Greene County Property Tax

Property taxes are a significant aspect of local governance and can greatly impact the lives of residents and the development of communities. In Greene County, understanding the property tax system is crucial for homeowners, businesses, and investors. This comprehensive guide aims to provide an in-depth analysis of Greene County's property tax, offering valuable insights into how it works, its impact on the community, and what it means for property owners.

Unraveling Greene County’s Property Tax: A Comprehensive Guide

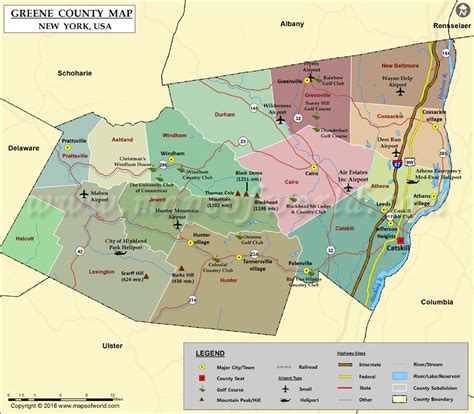

Greene County, nestled in the heart of [State], boasts a rich history and a thriving community. With its diverse landscape ranging from urban centers to rural areas, the county’s property tax system plays a pivotal role in shaping its economic landscape. This section aims to delve into the intricacies of Greene County’s property tax, offering a clear understanding of its assessment, calculation, and implications.

Property Assessment: The Foundation of Greene County’s Tax System

At the core of Greene County’s property tax system is the process of property assessment. The county’s tax assessor’s office is responsible for evaluating each property within its boundaries, ensuring a fair and accurate assessment. This involves regular inspections and the consideration of various factors, including:

- Market Value: The assessor estimates the fair market value of each property, considering its location, size, and recent sales data.

- Improvements: Any improvements or renovations made to the property are taken into account, as they can influence its overall value.

- Tax Exemptions: Certain properties may be eligible for tax exemptions, such as those owned by non-profit organizations or those with historical significance.

- Neighborhood Trends: The assessor also considers the overall real estate market trends in the area, ensuring that property values are assessed equitably.

The assessment process is a meticulous task, aiming to provide a transparent and fair valuation for each property owner. It serves as the foundation for the subsequent tax calculation, ensuring that the burden of taxation is distributed equitably across the community.

Calculating Property Taxes: A Step-by-Step Breakdown

Once the property assessment is complete, the process of calculating the actual property tax begins. Here’s a step-by-step breakdown of how it works in Greene County:

- Assessment Ratio: The assessed value of the property is multiplied by an assessment ratio, which is typically a percentage set by the county. This ratio ensures that the taxable value of the property is lower than its actual market value, providing a fair tax base.

- Tax Rate Determination: The county’s tax rate, expressed in mills, is applied to the taxable value of the property. One mill represents 1 of tax for every 1,000 of assessed value. The tax rate is determined by the county’s budgeting needs and can vary annually.

- Calculating the Tax Amount: The taxable value of the property, as determined in step 1, is multiplied by the tax rate (in mills) to calculate the total property tax owed. This amount is then divided by 1,000 to provide the final tax bill.

For instance, if a property has an assessed value of 200,000 and the assessment ratio is 80%, the taxable value would be 160,000. If the tax rate is 20 mills, the property tax calculation would be: (160,000 x 0.02) / 1,000 = 3,200. Thus, the property owner would owe $3,200 in property taxes for the year.

Impact on the Community: How Greene County’s Property Tax Benefits Residents

Greene County’s property tax system plays a vital role in supporting the local community and its infrastructure. The tax revenue generated contributes to a range of essential services and initiatives, including:

- Education: A significant portion of property tax revenue is allocated to funding local schools, ensuring high-quality education for students across the county.

- Public Safety: Property taxes help maintain a robust police and fire department, ensuring the safety and security of residents.

- Infrastructure Development: The tax revenue is invested in improving roads, bridges, and other public infrastructure, making the county more accessible and efficient.

- Community Programs: Greene County’s property tax supports various community programs, such as recreational activities, senior services, and youth development initiatives.

By contributing to these vital services, Greene County’s property tax system fosters a strong sense of community and ensures the well-being of its residents. It provides the necessary funds to maintain and enhance the quality of life in the county, making it an attractive place to live, work, and raise a family.

Appealing Property Tax Assessments: A Guide for Greene County Residents

In some cases, property owners in Greene County may feel that their assessed value is inaccurate or unfair. Fortunately, the county provides a process for appealing property tax assessments. Here’s a step-by-step guide for residents:

- Review the Assessment Notice: Upon receiving the annual assessment notice, carefully review the details. Check for any errors in the property description, recent improvements, or other factors that may impact the valuation.

- Gather Evidence: If you believe the assessment is incorrect, gather supporting evidence. This may include recent property sales data, appraisals, or documentation of any errors in the assessment.

- Contact the Assessor’s Office: Reach out to the Greene County Tax Assessor’s Office and express your concerns. They can provide guidance on the appeal process and help address any potential issues.

- File an Appeal: If necessary, file a formal appeal with the county’s Board of Assessment Appeals. Be sure to meet all deadlines and provide all required documentation.

- Attend the Hearing: If your appeal is accepted, you will be invited to attend a hearing before the Board of Assessment Appeals. Prepare your case and be ready to present your evidence and arguments.

It’s important to note that the appeal process is designed to ensure fairness and accuracy in property tax assessments. By following these steps and providing compelling evidence, Greene County residents can ensure that their property taxes are based on an accurate and fair valuation.

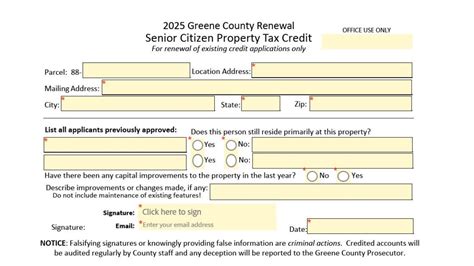

Greene County’s Property Tax Relief Programs: Supporting Homeowners

Recognizing the financial burden that property taxes can place on homeowners, Greene County offers a range of tax relief programs. These initiatives aim to assist residents, particularly those with limited incomes or specific circumstances. Here’s an overview of some of these programs:

- Homestead Exemption: Eligible homeowners can apply for a homestead exemption, which reduces the assessed value of their primary residence. This can lead to significant savings on property taxes, especially for long-term residents.

- Senior Citizen Tax Relief: Greene County provides tax relief for senior citizens, often in the form of reduced tax rates or exemptions. This program aims to support older residents and ensure they can continue to live comfortably in their homes.

- Veteran’s Exemption: Veterans who meet certain criteria may be eligible for a property tax exemption. This program recognizes the service and sacrifice of veterans, providing them with financial relief.

- Low-Income Assistance: The county offers assistance programs for low-income homeowners, helping them manage their property tax obligations. These programs may include deferred payment plans or reduced tax rates.

By offering these tax relief programs, Greene County demonstrates its commitment to supporting its residents and ensuring that property taxes are manageable for all. These initiatives provide much-needed assistance, allowing homeowners to stay in their homes and contribute to the vibrant community of Greene County.

Future Implications: The Evolving Landscape of Greene County’s Property Tax

As Greene County continues to grow and evolve, its property tax system will also undergo changes and adaptations. Here are some potential future implications and considerations:

- Population Growth: With an increasing population, the demand for services and infrastructure will rise. This may lead to adjustments in the tax rate to meet the growing needs of the community.

- Economic Development: As the county attracts new businesses and industries, the property tax base may expand. This can provide additional revenue for essential services and infrastructure projects.

- Technological Advancements: The implementation of advanced assessment technologies and data analytics can improve the accuracy and efficiency of the property tax system. This may lead to more precise valuations and a fairer distribution of the tax burden.

- Community Engagement: Engaging with residents and businesses to understand their needs and concerns can shape the future of Greene County’s property tax system. Open dialogue and collaboration can lead to innovative solutions and a more responsive tax structure.

Looking ahead, Greene County’s property tax system will continue to play a vital role in the economic and social development of the county. By adapting to changing circumstances and embracing innovation, the county can ensure a fair and sustainable tax system that benefits all its residents.

Conclusion: Navigating Greene County’s Property Tax with Confidence

Understanding Greene County’s property tax system is essential for anyone with a stake in the local community. From the assessment process to the appeal procedures, this guide has provided a comprehensive overview, ensuring that property owners can navigate the system with confidence. By recognizing the impact of property taxes on the community and exploring the available relief programs, residents can actively contribute to the vibrant and thriving Greene County.

How often are property taxes assessed in Greene County?

+Property taxes in Greene County are typically assessed annually. The tax assessor’s office conducts regular evaluations to ensure that property values are up-to-date and fair.

Can I estimate my property tax before receiving the official assessment notice?

+Yes, you can estimate your property tax by multiplying your property’s assessed value by the current tax rate. However, keep in mind that this is an approximation, and the official assessment notice will provide the final tax amount.

What happens if I disagree with my property tax assessment?

+If you disagree with your assessment, you have the right to appeal. Follow the guidelines provided in the “Appealing Property Tax Assessments” section above to initiate the appeal process.

Are there any property tax relief programs for low-income homeowners in Greene County?

+Yes, Greene County offers several tax relief programs for low-income homeowners. These programs aim to provide financial assistance and ensure that property taxes are manageable for those with limited incomes. Refer to the “Property Tax Relief Programs” section for more details.

How can I stay informed about changes in Greene County’s property tax system?

+Stay updated by regularly visiting the Greene County Tax Assessor’s Office website or following their official social media accounts. They often share important announcements, tax rate changes, and other relevant information.