City Of Dallas Real Estate Taxes

Welcome to a comprehensive guide on one of the most crucial aspects of property ownership in Dallas: real estate taxes. This article aims to provide an in-depth understanding of the tax landscape, offering valuable insights for both existing homeowners and prospective buyers in the Dallas real estate market. By delving into the intricacies of tax assessments, rates, and strategies, we aim to empower readers with the knowledge needed to navigate this critical financial aspect of property ownership effectively.

Understanding Real Estate Taxes in Dallas

Real estate taxes, also known as property taxes, are an essential component of the financial ecosystem in Dallas, Texas. These taxes are levied on the value of real property, including land, buildings, and any improvements made to the property. The revenue generated from these taxes plays a vital role in funding various public services and infrastructure projects, making it an integral part of the city’s economic framework.

In Dallas, the process of assessing and collecting real estate taxes is overseen by several governmental bodies, each with specific roles and responsibilities. The Dallas Central Appraisal District (DCAD) is tasked with the crucial responsibility of determining the taxable value of each property within the city limits. This valuation process, conducted annually, forms the basis for calculating the real estate tax bills that property owners receive.

Tax Assessment Process

The tax assessment process in Dallas is meticulous and involves a series of steps to ensure fairness and accuracy. Here’s a simplified breakdown:

- Property Valuation: The DCAD assesses the market value of properties based on recent sales data, construction costs, and other relevant factors. This valuation determines the property’s taxable value.

- Notice of Appraised Value: Property owners receive a notice from the DCAD detailing the appraised value of their property. This notice serves as a starting point for any potential protests or appeals.

- Protest and Appeal: Property owners have the right to protest their appraised value if they believe it is inaccurate. The DCAD provides an opportunity for informal hearings to resolve disputes.

- Final Appraisal: After considering any protests, the DCAD finalizes the appraised value. This value is then used to calculate the tax bill.

Tax Rates and Calculations

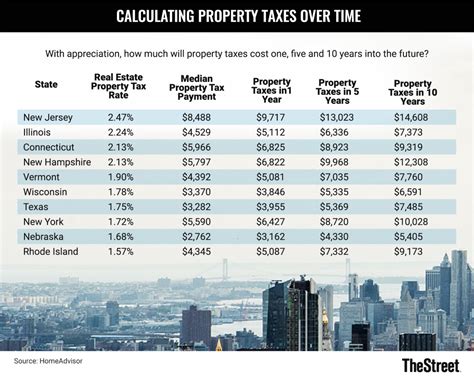

Real estate taxes in Dallas are calculated based on the appraised value of the property and the tax rate set by various taxing entities. These entities include the city of Dallas, Dallas County, local school districts, and other special districts. Each entity has its own tax rate, which is expressed as a percentage of the property’s taxable value.

To illustrate, let's consider a hypothetical property with an appraised value of $500,000. If the combined tax rate for all entities is 2%, the annual real estate tax bill for this property would be $10,000.

| Taxing Entity | Tax Rate | Tax Amount |

|---|---|---|

| City of Dallas | 0.5% | $2,500 |

| Dallas County | 0.4% | $2,000 |

| School District | 1.1% | $5,500 |

| Total | 2% | $10,000 |

Strategies for Managing Real Estate Taxes

Understanding the assessment and calculation process is just the first step. Here are some strategies and considerations to help property owners manage their real estate tax obligations effectively:

1. Property Tax Exemptions and Deductions

Dallas offers several tax exemptions and deductions that can reduce the taxable value of a property. These include:

- Homestead Exemption: Property owners who use their property as their primary residence can apply for a homestead exemption, which reduces the taxable value by up to $25,000.

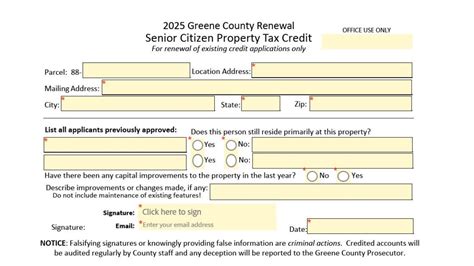

- Senior Citizen Exemption: Property owners aged 65 or older may be eligible for an additional exemption based on their income and property value.

- Disabled Veteran Exemption: Certain disabled veterans can receive an exemption on their primary residence.

2. Tax Appeals and Protests

If a property owner believes their appraised value is inaccurate, they have the right to appeal the assessment. The DCAD provides guidelines and procedures for filing protests. It’s crucial to gather supporting evidence, such as recent sales data or appraisals, to strengthen the case for a lower valuation.

3. Payment Options and Deadlines

Dallas offers various payment options for real estate taxes, including online payments, mail-in payments, and payment plans. Property owners should be aware of the tax due dates to avoid penalties and interest charges. Late payments can incur significant additional costs.

4. Tax Incentives and Abatements

Certain areas in Dallas offer tax incentives or abatements to encourage economic development or promote specific industries. These incentives can reduce the tax burden for eligible properties. Property owners should explore these opportunities, especially if their property falls within designated incentive zones.

5. Property Improvements and Their Impact

Any improvements made to a property, such as additions, renovations, or upgrades, can potentially increase its taxable value. Property owners should be aware of the potential tax implications of such improvements and plan accordingly. Consulting with a tax professional can help navigate these scenarios effectively.

Real-World Insights and Examples

To provide a more tangible understanding, let’s explore a real-life scenario of a Dallas homeowner, Mr. Johnson, and his experience with real estate taxes.

Mr. Johnson, a resident of the Lakewood neighborhood, recently received his annual notice of appraised value. The DCAD assessed his property's value at $700,000, an increase of 10% from the previous year. After reviewing the assessment, Mr. Johnson decided to protest the value, as he believed it was inflated compared to recent sales in the area.

With the help of a tax consultant, Mr. Johnson gathered comparative sales data and presented his case at an informal hearing with the DCAD. After a thorough review, the DCAD agreed to reduce the appraised value to $650,000, resulting in a significant savings on his annual tax bill.

This example highlights the importance of staying informed, seeking professional guidance, and actively participating in the tax assessment process. By understanding their rights and taking proactive steps, property owners can ensure fair and accurate assessments, ultimately saving on their real estate tax obligations.

Future Implications and Considerations

As Dallas continues to experience growth and development, the real estate tax landscape is likely to evolve. Here are some key considerations for the future:

1. Property Value Trends

The real estate market in Dallas has been on an upward trajectory, with property values rising steadily. This trend is expected to continue, especially in desirable neighborhoods and areas with strong economic growth. As property values increase, so do the real estate tax obligations, making it crucial for property owners to stay informed about market trends.

2. Tax Policy Changes

Tax policies and rates are subject to change, influenced by various factors such as economic conditions, political decisions, and public sentiment. Property owners should stay updated on any proposed or enacted changes to tax laws and regulations. Understanding these changes can help in financial planning and budgeting for future tax obligations.

3. Impact of Development Projects

Major development projects, such as new infrastructure, transportation initiatives, or urban renewal efforts, can have a significant impact on property values and, consequently, real estate taxes. Property owners should be aware of these projects and their potential effects on their neighborhoods. Staying engaged with local government and community initiatives can provide valuable insights into these developments.

4. Technology and Tax Assessment

Advancements in technology, such as aerial imaging and data analytics, are transforming the way properties are assessed. These technologies can provide more accurate and efficient assessments, potentially impacting tax obligations. Property owners should be aware of these advancements and their implications for the future of real estate taxes.

Conclusion

Real estate taxes in Dallas are a complex but essential aspect of property ownership. By understanding the assessment process, tax rates, and available strategies, property owners can navigate this financial responsibility with confidence. Staying informed, seeking professional guidance, and actively participating in the tax assessment process are key to ensuring fair and accurate tax obligations.

As the city of Dallas continues to thrive and evolve, property owners must stay vigilant and adapt to the changing tax landscape. With the right knowledge and strategies, homeowners can make informed decisions and effectively manage their real estate tax obligations, contributing to the vibrant and thriving community of Dallas.

How often are property values reassessed in Dallas?

+Property values in Dallas are reassessed annually by the Dallas Central Appraisal District (DCAD). This ensures that the taxable value of properties remains up-to-date and reflects any changes in the market.

What happens if I miss the deadline to protest my property’s appraised value?

+If you miss the deadline, you may still be able to appeal your appraised value, but the process becomes more complex. It’s essential to consult with a tax professional to understand your options and navigate the appeal process effectively.

Are there any online resources to estimate my real estate tax obligations in Dallas?

+Yes, the Dallas Central Appraisal District (DCAD) provides an online tax estimator tool. This tool allows property owners to estimate their tax obligations based on their property’s appraised value and the current tax rates. It’s a valuable resource for budgeting and financial planning.

Can I deduct my real estate taxes on my federal income tax return?

+Yes, real estate taxes paid on your primary residence are generally deductible on your federal income tax return. However, there are limits and specific rules, so it’s advisable to consult with a tax professional to maximize your deductions.

What happens if I don’t pay my real estate taxes in Dallas?

+Unpaid real estate taxes can lead to significant penalties, interest charges, and, in extreme cases, tax liens or even foreclosure. It’s crucial to stay current on your tax obligations to avoid these consequences.