Is Medical Insurance Tax Deductible

Medical insurance, also known as health insurance, plays a vital role in safeguarding individuals and families against unexpected medical expenses. In many countries, including the United States, the tax implications of medical insurance are an important aspect to consider when evaluating the overall cost and benefits of healthcare coverage. This comprehensive guide will delve into the topic of medical insurance tax deductibility, shedding light on the tax advantages and potential savings individuals can unlock.

Understanding Medical Insurance Tax Deductions

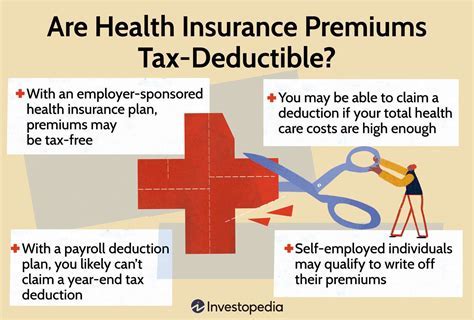

Medical insurance tax deductions refer to the ability to reduce one’s taxable income by a certain amount, based on the premiums paid for health insurance coverage. This deduction can result in significant tax savings, making health insurance an even more attractive financial investment. In the United States, the Internal Revenue Service (IRS) outlines specific guidelines for determining which medical insurance expenses are tax-deductible.

Eligibility for Medical Insurance Tax Deductions

Not all medical insurance plans are eligible for tax deductions. The IRS has set certain criteria that individuals must meet to qualify for these deductions. Here are the key eligibility requirements:

- Premium Payment Method: To be tax-deductible, medical insurance premiums must be paid using after-tax dollars. This means that the payments are made with income that has already been subjected to federal income tax withholding.

- Health Insurance Plan Type: Only certain types of health insurance plans are eligible for tax deductions. These include major medical insurance plans, dental and vision plans, and long-term care insurance. Other types of health-related expenses, such as cosmetic surgery or gym memberships, are generally not deductible.

- Qualifying Expenses: The IRS provides a comprehensive list of qualifying medical expenses. These include not only insurance premiums but also a wide range of other medical costs, such as prescription medications, doctor visits, hospital stays, and even certain travel expenses related to medical treatment.

Calculating Medical Insurance Tax Deductions

The process of calculating medical insurance tax deductions involves a few key steps. First, individuals must determine their adjusted gross income (AGI), which is the total income minus certain deductions and adjustments. From this AGI, they can subtract their qualifying medical expenses, including insurance premiums, to arrive at their medical expense deduction. This deduction is then subject to a threshold, which varies based on the taxpayer’s filing status and age.

| Filing Status | Standard Deduction Threshold |

|---|---|

| Single | 10% of AGI |

| Married Filing Jointly | 7.5% of AGI |

| Head of Household | 10% of AGI |

Once the threshold is met, individuals can deduct the remaining medical expenses from their taxable income. This deduction can significantly reduce the tax liability, especially for those with substantial medical expenses.

Maximizing Medical Insurance Tax Benefits

To make the most of the tax advantages associated with medical insurance, individuals can employ several strategies:

- Itemize Deductions: Rather than taking the standard deduction, taxpayers can choose to itemize their deductions. This allows them to list all eligible expenses, including medical insurance premiums, and potentially reduce their taxable income even further.

- Explore High-Deductible Health Plans (HDHPs): HDHPs, paired with a Health Savings Account (HSA), offer a unique tax-advantaged strategy. Contributions to an HSA are tax-deductible, and the funds can be used to pay for qualifying medical expenses. Additionally, earnings on HSA funds grow tax-free, and withdrawals for qualified medical expenses are tax-free as well.

- Consider Flexible Spending Accounts (FSAs): FSAs allow employees to set aside pre-tax dollars for eligible medical expenses. While FSAs have a “use-it-or-lose-it” nature, they can provide significant tax savings by reducing taxable income and lowering the tax liability.

The Impact of Health Care Reform on Tax Deductions

The implementation of the Affordable Care Act (ACA), often referred to as Obamacare, brought about significant changes to the U.S. healthcare system, including the tax landscape. One notable change is the elimination of the itemized deduction for unreimbursed medical expenses for tax years beginning after December 31, 2016. This means that taxpayers can no longer deduct medical expenses that exceed a certain percentage of their AGI. However, the tax deduction for health insurance premiums remains in effect.

ACA Premium Tax Credits

The ACA also introduced premium tax credits, which provide financial assistance to eligible individuals purchasing health insurance through the Health Insurance Marketplace. These credits are designed to make insurance more affordable and are based on an individual’s income and family size. Taxpayers can claim the credit either in advance, to help lower their monthly premiums, or as a refund when filing their taxes.

Real-World Examples of Medical Insurance Tax Savings

To illustrate the potential tax savings associated with medical insurance deductions, let’s consider a few hypothetical scenarios:

Scenario 1: Self-Employed Individual

Emily, a self-employed graphic designer, pays 1,200 per month for her health insurance premium. She also incurred 2,500 in other qualifying medical expenses throughout the year. Emily’s AGI is 60,000.</p> <p>By itemizing her deductions, Emily can deduct 14,500 (12,000 in insurance premiums + 2,500 in other medical expenses) from her AGI. This reduces her taxable income to $45,500, resulting in significant tax savings.

Scenario 2: Family with High Medical Expenses

John and Jane, a married couple with two children, pay a total of 1,500 per month for their family's health insurance. They also faced substantial medical expenses, including prescription medications and doctor visits, totaling 8,000 for the year. Their combined AGI is 120,000.</p> <p>By itemizing their deductions, John and Jane can deduct 19,500 (18,000 in insurance premiums + 1,500 in other medical expenses) from their AGI. This reduces their taxable income to $100,500, potentially saving them thousands of dollars in taxes.

Conclusion: The Financial Benefits of Medical Insurance Tax Deductions

Medical insurance tax deductions offer a valuable financial incentive for individuals and families to invest in health insurance coverage. By understanding the eligibility criteria, calculating deductions accurately, and exploring tax-advantaged strategies, taxpayers can unlock significant savings and make their healthcare expenses more manageable. As the healthcare landscape continues to evolve, staying informed about tax regulations and seeking professional advice can ensure individuals maximize their tax benefits and make the most of their health insurance investments.

Can I deduct medical insurance premiums for my entire family, including my spouse and children?

+Yes, you can deduct the medical insurance premiums for yourself, your spouse, and your dependents. However, the premiums must be paid with after-tax dollars, and you must meet the eligibility criteria outlined by the IRS.

Are there any limits to the amount of medical expenses I can deduct?

+Yes, there is a threshold that varies based on your filing status and age. You can deduct qualifying medical expenses that exceed this threshold from your taxable income. Consult the IRS guidelines for the specific threshold applicable to your situation.

Can I deduct medical expenses if I don’t itemize my deductions on my tax return?

+No, medical expense deductions are typically claimed as itemized deductions on Schedule A of your tax return. If you choose to take the standard deduction, you cannot deduct medical expenses.