How Do You Report Tax Fraud

Tax fraud is a serious offense that undermines the integrity of the tax system and can have significant consequences for both individuals and businesses. It is crucial for taxpayers to understand their rights and responsibilities when it comes to reporting tax fraud. In this comprehensive guide, we will delve into the process of reporting tax fraud, exploring the steps, considerations, and resources available to ensure a fair and transparent tax environment.

Understanding Tax Fraud

Tax fraud encompasses a range of illegal activities aimed at evading tax obligations. It can involve intentional misrepresentation, omission, or falsification of information on tax returns, as well as other schemes to avoid paying taxes. Common forms of tax fraud include:

- Tax Evasion: Deliberately underreporting income, overstating deductions, or failing to file tax returns.

- False Claims: Submitting fraudulent tax documents, such as fake receipts or inflated expense reports.

- Identity Theft: Using someone else’s identity to file false tax returns and claim refunds.

- Offshore Tax Schemes: Hiding assets or income in offshore accounts to avoid taxation.

- Business Fraud: Misrepresenting business income, expenses, or employee compensation.

The Importance of Reporting Tax Fraud

Reporting tax fraud plays a vital role in maintaining the fairness and integrity of the tax system. By exposing fraudulent activities, taxpayers contribute to a more equitable distribution of tax obligations and ensure that everyone pays their fair share. Additionally, reporting tax fraud helps protect honest taxpayers from bearing the burden of dishonest practices and prevents the erosion of public trust in the tax system.

Who Can Report Tax Fraud

Anyone who suspects or has knowledge of tax fraud can report it. This includes individuals, businesses, tax professionals, and even whistleblowers. Taxpayers have a responsibility to report any instances of tax fraud they encounter to the appropriate authorities.

Steps to Report Tax Fraud

Reporting tax fraud involves a systematic process to ensure accuracy and effectiveness. Here are the key steps to follow:

Gather Evidence

Before reporting tax fraud, it is essential to gather sufficient evidence to support your claim. This may include:

- Documentation of fraudulent activities, such as altered tax documents or fake receipts.

- Records of communications or interactions related to the fraud.

- Financial statements or bank records that reveal suspicious transactions.

- Witness testimonies or affidavits supporting your allegations.

Identify the Appropriate Authority

Depending on the nature and jurisdiction of the tax fraud, different authorities may be responsible for investigating and prosecuting the offense. Common authorities include:

- Internal Revenue Service (IRS): The IRS is the primary federal tax authority in the United States. They handle a wide range of tax-related matters, including tax fraud investigations.

- State Tax Agencies: Each state has its own tax agency responsible for administering state taxes. They investigate and prosecute tax fraud at the state level.

- Local Law Enforcement: In some cases, tax fraud may be linked to other criminal activities, such as identity theft or money laundering. Local law enforcement agencies can collaborate with tax authorities to investigate and prosecute such cases.

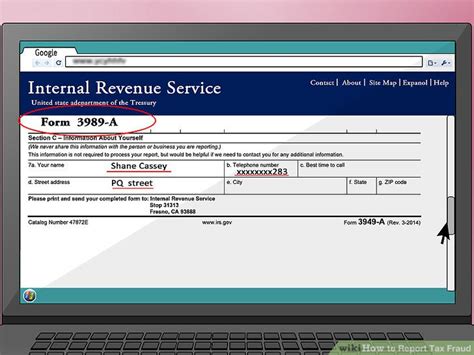

Contact the Relevant Authority

Once you have identified the appropriate authority, contact them to report the tax fraud. You can reach out through various channels, such as:

- Telephone: Contact the tax authority’s hotline or designated phone number for reporting tax fraud.

- Email: Send a detailed email outlining the fraud, providing evidence, and requesting further guidance.

- Online Reporting Form: Many tax authorities provide online platforms where you can securely submit your report and upload supporting documents.

- In-Person Visit: Consider visiting the local office of the tax authority to discuss the matter in person and provide physical evidence.

Provide Detailed Information

When reporting tax fraud, provide as much detail as possible to assist the authorities in their investigation. Include the following information:

- Names and contact details of the individuals or entities involved in the fraud.

- Specific dates, locations, and circumstances related to the fraudulent activities.

- A clear description of the fraud, including any supporting evidence or documentation.

- Any potential witnesses or individuals who can provide additional information.

Maintain Confidentiality

Tax authorities prioritize the confidentiality of taxpayers’ information. Rest assured that your identity will be protected unless you choose to disclose it. However, providing your contact information can be beneficial as it allows the authorities to reach out for further clarification or updates.

Follow-Up and Updates

After reporting tax fraud, it is essential to stay engaged and monitor the progress of the investigation. Keep a record of your interactions with the tax authorities and any updates they provide. If you have additional information or evidence, promptly share it with the investigating team.

Whistleblower Programs

For those who have insider knowledge of significant tax fraud, whistleblower programs offer incentives and protection. These programs aim to encourage individuals to come forward with information that can lead to the successful prosecution of tax fraud cases. Whistleblowers can receive a portion of the recovered funds as a reward for their assistance.

Benefits of Whistleblower Programs

- Financial Rewards: Whistleblowers can receive a percentage of the recovered tax funds, which can be substantial in complex fraud cases.

- Anonymity: Whistleblower programs prioritize confidentiality, allowing individuals to remain anonymous throughout the process.

- Protection from Retaliation: Whistleblower laws provide legal safeguards to protect individuals from any form of retaliation by the accused parties.

Eligibility and Process

To qualify as a whistleblower, individuals must possess original and credible information about tax fraud that has not been previously disclosed to the authorities. The process typically involves submitting a detailed whistleblower claim, providing evidence, and working closely with the tax authorities to build a strong case.

Resources and Support

Taxpayers seeking guidance or assistance in reporting tax fraud can utilize various resources and support systems. These include:

- IRS Taxpayer Advocate Service: This independent organization within the IRS helps taxpayers resolve complex tax issues, including fraud-related matters.

- Tax Professional Organizations: Reach out to professional associations, such as the National Association of Tax Professionals (NATP) or the American Institute of Certified Public Accountants (AICPA), for guidance and support.

- Legal Counsel: Consult with a tax attorney or legal expert who specializes in tax matters to navigate the reporting process and protect your rights.

- Online Resources: Reputable websites, such as the IRS website or government-sponsored tax resources, offer comprehensive information and guidance on reporting tax fraud.

Conclusion

Reporting tax fraud is a crucial responsibility for all taxpayers. By understanding the process, gathering evidence, and contacting the appropriate authorities, individuals can contribute to a fair and honest tax system. Remember, tax fraud not only undermines the integrity of the tax system but also impacts the economy and society as a whole. Together, we can work towards a more transparent and equitable tax environment.

Frequently Asked Questions

How do I know if an activity constitutes tax fraud?

+

Determining whether an activity is tax fraud can be complex. Generally, tax fraud involves intentional misrepresentation, omission, or falsification of information on tax returns. If you suspect any dishonest practices or have evidence of fraudulent activities, it is advisable to consult with a tax professional or the relevant tax authority for guidance.

Can I remain anonymous when reporting tax fraud?

+

Yes, tax authorities prioritize the confidentiality of taxpayers’ information. You can choose to remain anonymous when reporting tax fraud. However, providing your contact details can be beneficial as it allows the authorities to seek further clarification or updates if needed.

What happens after I report tax fraud?

+

After reporting tax fraud, the tax authorities will assess the information provided and determine the appropriate course of action. This may involve further investigation, audits, or legal proceedings. It is important to stay engaged and provide any additional information or evidence as requested by the authorities.

Are there any consequences for falsely reporting tax fraud?

+

Yes, making false allegations of tax fraud can have serious consequences. It is important to ensure the accuracy and validity of the information provided. False reporting may lead to legal repercussions and damage your credibility with the tax authorities.

How long does the tax fraud investigation process typically take?

+

The duration of a tax fraud investigation can vary depending on the complexity of the case and the availability of evidence. Simple cases may be resolved within a few months, while more intricate investigations can take several years. It is important to be patient and provide ongoing support to the authorities throughout the process.