Miami Dade Property Taxes Payment

Property taxes are an essential aspect of homeownership, and understanding the process and options available for payment is crucial for homeowners in Miami-Dade County. This comprehensive guide will delve into the specifics of Miami-Dade property taxes, providing an in-depth analysis of the tax assessment process, payment options, and strategies to manage your property tax obligations effectively.

Understanding Property Taxes in Miami-Dade County

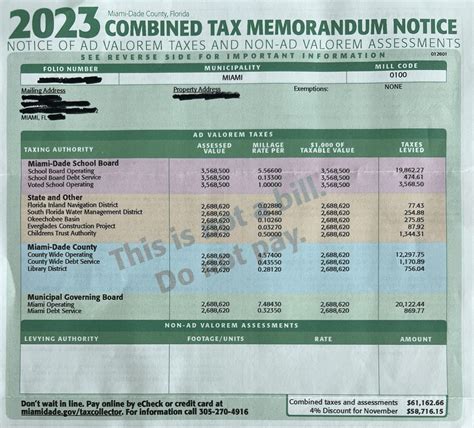

Property taxes are a primary source of revenue for local governments, funding essential services such as education, public safety, and infrastructure. In Miami-Dade County, property taxes are determined based on the assessed value of your property and the applicable millage rate, which is set annually by the county and various taxing authorities.

The assessed value of your property is typically determined by the Miami-Dade Property Appraiser's Office. This office assesses properties annually, considering factors such as location, size, improvements, and market conditions. The assessed value is then multiplied by the millage rate to calculate your property tax liability.

The millage rate, often referred to as the tax rate, is the rate per thousand dollars of assessed value. It is expressed in mills, where one mill equals $1 for every $1,000 of assessed value. For instance, if your property has an assessed value of $200,000 and the millage rate is 10 mills, your annual property tax liability would be $2,000.

It's important to note that the millage rate can vary depending on the specific taxing authorities that provide services to your property. Common taxing authorities in Miami-Dade County include the county government, school districts, and special districts such as water management districts or fire rescue districts.

Property Tax Assessment Process

The property tax assessment process in Miami-Dade County involves several key steps:

- Property Appraisal: The Miami-Dade Property Appraiser's Office conducts an annual appraisal of properties, considering factors like recent sales, construction costs, and other market data.

- Notice of Proposed Property Taxes (TRIM Notice): Property owners receive a TRIM (Truth in Millage) Notice, which outlines the proposed assessed value, tax rates, and estimated taxes for the upcoming year.

- Review and Appeal: Property owners have the right to review their assessment and file an appeal if they believe the assessed value is inaccurate. The appeal process typically involves submitting evidence and attending a hearing before the Value Adjustment Board.

- Final Assessment and Tax Bills: After the appeal period, the Property Appraiser's Office finalizes the assessments, and the Miami-Dade Tax Collector's Office generates tax bills based on the assessed values and applicable millage rates.

Miami-Dade Property Tax Payment Options

Miami-Dade County offers various payment options to accommodate different preferences and financial situations. Understanding these options can help you choose the most convenient and cost-effective method for paying your property taxes.

Online Payment

The Miami-Dade Tax Collector's Office provides an online payment portal, allowing property owners to pay their taxes conveniently from the comfort of their homes. This method offers real-time payment confirmation and the ability to view tax statements and transaction history. To pay online, you'll need your tax account number and a valid form of payment, such as a credit card, debit card, or electronic check.

In-Person Payment

If you prefer a more traditional approach, you can make your property tax payments in person at the Miami-Dade Tax Collector's Office. This option allows you to interact directly with tax officials and obtain immediate confirmation of your payment. You can visit any of the Tax Collector's branch offices during regular business hours to make your payment in cash, check, or money order.

Mail-In Payment

For those who prefer to avoid crowds and lines, the mail-in payment option provides a convenient alternative. You can simply write a check or money order payable to the "Miami-Dade Tax Collector" and mail it along with the payment coupon provided with your tax bill. Ensure that you allow sufficient time for the mail to reach the Tax Collector's Office before the due date to avoid late fees and penalties.

Automatic Payment Plans

To streamline the payment process and avoid late payments, Miami-Dade County offers automatic payment plans. With this option, you can authorize the Tax Collector's Office to deduct your property tax payments directly from your bank account on the due dates. This ensures timely payment and helps you avoid the hassle of remembering payment deadlines. Automatic payment plans can be set up for both annual and quarterly payments.

Credit Card Payment

Miami-Dade County accepts credit card payments for property taxes, providing an additional level of convenience. You can pay your taxes using major credit cards, such as Visa, MasterCard, American Express, or Discover, through the online payment portal or by phone. However, it's important to note that credit card payments typically incur a convenience fee, which is charged by the payment processor and not by the Tax Collector's Office.

| Payment Method | Description | Convenience | Fees |

|---|---|---|---|

| Online Payment | Secure portal, real-time confirmation | High | None |

| In-Person Payment | Branch offices, immediate confirmation | Medium | None |

| Mail-In Payment | Send check or money order | Low | None |

| Automatic Payment Plans | Direct bank account deduction | High | None |

| Credit Card Payment | Online or by phone | High | Convenience fee |

Strategies for Managing Property Taxes

Understanding the property tax assessment process and payment options is essential, but there are also strategies you can employ to manage your property tax obligations effectively.

Understanding Exemptions and Discounts

Miami-Dade County offers various exemptions and discounts that can reduce your property tax liability. These include:

- Homestead Exemption: If you own and occupy your property as your primary residence, you may be eligible for a homestead exemption, which can significantly reduce your taxable value. The exemption amount varies based on your income and other factors.

- Senior Exemption: Property owners aged 65 or older may qualify for an additional exemption, further reducing their taxable value. The senior exemption is separate from the homestead exemption and has specific income and residency requirements.

- Veteran's Exemption: Miami-Dade County offers property tax exemptions for eligible veterans, providing a partial or full exemption based on their service and disability status.

- Discounts for Early Payment: Paying your property taxes early can result in discounts. Miami-Dade County offers a 1% discount for payments made within the first 30 days of the tax bill's issuance. Additionally, a 3% discount is available for payments made within the first 90 days.

Reviewing and Appealing Assessments

If you believe your property's assessed value is inaccurate, it's essential to review your TRIM Notice and consider appealing the assessment. The appeal process allows you to present evidence and argue for a reduction in your assessed value, potentially leading to lower property taxes.

Consideration of Alternative Financing Options

For those facing financial challenges, there are alternative financing options available to assist with property tax payments. These options include:

- Property Tax Loans: Property tax loans, also known as tax anticipation notes, allow you to borrow the amount needed to pay your property taxes. These loans are typically short-term and carry a higher interest rate compared to traditional mortgages.

- Home Equity Loans or Lines of Credit: If you have equity in your home, you can consider a home equity loan or line of credit to pay your property taxes. These financing options offer more favorable interest rates compared to property tax loans but may require a longer repayment period.

- Refinancing: Refinancing your mortgage can provide an opportunity to include your property tax payments in the new loan. This can be beneficial if you're facing a large tax bill and need to spread out the payments over a longer period.

Budgeting and Planning

Effective financial planning is crucial for managing property taxes. Consider budgeting for your annual property tax liability and setting aside funds throughout the year to ensure you have the necessary funds available when tax bills are due. This proactive approach can help prevent financial strain and late payment penalties.

Frequently Asked Questions (FAQ)

When are property taxes due in Miami-Dade County?

+Property taxes in Miami-Dade County are due in two installments. The first installment is due on November 1st and becomes delinquent after April 1st of the following year. The second installment is due on March 1st and becomes delinquent after September 30th of the same year.

<div class="faq-item">

<div class="faq-question">

<h3>Can I pay my property taxes in installments?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Miami-Dade County offers an installment payment plan for property taxes. You can choose to pay your taxes in two installments, with the first installment due on November 1st and the second on March 1st. This plan is automatic and requires no additional application.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I don't pay my property taxes on time?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Unpaid property taxes in Miami-Dade County can result in late fees, interest charges, and potential tax certificates being sold to third-party investors. If taxes remain unpaid, the property may be subject to a tax deed sale, which could result in the loss of ownership.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any exemptions or discounts available for property taxes in Miami-Dade County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Miami-Dade County offers various exemptions and discounts, including the homestead exemption for primary residences, senior exemptions, and veteran's exemptions. Additionally, early payment discounts are available for payments made within the first 30 days (1% discount) or the first 90 days (3% discount) of the tax bill's issuance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I appeal my property tax assessment in Miami-Dade County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To appeal your property tax assessment in Miami-Dade County, you must first review your TRIM Notice and identify any discrepancies or inaccuracies. You can then file an appeal with the Value Adjustment Board (VAB) by submitting an application and supporting documentation. The VAB will schedule a hearing, where you can present your case and argue for a reduction in your assessed value.</p>

</div>

</div>

</div>

By understanding the property tax assessment process, exploring payment options, and implementing effective management strategies, you can navigate the complexities of Miami-Dade property taxes with confidence. Remember to stay informed about exemptions, discounts, and payment deadlines to ensure timely and accurate tax payments.