Lake County Tax

Welcome to this in-depth exploration of the Lake County Tax system, a crucial aspect of the local economy and governance. This comprehensive guide will delve into the various facets of Lake County's tax landscape, providing an insightful analysis for residents, business owners, and anyone interested in understanding the financial workings of this vibrant community.

Understanding the Lake County Tax Structure

Lake County’s tax system is a complex yet essential mechanism that funds public services, infrastructure, and community development. It plays a pivotal role in shaping the county’s future and ensuring the well-being of its residents. This section aims to demystify the tax structure, providing a clear overview for better understanding and informed decision-making.

Tax Types and Categories

The tax landscape in Lake County is diverse, encompassing several categories. These include property taxes, which are a significant source of revenue for the county and are based on the assessed value of real estate properties. Additionally, sales taxes are levied on goods and services, contributing to the county’s economic growth and supporting various initiatives.

Lake County also imposes income taxes on individuals and businesses, ensuring a fair contribution to the community's development. Other tax categories, such as excise taxes on specific goods and occupancy taxes for short-term rentals, further diversify the county's revenue streams.

| Tax Category | Description |

|---|---|

| Property Tax | Based on property value, funds local services. |

| Sales Tax | Applied to goods and services, supporting economic growth. |

| Income Tax | Levied on individuals and businesses, contributing to community development. |

| Excise Tax | Specific taxes on certain goods, such as fuel or tobacco. |

| Occupancy Tax | Charged on short-term rentals, benefiting tourism and local businesses. |

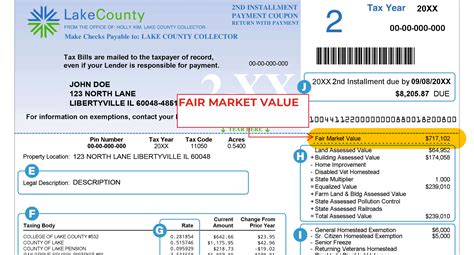

Tax Rates and Assessments

Tax rates in Lake County are determined by various factors, including the type of tax, the assessed value of properties or goods, and the specific needs of the county. These rates can vary annually, influenced by economic trends, infrastructure projects, and community priorities.

For instance, the property tax rate is often expressed as a millage rate, which is the amount of tax per $1,000 of assessed property value. The sales tax rate, on the other hand, is typically a percentage of the sale price, with different rates applied to different types of goods and services.

Lake County's tax assessments are conducted periodically to ensure fairness and accuracy. These assessments consider factors such as market value, property improvements, and economic conditions, ensuring that tax liabilities are just and reflect the current state of the county's economy.

The Impact of Lake County Taxes

The revenue generated through Lake County’s tax system has a profound impact on the community’s growth and development. It funds essential services, infrastructure projects, and initiatives that enhance the quality of life for residents.

Funding Public Services and Infrastructure

A significant portion of the tax revenue is dedicated to public services, including education, public safety, healthcare, and social services. These funds ensure that Lake County residents have access to quality schools, efficient emergency response systems, and robust healthcare facilities.

Furthermore, tax dollars contribute to the development and maintenance of infrastructure projects such as roads, bridges, public transportation systems, and utilities. Well-maintained infrastructure not only enhances the county's appeal to residents and businesses but also attracts new investment and economic opportunities.

Community Development and Initiatives

Lake County’s tax revenue is not only directed towards essential services and infrastructure but also towards community development initiatives. These initiatives aim to enhance the county’s cultural, social, and economic fabric, making it a more desirable place to live, work, and visit.

For instance, tax funds may be allocated to support local arts and cultural programs, which enrich the community's cultural life and attract tourism. They may also be used to fund environmental conservation efforts, preserving Lake County's natural beauty and promoting sustainable practices.

In addition, tax revenue can be instrumental in economic development initiatives, such as business grants, infrastructure improvements in commercial districts, and workforce development programs. These efforts aim to foster a thriving business environment, create jobs, and stimulate economic growth.

Navigating Lake County’s Tax System

Understanding and effectively managing one’s tax obligations in Lake County is crucial for residents and businesses alike. It ensures compliance with tax laws, minimizes potential penalties, and allows for better financial planning.

Tax Filing and Payment Options

Lake County offers various tax filing and payment options to cater to the diverse needs of its residents and businesses. These options include online filing and payment platforms, which provide convenience and efficiency, especially for those with busy schedules.

For those who prefer traditional methods, the county also offers in-person filing and payment options at designated tax offices. This ensures that individuals and businesses have the flexibility to choose the method that best suits their preferences and circumstances.

Tax Incentives and Exemptions

Lake County recognizes the importance of incentivizing certain behaviors and activities that contribute to the community’s well-being. As such, the tax system includes provisions for tax incentives and exemptions, which can significantly reduce tax liabilities for eligible individuals and businesses.

For instance, the county may offer property tax exemptions for certain types of properties, such as those owned by non-profit organizations or used for religious purposes. Similarly, income tax incentives may be provided to encourage investment in specific sectors or to promote job creation.

Furthermore, Lake County may provide tax credits for activities that support community development, such as donations to local charities or investments in renewable energy projects. These incentives not only benefit the individuals and businesses involved but also strengthen the county's social and economic fabric.

The Future of Lake County’s Tax System

As Lake County continues to evolve and adapt to changing economic, social, and environmental landscapes, its tax system will play a crucial role in shaping its future. The county’s leadership and tax authorities are committed to ensuring that the tax system remains fair, efficient, and responsive to the community’s needs.

Ongoing Tax Reforms and Updates

Lake County is proactive in its approach to tax reforms, regularly reviewing and updating its tax policies to ensure they remain aligned with the community’s aspirations and challenges. These reforms may include adjustments to tax rates, the introduction of new tax categories, or the revision of existing tax laws to enhance fairness and efficiency.

For instance, the county may consider progressive tax reforms that ensure higher-income earners contribute a fair share to community development while minimizing the tax burden on lower-income residents. Such reforms aim to foster social equity while maintaining a robust tax base.

Embracing Technological Advancements

In today’s digital age, Lake County recognizes the importance of leveraging technology to enhance its tax system. The county is actively exploring and implementing digital tax solutions that streamline tax filing and payment processes, improve data accuracy, and enhance overall efficiency.

By embracing technological advancements, Lake County aims to create a more user-friendly tax system that caters to the needs of its residents and businesses. This includes developing user-friendly online platforms, integrating data analytics for better decision-making, and exploring blockchain technology for secure and transparent tax transactions.

How can I determine my property tax liability in Lake County?

+Your property tax liability is calculated based on the assessed value of your property and the current tax rate. You can determine this by obtaining your property’s assessed value from the county’s property appraiser’s office and multiplying it by the tax rate. Alternatively, you can use online tax calculators provided by the county to estimate your tax liability.

Are there any tax incentives for renewable energy projects in Lake County?

+Yes, Lake County recognizes the importance of renewable energy and offers tax incentives for projects that promote clean energy. These incentives can include property tax exemptions or reductions for eligible renewable energy systems. You can contact the county’s tax office or visit their website for more information on these incentives.

What support is available for businesses facing financial challenges due to high tax liabilities?

+Lake County understands the challenges businesses face and offers support through various programs. These may include tax relief measures, such as deferred tax payment plans or tax abatement programs for qualifying businesses. The county’s economic development office can provide guidance and resources to help businesses navigate these challenges.