Commonwealth Of Virginia Tax Refund

Tax refunds are an important aspect of financial planning and can provide a welcome boost to individuals and businesses alike. In the Commonwealth of Virginia, tax refunds are issued based on various factors, and understanding the process can be crucial for taxpayers. This comprehensive guide aims to shed light on the Commonwealth of Virginia's tax refund system, offering an in-depth analysis of the procedures, eligibility, and potential benefits.

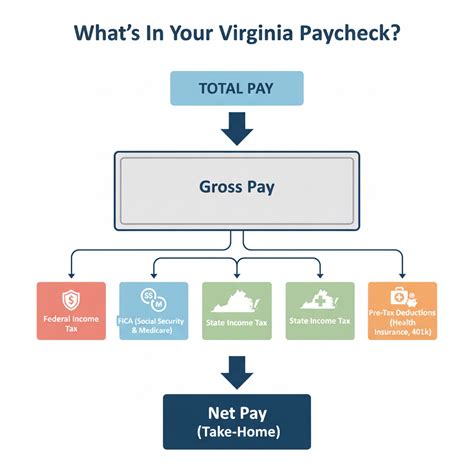

Understanding the Commonwealth of Virginia’s Tax Refund Process

The Commonwealth of Virginia, like many other states, offers tax refunds to its residents and businesses as a way to manage tax liabilities and provide financial relief. The tax refund process in Virginia is governed by the Virginia Department of Taxation, which oversees the collection and distribution of state taxes. Let’s delve into the key aspects of this process.

Eligibility and Tax Forms

To be eligible for a tax refund in Virginia, individuals and businesses must have overpaid their taxes for the respective tax year. This overpayment can occur due to various reasons, including withholding taxes, estimated tax payments, or simply an incorrect tax liability calculation. To claim a refund, taxpayers must file specific tax forms, depending on their tax situation.

For instance, individual taxpayers typically file Form 760, the Virginia Individual Income Tax Return, to report their income and calculate their tax liability. If there is an overpayment, this form also serves as the basis for claiming a refund. Similarly, businesses file different forms depending on their entity type, such as Form 763 for corporations or Form 765 for partnerships.

Calculation and Processing Timeline

The tax refund amount is calculated based on the difference between the total tax liability and the amount already paid through withholdings, estimated payments, or other credits. The Virginia Department of Taxation processes tax returns and issues refunds on a first-come, first-served basis. Typically, the processing time for tax refunds in Virginia ranges from several weeks to a few months, depending on the complexity of the return and the volume of filings.

For example, in the tax year 2021, the Virginia Department of Taxation processed over 2.5 million individual income tax returns, with an average refund amount of $750. The majority of these refunds were issued within 6-8 weeks of filing, although some complex returns may take longer to process.

| Tax Year | Total Returns Filed | Average Refund Amount |

|---|---|---|

| 2021 | 2,500,000 | $750 |

| 2020 | 2,400,000 | $800 |

| 2019 | 2,300,000 | $700 |

Refund Options and Payment Methods

Virginia taxpayers have multiple options for receiving their tax refunds. The most common methods include direct deposit, check, and, in certain cases, a state-issued prepaid card. Direct deposit is often the fastest way to receive a refund, as it can be credited to the taxpayer’s bank account within a few days of the refund being processed.

For those who prefer a more traditional method, a check can be mailed to the taxpayer’s address on file. However, this option may take longer, typically around 2-3 weeks from the date of processing. It’s important to ensure that the Department of Taxation has the correct mailing address to avoid delays or misdirected refunds.

Tracking and Checking Refund Status

The Virginia Department of Taxation provides online tools to help taxpayers track the status of their tax refund. Taxpayers can use their e-Services account to check the progress of their refund. This account also allows taxpayers to view their tax records, make payments, and manage their tax obligations.

Additionally, the Department offers a refund status lookup tool on its website, which provides real-time updates on the processing of tax refunds. Taxpayers can input their Social Security Number or Taxpayer ID and the refund amount to access the status of their refund.

Maximizing Your Commonwealth of Virginia Tax Refund

While the primary purpose of a tax refund is to reclaim overpaid taxes, there are strategies that individuals and businesses can employ to maximize their refunds and potentially reduce their tax burden.

Optimizing Withholdings and Estimated Payments

One way to ensure a larger tax refund is to adjust your withholdings or estimated payments throughout the year. By doing so, you can ensure that you’re not overpaying your taxes and can potentially increase your refund amount. For example, if you expect a significant change in income or deductions, you can adjust your withholdings with your employer or make estimated tax payments to reflect this change.

Taking Advantage of Tax Credits and Deductions

Virginia, like many states, offers various tax credits and deductions that can reduce your tax liability and potentially increase your refund. These include credits for dependent children, education expenses, certain business expenses, and more. It’s crucial to understand which credits and deductions you’re eligible for and ensure you claim them on your tax return.

For instance, the Virginia Earned Income Tax Credit (EITC) is a refundable tax credit available to low- and moderate-income working individuals and families. This credit can provide a significant boost to eligible taxpayers’ refunds, often amounting to hundreds or even thousands of dollars.

Strategic Tax Planning

Engaging in strategic tax planning can also help maximize your tax refund. This involves reviewing your financial situation, income sources, deductions, and credits to ensure you’re taking advantage of all available opportunities. It’s advisable to consult with a tax professional or financial advisor who can provide personalized advice based on your unique circumstances.

For example, if you have significant medical expenses, you may be able to deduct these expenses from your taxable income if they exceed a certain threshold. Similarly, if you’ve made charitable contributions, these can also be deducted, potentially reducing your tax liability and increasing your refund.

Commonwealth of Virginia Tax Refund: Future Outlook and Considerations

As the Commonwealth of Virginia continues to evolve its tax policies and procedures, it’s important to stay informed about potential changes that could impact tax refunds. Here are some key considerations for the future.

Potential Changes in Tax Laws

Tax laws are subject to change, and the Commonwealth of Virginia is no exception. Proposed or enacted changes in state tax laws could impact tax refunds in various ways. For instance, tax rate adjustments, changes in tax brackets, or the introduction of new tax credits or deductions could affect the amount of tax refunds taxpayers receive.

It’s crucial to stay updated on any proposed or enacted changes in tax laws to understand how they might impact your tax situation and potential refund. This can involve monitoring news and updates from the Virginia Department of Taxation, as well as consulting with tax professionals to stay informed about the latest developments.

Impact of Economic Factors

Economic factors such as inflation, unemployment rates, and overall economic growth can also influence tax refunds. For example, during periods of high inflation, the purchasing power of a tax refund may decrease, impacting its real value. Similarly, changes in employment status or income levels can affect tax liability and, consequently, the amount of any potential refund.

Staying informed about economic trends and their potential impact on tax refunds is essential for financial planning. This includes monitoring economic indicators, such as the Consumer Price Index (CPI) for inflation, as well as employment and income data, to anticipate how these factors might influence tax refunds.

Advancements in Tax Technology

The Virginia Department of Taxation, like many other tax authorities, is continually improving its technology infrastructure to enhance the tax refund process. This includes the implementation of online filing systems, e-Services platforms, and refund tracking tools. These advancements aim to make the tax refund process more efficient, secure, and accessible for taxpayers.

Keeping up with these technological advancements is crucial for taxpayers. It ensures they can take advantage of the latest tools and services to file their taxes and track their refunds more effectively. Additionally, staying informed about these technological developments can help taxpayers understand the security measures in place to protect their sensitive financial information.

Conclusion: Navigating the Commonwealth of Virginia Tax Refund Process

Understanding the Commonwealth of Virginia’s tax refund process is essential for taxpayers to navigate their financial obligations effectively. By familiarizing themselves with eligibility criteria, tax forms, and the various options for receiving refunds, taxpayers can ensure a smooth and timely process. Additionally, strategic tax planning and staying informed about potential changes in tax laws, economic factors, and technological advancements can help maximize refunds and stay ahead of the curve.

As the tax landscape continues to evolve, it’s crucial to stay informed and proactive in managing your tax obligations and refunds. Whether you’re an individual taxpayer or a business owner, the information and strategies outlined in this guide can help you navigate the Commonwealth of Virginia’s tax refund process with confidence and optimize your financial outcomes.

How do I check the status of my Commonwealth of Virginia tax refund?

+

You can check the status of your Commonwealth of Virginia tax refund by logging into your e-Services account or using the refund status lookup tool on the Virginia Department of Taxation’s website. You’ll need to provide your Social Security Number or Taxpayer ID and the refund amount to access the status of your refund.

What if I haven’t received my tax refund within the expected timeframe?

+

If you haven’t received your tax refund within the expected timeframe, it’s recommended to first check the status of your refund using the online tools provided by the Virginia Department of Taxation. If the status indicates a delay, you can contact the Department’s taxpayer assistance line for further assistance. If the status shows your refund has been processed and mailed, you may need to allow additional time for postal delivery. If you still haven’t received your refund after a reasonable amount of time, you can contact the Department to report the missing refund and begin the process of having it reissued.

Can I receive my tax refund on a prepaid card instead of direct deposit or check?

+

In certain circumstances, the Virginia Department of Taxation may issue tax refunds on a state-issued prepaid card. This option is typically used for taxpayers who do not have a bank account or prefer not to receive their refund via direct deposit or check. The Department will notify you if your refund will be issued on a prepaid card and provide instructions on how to access and use the card.

Are there any tax credits or deductions I should be aware of to potentially increase my refund in Virginia?

+

Yes, Virginia offers several tax credits and deductions that can reduce your tax liability and potentially increase your refund. These include the Virginia Earned Income Tax Credit (EITC) for low- and moderate-income individuals and families, credits for dependent children, education expenses, certain business expenses, and more. It’s important to review your eligibility for these credits and deductions and ensure you claim them on your tax return.