significantly impact financial planning, as they determine the tax liability on capital gains. Understanding these rates is crucial for effective tax optimization.

How can investors minimize their capital gains tax liability in Texas?

+Investors can minimize their capital gains tax liability by employing strategies such as holding assets for the long term to qualify for lower tax rates, diversifying their investment portfolio to leverage different tax treatments, and utilizing tax-advantaged accounts to grow investments tax-free.