Pa State Income Tax Filing

For residents of the Commonwealth of Pennsylvania, filing state income taxes is a yearly obligation, and understanding the process and requirements is essential for every taxpayer. This comprehensive guide will delve into the specifics of Pennsylvania's state income tax filing, providing an in-depth analysis of the procedures, forms, and deadlines involved.

Understanding Pennsylvania’s Income Tax Structure

Pennsylvania imposes a personal income tax on its residents, which is a percentage of the taxable income earned within the state. The Pennsylvania Department of Revenue administers the state’s income tax system, which operates under a progressive tax structure. This means that higher income levels are subject to higher tax rates.

As of 2023, Pennsylvania has three income tax brackets, each with its own tax rate. These brackets are:

| Income Bracket | Tax Rate |

|---|---|

| 0 - $36,000 | 3.07% |

| $36,001 - $87,000 | 3.32% |

| $87,001 and above | 3.5% |

It's important to note that these tax rates are subject to change, so it's crucial to refer to the latest tax tables and guidelines provided by the Pennsylvania Department of Revenue for the most accurate information.

Who Needs to File Pennsylvania State Income Taxes

Pennsylvania state income taxes are applicable to various entities, including individuals, estates, trusts, and businesses. Here’s a breakdown of who needs to file:

Individuals

Pennsylvania residents who earn income from wages, salaries, commissions, bonuses, tips, dividends, interest, rents, royalties, and other sources are generally required to file state income taxes. Even if you have federal income tax withheld from your paychecks, you might still need to file a state return if your income exceeds the filing threshold.

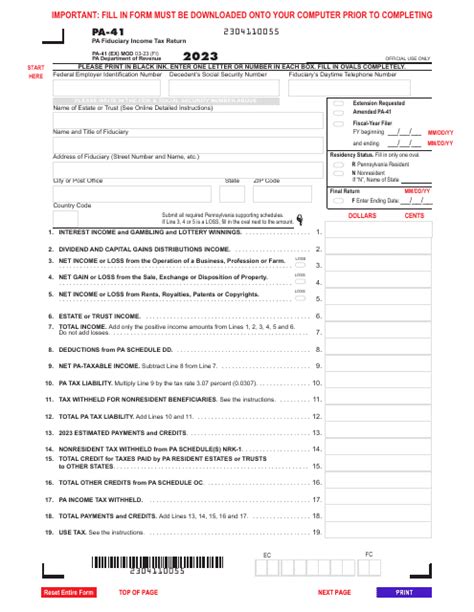

Estate and Trusts

Estate and trusts with income earned or derived from Pennsylvania sources must file a state income tax return. This includes income from investments, rental properties, and business activities.

Businesses

Pennsylvania-based businesses, regardless of structure (sole proprietorship, partnership, corporation, etc.), are subject to state income taxes. This includes businesses that operate solely within the state as well as those with multi-state operations.

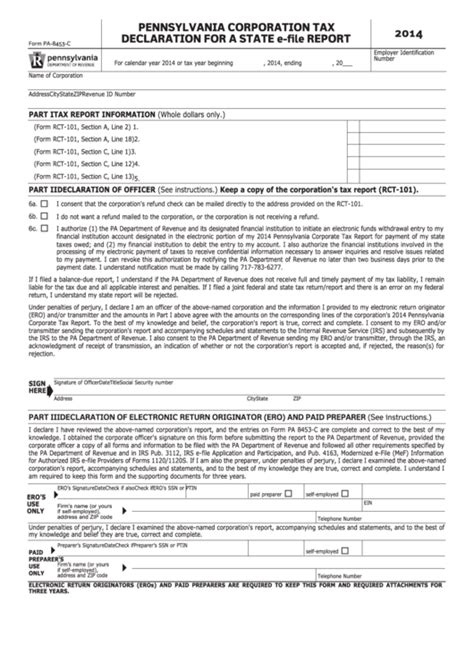

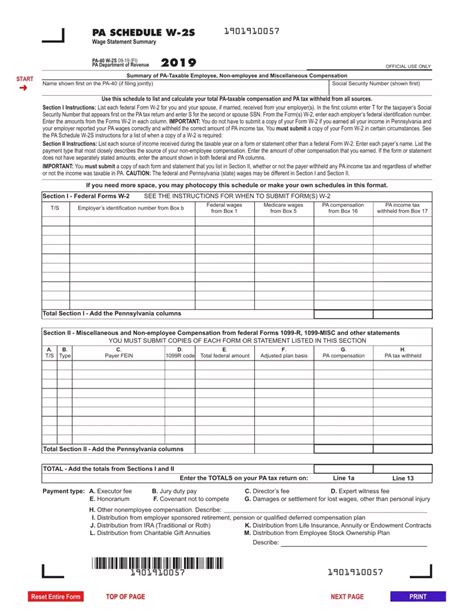

Pennsylvania State Income Tax Forms

The specific forms required for filing Pennsylvania state income taxes depend on the type of filer and the complexity of their financial situation. The most common forms include:

- PA-40: This is the standard form used by individuals to report income, deductions, and credits. It covers most types of income and expenses.

- PA-40 ES: If you're a self-employed individual or have variable income, you might need to make estimated tax payments throughout the year. The PA-40 ES form is used for this purpose.

- PA-40 X: This form is for individuals who need to amend their previously filed PA-40 returns.

- PA-40 Schedule SN: Used to calculate the School Tax Relief (STAR) Program credit for homeowners.

- PA-40 Schedule CR: This schedule is for individuals to claim personal income tax credits, such as the Property Tax/Rent Rebate credit.

- PA-40 Schedule LL: Businesses use this schedule to report income from Limited Liability Companies (LLCs) or partnerships.

- PA-40 Schedule K-1: This schedule is for partners or members of a partnership, LLC, or S corporation to report their share of income or loss.

The Pennsylvania Department of Revenue provides detailed instructions and guides for each form, helping taxpayers understand the specific requirements and how to complete them accurately.

Filing Deadlines and Extensions

The standard deadline for filing Pennsylvania state income taxes is aligned with the federal tax filing deadline, which is typically April 15th. However, this deadline can vary depending on the day of the week and certain circumstances.

For instance, if the federal deadline falls on a weekend or a holiday, the state deadline is typically extended to the next business day. It's crucial to check the official Pennsylvania Department of Revenue website or consult a tax professional to confirm the exact deadline for the current tax year.

Taxpayers who cannot meet the filing deadline can request an extension. The extension, however, only extends the time to file, not the time to pay any taxes owed. To request an extension, you need to complete Form PA-4868, Application for Automatic Extension of Time to File Pennsylvania Income Tax Return.

Late Filing Penalties

Filing late can result in penalties and interest charges. The penalty for late filing is typically 5% of the tax due per month, up to a maximum of 25%. Additionally, interest accrues on any unpaid tax balance at a rate of 6% per year, compounded daily.

Filing Methods and Options

Pennsylvania offers several methods for filing state income taxes, providing flexibility to taxpayers with varying preferences and technical capabilities.

Paper Filing

For those who prefer a traditional approach, paper filing is an option. This involves completing the appropriate tax forms and schedules, attaching any necessary supporting documentation, and mailing the package to the Pennsylvania Department of Revenue by the filing deadline.

e-Filing

Electronic filing, or e-filing, is a secure and efficient method that offers faster processing and direct deposit of any refunds. The Pennsylvania Department of Revenue provides an online filing system called PA eFile, which is available to individuals, businesses, and tax professionals.

To e-file, taxpayers need to create an account and follow the step-by-step process to complete their tax return. This method is especially beneficial for those who have straightforward tax situations and prefer the convenience of online filing.

Tax Preparation Software

For more complex tax situations or for those who want additional support, tax preparation software can be a valuable tool. These software programs guide taxpayers through the filing process, ensuring accuracy and completeness. Many of these programs also offer e-filing capabilities, streamlining the entire process.

Pennsylvania Tax Credits and Deductions

Pennsylvania offers a range of tax credits and deductions to help reduce the tax burden for eligible taxpayers. Some of the most common ones include:

School Tax Relief (STAR) Program

The STAR program provides property tax relief for eligible homeowners. The credit is calculated based on the homeowner’s income and the assessed value of their property. This credit is claimed using Schedule SN with the PA-40 form.

Property Tax/Rent Rebate Program

This program offers rebates to eligible Pennsylvanians for the property taxes or rent they’ve paid. To claim this credit, taxpayers use Schedule CR with the PA-40 form.

Business Tax Credits

Pennsylvania offers various business tax credits, including the Research and Development Tax Credit, the Job Creation Tax Credit, and the Film Production Tax Credit, among others. These credits are designed to encourage investment, job creation, and economic development within the state.

Special Considerations for Nonresidents

Nonresidents of Pennsylvania who earn income within the state may be subject to state income tax. The tax liability for nonresidents is typically based on the portion of income earned within Pennsylvania. This can be calculated using the reciprocal tax agreement that Pennsylvania has with other states.

Reciprocal Tax Agreements

Pennsylvania has reciprocal tax agreements with several states, including New Jersey, Delaware, Maryland, Ohio, West Virginia, and Virginia. These agreements allow for the adjustment of state taxes for individuals who are residents of one state but earn income in another. The specific rules and provisions of these agreements can be found on the Pennsylvania Department of Revenue website.

Future Implications and Changes

Pennsylvania’s state income tax system is subject to ongoing changes and updates, influenced by various factors such as economic conditions, legislative decisions, and tax reform initiatives. Staying informed about these changes is crucial for taxpayers to ensure compliance and take advantage of any new benefits or credits.

Some potential future implications include:

- Changes to tax rates or brackets

- Introduction or removal of tax credits and deductions

- Modifications to filing deadlines or extension policies

- Implementation of new tax laws or regulations

- Updates to electronic filing systems and processes

The Pennsylvania Department of Revenue regularly publishes updates and news on their website, providing taxpayers with the latest information. It's advisable to subscribe to their updates or consult a tax professional to stay informed about any changes that may impact your state income tax filing.

Frequently Asked Questions

What is the current tax rate for Pennsylvania state income tax?

+

As of 2023, Pennsylvania has three tax brackets with rates of 3.07%, 3.32%, and 3.5%, depending on income level. However, tax rates are subject to change, so it’s advisable to refer to the latest tax tables provided by the Pennsylvania Department of Revenue.

When is the deadline for filing Pennsylvania state income taxes?

+

The standard deadline aligns with the federal tax filing deadline, typically April 15th. However, this can vary based on the day of the week and certain circumstances. It’s crucial to check the official Pennsylvania Department of Revenue website for the exact deadline.

How do I know if I need to file a Pennsylvania state income tax return?

+

Pennsylvania residents who earn income from various sources, including wages, salaries, dividends, interest, and rents, are generally required to file a state income tax return. The filing requirement also applies to estates, trusts, and businesses. It’s recommended to consult the Pennsylvania Department of Revenue guidelines or a tax professional for specific details.

What happens if I miss the filing deadline for Pennsylvania state income taxes?

+

Missing the filing deadline can result in penalties and interest charges. The penalty for late filing is typically 5% of the tax due per month, up to a maximum of 25%. Additionally, interest accrues on any unpaid tax balance at a rate of 6% per year, compounded daily. To avoid penalties, it’s advisable to request an extension using Form PA-4868 if you cannot meet the filing deadline.

How can I file my Pennsylvania state income taxes online?

+

Pennsylvania offers an online filing system called PA eFile, which is available to individuals, businesses, and tax professionals. To e-file, you need to create an account and follow the step-by-step process to complete your tax return. This method is efficient and secure, and it allows for faster processing and direct deposit of any refunds.