Fairfax Property Tax

Property taxes are an essential part of the revenue system for local governments, including counties, cities, and towns, as they contribute significantly to funding essential services and infrastructure. Fairfax County, located in Virginia, is no exception. The Fairfax property tax is a crucial component of the county's financial framework, and understanding its intricacies is vital for both residents and investors.

This article aims to provide an in-depth exploration of the Fairfax property tax, delving into its structure, calculation methods, payment options, and the various factors that influence it. By the end of this guide, readers should have a comprehensive understanding of the tax's role in Fairfax County's economy and its implications for property owners.

The Role of Property Taxes in Fairfax County

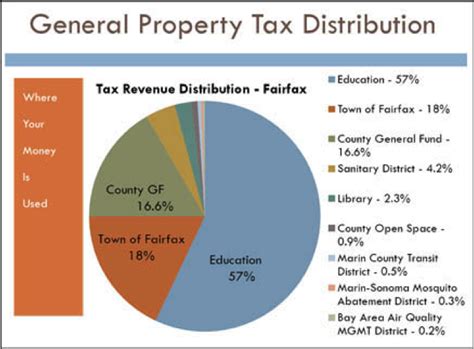

Property taxes are a primary source of revenue for Fairfax County, used to finance a wide range of public services and projects. These taxes contribute to the maintenance and development of the county’s infrastructure, including roads, schools, public safety services, and recreational facilities. Additionally, they support the county’s administration and various community initiatives.

The Fairfax property tax system is designed to ensure that property owners contribute equitably to the county's financial needs, based on the value of their properties. This tax not only sustains the county's day-to-day operations but also enables long-term planning and development, making Fairfax County an attractive place to live and do business.

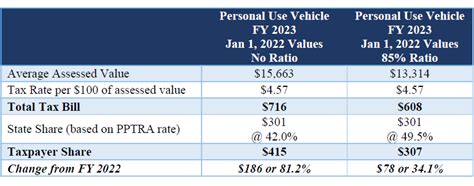

How Fairfax Property Taxes Are Calculated

The calculation of Fairfax property taxes involves several key steps, each influenced by specific factors. These steps ensure that the tax assessment process is fair and accurate, reflecting the current market value of properties within the county.

Step 1: Property Assessment

The first step in calculating Fairfax property taxes is the assessment of each property’s value. This is typically done by the Fairfax County Office of the Commissioner of the Revenue, which employs professional assessors. These assessors take into account various factors, such as the property’s size, location, age, condition, and recent sales data of comparable properties.

Properties in Fairfax County are assessed annually, ensuring that tax rates reflect the current market conditions. This process allows for adjustments to be made if a property's value has increased or decreased significantly due to market fluctuations or improvements made to the property.

Step 2: Tax Rate Determination

Once the assessed value of a property is established, the next step is to determine the applicable tax rate. In Fairfax County, the tax rate is set by the Board of Supervisors and can vary depending on the type of property and its location within the county. Tax rates are usually expressed in cents per $100 of assessed value, making it easier to calculate the final tax amount.

For instance, if the tax rate is set at 0.99 cents per $100 of assessed value, a property with an assessed value of $500,000 would have a tax rate of $4,950 ($0.99 x $500,000 / 100). This rate is then used to calculate the property tax for that specific property.

| Property Type | Tax Rate (Cents per $100) |

|---|---|

| Residential Property | 0.99 |

| Commercial Property | 1.15 |

| Agricultural Land | 0.55 |

Step 3: Tax Calculation

With the assessed value and tax rate determined, the final step is to calculate the actual property tax amount. This is a straightforward process, involving multiplying the assessed value of the property by the applicable tax rate.

Using the previous example, if a residential property has an assessed value of $500,000 and the tax rate is 0.99 cents per $100, the property tax would be $4,950 ($500,000 x 0.99 / 100). This calculation provides the property owner with a clear understanding of their tax liability for the year.

Payment Options and Due Dates

Fairfax County offers several convenient payment options for property taxes, ensuring that property owners can choose the method that best suits their preferences and financial situations.

Online Payment

The Fairfax County website provides an online platform where property owners can securely make their tax payments. This option is particularly convenient for those who prefer digital transactions and wish to avoid the hassle of physical checks or cash payments.

Electronic Funds Transfer (EFT)

Property owners can also opt for Electronic Funds Transfer, which allows for automatic deductions from their bank accounts on the due date. This method ensures timely payment and removes the need to remember due dates or physically make payments.

Credit Card Payment

Fairfax County accepts credit card payments for property taxes, providing an additional level of convenience for those who prefer this method. However, it’s important to note that credit card payments may incur additional fees, which are typically charged by the credit card companies and not by Fairfax County.

Mail-In Payment

For those who prefer traditional methods, Fairfax County also accepts checks and money orders by mail. Property owners can send their payments to the designated address, ensuring they include the necessary information to ensure proper processing.

Payment Due Dates

Fairfax property taxes are due semi-annually, with payments typically due in late May and late November. However, these dates can vary slightly from year to year, so it’s essential for property owners to check the official Fairfax County website for the exact due dates. Failure to pay by the due date may result in late fees and penalties, which can quickly accumulate.

Factors Influencing Fairfax Property Taxes

Several factors can influence the amount of Fairfax property taxes an owner is required to pay. Understanding these factors can help property owners anticipate changes in their tax liability and make informed financial decisions.

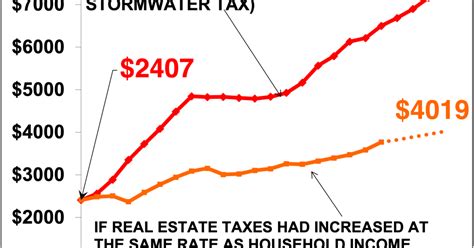

Property Value

The assessed value of a property is a significant determinant of the property tax. As property values can fluctuate due to market conditions, improvements, or changes in zoning regulations, the corresponding property tax can also change. Therefore, it’s essential for property owners to stay informed about their property’s assessed value and any potential factors that could influence its valuation.

Tax Rates

The tax rate set by the Board of Supervisors can vary from year to year, depending on the county’s financial needs and budgetary decisions. An increase in the tax rate can result in higher property taxes, while a decrease can lead to lower taxes. Property owners should stay updated on any proposed changes to the tax rate to understand how it might impact their tax liability.

Exemptions and Deductions

Fairfax County offers certain exemptions and deductions that can reduce the amount of property tax owed. These include the Homestead Exemption, which provides a reduction in the assessed value of a primary residence, and the Land Conservation Tax Credit, which can reduce taxes for properties used for agricultural or forestry purposes. Understanding these exemptions and ensuring eligibility can help property owners minimize their tax liability.

Late Payment Penalties

Failing to pay property taxes by the due date can result in penalties and interest charges. These additional fees can quickly add up, making it crucial for property owners to pay their taxes on time. It’s also worth noting that late payments can impact a property owner’s credit score, further emphasizing the importance of timely payments.

Future Implications and Planning

As Fairfax County continues to grow and develop, the Fairfax property tax system will likely evolve to meet the changing needs of the community and the county’s financial requirements. Understanding the current system and staying informed about potential changes can help property owners make strategic financial decisions.

For instance, if the county experiences significant growth and development, the demand for public services and infrastructure improvements may increase. This could lead to a higher tax rate or additional fees to fund these initiatives. Conversely, if the county experiences economic challenges, tax rates may be adjusted to ensure the county's financial stability.

Therefore, it's essential for property owners to stay engaged with local government initiatives and budget proposals. Attending public meetings, staying informed through local news sources, and engaging with community organizations can provide valuable insights into the county's financial planning and potential impacts on property taxes.

Conclusion

The Fairfax property tax system is a vital component of the county’s financial framework, ensuring the sustainable development and maintenance of the community. By understanding how property taxes are calculated, the various payment options available, and the factors that can influence tax liability, property owners can navigate this system with confidence.

As Fairfax County continues to evolve, the property tax system will adapt to meet the changing needs of the community. By staying informed and engaged, property owners can contribute to the county's growth while also making informed financial decisions that benefit their personal and financial well-being.

How often are property taxes assessed in Fairfax County?

+

Property taxes in Fairfax County are assessed annually. This ensures that the tax assessment reflects the current market value of the properties and any changes that may have occurred over the year.

Can I appeal my property tax assessment if I believe it’s incorrect?

+

Yes, Fairfax County provides a process for property owners to appeal their tax assessments if they believe the assessed value is incorrect. The process typically involves submitting an appeal application and providing evidence to support the appeal. It’s recommended to consult with a tax professional or the Fairfax County Department of Tax Administration for guidance on the appeal process.

Are there any discounts or exemptions available for property taxes in Fairfax County?

+

Yes, Fairfax County offers various discounts and exemptions that can reduce the property tax liability. These include the Homestead Exemption for primary residences, the Land Conservation Tax Credit for agricultural or forestry properties, and discounts for senior citizens and disabled veterans. It’s advisable to check with the Fairfax County Department of Tax Administration to understand your eligibility for these benefits.