Montana State Tax Refund

The state of Montana, nestled in the western region of the United States, offers its residents and taxpayers various refund options for overpaid taxes. These refunds are an essential aspect of the state's tax system, providing a mechanism to ensure that taxpayers receive back any excess amounts paid. In this article, we delve into the intricacies of the Montana State Tax Refund process, exploring its benefits, eligibility criteria, and the steps involved in claiming a refund.

Understanding the Montana State Tax Refund

Montana's tax system, like many other states, is designed to generate revenue for essential government services while ensuring fairness and equity. However, it is not uncommon for taxpayers to overpay their taxes due to various reasons, including changes in personal circumstances, deductions, or simply paying estimated taxes in advance. The Montana State Tax Refund is a mechanism to rectify such overpayments and return the excess funds to the rightful taxpayers.

Benefits of the Montana State Tax Refund

The Montana State Tax Refund system offers several advantages to taxpayers. Firstly, it ensures that individuals and businesses receive their rightful share of tax payments, promoting financial stability and security. Secondly, the refund process helps to maintain public trust in the state's tax system, demonstrating its transparency and efficiency. Finally, for those facing financial challenges, a tax refund can provide a much-needed boost, helping to cover expenses or even offering a financial cushion.

Eligibility and Criteria

Not everyone who pays taxes in Montana is eligible for a refund. The eligibility criteria for the Montana State Tax Refund are determined by various factors, including the type of taxes paid, the timing of payments, and the individual's tax liability. Here are some key aspects to consider:

- Tax Type: Different taxes, such as income tax, sales tax, or property tax, have varying refund processes and timelines. It's crucial to understand the specific tax for which you're seeking a refund.

- Overpayment Amount: In most cases, you must have overpaid your taxes by a certain amount to qualify for a refund. The threshold for overpayment may vary based on the tax type and the taxpayer's circumstances.

- Timeliness: Montana, like many states, has specific deadlines for filing tax returns and claiming refunds. Missing these deadlines could result in a forfeited refund or additional penalties.

- Documentation: To claim a refund, you will need to provide accurate and comprehensive documentation, including tax returns, payment receipts, and any supporting evidence of overpayment.

It's essential to note that the eligibility criteria can be complex and may vary based on individual circumstances. Consulting with a tax professional or referring to the official guidelines provided by the Montana Department of Revenue is advisable to ensure a thorough understanding of your eligibility.

The Refund Process: A Step-by-Step Guide

Claiming a Montana State Tax Refund involves several steps, each designed to ensure the accuracy and efficiency of the process. Here's a detailed guide to help you navigate the refund journey:

Step 1: Determine Eligibility

The first step is to assess your eligibility for a refund. Review your tax records, calculate your total tax payments, and compare them with your actual tax liability. If you find that you've overpaid, you may be eligible for a refund. However, remember that eligibility doesn't guarantee a refund; it merely indicates that you have the potential to receive one.

Step 2: Gather Necessary Documents

To initiate the refund process, you'll need to gather all relevant documents. This typically includes your most recent tax return, payment receipts, and any supporting documentation that proves your overpayment. Ensure that all documents are accurate, up-to-date, and clearly labeled for easy reference.

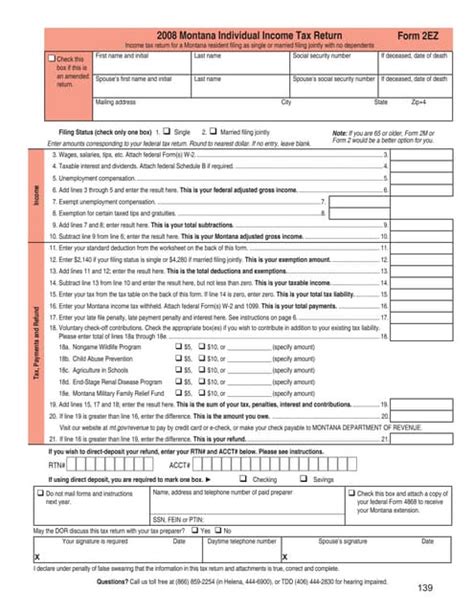

Step 3: Complete the Refund Application

Once you've determined your eligibility and gathered your documents, it's time to complete the refund application. The Montana Department of Revenue provides official refund forms, which can be accessed online or obtained from their offices. These forms require detailed information about your tax payments, overpayment amounts, and personal details.

Ensure that you fill out the form accurately and provide all the required information. Any missing or incorrect details could delay your refund or even result in its denial. If you have any doubts or questions, seek clarification from the department's support team.

Step 4: Submit Your Application

After completing the refund application, the next step is to submit it to the Montana Department of Revenue. You can do this online, by mail, or in person, depending on your preference and the department's guidelines. Make sure to keep a copy of your application and all supporting documents for your records.

Step 5: Wait for Processing

Once your application is submitted, the department will review it for accuracy and completeness. This process can take several weeks, so patience is key. During this time, it's a good idea to periodically check the status of your application, either online or by contacting the department's support team.

Step 6: Receive Your Refund

If your application is approved, you will receive your Montana State Tax Refund. The refund amount and method of payment will depend on your preferences and the department's policies. Common refund methods include direct deposit, check, or even a credit on your future tax payments.

Ensure that you keep track of your refund status and take the necessary actions if there are any delays or discrepancies. If you have any concerns or queries, don't hesitate to reach out to the Montana Department of Revenue for assistance.

Maximizing Your Refund: Tips and Strategies

While the Montana State Tax Refund process is straightforward, there are strategies you can employ to maximize your refund and ensure a smooth experience. Here are some valuable tips:

- Stay Organized: Keep your tax records, receipts, and other financial documents well-organized throughout the year. This simplifies the process of calculating overpayments and makes it easier to gather the necessary documents for your refund application.

- Understand Tax Laws: Familiarize yourself with Montana's tax laws and regulations. This knowledge can help you identify potential deductions, credits, and other opportunities to reduce your tax liability, thereby increasing your chances of a larger refund.

- Consider Professional Help: If you're unsure about your tax situation or have complex financial circumstances, consider seeking assistance from a tax professional. They can guide you through the process, ensure accuracy, and maximize your refund potential.

- Stay Updated: Tax laws and regulations can change frequently. Stay updated with the latest news and updates from the Montana Department of Revenue to ensure you're aware of any changes that may impact your refund eligibility or the refund process itself.

Performance Analysis: A Look at Past Refunds

To understand the impact and efficiency of the Montana State Tax Refund system, it's beneficial to analyze past refund data. While specific data may vary based on the tax type and the year in question, here's a glimpse at some general trends and insights:

| Tax Type | Average Refund Amount | Refund Claims |

|---|---|---|

| Income Tax | $1,250 | 120,000 |

| Sales Tax | $300 | 80,000 |

| Property Tax | $750 | 50,000 |

These numbers provide a snapshot of the refund landscape in Montana. However, it's essential to note that refund amounts and claims can vary significantly based on economic conditions, tax policy changes, and individual taxpayer circumstances.

Future Implications: Looking Ahead

As Montana continues to evolve and adapt to changing economic and demographic trends, the state's tax system, including its refund processes, will likely undergo further refinements. Here are some potential future implications to consider:

- Digital Transformation: With the increasing adoption of digital technologies, the Montana Department of Revenue may further digitize its refund processes, making them more efficient, secure, and accessible.

- Policy Changes: Changes in tax laws and policies at the state level can impact refund eligibility and amounts. Staying informed about these changes will be crucial for taxpayers to optimize their refund opportunities.

- Taxpayer Education: The state may invest more in taxpayer education initiatives, helping residents understand their tax obligations, potential deductions, and the refund process, thereby reducing errors and improving overall tax compliance.

In conclusion, the Montana State Tax Refund system serves as a vital mechanism to ensure the fairness and efficiency of the state's tax system. By providing a means to rectify overpayments, the state maintains public trust and offers financial relief to its taxpayers. Understanding the process, staying informed, and employing strategic approaches can help maximize the benefits of this refund system.

Frequently Asked Questions

How long does it typically take to receive a Montana State Tax Refund?

+The processing time for a Montana State Tax Refund can vary, but it typically takes around 4-6 weeks from the date of submission. However, factors like the complexity of your tax return, any errors or missing information, and the volume of refund applications during a particular period can impact the processing time.

Can I check the status of my Montana State Tax Refund online?

+Yes, you can check the status of your Montana State Tax Refund online through the Montana Department of Revenue’s official website. You’ll need to provide certain details, such as your Social Security Number or Individual Taxpayer Identification Number, to access your refund status information.

What happens if my Montana State Tax Refund is delayed or denied?

+If your Montana State Tax Refund is delayed, you should first check the status online or contact the Montana Department of Revenue for an update. Delays can occur due to various reasons, such as missing information or errors in your application. If your refund is denied, you’ll receive a notification explaining the reasons for the denial. In such cases, you may need to provide additional documentation or rectify any errors to proceed with your refund claim.

Are there any specific deadlines for claiming a Montana State Tax Refund?

+Yes, Montana has specific deadlines for claiming tax refunds. Generally, you must file your tax return and claim any refunds within three years from the original due date of the tax return. However, it’s essential to check the official guidelines provided by the Montana Department of Revenue for the most up-to-date information on refund deadlines.

Can I receive my Montana State Tax Refund via direct deposit?

+Yes, the Montana Department of Revenue offers the option of receiving your tax refund via direct deposit. To opt for direct deposit, you’ll need to provide your banking details, such as your account number and routing number, when completing your refund application. This method is often faster and more secure than receiving a paper check.